Crypto news

Bitcoin fails to convince that bottom is in with $12K ‘still likely’

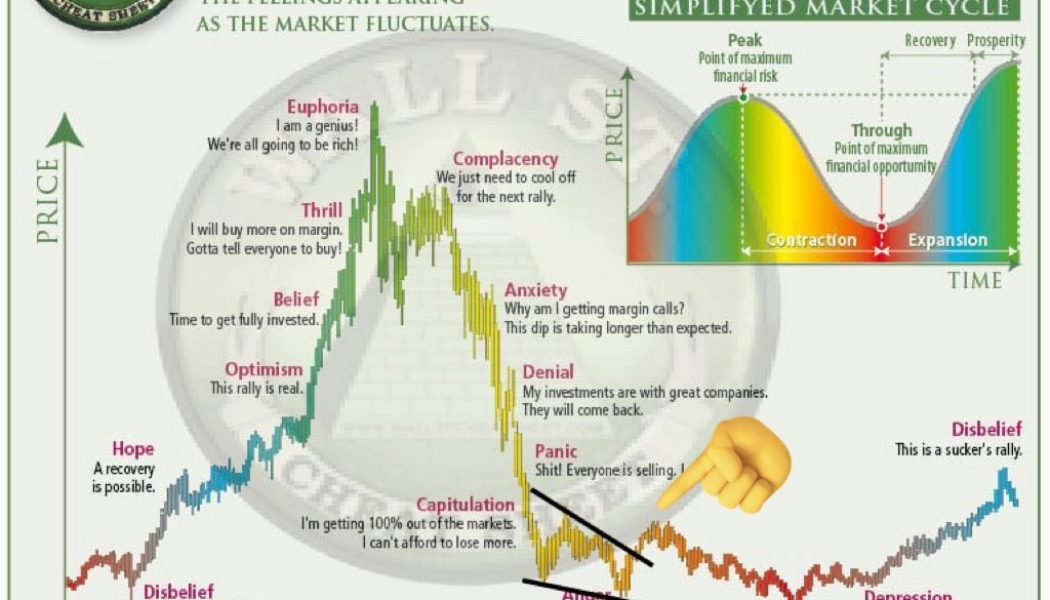

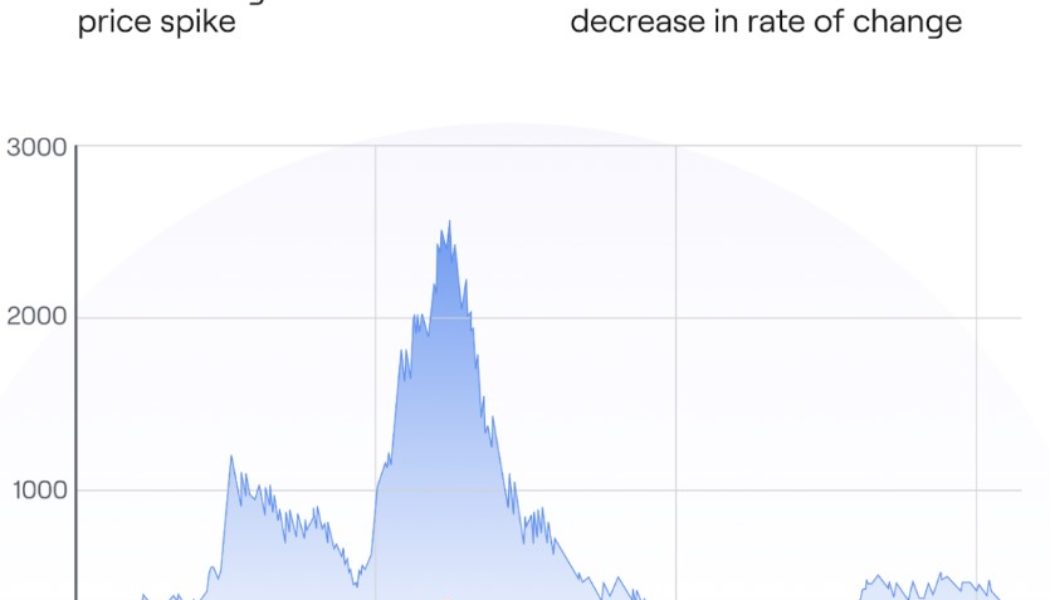

Bitcoin (BTC) may be circling its highest levels in months, but few are convinced that the bull market is back. Ahead of a key weekly close, BTC/USD remains near $21,000, data from Cointelegraph Markets Pro and TradingView shows, with analysts nervous about the good times ending all too soon. Bitcoin to see new “depression” before bull run resumes Bitcoin is dividing opinion after its week of brisk gains. Warnings over a potential pullback abound, while others are already commiserating bears ahead of time. “Now bears will be caught in the vicious cycle of praying for pullbacks to go lower, not realizing the tides have shifted for a time and we’re going higher,” Chris Burniske, former head of crypto at ARK Invest, summarized. Even more optimistic takes such as that of Burniske, however, do ...

Can Canada stay a crypto mining hub after Manitoba’s moratorium?

Canada has remained a peculiar regulatory alternative to the neighboring United States in regard to cryptocurrency. While its licensing process has become more stringent than in some countries, Canada was the first to approve direct crypto exchange-traded funds. State pension funds have invested in digital assets, and crypto mining firms