Crypto investment products

CoinShares’ Butterfill suggests ‘continued hesitancy’ among investors

Minor inflows for digital asset investment products over the last few weeks suggest a “continued hesitancy” towards crypto amongst institutional investors amid a slowdown of the U.S. economy. In the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Coinshares head of research James Butterfill highlighted stand-offish institutional sentiment towards crypto investment products, which saw “minor inflows” for the third week in a row. “The flows remain low implying continued hesitancy amongst investors, this is highlighted in investment product trading volumes which were US$886m for the week, the lowest since October 2020.” Between Sept. 26 and Sept. 30, investment products offering exposure to Bitcoin (BTC) saw the most inflows at just $7.7 million, with...

Almost $100M exits US crypto funds in anticipation of hawkish monetary policy

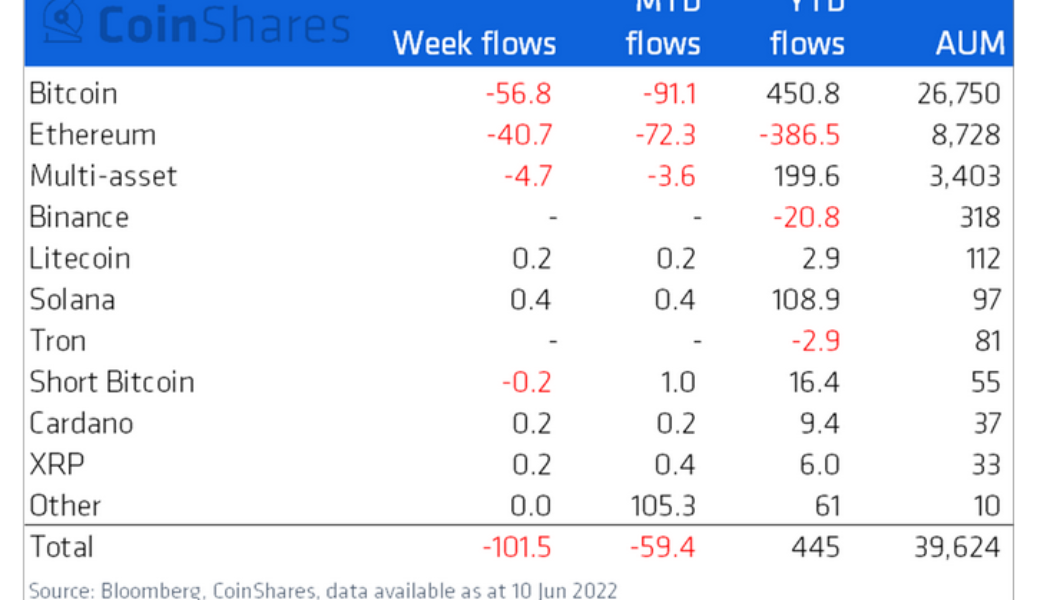

Institutional investors offloaded $101.5 million worth of digital asset products last week in ‘anticipation of hawkish monetary policy’ from the U.S. Federal Reserve according to CoinShares. U.S. inflation rates hit 8.6% year-on-year at the end of May, marking a return to levels not seen since 1981. As a result, the market is expecting the Fed to take considerable action to reel in inflation, with some traders pricing in three more 0.5% rate hikes by October. According to the latest edition of CoinShares’ weekly Digital Asset Fund Flows report, the outflows between June 6 and June 10 were primarily led by investors from the Americas at $98 million, while Europe accounted for just $2 million. Products offering exposure to crypto’s top two assets, Bitcoin (BTC) and Ethereum (ETH), accounted ...