Crypto Exchanges

New Apple rules double down on 30% NFT ‘tax’ and geo-limits exchanges

Technology heavyweight Apple has clarified its App Store rules around nonfungible tokens (NFTs) and cryptocurrency exchanges marking the first time its codified specific rules for NFTs. The new rules confirm how NFT purchases will be taxed and what they can and can’t be used for, while also clarifying rules around when a crypto exchange app can be listed. The Oct. 24 update to its App Store guidelines saw language added that allows fo in-app purchases of NFTs, but bars any NFTs acquired elsewhere to be used for anything other than viewing. It also allows applications to use in-app purchases to “sell and sell services” related to NFTs such as “minting, listing, and transferring.” However, the tech company is seemingly double-downing on its NFT “Apple tax” — which lumps in-...

Cardano Vasil upgrade ready with all ‘critical mass indicators’ achieved

The Cardano Vasil upgrade is set to take place in less than 24 hours on Sept. 22, with the Cardano team noting all three “critical mass indicators” needed to trigger the upgrade are now met. A Sept. 21 update on Twitter by the company behind Cardano, Input Output Hong Kong (IOHK) states within the last 48 hours 13 cryptocurrency exchanges had confirmed their readiness for the hard fork, representing over 87% of Cardano’s (ADA) liquidity. With this latest addition we have met all 3 critical mass indicators: 39 exchanges upgraded (87,59% by liquidity)Over 98% of mainnet blocks are now being created by the Vasil node (1.35.3)The top Cardano #DApps by TLV have confirmed they have tested and are ready — Input Output (@InputOutputHK) September 21, 2022 Of the top exchanges for ADA liquidity, Coi...

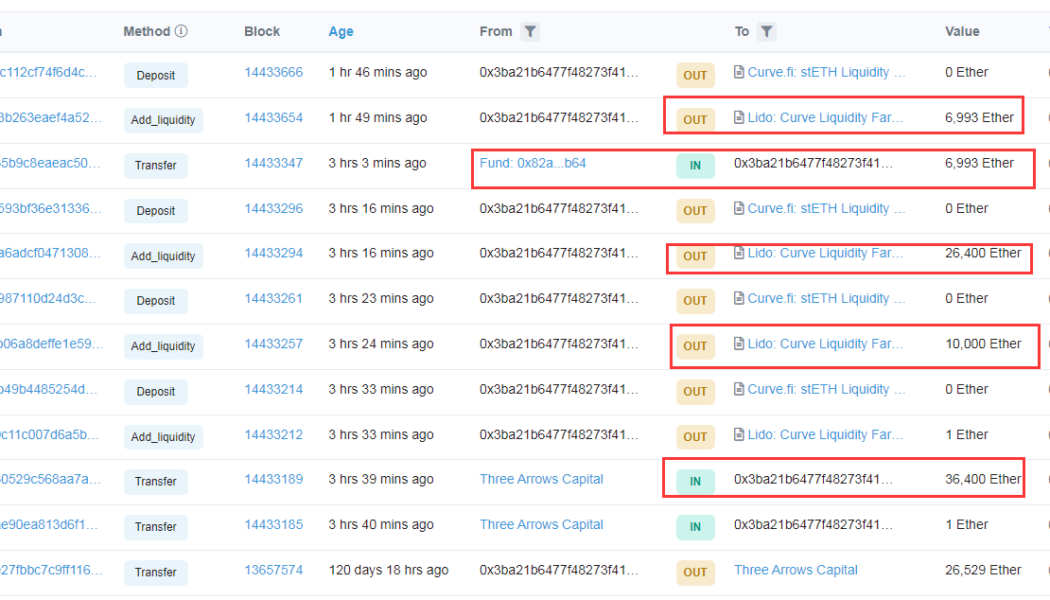

ETH price hits $3K as major crypto fund adds over $110M Ethereum to Lido’s staking pool

Ethereum’s native token Ether (ETH) rose above $3,000 on March 22 as fresh data suggests Three Arrows Capital staked at least $110 million worth of ETH into Lido’s liquidity pools. The Singapore-based hedge fund manager provided liquidity worth 36,401 ETH to Lido’s “Curve stETH pool” using a third-party Ether wallet, data from Etherscan shows. As a result, it became eligible to receive at least 36,401 stacked Ether (stETH) tokens from Lido: to ensure low slippage when un-staking those tokens for real ETH plus staking reward. Third-party Ethereum wallet that received ETH from Three Arrow Capital. Source: Etherscan.io Almost an hour later, another Ether address, marked with the word “fund,” sent 6,993 ETH (worth $21.12 million) to the ...

