crypto blog

Host of popular cryptocurrency trading YouTube series “Coin Bureau” says Polygon (MATIC) could triple in this cycle

Polygon (MATIC) has seen large swings in 2021. It started the year on a monster bull run that took it to $2.4544 in March. It then nose-dived to $0.6901 in July and then started another that it has maintained to date amid several small pullbacks. During the same period, Polygon has also made several milestones including the recent acquisition of the zero-knowledge (ZK) protocol developer, Mir, for $400 million. The acquisition is expected to add to Polygon’s strengths as it seeks to aggregate various Ethereum-based blockchains and allow them to communicate with one other. To that end, Guy, the host of the highly popular cryptocurrency trading YouTube series “Coin Bureau,” said that the price of Polygon (MATIC) could double or triple in the course of the current cycle depending on how well ...

Binance partners with Indonesian telco to develop new crypto exchange

Major cryptocurrency exchange Binance has partnered with MDI Ventures, PT Telkom Indonesia’s venture capital arm, to establish a crypto exchange platform. According to a joint announcement on Wednesday, the agreement will also seek to broaden blockchain adoption throughout Indonesia, which is home to about 240 million people. To assist with the development of the new exchange platform, Binance will provide asset management infrastructure and technology. The agreement will also seek to increase the application of blockchain technology in Indonesia more broadly. The new partnership enables Binance to grow its operations in a nation where it already has an investment in crypto trading platform Tokocrypto. Binance CEO and founder Changpeng Zhao said: “Our ambition at Binance is to grow th...

Only a paper moon: Bitcoin price briefly shows $870B on CoinMarketCap

Crypto traders experienced a moment of joy, followed by confusion, when a glitch caused several data aggregators to briefly display enormous gains for Bitcoin (BTC), Ether (ETH) and other cryptocurrencies. CoinMarketCap and several other price indexes showed Bitcoin’s price closing to $900 billion as ETH showed over $81 billion. The momentary glitch also impacted Cointelegraph’s price indexes. Hey @CoinMarketCap, you doing ok there buddy? pic.twitter.com/WfXwpSmURU — Cointelegraph (@Cointelegraph) December 14, 2021 Displayed numbers didn’t affect the trading prices on exchanges, and the platforms quickly solved the issue. CoinMarketCap explained on Twitter that the data provider is rebooting its servers as part of the remediation plan. “CoinMarketCap is now back to normal after an issue th...

KKR leads $350M raise for crypto custody bank Anchorage Digital

Major cryptocurrency custody bank Anchorage Digital has closed a fresh funding round, bringing its valuation to over $3 billion. Anchorage Digital announced on Wednesday that it had raised $350 million in a Series D funding round led by equity investment giant KKR. According to the announcement, this is the first time for KKR to directly invest in equity in a company in the crypto industry. The company invested through its Next Generation Technology Growth Fund II, which is dedicated to developing equity investment in the technology space. “As a pioneer in enabling institutional investors to access digital assets, Anchorage has built a best in class, institutional-grade digital asset platform that combines the best practices of both modern security and usability,” KKR senior leader of tech...

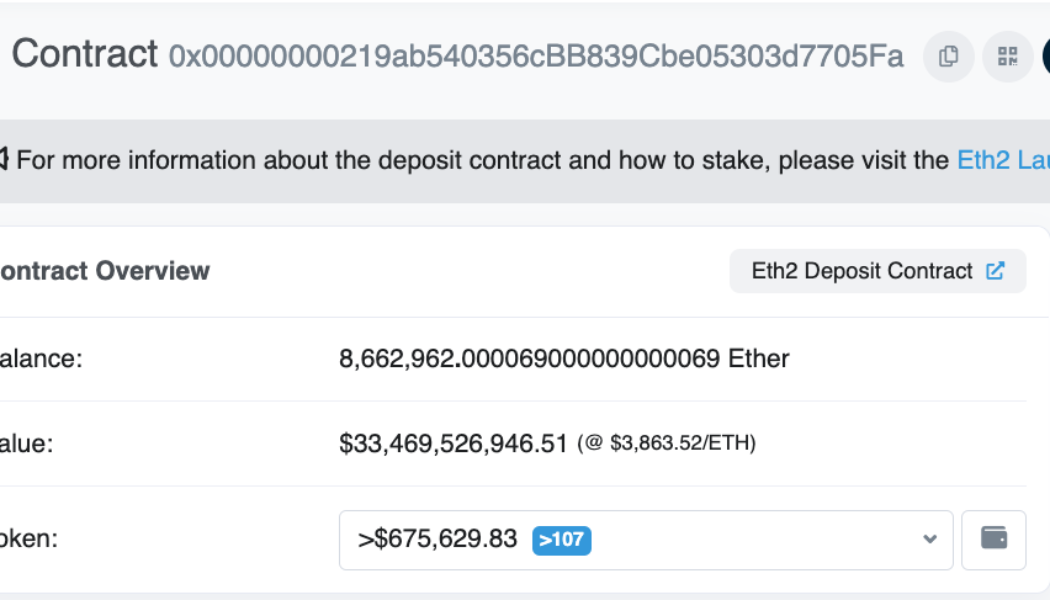

$33.5 billion worth of ETH ‘trapped’ in largest Ethereum contract

The single largest Ethereum contract containing 8,641,954 Ether (ETH) worth $33.5 billion is sitting idle because it cannot be spent or sent. A Twitter user highlighted the Beacon chain contract claiming it to be the largest Ethereum contract with billions of dollars worth of ETH “trapped” inside it. BREAKING: 8,641,954 ETH ($32 billion) trapped in single largest Ethereum contract and unable to be sent or spent. Will require hard fork that hasn’t been written or specified yet. Timing and terms of hard fork still unknown.https://t.co/xcXPwbS93v — Tomer Strolight | Not interested in your trades. (@TomerStrolight) December 14, 2021 The contract in question is an Ethereum 2.0 Beacon Chain staking contract launched in November 2020, and it cannot be spent without a hardfork. Beacon ...

