crypto blog

Vodafone auctions world’s first SMS ‘Merry Christmas’ as NFT for charity

British telco giant Vodafone has reportedly plans to auction the world’s first Short Message Service (SMS) in the form of a nonfungible token (NFT) on Dec. 21. The SMS, that reads “Merry Christmas”, was sent 29 years ago over the Vodafone network on Dec 3, 1992, and was received by Richard Jarvis, an employee at the time. The historic 15 character-long SMS will be auctioned off as an NFT in a one-off sale conducted by the Aguttes Auction House in France, according to Romanian news outlet Ziarul Financiar. By auctioning off the world’s first SMS in the form of NFT, Vodafone intends to redirect the earnings to the United Nations High Commissioner for Refugees (the UN Refugee Agency) for helping the forcibly displaced people. Source: Ziarul Financiar The advertisement banner above trans...

Altcoin Roundup: Three smart contract platforms that could see deeper adoption in 2022

Decentralized finance (DeFi) dominated media headlines throughout 2021 and the sector, along with nonfungible tokens (NFTs), helped to initiate the mass adoption of cryptocurrencies. While high yields on staking and instant profits from flipping jpegs have proven to be very lucrative for investors, it’s important to remember that none of it would have been possible without the underlying capabilities of smart contract technology. The Ethereum network remains, hands-down, the most widely used layer-one smart contract platform in the crypto ecosystem, but everyone knows about the high fee and clogged network issues of the past few years. In 2021, competing networks like Avalanche and Binance Smart Chain enabled compatibility with the Ethereum Virtual Machine (EVM) and this produced pos...

US Financial Stability Oversight Council identifies stablecoins and cryptos as threats to financial system

In an annual report published on Friday, the United States Financial Stability Oversight Council, or FSOC, voiced its concern over the adoption of stablecoins and other digital assets. Regarding stablecoins, the FSOC said consumer confidence could be undermined by factors such as illiquidity, lack of appropriate safeguards, opacity regarding redemption rights, and cyber attacks. “A run on stablecoins during strained market conditions may have the potential to amplify a shock to the economy and the financial system,” the report said. The report also alerted to developments in decentralized finance, or DeFi, where the use of high leverage could trigger a fire sale when the price of the underlying asset declines. This would result in a cycle of margin calls and further price...

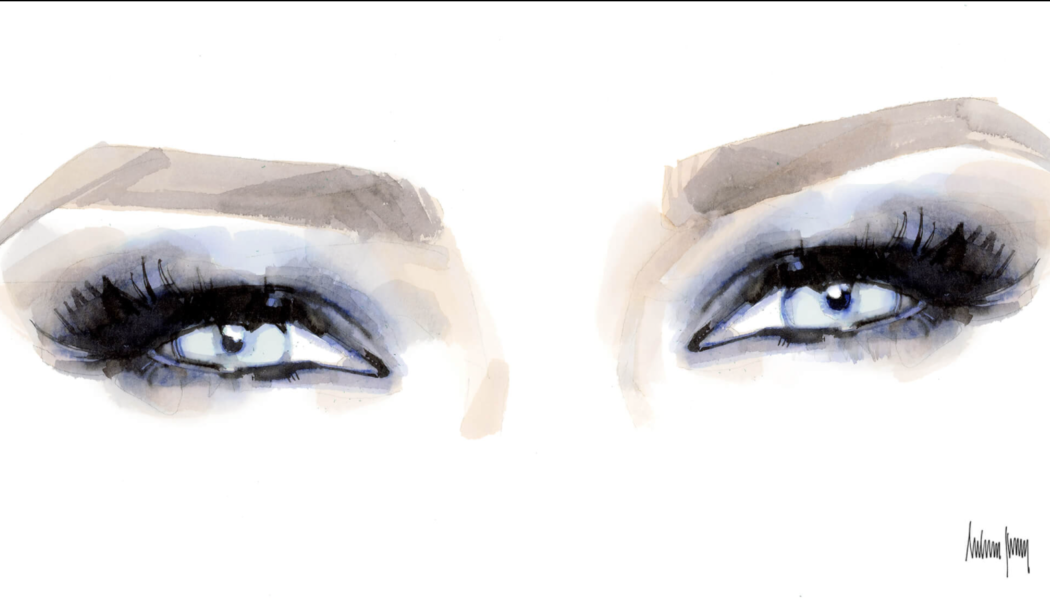

Nifty News: Melania Trump drops NFT, Arabian Camels produces NFT film and Whitney Houston keeps selling hits

