crypto investment

GameStop to drop crypto efforts as Q3 losses near $95M

Gaming retailer GameStop says it will no longer focus any efforts on cryptocurrencies, after amounting $94.7 million in net losses in the third quarter and laying off staff from its digital assets department. On a Dec. 7 earnings call GameStop CEO, Matt Furlong, said it “proactively minimized exposure to cryptocurrency” over the year and “does not currently hold a material balance of any token,” adding: “Although we continue to believe there is long-term potential for digital assets in the gaming world, we have not and will not risk meaningful stockholder capital in this space.” Earlier this year the company said it was looking at crypto, along with nonfungible tokens (NFTs) and Web3 applications, as avenues for growth calling these spaces “increasingly relevant for gamers of the fut...

Goldman Sachs’ bearish macro outlook puts Bitcoin at risk of crashing to $12K

A sequence of macro warnings coming out of the Goldman Sachs camp puts Bitcoin (BTC) at a risk of crashing to $12,000. Bitcoin in “bottom phase?” A team of Goldman Sachs economists led by Jan Hatzius raised their prediction for the speed of Federal Reserve benchmark rate hikes. They noted that the U.S. central bank would increase rates by 0.75% in September and 0.5% in November, up from their previous forecast of 0.5% and 0.25%, respectively. Fed’s rate-hike path has played a key role in determining Bitcoin’s price trends in 2022. The period of higher lending rates — from near zero to the 2.25-2.5% range now — has prompted investors to rotate out of riskier assets and seek shelter in safer alternatives like cash. Bitcoin has dropped by almost 60% year-to-date and is...

11% of US insurers invest — or are interested in investing — in crypto

United States-based insurers are the most interested in cryptocurrency investment according to a Goldman Sachs global survey of 328 chief financial and chief investment officers regarding their firm’s asset allocations and portfolios. The investment banking giant recently released its annual global insurance investment survey, which included responses regarding cryptocurrencies for the first time, finding that 11% of U.S. insurance firms indicated either an interest in investing or a current investment in crypto. Speaking on the company’s Exchanges at Goldman Sachs podcast on Tuesday, Goldman Sachs global head of insurance asset management Mike Siegel said he was surprised to get any result: “We surveyed for the first time on crypto, which I thought would get no respondents, but I was surp...

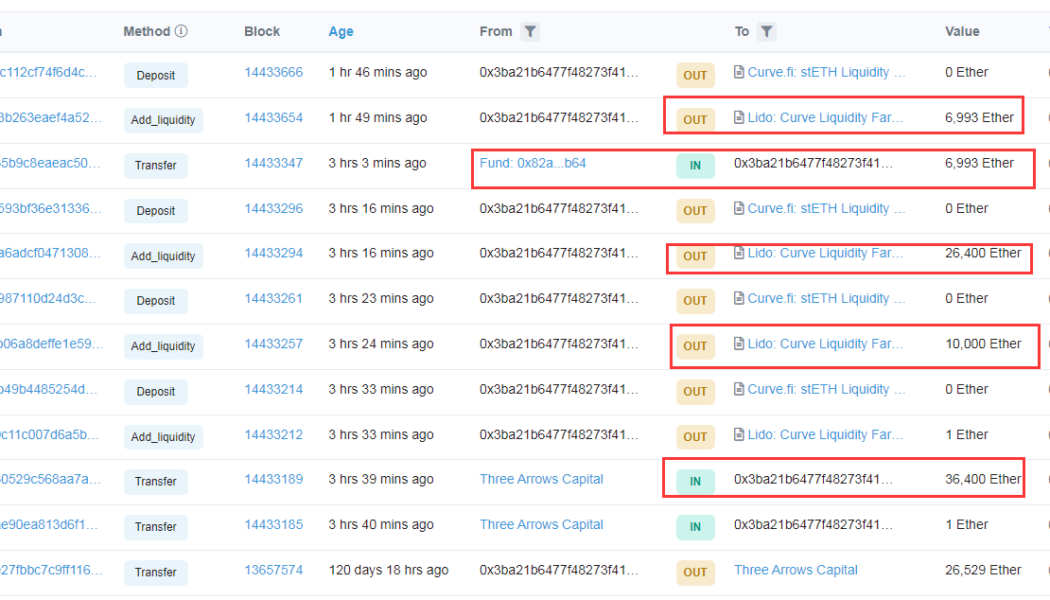

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

Treasury to launch financial education initiative around crypto investments

The United States Treasury Department is launching a new initiative to raise awareness of the risks involved in investing in digital assets. The move comes as the asset class transitions from a niche market into mainstream investment, according to a top Treasury official, potentially drawing in less sophisticated investors. The Department’s Financial Literacy Education Commission is developing educational materials designed to inform the public how crypto assets operate and differ from traditional assets. Treasury undersecretary for domestic finance, Nellie Liang, told Reuters that the target demographic is people that have limited access to mainstream financial services. She stated: “We’re hearing more and more about investors and households who are purchasing crypto assets, and we recogn...