crypto blog

Bitmart pledges to reimburse hack victims as crypto community voices support

As regulatory uncertainty continues to plague the global digital asset ecosystem, there are many anti-crypto proponents who continue to harp on the fact that the industry as a whole has a long way to go when it comes to securing itself in a manner that is anywhere comparable to the traditional finance system. Now, with the recent Bitmart hack coming to light, these individuals have been given even more firepower. To recap, on Dec 5, cryptocurrency exchange Bitmart was on the receiving end of a major hack that saw the platform lose nearly $200 million via a hot wallet compromise hosted over the Ethereum and Binance Smart Chain blockchains. The breach was first exposed by blockchain security firm Peckshield whose cybersecurity team revealed that nefarious third parties were able to initially...

What is an eclipse attack?

When an attacker targets a network’s user, there is usually a deeper motive for doing so. Typically, eclipse attacks can serve as gateways for more complex attacks and disruptions. 0-confirmation double spends A user is at risk of a double-spend if they accept a transaction with no confirmations. By principle, although the transaction has already been broadcast, the sender can still create a new transaction and spend the funds somewhere else. Double spends can occur until a transaction has been included in a block and committed to the blockchain. New transactions that have a higher fee can also be included before original transactions to invalidate earlier transactions. What’s risky about this is that some individuals and businesses are in the practice of acce...

DeFi resolving the five flaws of traditional finance, book review

Writing a book on decentralized finance is a bit like describing a riddle, wrapped in a mystery inside an enigma, to borrow from Winston Churchill. First, one must summarize the origins of modern decentralized finance, then the mechanics of the blockchain technology that provides the sector’s backbone, and only then do you arrive at DeFi’s infrastructure. It all should be done in 191 pages, too, including glossary, notes and index. It is not an undertaking for the faint of heart. Fortunately, the authors of DeFi and the Future of Finance — Duke University finance professor Campbell Harvey, Dragonfly Capital general partner Ashwin Ramachandran, and Fei Labs founder Joey Santoro — were up to the task. After recapitulating the “five flaws of traditional finance” — inefficiency, limited access...

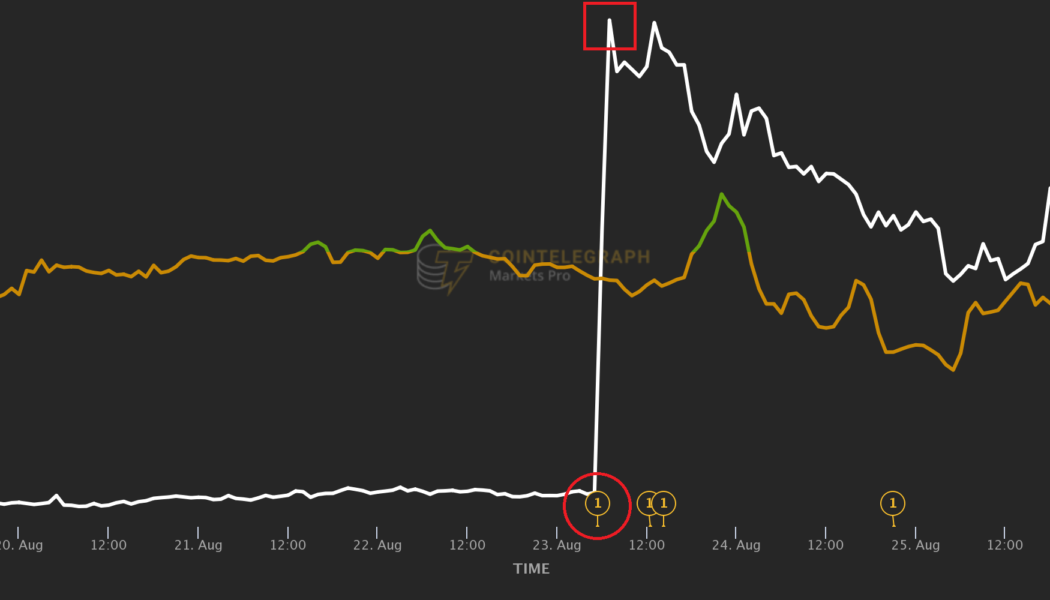

5 times quickfire crypto traders bought the news for double (or triple) digit profits

Why do crypto traders “buy the rumor, sell the news”? Simple. Because whispers of exchange listings or big-name partnerships reach very few people… while an article in Cointelegraph can reach hundreds of thousands of crypto enthusiasts in seconds. While insiders are quietly amassing tokens on rumors, the rest of us are completely ignorant of what may be coming. But with rumors, there are no guarantees. Which can lead to disappointment and serious loss of investment for those traders who gamble that they’re true… and end up wrong. So how can you possibly compete with thousands of other market participants when important news actually breaks? You’d have to be one of the very first to know in order to catch the price before it spikes. Look at the examples below — the time between a closely-gu...