Catch up on nonfungible token (NFT)-related news this week from restaurants to movies and music. Below is a roundup of stories you don’t want to miss. Melania Trump’s eyes become an NFT Former first lady Melania Trump launched her own NFT platform and dropped her first digital collectible titled “Melania’s Vision,” which will be on sale through the rest of the month. “Melania’s Vision” is a watercolor art piece by artist Marc-Antoine Coulon. The limited-edition digital artwork will be available for 1 SOL ($150) and includes an audio recording from Mrs. Trump. The Melania Trump NFT platform utilizes the Solana blockchain protocol and is powered by Parler, an alternative social media network. “Melania’s Vision” NFT...

Bitwise launches NFT index fund for accredited investors

In an effort to democratize access to nonfungible tokens, art collections and other digital assets of value for the masses, Bitwise Asset Management launched its new index fund on Dec. 16. As per the announcement, the Bitwise Blue-Chip NFT Index Fund is designed to allow accredited investors to invest in major nonfungible tokens and art collections. The NFT industry has exploded in 2021. Retailers throughout the world purchased millions of dollars worth of CryptoPunks, drawing institutional and accredited investors. In the third quarter of 2021, NFT trading volumes surpassed $10 billion for the first time. The crypto firm stated that the Bitwise Blue-Chip NFT Index Fund is now available to qualified investors for private placement subscriptions. The minimum investment is set at $25,00...

Senate hearing on stablecoins: Compliance anxiety and Republican pushback

On Dec. 14, the United States Senate Banking, Housing and Urban Affairs Committee held a hearing titled “Stablecoins: How Do They Work, How Are They Used, and What Are Their Risks?” The testimonies, both spoken and written, focused largely on the last two issues, as anxieties over Know Your Customer compliance and the U.S. dollar inflation threat dominated the discussion. Held less than a week after the House of Representatives Financial Services Committee’s hearing on digital assets, which was generally perceived as “constructive”, the meeting held by the Banking Committee was expected to be tough. Senator Sherrod Brown, a Democrat from Ohio who chairs the Committee and had called the hearing, is infamous for his critical stance on the crypto industry, and the November report from Preside...

Reddit co-founder and Polygon launch $200M Web 3.0 social media initiative

On Friday, Polygon and Alexis Ohanian’s venture capital firm, Seven Seven Six, announced a $200 million initiative backing projects operating at the intersection of social media and Web 3.0. The initiative will focus on gaming applications and social media platforms built on Polygon’s infrastructure. Ohanian co-founded Reddit in 2005, left in 2010 and returned as executive chairman in 2014 to lead a turnaround before resigning in 2020. He has been a seed investor in several prominent tech and blockchain firms such as Coinbase, Instacart, Sky Mavis — the developer of Axie Infinity — and Patreon. As an Ethereum scaling solution, Polygon’s ecosystem has expanded rapidly this year, with over 3,000 decentralized applications built on its network. Earlier this month, Polygon announced...

YFI price gains 46% in just four days after Yearn Finance’s $7.5M buyback

Yearn Finance (YFI) emerged as one of the best performers in the crypto market this week, rallying by over 46% in just four days to reach a two-week high above $29,100. YFI/USD daily price chart featuring its four-day bull run. Source: TradingView The gains surfaced primarily as Yearn Finance revealed that it has been buying back YFI en masse since November in response to a community vote to improve the YFI token’s economics. The decentralized asset management platform purchased 282.40 YFI at an average price of $26,651 per token — a total of over $7.50 million. Furthermore, Yearn Finance noted that it has more than $45 million saved in its Treasury and has “stronger than ever” earnings. As a result, it would — in the future — could deploy its income to buy...

