crypto blog

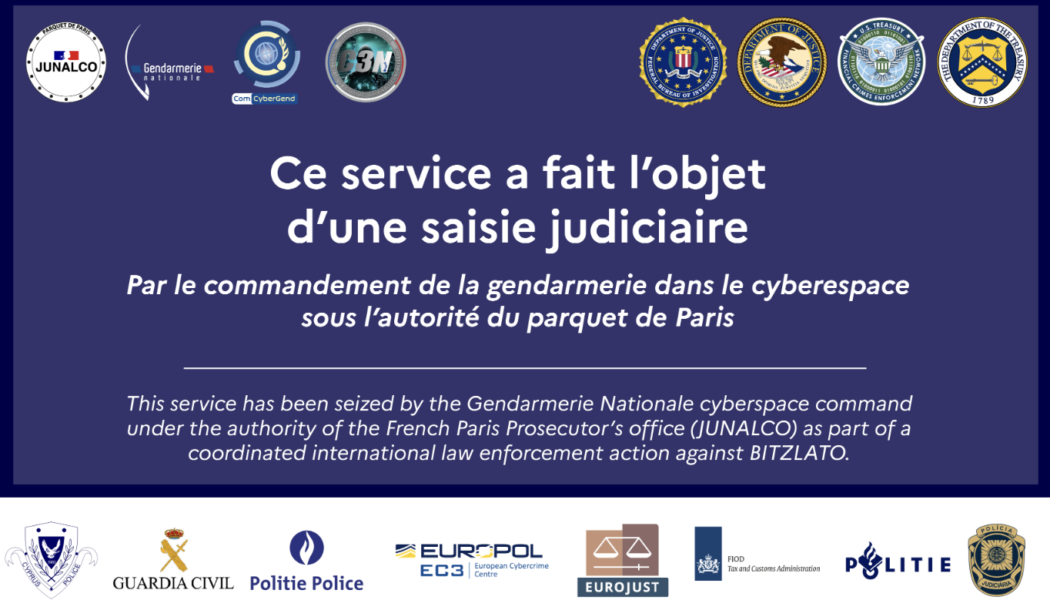

FinCEN lists Binance among the top Bitcoin counterparties of Bitzlato

The United States Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury Department, has argued that Binance is linked to the illegal cryptocurrency platform Bitzlato. In an order published on Jan. 18, FinCEN stated that Binance cryptocurrency exchange was among the “top three receiving counterparties” of Bitzlato in terms of Bitcoin (BTC) transactions. According to the authority, Binance was among the biggest counterparties that received Bitcoin from Bitzlato between May 2018 and September 2022. Other such counterparties included Russia-connected darknet market Hydra and the alleged Russia-based Ponzi scheme known as “TheFiniko,” FinCEN noted. On the other hand, FinCEN did not mention Binance as the top three sending counterparties in the order. According to the document,...

Bitcoin crowd sentiment hit multi-month high as BTC price touches $21K

Bitcoin (BTC) price climbed to a four-month high above $21,000 in the third week of January, relishing trader’s hope. The market has seen the most substantial investor optimism since July due to the January BTC price rebound. According to data shared by crypto analytic firm Santiment, the trading crowd sentiment has touched its highest in six months and second highest bullish sentiment in the past 14 months. The data indicates that traders are treating Bitcoin’s price rebound as a signal of a possible bigger breakout in the near future. The term “crowd/investor sentiment” describes how investors generally feel about a specific asset or financial market. It refers to the mood or tenor of a market, or the psychology of its participants, as expressed by activity and changes ...

FTX profited from Sam Bankman-Fried’s inflated coins: Report

Sam Bankman-Fried, the former CEO of the FTX crypto exchange, used his influence in the crypto industry to inflate some coins prices through a coordinated strategy with FTX’s sister company, Alameda Research, a New York Times report claimed on Jan. 18. As a way to keep FTX and the companies under its umbrella profitable, Bankman-Fried allegedly approached developers behind projects, insisting that they make their trading debuts on the exchange’s platform. Following that, the report claimed, Alameda Research would buy some of these freshly listed coins to raise their value. Bankman-Fried thenallegedly relied on his popularity to advertise the projects and persuade the crypto community to invest in these “Samcoins.” As a result, Alameda appeared to be in a stronger position than it actually ...

Digital Dollar Project urges US to take action on CBDC development

The Digital Dollar Project (DDP) released a new version of its white paper “Exploring a U.S. CBDC” on Jan. 18. The project expanded the paper in order to examine central bank digital currency projects internationally, though its focus is still on the United States. The DDP introduced its “champion model” of an intermediated wholesale and retail CBDC in the first version of the paper in May 2020. Since that time, CBDC projects worldwide have increased from 35 to 114. The updated DDP paper retained the core tenets of the champion, such as those on privacy and monetary policy, and it discussed technological advancements of recent years. The new ideas in the report mainly revolved the authors’ warnings about the United States falling behind in CBDC research and leade...

