crypto etf

ETH products grow in August as BTC products dip: CryptoCompare report

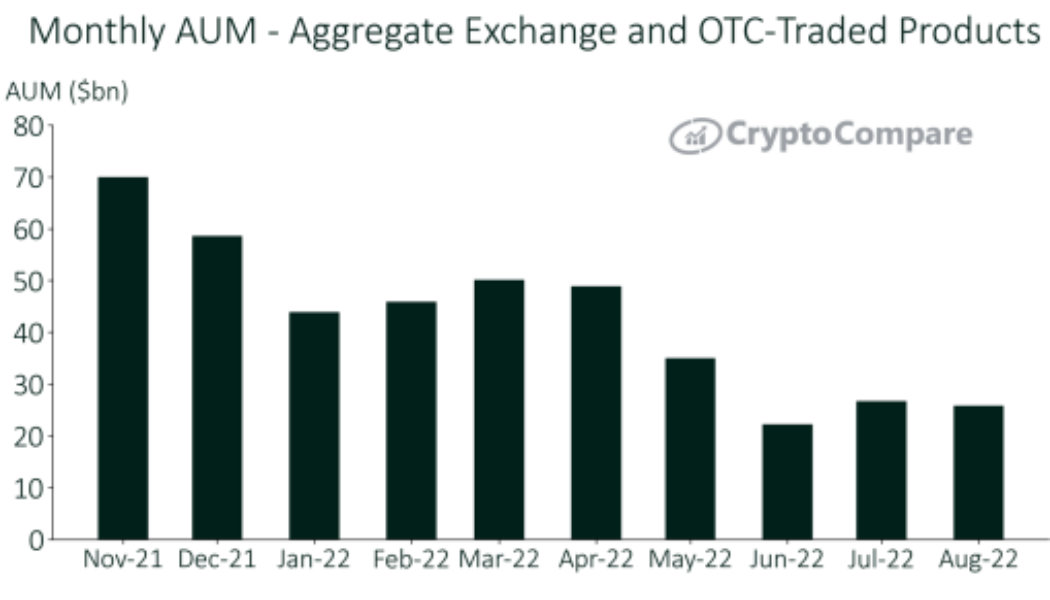

Ethereum investment products increased by 2.36% to $6.81 billion in assets under management (AUM) throughout August, outperforming Bitcoin products which saw a 7.16% drop off to $17.4 billion. The figures were contained in a new report by CryptoCompare. This was also reflected in the Bitcoin (BTC) and Ethereum (ETH)-product trading volumes, with Grayscale’s most notable Bitcoin product, GBTC experiencing a 24.4% drop in volume, while its Ethereum product, GETH actually increased 23.2%. CryptoCompare’s report suggeste the highly anticipated Ethereum Merge was the cause behind the change in trading volumes: Indeed, even at a more granular level, no Bitcoin products covered in this report saw AUM or volume gains in the month of August. We could be seeing interest move away from Bi...

Aussie crypto ETFs see $1.3M volume so far on difficult launch day

With crypto markets tanking, three crypto-focused exchange-traded funds (ETFs) picked a difficult day to commence trading on local exchange Cboe Australia today. The trio’s launch marks the first crypto ETFs to go live in Australia, with two of them focused on offering exposure to Bitcoin (BTC) and the other focused on Ethereum (ETH). So far the three ETFs have generated more than $1.3 million between them, and it has been estimated that they could see around $1 billion worth of inflows moving forward. The Cosmos Purpose Bitcoin Access ETF (CBTC) from Sydney-based crypto investment firm Cosmos Asset Management offers a relatively indirect route to BTC, as it “approximately tracks the performance of the USD denominated ETF non-currency hedged units (Purpose ETF Units) in the Purpose Bitcoin...

Three new crypto ETFs to begin trading in Australia this week

Australians will soon have more options for spot cryptocurrency exchange-traded funds (ETFs) after a previous hold-up was given the green light this week and new funds entered the ETF market. The latest update came late on May 9 as Cboe Australia issued a round of market notices that three funds previously delayed are expected to begin trading on Thursday, May 12. They include a Bitcoin ETF from Cosmos Asset Management, plus Bitcoin (BTC) and Ethereum (ETH) spot ETFs from 21Shares. Cboe Australia and Cosmos did not immediately respond to a request for comment, but a spokesperson from 21Shares confirmed to Cointelegraph: “We’re listing on May 12, this Thursday. The downstream issues are resolved.” On April 26, a day before three of the first crypto ETFs were set to launch, the Cboe Au...

Failure to launch: Australia’s first 3 crypto ETFs all miss launch day

The launch of Australia’s first three Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETF) scheduled for today, has been delayed as a result of further “checks” needing to be completed. The exchange listing the Bitcoin Spot ETF from Cosmos Asset Management, Cboe Australia, released a statement late Tuesday stating that “standard checks prior to the commencement of trading are still being completed” and a “further update will be provided in the coming days.” Cboe issued the same notice regarding two spot ETFs issued by 21Shares also scheduled for launch today, a Bitcoin ETF and an Ethereum ETF. It’s unclear why the products are delayed with the Australian Financial Review reporting that a “service provider downstream” — an entity such as a prime broker or major institution with the ...