South Africa’s financial regulator plans to introduce framework aimed at protecting vulnerable crypto investors: Report

Unathi Kamlana, the commissioner of South Africa’s Financial Sector Conduct Authority, has reportedly said the government’s rollout of a crypto framework would be aimed at mitigating any potential risks. According to a Friday report from Bloomberg, Kamlana said the financial regulator planned to present a regulatory framework early in 2022 intended to protect investors from “potentially highly risky” crypto assets. The commissioner said any framework on crypto would be created in coordination with the Prudential Authority and Financial Surveillance Board of the South African Reserve Bank. “What we want to be able to do is to intervene when we think that what is provided to potential customers are products that they don’t understand that are potentially highly risky,” said Kamlana. “We must...

Reelected Miami mayor to take 401k retirement savings partly in Bitcoin

The long-standing mayor of Miami Francis Suarez has now announced plans to take a part of his 401(k) payout in Bitcoin (BTC) just a month after he started receiving salary in BTC. Soon after becoming the first United States lawmaker to accept a part of his salary in Bitcoin, Suarez wants to dedicate a part of his retirement savings to Bitcoin based on “a personal choice,” he said in an interview with Real Vision: “I just think it is a good asset to be invested in. I think it’s one that’s obviously going to appreciate over time. It’s one that I believe in.” Suarez highlighted that Bitcoin’s success is tightly tied to the confidence in the system, which is inherently an “open-source, un-manipulatable system”. The mayor revealed that he has started receiving salary payments in Bitcoin t...

Fan token market cap surged over 60% since June: Data

The fan token market has been growing in value this year, surging around $157 million in terms of total market capitalization since June. According to data from major fan token website FanMarketCap, the market cap of all fan tokens is estimated to amount to slightly over $417 million at the time of writing. This is almost 60.4% up from the overall value of $260 million recorded in mid-June 2021, as Cointelegraph previously reported. The fan token market’s daily trading volume amounts to $270.2 million at publishing time. According to FanTokenStats, some of the most-valued fan tokens include Paris Saint-Germain (PSG) and Manchester City (CITY) issued by major fan token provider Socios and based on the Chiliz blockchain infrastructure. While PSG’s market capitalization is valued at jus...

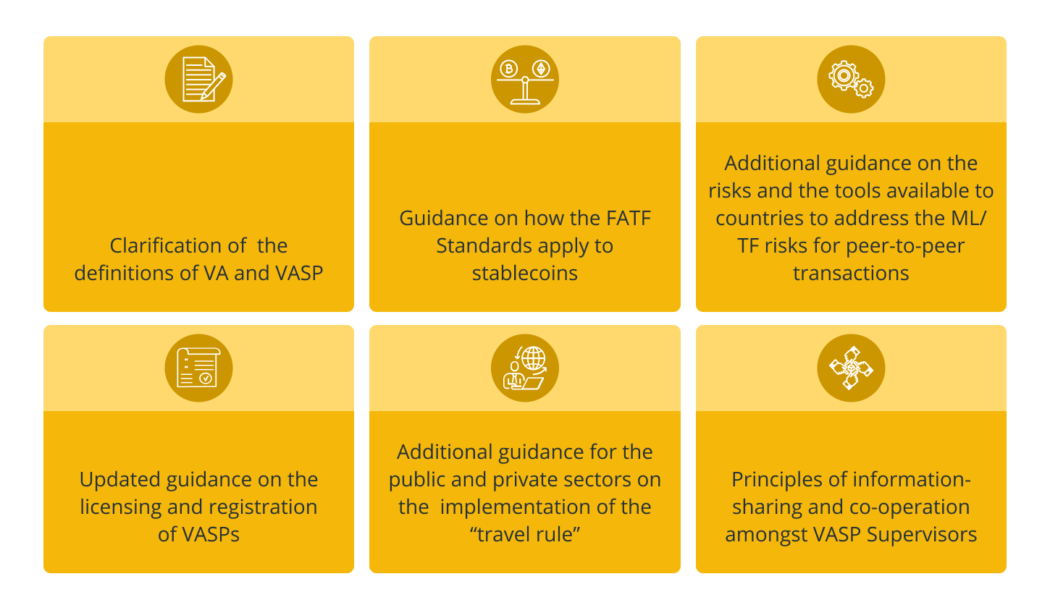

FATF guidance on virtual assets: NFTs win, DeFi loses, rest remains unchanged

The Financial Action Task Force (FATF) released its long-awaited guidance on virtual assets, laying out standards that have the potential to reshape the crypto industry in the United States and around the world. The guidance addresses one of the most important challenges for the crypto industry: To convince regulators, legislators and the public that it does not facilitate money laundering. The guidance is particularly concerned with the parts of the crypto industry that have recently brought about significant regulatory uncertainty including decentralized finance (DeFi), stablecoins and nonfungible tokens (NFTs). The guidance largely follows the emerging approach of U.S. regulators toward DeFi and stablecoins. In a positive note for the industry, the FATF is seemingly less aggressive towa...