SBF says Sullivan & Cromwell contradicted itself with insolvency claims

Law firm Sullivan & Cromwell contradicted itself when it stated that shuttered crypto exchange FTX US is insolvent, former CEO Sam Bankman-Fried claimed in a Jan. 17 blog post that was shared on Twitter. FTX US is solvent, as it always as been.https://t.co/XjcyYFsoU0 pic.twitter.com/kn9Wm9wxjl — SBF (@SBF_FTX) January 18, 2023 The law firm was hired by FTX Group to handle the bankruptcy proceedings of several of its subsidiaries, including FTX International, Alameda Research and FTX US. However, Bankman-Fried has stated on several occasions that he believes FTX US is solvent and should not have declared bankruptcy. In a statement filed with the United States Bankruptcy Court for the District of Delaware on Jan. 17, Sullivan and Cromwell reiterated its claim that FTX US is not solvent, ...

ConsenSys slashes headcount 11% as chief economist reveals formula for adoption

ConsenSys, the parent company behind MetaMask, is letting go of 11% of its workforce, with CEO Joseph Lubin blaming “uncertain market conditions” brought on by recent collapses. In a blog post from ConsenSys CEO Joseph Lubin on Jan. 18, the blockchain firm CEO said “poorly behaved” centralized finance (CeFi) actors have cast a “broad pall on our ecosystem that we will all need to work through.” Lubin said the decision will impact 96 employees and is part of plans to focus its resources on its core businesses. Today we need to make the extremely difficult decision to streamline some of ConsenSys’ teams to adjust to challenging and uncertain market conditions.https://t.co/Svuk9yYj6J 1/10 — Joseph Lubin (@ethereumJoseph) January 18, 2023 Speaking to Cointelegraph a few days before the layoffs...

Bitcoin sees new 4-month high as US PPI, retail data posts ‘big misses’

Bitcoin (BTC) set yet another multi-month high before the Jan. 18 Wall Street open as United States macroeconomic data fell far wide of expectations. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView U.S. PPI numbers fall wide of the mark Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking to $21,646 on Bitstamp. A subsequent correction saw the pair moving around $21,400 at the time of writing, with U.S. stocks reacting to surprise data surrounding economic activity in December. Specifically, the Producer Price Index (PPI) showed cost rises cooling faster than consensus predicted, with retail sales also declining beyond estimates. “PPI comes in at 6.2%, while expectation was 6.8%. Core PPI comes in at 5.5%, while expectation was 5.7%,” Cointelegraph contribu...

Deal Box launches $125M blockchain and Web 3 venture fund

According to a press release published on Jan. 18, U.S.-based capital markets advisory and token offering platform Deal Box has launched a new $125 million venture capital arm dedicated to blockchain and Web 3.0 startups. The fund, dubbed Deal Box Ventures, will invest in companies categorized in the emerging growth, real estate, fintech, funtech, and social impact fields. Commenting on today’s development, Thomas Carter, founder and chairman of Deal Box, said: “Deal Box Ventures is an important milestone in our journey to invest in the most promising and disruptive blockchain startups, providing them with the tools and funding ecosystem they need to be successful by simplifying and reimagining traditional financing models.” As part of initial Web 3.0 investments, D...

US authorities seize crypto website Bitzlato as part of international enforcement action

The United States Department of Justice is expected to announce a “major international cryptocurrency enforcement action.” According to a Jan. 18 announcement, U.S. Deputy Attorney General Lisa Monaco will lead a press conference in which the Justice Department will announce a major enforcement action — now believed to be against the crypto firm Bitzlato. The U.S. Treasury Department is also expected to announce a similar enforcement action. Other speakers at the event will include Assistant Attorney General Kenneth Polite of the Department of Justice’s criminal division, U.S. Attorney Breon Peace of the Eastern District of New York, FBI Associate Deputy Director Brian Turner, and Deputy Treasury Secretary Wally Adeyemo. This story is developing and will be updated. [flexi-common-too...

FTX fallout: SBF trial could set precedent for the crypto industry

After the collapse of major cryptocurrency exchange FTX in November 2022, former CEO Sam “SBF” Bankman-Fried was arrested by Bahaman authorities on Dec. 12. Just a day later, the United States Securities and Exchange Commission and Commodity Futures Trading Commission filed charges against him for allegedly defrauding investors and violating securities laws. On Dec. 22, Bankman-Fried was granted bail on a $250 million bond paid by his parents against the equity in their house. The bail order added that he would require “strict pretrial supervision,” including mental health treatment and evaluation. The former CEO faces eight criminal counts in the United States, which could result in 115 years in prison if convicted. Bankman-Fried had been under house arrest at his parent’s home in Califor...

Digital Currency Group halts dividends in an effort to preserve liquidity

Venture capital firm Digital Currency Group (DCG) has told shareholders it is halting its quarterly dividend payments until further notice as it attempts to preserve liquidity. According to the letter sent to shareholders on Jan. 17, the firm is focused on “strengthening our balance sheet by reducing operating expenses and preserving liquidity.” DCG said it was also considering selling some of the assets within its portfolio. Its financial issues are derived from the woes of a subsidiary, crypto broker Genesis Global Trading, which reportedly owes creditors more than $3 billion. Customers are currently unable to withdraw funds from Genesis after it halted withdrawals on Nov. 16, which has prompted Cameron Winklevoss — on behalf of his exchange Gemini and its users with fund...