Crypto news

Nifty News: Price drops on ‘Cryptohouse’ with NFT decor, mint your personality as an NFT and more

Waning interest in a North Hollywood crypto-themed home A crypto-friendly house in North Hollywood, Los Angeles, is seemingly struggling to sell, as the property has seen its price reduce three times in a little over four months. The so-called “Cryptohouse,” as stated on the glowing neon sign in its kitchen, was listed for sale at $1.2 million in October 2022. As of Jan. 5, its asking price is now $949,000. The impressive custom neon sign never lets you forget just where you are. Image: Zillow The four-bed, three-bath home sees the listing agents boasting in the property description of its spacious and flowing floor plan ideal for “savvy investors.” For unknown reasons, the description doesn’t mention its tasteful wallpaper choices, which include multiple nonfungible tokens (NFTs) f...

Cross-border crypto scammers on the hit list for EU agencies

By the end of 2022, scammers shifted their focus to duping crypto investors who desperately tried to recoup their year-long losses. An international law enforcement operation led by European government agencies joined crypto entrepreneurs and businesses to curb cross-border crypto scams since July 2022, uncovering a criminal network operating through call centers. Europol and Eurojust, two EU agencies for law enforcement cooperation, joined authorities from Bulgaria, Cyprus, Germany and Serbia to investigate online investment fraud since June 2022. The investigation identified a criminal network that incurred over $2.1 million in losses — primarily for German investors. Call centres selling fake crypto taken down in Bulgaria, Serbia & Cyprus. The criminal organisations lured victims to...

BTC price cancels FTX losses — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week at new 2023 highs but still dividing opinion after a blistering price rally. In what is shaping up to be the antidote to last year’s slow bleed lower, January has delivered the volatility Bitcoin bulls were hoping for — but can they sustain it? This is the key question for market participants going into the third week of the month. Opinion remains divided on Bitcoin’s fundamental strength; some believe outright that the march to two-month highs is a “sucker’s rally,” while others are hoping that the good times will continue — at least for the time being. Beyond market dynamics, there is no shortage of potential catalysts waiting to assert themselves on sentiment. United States economic data will keep coming, while corporate earnings could deliver some fresh ...

Shiba Inu devs to launch Shibarium L2 network beta

The developers of the dog-themed token Shiba Inu (SHIB) posted an update to inform its community about its upcoming beta release of Shibarium — a layer-2 network that will run on top of the Ethereum mainnet. In the announcement, SHIB developers shared information about layer-2 blockchains. They highlighted that Shibarium is being developed to provide a tool to allow the community to build and grow the project and fulfill its founder’s vision. While some believe creating Shibarium is a way to increase the memecoins price, the developers noted that this wasn’t the goal. They wrote: “Patience is key, and some see Shibarium as a price-pumping tool, but that is not the project’s focus and never has been.” Instead, the developers mentioned that the goal of the new update in its infras...

Nexo investigation is not political, Bulgarian prosecutors say

Siika Mileva, a spokesperson for Bulgaria’s chief prosecutors, has denied political motivations behind the probe against the crypto lending firm Nexo, according to local reports. The comments were made in response to claims that the investigation had a connection to the company’s political donations. Almost all cases where a prosecution launches an investigation that affects someone’s financial interests results in attacks and accusations, Mileva said. “It has become a national sport to attack the institutions,” he added. On Jan. 12, a group of prosecutors, investigators and foreign agents searched the company’s offices in the Bulgarian capital city of Sofia. The operation targeted a large-scale money laundering scheme as well as violations of Russia’s international sanctions. In less than...