have moved to the country to take advantage of the cool temperatures and cheap energy prices. But the gold rush for miners in Canada may be slowing down. In early December, the province of Manitoba — rich in hydroelectric resources — enacted an 18-month moratorium on new mining projects. This move resembled a recent initiative in the U.S. state of New York that stopped the renewal of licenses for existing mining operations and required any new proof-of-wor...

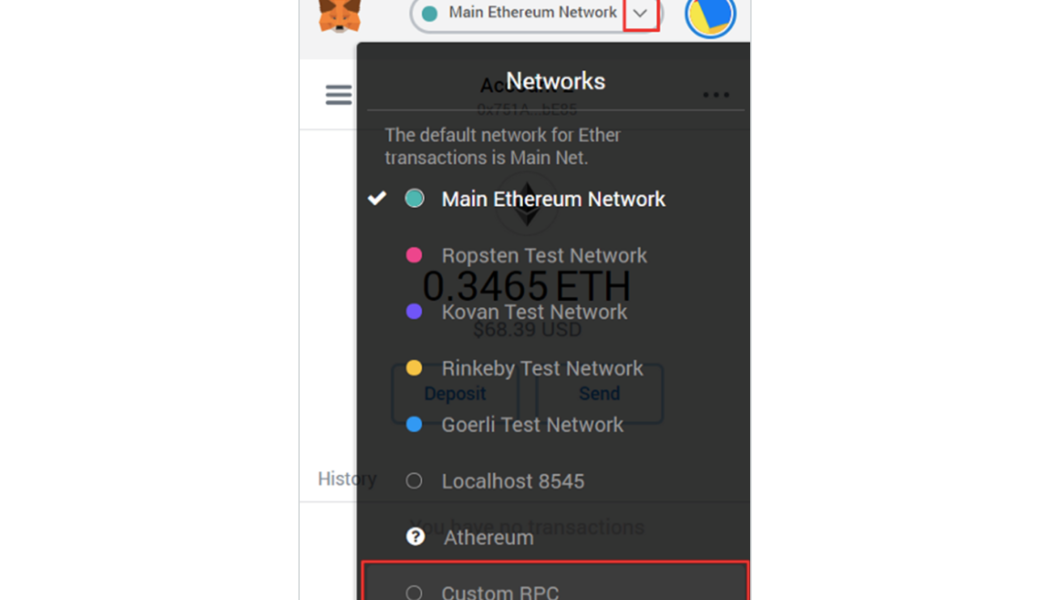

Polygon primed for hard fork aimed at reducing gas fee spikes: New details revealed

Ethereum layer-2 scaling solution Polygon will undergo a hard fork on Jan. 17 in order to address gas spikes and chain reorganizations issues that has affected user experience on the Polygon proof-of-stake (POS) chain. Polygon officially confirmed the hard fork event in Jan. 12 a blog post, which came after weeks of preliminary discussion on Polygon Improvement Proposal (PIP) forum page in late December. GET READY FOR THE HARDFORK The proposed hardfork for the #Polygon PoS chain will make key upgrades to the network on Jan 17th. This is good news for devs & users — & will make for better UX. You will NOT need to do anything differently. Details:https://t.co/RaBWDjEGrI pic.twitter.com/nipa15YQdZ — Polygon (@0xPolygon) January 12, 2023 A Polygon spokesperson also provided...

