crypto laws

BitMEX co-founder Benjamin Delo avoids jail, receives 30 months probation

Benjamin Delo the co-founder of cryptocurrency exchange BitMEX has been sentenced to 30 months probation for violating the Bank Secrecy Act (BSA), which is an anti-money laundering law. The sentence, handed down at a federal court in New York on June 15th, follows his guilty plea to charges in February of “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program” in his role at BitMEX. Prosecutors had argued Delo should serve a year in prison or at least receive a two-year probation along with six months of home detention, as was given to former CEO Arthur Hayes in May. For Delo, his lesser sentence closes the legal saga which started in October 2020 which also saw co-founders Hayes and Samuel Reed along with BitMEX’s first official employee Gregory (Gr...

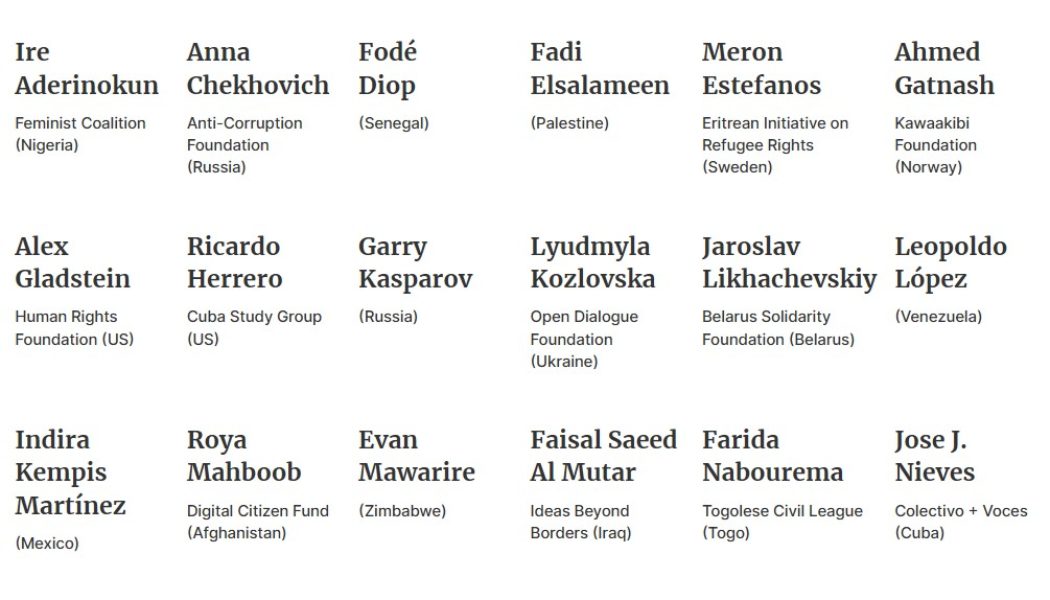

Human rights activists take aim at privileged crypto critics in letter to Congress

Human rights activists from 20 countries have submitted an open letter to the United States Congress in support of a “responsible crypto policy” and praising Bitcoin and stablecoins as essential tools aiding democracy and freedom for tens of millions. The letter comes just a week after an anti-crypto open letter was sent to Congress purporting to be from the scientific community but whose lead signatures included well known crypto critics and authors from high income, democratic countries. The group of 21 activists clapping back include those from countries which have either seen recent conflict or have otherwise unstable economies such as Ukraine, Russia, Iraq, Nigeria, Venezuela, Cuba and even North Korea. The letter states: “We write to urge an open-minded, empathetic approach toward mo...

Aussie consumer group calls for better crypto regs due to ‘lagging laws’

Australian consumer advocacy group CHOICE has called on the federal government to provide better protection for crypto investors while submitting a proposed regulatory framework for cryptocurrency exchanges operating in the country. The regulatory framework was submitted in response to the federal Treasury’s consultation paper for “crypto asset secondary service providers” (CASSPs) defined as firms providing custodial crypto wallets and exchange services. CHOICE commented: “As it stands, enforceable protections in the unregulated cryptocurrency market are somewhere between negligible and non-existent.” Outlining four main areas in its framework, the group called for a single definition of crypto for better regulation, a license for exchanges in line with current financial licensing, ...