Crypto news

Price analysis 1/17: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

Risk assets have started the new year on a strong note. The S&P 500 (SPX) and the Nasdaq closed in the positive for the second successive week and also notched their best weekly performance since November. Bitcoin (BTC) led the recovery in the crypto markets with a sharp 21% rally last week. That sent the Bitcoin Fear and Greed Index into the neutral territory of 52 on Jan. 15, its highest since April 5, 2022. However, the index has given back its gains and is again back into the Fear zone on Jan. 17. Daily cryptocurrency market performance. Source: Coin360 The strong rally in Bitcoin has divided analysts’ opinions. While some expect the rally to be a bull trap, others believe that the up-move could be the start of a new bull market. The confirmation of the same will happen...

Putting carbon credits on blockchain won’t solve the problem alone: Davos

Simply trading carbon credits on the blockchain won’t solve much for the environment. Carbon blockchain executives argue that companies must understand why they’re using them and how to make a real impact. During a panel session in Davos, Switzerland, moderated by Cointelegraph’s editor-in-chief, Kristina Lucrezia Cornèr on Jan. 16, several executives from carbon blockchain platforms spoke about the increasing interest from companies in carbon trading. Karen Zapata, the chief operating officer of carbon blockchain platform ClimateTrade, said that sustainability had been a “trending topic” with many companies keen to get involved, but noted that many still don’t understand it. She recalled talking to a sustainability manager of a “big, big company” who told her he doesn’t know what a carbon...

Bank of England governor questions need for digital pound

Andrew Bailey, the Bank of England (BoE) governor, expressed skepticism on the need for a digital pound shortly after finance ministers from eurozone countries backed further work on a digital euro. The BoE governor recently questioned the need for a wholesale central bank digital currency (CBDC), citing that there already is a “wholesale central bank money settlement system with a major upgrade.” In addition, Bailey also expressed that there are no plans to abolish cash regarding retail use. The BoE governor does not believe that retail payments need to change at the moment. He explained: “We have to be very clear what problem we are trying to solve here before we get carried away by the technology and the idea.” Bailey’s comments follow new CBDC developments in the eurozone and rec...