Former FTX US President lashes out at ‘insecure’ SBF in 49-part Twitter thread rant

Former FTX US President Brett Harrison has lashed out at Sam Bankman-Fried for manipulating and threatening colleagues who proposed solutions to reorganize FTX US’ management structure. Harrison shared his experiences with Bankman-Fried and FTX US on Dec. 14, explaining how he was hired “casually over text” in Mar. 2021 after working together at New York-based trading firm Jane Street for a few years. But six months into Harrison’s tenure at FTX US, “cracks began to form” between the two, he said. Despite recalling Bankman-Fried to be a “sensitive and intellectually curious person” at first, Harrison said he saw “total insecurity and intransigence” in Bankman-Fried when confronted with conflict, particularly when Harrison suggested FTX US establish separate branches for i...

Alameda Research had a $65B secret line of credit with FTX: Report

Former FTX CEO Sam Bankman-Fried (SBF) reportedly ordered Gary Wang, co-founder of the crypto exchange, to open a $65 billion “secret backdoor line of credit” for Alameda Research, according to FTX attorney Andrew Dietderich. The attorney disclosed the information during a Delaware bankruptcy court hearing on Jan. 11, the New York Post reported. The alleged line of credit was financed with FTX customers’ funds. As per Dietderich testimony, the “backdoor was a secret way for Alameda to borrow from customers on the exchange without permission.” “Mr. Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” Dietderich told the court, adding...

Alameda Research had a $65B secret line of credit with FTX: Report

Former FTX CEO Sam Bankman-Fried (SBF) reportedly ordered Gary Wang, co-founder of the crypto exchange, to open a $65 billion “secret backdoor line of credit” for Alameda Research, according to FTX attorney Andrew Dietderich. The attorney disclosed the information during a Delaware bankruptcy court hearing on Jan. 11, the New York Post reported. The alleged line of credit was financed with FTX customers’ funds. As per Dietderich testimony, the “backdoor was a secret way for Alameda to borrow from customers on the exchange without permission.” “Mr. Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” Dietderich told the court, adding...

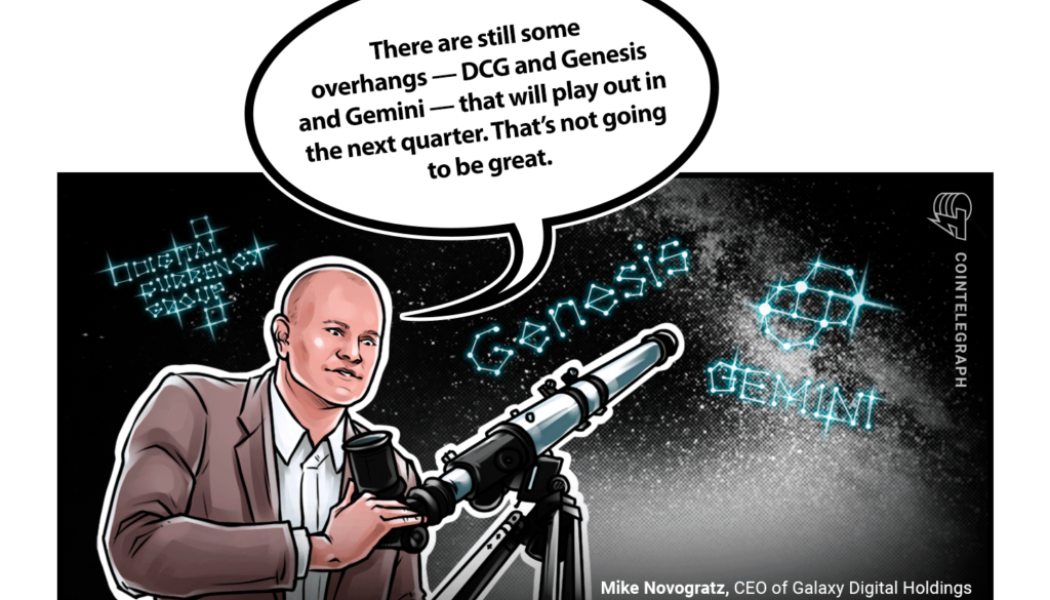

SBF denies stealing FTX assets, SEC charges Gemini and Genesis, and more: Hodler’s Digest: Jan. 8-14

