Crypto lending

NEXO risks 50% drop due to regulatory pressure and investor concerns

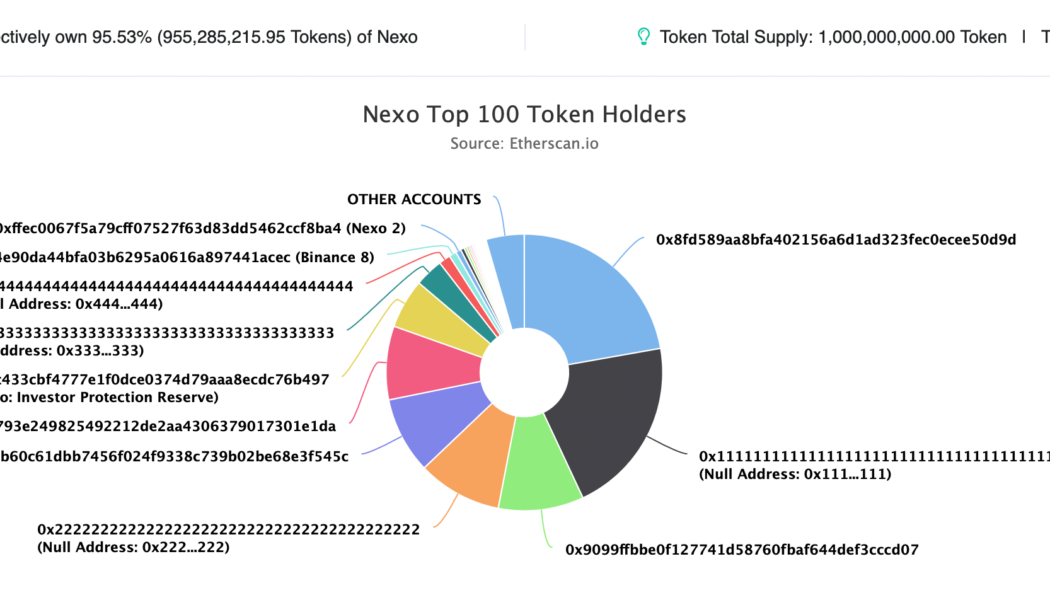

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...

Nexo ‘surprised’ by state regulators’ actions, says co-founder

Kalin Metodiev, the co-founder and managing partner of crypto lender Nexo stated his firm was “surprised” by the way in which eight state regulators publicly took action against it for securities violations. Earlier this week the California Department of Financial Protection & Innovation (DFPI) filed a desist and refrain order against Nexo’s Earn Interest Product, claiming the company was offering a security product that had not been cleared by the government for sale in the form of an investment contract. The DFPI also stated that it was joining regulators from seven other states in taking action against the company, including Kentucky, New York, Maryland, Oklahoma, South Carolina, Washington and Vermont. Speaking with Cointelegraph at Token2049, Metodiev explained that Nexo was caugh...

Celsius Network is bankrupt, so why is CEL price up 4,000% in two months?

Crypto lending platform Celsius Network has an approximately $1.2 billion gap in its balance sheet, with most liabilities owed to its users. In addition, the firm has filed for bankruptcy protection, so its future looks bleak. Still, Celsius Network’s native utility token CEL has soared in valuation by over 4,100% in the last two months, reaching around $3.93 on Aug. 13 compared to its mid-June bottom of $0.093. In comparison, top coins Bitcoin (BTC) and Ether (ETH) rallied 40% and 130% in the same period. CEL/USD daily price chart. Source: TradingView Takeover rumors behind CEL explosion? Technically, the price rally made CEL an excessively valued token in early August when its relative strength index (RSI) crossed above the 70 threshold. Takeover rumors appear to be behind CEL̵...

California regulator investigating crypto interest accounts

The California Department of Financial Protection and Innovation (DFPI) has warned consumers to “exercise extreme caution” when dealing with interest-bearing crypto-asset accounts. The DFPI stated that it is investigating multiple crypto interest account providers to determine whether they are “violating laws under the Department’s jurisdiction.” In a July 12 note, the DFPI emphasized that crypto-interest account providers “are not governed by the same rules and protections as banks and credit unions” and that some platforms are “preventing customers from withdrawing from and transferring between their accounts.” “The Department warns California consumers and investors that many crypto-interest account providers may not have adequately disclosed risks customers face when they deposit crypt...

Crypto lending platform Babel Finance reaches counterparty debt agreement

Hong Kong-based crypto lending firm, Babel Finance, has eased some of its immediate liquidity troubles by reaching debt repayments agreements with some of its counterparties. As previously reported, the firm issued a temporary suspension of redemptions and withdrawals from its products on June 17 after citing “unusual liquidity pressures” in the current bear market. The company stated it was taking swift action to protect clients and communicate with “all related parties.” In an update posted on June 20, Babel Finance stated that it has since taken three steps to help ease its current liquidity situation. These include: carrying out an emergency assessment of the firm’s business operations, communicating with shareholders/investors, and reaching “preliminary agreements” for some debt...

Celsius seeks help from Citigroup and reportedly hires restructuring attorneys

Wall Street Journal reported yesterday that the network is seeking to restructure to survive the financial crisis it is caught in At the start of this week, Celsius announced that it was temporarily halting withdrawal services on its platform Crypto lender, Celsius, has sought the services of ‘restructuring’ attorneys from the international law firm Akin Gump Strauss Hauer and Feld, WSJ reported on Tuesday. The lending firm is exploring the restructuring avenue amid alleged liquidity issues, with the lawyers from the largest US lobbying firm being called to offer assistance. The lawyers will reportedly advise on the financial restructuring path and offer consultation services. However, it is not concluded that this is the firm’s path. Citing unnamed sources in the know, the...

Crypto lender Celsius freezes withdrawals; rival Nexo offers a ‘helping hand’

Celsius halted withdrawals on Monday, noting that said the process back to normalcy could see delays Fellow crypto lending Nexo tabled an offer to ‘bail’ Celsius by taking up its qualifying assets Crypto lending platform Celsius is seeing the worst of the crypto markets and, in effect, announced on Monday morning that it paused redemptions citing severe “market conditions.” In what it termed a very important message to the community, Celsius justified that it took the decision in order to remain ‘fit’ to honor its withdrawal obligations to customers over time. “Acting in the interest of our community is our top priority. In service of that commitment and to adhere to our risk management framework, we have activated a clause in our Terms of Use that will allow for this process to take place...