Witnesses offer differing opinions on approach to stablecoins at congressional hearing

The Senate Committee on Banking, Housing and Urban Affairs heard from several expert witnesses with knowledge of stablecoins who urged lawmakers to establish a clear regulatory framework but could not seem to agree on where lines would be drawn. In a Tuesday hearing on “Stablecoins: How do They Work, How Are They Used, and What Are Their Risks?” Hilary Allen, a professor at the American University Washington College of Law, Alexis Goldstein, director of financial policy at Open Markets, Jai Massari, partner at Davis Polk & Wardwell, and Dante Disparte, chief strategy officer and head of global policy at Circle, addressed U.S. senators regarding some of the risks stablecoins may pose to the U.S. financial system and how lawmakers could handle regulating the space. Goldstein’s written te...

3 reasons why Nexus Mutual (WNXM) price is holding steady in a volatile market

There is always going to be risks involved with interacting with cryptocurrencies and recent proof of this can be seen over the past few weeks after savvy hackers managed to abscond with millions of dollars worth of tokens from Bitmart, AscendEX and BadgerDAO exchange. Nexus Mutual is a decentralized platform that allows investors to secure insurance coverage against smart contract exploits and today the altcoin rallied by 38% even as Bitcoin and the wider crypto market continue to correct. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $46.59 on Dec. 13, the price of the protocols native WNXM token spiked 38% to a daily high at $69.22 on Dec. 14. WNXM/USDT 4-hour chart. Source: TradingView Three reasons for the sudden price ...

Cove Markets to join Robinhood Crypto in latest acquisition

Cove Markets, an API platform that enables users to trade across multiple centralized exchanges and manage aggregate financial data, will become part of Robinhood Crypto, as announced by the discount brokerage late Tuesday. Traders and investors can connect up to seven exchanges, including Coinbase Pro, Kraken, Bitfinex, etc., using Cove Markets to trade over 50 major currencies and altcoins. The two trading firms said they plan to increase the volume of order routing and execution on Robinhood with the acquisition. Christine Brown, chief operating officer of Robinhood Crypto, made the following remarks regarding the development: The Cove Markets team’s wealth of experience in trading execution and crypto market infrastructure will help us to build more powerful trading capabilities,...

Block, formerly Square, will allow users to gift BTC for the holidays using Cash App

Digital payments company Block, formerly called Square, has announced that Cash App users will be able to gift friends and family both crypto and stock over the holiday season. According to a Tuesday tweet, Cash App said its users — roughly 40 million active monthly — could send as little as $1 in Bitcoin (BTC) or stock as a gift in the same way they had been sending cash. The payments firm joins others including PayPal and Coinbase in allowing users to send crypto as payments or gifts to third parties. With Cash App, you can now send as little as $1 in stock or bitcoin. It’s as easy as sending cash, and you don’t need to own stock or bitcoin to gift it. So this holiday season, forget the scented candles or novelty beach towel, and help your cousin start investing. pic.twitter.com/HS...

Coinbase Wallet rolls out support for NFTs

United States crypto exchange Coinbase has made new upgrades to its self-custody wallet, including adding support for nonfungible tokens, or NFTs, in a move that could drive further adoption of its browser extension. The company announced Tuesday that Coinbase Wallet will soon be able to support NFTs, giving users the ability to view their collections and access leading NFT marketplaces like OpenSea. Coinbase didn’t specify an exact date for the rollout but said users will need to have the latest version of the browser extension installed to access the features. Looking ahead into 2022, Coinbase said it plans to expand its support for NFTs, as well as make its native decentralized exchange trading feature more accessible and affordable. Coinbase Wallet has a DEX integration feature t...

‘DeFi is the most dangerous part of the crypto world,’ says Senator Elizabeth Warren

Massachusetts Senator Elizabeth Warren did not hold back in her criticism of decentralized finance (DeFi), expressing concern about how a run on stablecoins would affect the average investor. In a Tuesday hearing with the Senate Banking Committee discussing stablecoins, Warren questioned Hilary Allen, a professor at the American University Washington College of Law, as to whether a run on stablecoins could potentially endanger the United States financial system. Though Allen said an “en masse” redemption of stablecoins from people who had lost faith in the tokens would be unlikely to have “systemic consequences” for traditional markets at present, the DeFi system would be more likely to feel the effects. Warren countered that because stablecoins provided “the lifeblood of the DeFi eco...

Mintable app to support minting NFTs on the layer two Immutable X protocol

Mintable marketplace announced its partnership with Immutable X, a StarkWare-based layer-two solution for nonfungible tokens (NFTs) on Ethereum, to make over 24 million NFTs on Immutable X available for sale on Mintable. This integration will enable users to deposit ETH and ERC-20 tokens with instant confirmation and no gas fees. According to Mintable’s Twitter thread, Mintable and Immutable X share a vision to scale NFT marketplaces by offering access to NFTs to the masses. 1/We’re thrilled to partner up with @Immutable X – the 1st & leading Layer 2 for #NFTs on Ethereum! All NFTs on Immutable X are now available for trade on https://t.co/NJ1lSPqL1Q! ✅ Zero gas fees✅Instant secure trades✅100% carbon neutral. Details: https://t.co/TQh7Cggq2z — Mintable ...