Top Stories This Week Sam Bankman-Fried: ‘I didn’t steal funds, and I certainly didn’t stash billions away.’ In a “pre-mortem overview” of FTX’s bankruptcy, Sam Bankman-Fried denied allegations of improper use of customer funds stored with the crypto exchange, attributing responsibility for the company’s dramatic fall to the market crash of 2022 and Binance CEO Changpeng Zhao’s PR campaign against FTX. In Bankman-Fried’s view, a run on the bank turned illiquidity issues into insolvency. Among the latest developments in the bankruptcy proceedings, a bipartisan group of United States senators criticized one of the law firms involved in the case on the grounds of a conflict of interest, and called on the U.S. Bankruptcy Court for the District of Delaware to appoint an independent examiner int...

SBF denies stealing FTX assets, SEC charges Gemini and Genesis, and more: Hodler’s Digest: Jan. 8-14

Top Stories This Week Sam Bankman-Fried: ‘I didn’t steal funds, and I certainly didn’t stash billions away.’ In a “pre-mortem overview” of FTX’s bankruptcy, Sam Bankman-Fried denied allegations of improper use of customer funds stored with the crypto exchange, attributing responsibility for the company’s dramatic fall to the market crash of 2022 and Binance CEO Changpeng Zhao’s PR campaign against FTX. In Bankman-Fried’s view, a run on the bank turned illiquidity issues into insolvency. Among the latest developments in the bankruptcy proceedings, a bipartisan group of United States senators criticized one of the law firms involved in the case on the grounds of a conflict of interest, and called on the U.S. Bankruptcy Court for the District of Delaware to appoint an independent examiner int...

Solana Foundation warns about security incident with Mailchimp

Solana Foundation, the non-profit organization of the Solana Network, disclosed on Jan. 14 a security incident involving its email service provider Mailchimp. According to an email sent to users and seen by Cointelegraph, the Foundation was informed by Mailchimp on Jan. 12 that “an unauthorized actor accessed and exported certain user data from the Solana Foundation’s Mailchimp instance.” Among the information accessed and exported in the incident were user’s names and Telegram usernames. The Solana Foundation stated: “Based on the information we have received from Mailchimp, the affected information may have included, inter alia, email addresses, names, and Telegram usernames, in each case only to the extent users provided any such information. Mailchimp advi...

Solana Foundation warns about security incident with Mailchimp

Solana Foundation, the non-profit organization of the Solana Network, disclosed on Jan. 14 a security incident involving its email service provider Mailchimp. According to an email sent to users and seen by Cointelegraph, the Foundation was informed by Mailchimp on Jan. 12 that “an unauthorized actor accessed and exported certain user data from the Solana Foundation’s Mailchimp instance.” Among the information accessed and exported in the incident were user’s names and Telegram usernames. The Solana Foundation stated: “Based on the information we have received from Mailchimp, the affected information may have included, inter alia, email addresses, names, and Telegram usernames, in each case only to the extent users provided any such information. Mailchimp advi...

One of the largest US colleges has begun teaching students about Bitcoin

Classroom adoption of Bitcoin and cryptocurrency courses continue to skyrocket, with Texas A&M now being the latest U.S. College to offer a Bitcoin course to some of its 74,000+ students. The news was announced on Jan. 13 by Associate Professor Korok Ray of Mays Business School at Texas A&M, who will be teaching the “Bitcoin Protocol” course to students in the College of Engineering and Mays Business School when the Spring Semester starts on Jan. 17. I will be teaching the first ever Bitcoin class at Texas A&M this spring! — Korok Ray (@KorokRay) January 12, 2023 Ray stated in the 4-part Twitter thread that “Programming Bitcoin” will follow Bitcoin Protocol, where students will learn to “build a Bitcoin library from scratch.” The professor added that it was no easy feat to rece...