5 altcoins that could breakout if Bitcoin price stays bullish

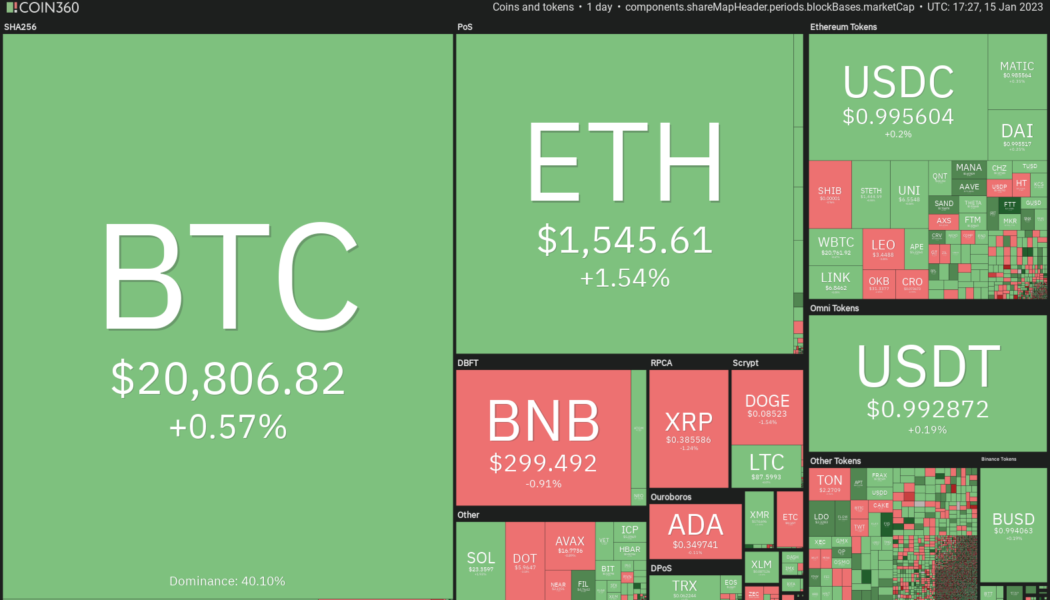

The cryptocurrency markets have made a strong comeback in the past few days. That drove the total crypto market capitalization to $995 billion on Jan. 14, according to CoinMarketCap data. Bitcoin (BTC) led the recovery from the front and skyrocketed above $21,000 on Jan. 14. After the sharp rally, the big question is whether the recovery is a dead cat bounce that is a selling opportunity, or is it the start of a new uptrend. It is difficult to predict with certainty if a macro bottom has been made but the charts suggest that a bottoming process has begun. Crypto market data daily view. Source: Coin360 Independent market analyst HornHairs highlighted that the 2017 to 2018 bear market lasted for 364 days and from 2021 to the current market low, the duration is again 364 days. Another interes...

Bank of Thailand to allow first virtual banks by 2025

Bank of Thailand has disclosed plans to allow virtual banks to operate in the country for the first time. Financial firms will be able to provide services by 2025, a Bloomberg report shows. The “Consultation Paper on Virtual Bank Licensing Framework” published by the central bank says that applications will be available later in 2023 allowing virtual banks to act as financial services providers. The move focuses on increasing competition and boosting Thailand’s economic growth. The Bank of Thailand will issue three different licenses for interested companies by 2024. There are at least 10 parties interested in granting permissions, the report states. Regulations and supervision for virtual banks will be the same as those for traditional commercial banks under the licensing framework....

Scaramucci to invest in crypto firm founded by former FTX US boss

SkyBridge Capital founder Anthony Scaramucci is investing in a crypto company founded by the former president of FTX US. According to an email to Bloomberg, Scaramucci said he would be investing his own personal funds to support ex-FTX US president Brett Harrison’s new venture, which became known just three weeks after the collapse of crypto exchange FTX. It is understood that the crypto software company — which doesn’t yet have a name — will enable crypto traders to create algorithmic-based strategies to access different markets — both centralized and decentralized. It is also understood that Harrison has been seeking a fundraising target as high as $10 million for a $100 million valuation. In a Jan. 14 tweet responding to Harrison’s lengthy thread on Sam Bankman-Fried and his ...

3 blockchain use cases that extend beyond crypto

Blockchain use cases have expanded far beyond cryptocurrency in recent years, with multiple industries embracing the technology in a wide range of fields, including healthcare, logistics and financial services. There are many factors behind the hype. Blockchains are decentralized, transparent and increase the capacity of a whole network, opening a window for solutions that require significant computational power. More importantly, they give users the capacity to control their assets, including their data, without relying on third parties. As blockchain evolves, companies across the world are working to find the best ways to implement the technology for a range of applications. To gain further insight, Cointelegraph reached out to projects disrupting industries and bringing blockchain...

The aftermath of LBRY: Consequences of crypto’s ongoing regulatory process

The case of LBRY highlights a wave of renewed regulatory pressure that could affect both blockchain token-issuing companies and their investors. In November, an over year-long court battle between the United States Securities and Exchange Commission (SEC) and blockchain development company LBRY and its LBRY Credits (LBC) token culminated in the ruling of the token as an unregistered security, despite the company’s argument of its use as a commodity within the platform. The court’s decision in this case sets a precedent that could influence not only the regulatory perception of blockchain-based platforms, but cryptocurrencies as well. The old Howey Old standards don’t always apply when it comes to the regulation of new technologies. The LBRY case was mostly centered on the basis of th...

Navigating the World of Crypto: Tips for Avoiding Scams

Despite the belief of many crypto enthusiasts that centralized exchanges (CEXs) are safer, history has often shown them to be rather vulnerable to attacks. Because these exchanges centralize the storage of users’ assets, they can be attractive targets for cybercriminals. If an exchange’s security measures are inadequate or successfully compromised, user assets may be stolen or lost. Another risk of centralized exchanges is the potential for fraud or mismanagement by their operators. Since CEXs may have a single point of control, they may be more susceptible to insider fraud or other forms of misconduct — which can lead to the loss of funds or other negative consequences for users. Over the last year, with the collapse of major centralized cryptocurrency platforms like FTX and Celsius, more...