Blockchain folk hero Nandy Martin hopes to build a better community for Haitians in Miami

Haiti, a Western Caribbean country torn by a tragic past, natural disasters, poor leadership and ineffective foreign aid, is not a country that comes to people’s minds when they think of blockchain adoption. For years, Haiti has been among the world’s poorest countries in terms of GDP per capita, as per data from the World Bank. But Haitian-Canadian entrepreneur Nandy Martin, colloquially known as Captain Haiti for wandering the streets of his community in his superhero attire and signature shield prop, has ambitious goals to change that. Operating from the sunny domains of his humble abode in Miami’s Little Haiti, Martin launched the Little Haiti Coin on the Cardano blockchain as an initiative to clean up his community, drive business crypto adoption and use it as a mean...

Nifty News: Pepsi’s debut drop, 1inch expands P4 Metaverse and Tom Brady gifts NFTs

Cointelegraph has had a lot of NFT related news this week from pop culture to sports and gaming. Below is a roundup of stories you don’t want to miss. Pepsi and VaynerNFT team up Pepsi launched their Mic Drop genesis NFT collection made up of 1,893 generative style NFTs on the Ethereum blockchain. The number commemorates the year Pepsi was born. Consumers will only have to pay gas fees, and to ensure more manageable fees, Pepsi implemented a waitlist process from now until December 14. In homage to the brand’s history, the design of the NFTs are grounded in variations of a microphone visual and inspired by iconic Pepsi flavors including classic blue Pepsi, silver Diet Pepsi, red Pepsi Wild Cherry, black Pepsi Zero Sugar and more. The Pepsi Mic Drop NFT collection was designed b...

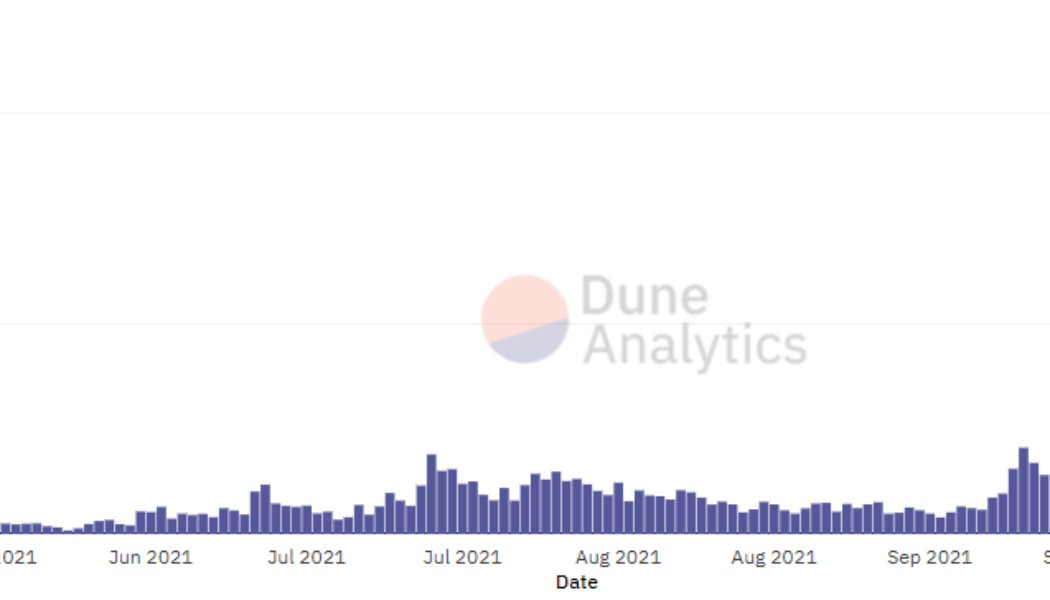

Altcoin Roundup: 3 metrics that traders can use to effectively analyze DeFi tokens

Much to the chagrin of cryptocurrency proponents who call for the immediate mass adoption of blockchain technology, there are many “digital landmines” that exist in the crypto ecosystem such as rug pulls and protocol hacks that can give new users the experience of being lost at sea. There’s more to investing than just technical analysis and gut feelings. Over the past year, a handful of blockchain analysis platforms launched dashboards with metrics that help provide greater insight into the fundamentals supporting — or the lack thereof — a cryptocurrency project. Here are three key factors to take into consideration when evaluating whether an altcoin or decentralized finance (DeFi) project is a sound investment. Check the project’s community and developer activity One of the basic wa...