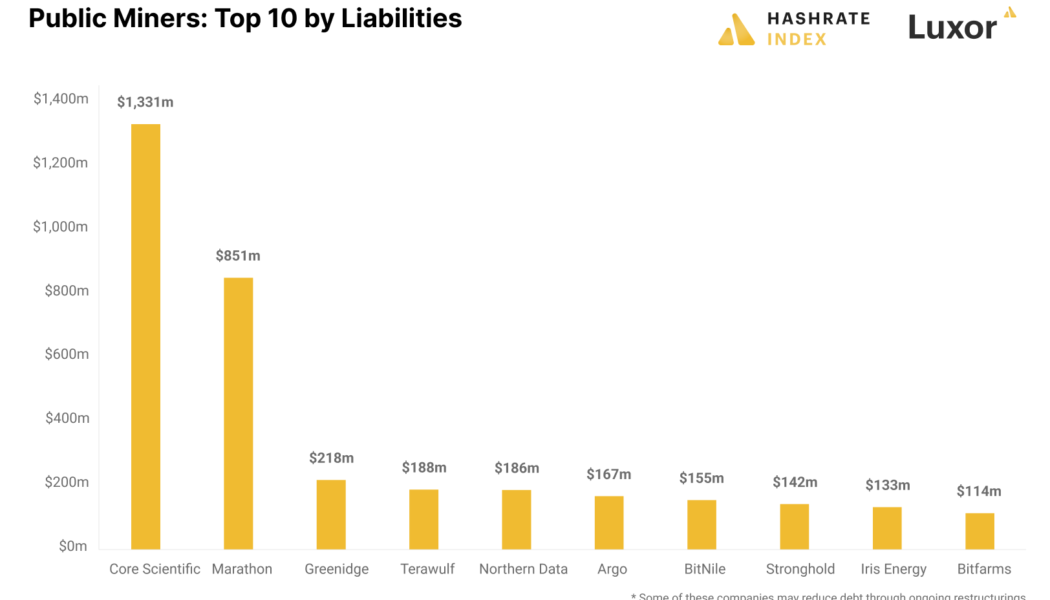

Crypto mining stocks surge to yearly highs after Bitcoin bounces back

The Bitcoin (BTC) price rebound to a multi-month high has also positively affected mining stocks. Many crypto-mining stocks recorded their best monthly performance in a year. The surge in mining stocks also relieved the troubled miners who had to sell a significant chunk of their mined coins to boost liquidity in 2022. Bitfarms — one of the top BTC mining firms — registered a 140% surge in the first two weeks of January 2023, followed by Marathon Digital Holdings with a 120% surge. Hive Blockchain Technologies saw its stock value nearly double in the same period, while the MVIS Global Digital Assets Mining Index is up by 64% in the first month of the new year. The Luxor Hashprice Index, which aims to quantify how much a miner might make from the processing power used by the Bitcoin network...

Troubled crypto lender Vauld gets extended creditor protection

Embattled crypto lending platform Vauld one more time gets the period of creditor protection from a Singapore court. The company should come up with a revival plan before Feb. 28. As reported by Bloomberg on Jan. 17, Vauld has been granted more than a month to close its negotiations with one of two digital-asset fund managers to take over the executive control of the tokens stuck on its platform. Apparently, the Singapore high court was satisfied by the company’s claim that the negotiations have entered to the “advanced stage.” In July 2022 the platform halted the withdrawals for its 800,000 customers, citing unfavorable market conditions and an unprecedented $200 million worth of withdrawals in under two weeks. In August, it has already been granted a three-month moratorium to come ...

EU finance ministers’ group releases statement on political aspects of digital euro

The finance ministers from the eurozone countries have released a statement on the introduction of the digital euro after a meeting in Brussels. The Eurogroup meets regularly to discuss political dimensions of the potential digital currency, it said. The Jan. 16 statement coincides with the release of a European Central Bank (ECB) “stock taking” document detailing the progress of digital euro design. The Eurogroup statement addressed the need for the European Central Bank and European Commission to inform the Eurogroup and EU member states of developments in the creation of the digital euro, which is in its investigative phase. The statement said: “The Eurogroup considers that the introduction of a digital euro as well as its main features and design choices requires political decisions th...

CoinFLEX attempts to hose down backlash over proposed new 3AC project

Amid mounting criticism on social media, crypto investment firm CoinFLEX has attempted to clarify its plans to build a new crypto exchange with Three Arrows Capital (3AC). A leaked pitch deck on Jan. 16 revealed it was collaborating with the now-bankrupt hedge fund to build a proposed crypto exchange called “GTX” — which would focus on the trading of claims against bankrupt firms. In a blog post published shortly after, CoinFLEX went on to “clarify misconceptions about the leaked materials concerning the proposed ‘GTX’ Exchange.” Firstly, CoinFLEX said it won’t actually be using the “GTX” name as detailed in the pitch deck, noting that it only serves as a placeholder name for now. Some members of the community had ...

