Crypto exchange

Bahamian liquidators reject validity of FTX’s US bankruptcy filing

Brian Simms, the court-appointed provisional liquidator overseeing the bankruptcy proceedings of FTX Digital Markets in The Bahamas, has called into question the validity of a Chapter 11 bankruptcy filing by subsidiary FTX Trading and 134 other affiliates in a Delaware court on Nov. 14. In the Nov. 15 document, Simms filed for Chapter 15 Bankruptcy in the United States Bankruptcy Court in the Southern District of New York, which is used when a foreign representative of the debtor seeks recognition in the U.S. for a pending foreign insolvency proceeding. In the filing Simms notes FTX Digital is not part of the Delaware Petition, and says as the provisional liquidator he is the only one, “authorized to take any act including, but not limited to, filing the Delaware Petition,” add...

Binance to liquidate its entire FTX Token holdings after ‘recent revelations’

The CEO of cryptocurrency exchange Binance, Changpeng “CZ” Zhao, said his company will liquidate the entirety of its position in FTX Token (FTT), the native token of competing exchange FTX. In a Nov. 6 tweet, Zhao said the decision was made after “recent revelations that have came to light.” In a later tweet, CZ explained the FTT liquidation was “just post-exit risk management” referring to lessons learned from the fall of Terra Luna Classic (LUNC) and how it impacted market players. He also added “we won’t support people who lobby against other industry players behind their backs.” Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t supp...

FTX to give a ‘one-time’ $6M compensation to phishing victims

Cryptocurrency exchange FTX will provide around $6 million in compensation to victims of a phishing scam that allowed hackers to conduct unauthorized trades on certain FTX users’ accounts. FTX founder and CEO Sam Bankman-Fried posted in a Twitter thread on Oct. 23 that the exchange generally doesn’t award compensation to its users “phished by fake versions of other companies in the space” but in this case, it would compensate users. Bankman-Fried said that this was a “one-time thing” and FTX would “not do this going forward.” “THIS IS NOT A PRECEDENT,” he wrote, clarifying it was only the accounts of FTX users that would be reimbursed. 14) But this once, we’ll do it; roughly $6m total. (To be clear, only for FTX accounts! Hopefully other exchanges will comp theirs.) BUT AGAIN N...

Brett Harrison will step down as FTX US president, move into advisory role

The president of cryptocurrency exchange FTX US, Brett Harrison, has announced he will be transitioning into an advisory role in the next few months. In a Sept. 27 announcement on Twitter, Harrison said he will be resigning his position as FTX US president but will remain with the exchange “with the goal of removing technological barriers to full participation in and maturation of global crypto markets, both centralized and decentralized.” Harrison has worked as FTX US president since May 2021, following a job at Citadel Securities. “I can’t wait to share more about what I’m doing next,” said Harrison. “Until then, I’ll be assisting Sam [Bankman-Fried] and the team with this transition to ensure FTX ends the year with all its characteristic momentum.” 1/ An announcement: I’m stepping down ...

XRP price pumps and dumps amid mysterious $51M whale transfers — What’s next?

XRP price saw a major spike on Aug. 26, hinting at a possible effect from some big traders. Large XRP transfers, Ripple Swell Global event Notably, XRP’s price jumped 6% to $0.37, a two-week high, during the early London hours. The token’s upside move occurred hours after its network processed three massive transfers worth $51 million involving crypto exchanges Bitso and FTX, as highlighted by Whale Alert. XRP/USD hourly price chart. Source: TradingView XRP’s gains also came as a part of a broader upside move that started on Aug. 25, a day after Ripple announced its flagship event, “Ripple Swell Global,” to be held in London in November 2022. The market has seen similar reactions to the Swell event in the past. Bearish reversal setup in play XRP’s i...

Crypto exchange Hotbit says it froze customer funds due to alleged criminal ties of formal employee

On Thursday, cryptocurrency exchange Hotbit said it “suspended trading, deposit, withdrawal and funding functions,” with no timeframe for resumption. In explaining the decision, Hotbit stated: “A former Hotbit management employee who left in April this year was, unbeknownst to Hotbit, involved in a project in 2021 that law enforcement authorities now think is suspected of violating criminal laws. As a result, a number of Hotbit senior managers have been subpoenaed by law enforcement since the end of July and are assisting in the investigation. Furthermore, law enforcement has frozen some funds of Hotbit, which has prevented Hotbit from running normally.” The firm further claims that the remainder of its employees are not involved in the project and possess no knowle...

Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM

Cryptocurrency exchange Unizen has scored a $200 million investment from private equity group Global Emerging Markets (GEM) which it will use to expand its business and its ecosystem. Rather than receiving the $200 million in funding all at once, Unizen noted on June 27 that the investment will come in the form of a “capital commitment’, with part of the funding released upfront and the rest will be provided later based on achieved milestones. Unizen did not disclose what particular criteria it had to achieve to receive the funding. Unizen calls itself a “CeDeFi” exchange mixing features of both centralized exchanges (CEXs) and decentralized exchanges (DEXs), it runs on the BNB Chain, formerly called the Binance Smart Chain. It aims to attract both retail and institutional investors by fin...