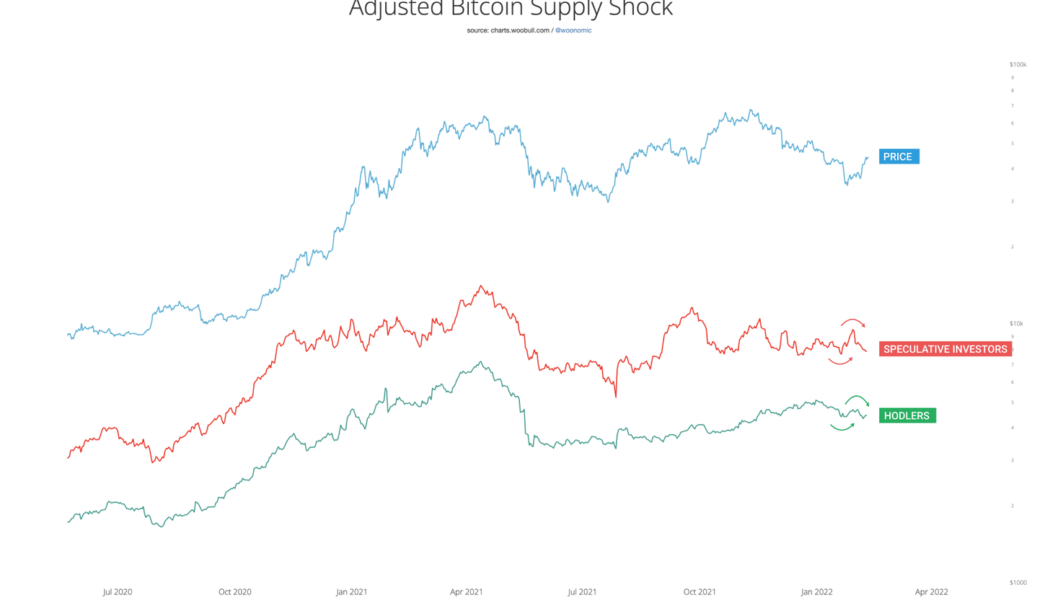

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

Robinhood hits new low as FTX US and Bitstamp USA move into stocks

Crypto exchanges FTX US and Bitstamp USA are working on offering stock trading, which would be a further blow to Robinhood as its share price slumps to new lows. FTX US President Brett Harrison tweeted on Tuesday that the crypto exchange is “hard at work on stocks,” commenting that a launch would be coming in “a couple months.” We’re hard at work on stocks! Features we’re planning for day 1: -Live BBO and historical candles-Stock screening/search functionality-Basic fundamentals (market cap, P/E ratio, dividend yield)-Portfolio performance tracking, order/trade details What else should we have? pic.twitter.com/q2bTpsfuna — Brett Harrison (@Brett_FTXUS) January 11, 2022 This isn’t FTX’s first dalliance with stocks. Back in Oct. 2020, the global arm of the crypto exchange launched a feature ...

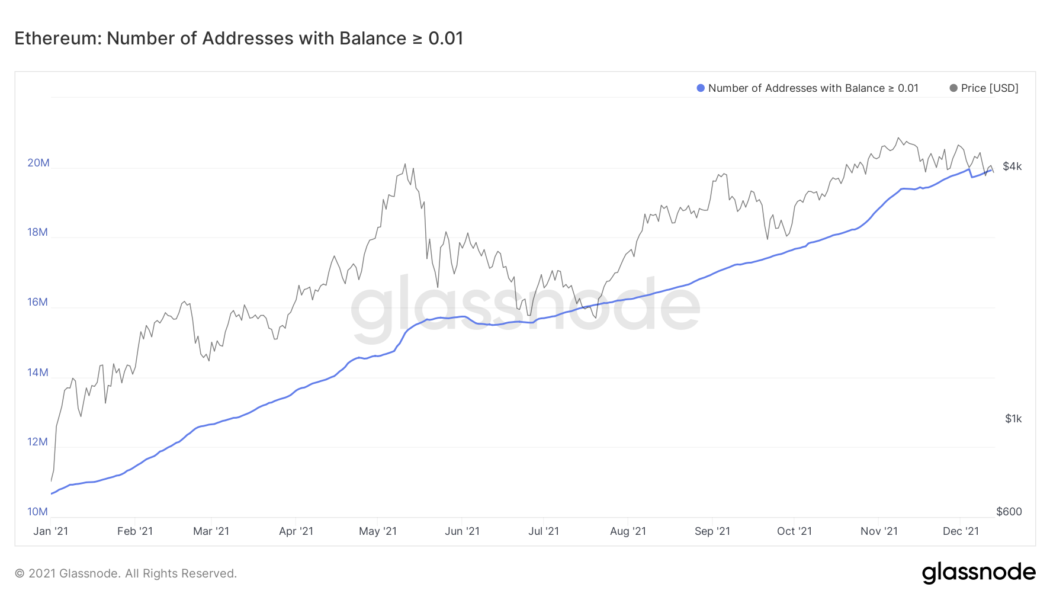

Small Ethereum investors increase exposure as ETH loses $4K level

Ethereum’s native token Ether (ETH) has dropped by over 18% after establishing an all-time high around $4,867 on Nov. 10, now trading near $3,900. Nonetheless, the plunge has not deterred retail investors from buying the token in small quantities. According to data gathered by Glassnode — a blockchain analytics platform, the number of Ether addresses holding less than or equal to 0.01 ETH reached a record high level of 19.95 million on Dec. 4, the day ETH dropped to as low as $3,575 (data from Coinbase). Ethereum addresses with balances less than or equal to 0.01. Source: Glassnode Meanwhile, the number of Ethereum wallets with balances of at least 0.1 ETH also kept climbing despite Ether’s correction from $4,867 to $3,575, eventually hitting a new all-time high of 6.37 million...