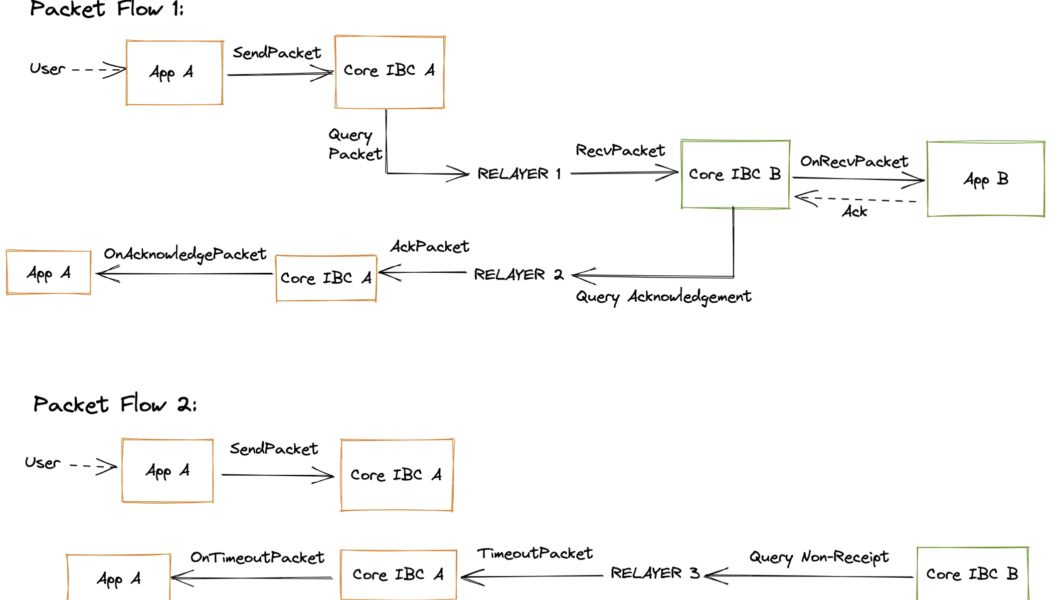

Opinion: The Inter-Blockchain Communication Protocol will end ecosystem maximalism

When I entered crypto, I succumbed to the contest between blockchain ecosystems, believing one had to be “better” than others. I have since realized the future of cryptocurrency is bringing with it a variety of platforms that will excel at different things. With the Inter-Blockchain Communication Protocol (IBC), I’ve left behind the days of thinking chains have to compete and embrace a connected interchain future. Let me explain. Solana, Polkadot, etc. — what do they have in common? They are individual state machines, each trying to achieve something only one has done before: create a sustainable, robust ecosystem of developers, investors and, most importantly, users. So far, Ethereum shows no signs of slowing. Since beginning the summer of 2020 with an 8% share of the total crypto market,...

Alameda wallet under liquidator control incurred $11.5M in losses: Arkham

The liquidators of Alameda Research have reportedly incurred at least $11.5 million in losses since taking control of Alameda’s trading accounts. On Jan. 16, a Twitter thread from Arkham Intelligence reported that one wallet under the control of liquidators has seen a string of “significant losses” due to liquidations, some of which were “preventable losses.” Over the past two weeks being under Liquidator control, the account incurred significant losses: Largest single liquidation: $4.85MTotal liquidated amount: $11.5MPreventable losses: $4M+ — Arkham (@ArkhamIntel) January 16, 2023 As one example, Arkham noted that the account ending 0x997 initially had a short position of 9,000 Ether (ETH) ($10.8 million) against the collateral of $20 million in USD Coin (US...

Binance to let institutions store crypto with cold custody

Amid the centralized cryptocurrency exchanges (CEX) crisis, crypto exchange Binance is moving to improve its institutional trading services with cold-custody opportunities. On Jan. 16, Binance announced the official launch of Binance Mirror, an off-exchange settlement solution that enables institutional investors to invest and trade using cold custody. The newly launched Mirror service is based on Binance Custody, a regulated institutional digital asset custodian, and involves mirroring cold-storage assets through 1:1 collateral held on a Binance account. Binance emphasized that the new solution enables more security, allowing traders to access the exchange ecosystem without having to post collateral directly on the platform, stating: “Their assets remain secure in their seg...

Bitcoin price breakout or bull trap? 5K Twitter users weigh in

Bitcoin (BTC) is trading at its highest levels in over two months, but the phrase on every trader’s lips is “bull trap.” After delivering 25% returns in a single week, BTC/USD remains under suspicion among Bitcoin bear market survivors. Bitcoin bull trap fails to convince It has been called the “biggest bull trap” ever seen, and despite holding above $20,000, BTC price action is fooling no one. This week, with Wall Street closed until Jan. 17, out-of-hours trading continues to support higher levels, but faith in these staying around for long is hard to find. For those who observed drop after drop throughout 2022, culminating in the FTX scandal, it appears simply too good to be true that Bitcoin will now flip bullish. That is the current result of Cointelegraph’s dedicated Twitter sur...

3AC, Coinflex founders collaborating to raise $25M for new claims trading exchange

Founders of collapsed crypto hedge fund Three Arrows Capital (3AC) Su Zhu and Kyle Davies are reportedly trying to raise money for a new cryptocurrency exchange in partnership with Coinflex cofounders Mark Lamb and Sudhu Arumugam. According to a pitch deck, they are looking to raise $25 million. The proposed new exchange is to be called GTX, according to the presentation. They propose to specifically target claims against bankrupt firms. “FTX users are selling claims at ~10% face value for immediate liquidity or waiting 10+ years for the bankruptcy to process disbursements,” the presentation said. It promised to crack the claims market: “Our legal team will streamline and automate claims onboarding to GTX and make it the dominant marketplace for FTX and other bankrupt companies...