BitMEX co-founder Benjamin Delo avoids jail, receives 30 months probation

Benjamin Delo the co-founder of cryptocurrency exchange BitMEX has been sentenced to 30 months probation for violating the Bank Secrecy Act (BSA), which is an anti-money laundering law. The sentence, handed down at a federal court in New York on June 15th, follows his guilty plea to charges in February of “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program” in his role at BitMEX. Prosecutors had argued Delo should serve a year in prison or at least receive a two-year probation along with six months of home detention, as was given to former CEO Arthur Hayes in May. For Delo, his lesser sentence closes the legal saga which started in October 2020 which also saw co-founders Hayes and Samuel Reed along with BitMEX’s first official employee Gregory (Gr...

Crypto.com gets nod in Dubai and FTX launches in Japan

Two out of the top 10 largest cryptocurrency exchanges by volume will expand into new markets, with Crypto.com obtaining a provisional crypto license in Dubai and FTX launching in Japan. Crypto.com announced on June 2 that the Dubai Virtual Assets Regulatory Authority (VARA) provided the exchange with provisional approval of its Virtual Asset License giving the company the go-ahead based on initial compliance checks. The exchange said that VARA will carry out further due diligence and other mandated requirements before its full operating license is issued which it expects to happen in the “near term” Crypto.com said in March it would create a regional office in the United Arab Emirates (UAE) largest city after it enacted new laws for crypto and created VARA with the goal of making Dubai a ...

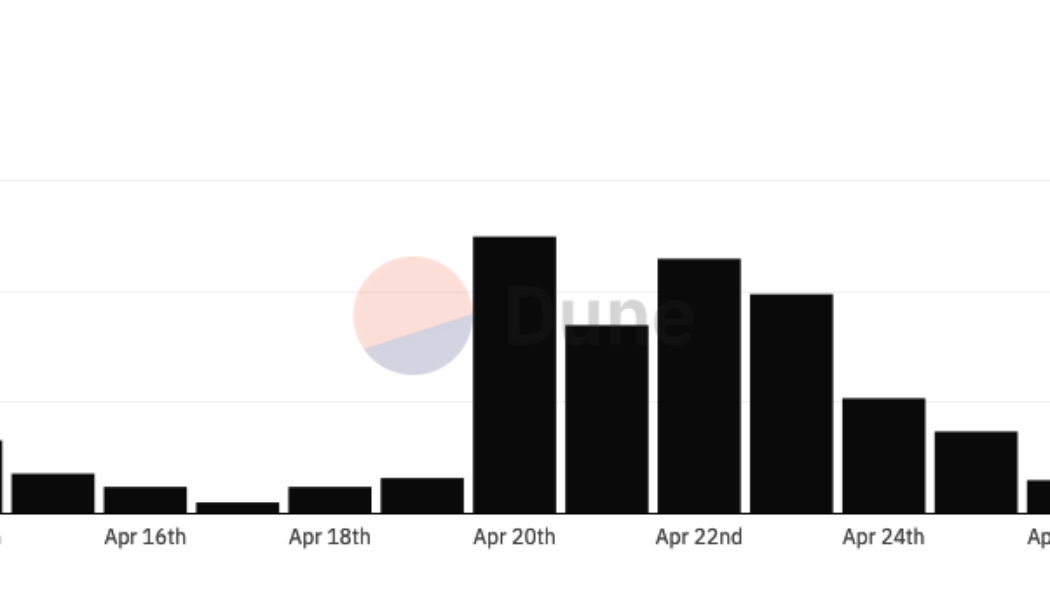

Tumbleweeds blow through Coinbase NFT on its first day: Just $75K in volume

Coinbase, one of the largest crypto exchanges by volume, opened its beta non-fungible token (NFT) marketplace to the public on May 4 with on-chain data showing a maximum of 150 total transactions on the day and $75,000 in USD volume. The transactions captured by Dune Analytics show the total amount which took place through the 0x Protocol, the infrastructure behind Coinbase’s marketplace. Whilst not all transactions are guaranteed to be from Coinbase, since 0x announced its support for NFTs in January it has yet to announce any other partners apart from Coinbase. Number of market transactions on the 0x Protocol. Dune Analytics. The number pales into insignificance compared to expectations arising from the marketplace’s waitlist. More than 8.4 million email addresses signed up for the...

Leading centralized exchanges extend market share in 2022

The top centralized cryptocurrency exchanges have reached all-time highs for market share this year as the trading volume in crypto consolidates onto the platforms of only a few trusted companies. These named “top-tier” crypto exchanges have increased their market share from 89% in August 2021 to 96% in February 2022, according to data collected by United Kingdom analytics company CryptoCompare published on Monday. The firm analyzed over 150 active centralized exchanges, ranking them on security, number of assets available, regulatory compliance, Know Your Customer checks and more, grading them from a top score of AA to a low of F, with “top tier” receiving a grade B or above. A total of 78 exchanges received a “top tier” grade, with Coinbase, Gemini, Bitstamp and Binance as the only four ...