Valkyrie’s latest ETF offering has exposure to Bitcoin

Crypto asset manager Valkyrie has launched an exchange-traded fund with exposure to Bitcoin on the Nasdaq Stock Market. In a Wednesday SEC filing, Valkyrie said its Balance Sheet Opportunities ETF will not invest directly in Bitcoin (BTC) but 80% of its net assets would offer exposure to the crypto asset through securities of U.S. companies with BTC on their balance sheets. These companies may include custodians, crypto exchanges, and traders. The filing specifies that Valkyrie’s ETF may invest up to 10% of its net assets in securities of Bitcoin mining firms, as well as up to 5% in the securities of pooled investment vehicles in the U.S. that hold BTC. At the time of publication, shares of the fund under the ticker VBB are trading for $24.48, having fallen more than 1.5% since launch...

World’s biggest douchebag releases NFT collection

Around the world, douchebags are getting into NFTs in a big way. Now it’s true that there are thousands and thousands of legitimate artists in the growing non-fungible token space, and that precisely none of them are Paris Hilton. And sure, NFTs are a potentially world-changing phenomenon that were just declared ArtReview’s most powerful entity in the art world, though probably not as a result of the “catastrophic failure” that resulted in John Cena selling just 37 sad copies of a one thousand-NFT drop. There may indeed be all kinds of use-cases for NFTs — such as the censorship-proof preservation of historical records — that will cause future generations to wonder why it took us so long. But don’t let any of these important developments detract from the absolute douchebaggery that’s curre...

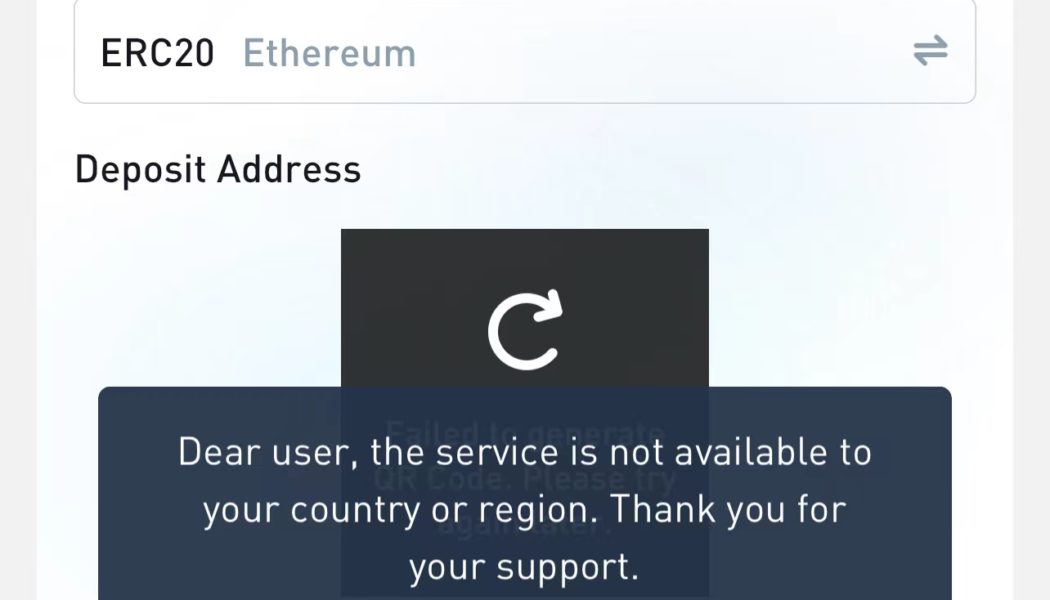

Shanghai Man: AscendEX reopened after $80m hack, Huobi suffers key personnel departures, and government officials punished for mining activities

This weekly roundup of news from Mainland China, Taiwan, and Hong Kong attempts to curate the industry’s most important news, including influential projects, changes in the regulatory landscape, and enterprise blockchain integrations. Limping out of 2021 Last week we thought we had hit rock bottom for Chinese exchanges, as Bitmart was on the unfortunate end of a $150m hack. This week, it was more of the same, as AscendEX lost $80m to a similar style of theft affecting its Ethereum, BSC and Polygon hot wallet. On December 16, AscendEX released a security post-mortem detailing the attack: An in-depth security audit identified the breach as the result of an exploit of hardware-level vulnerability from third-party infrastructure utilized by AscendEX. The infiltration was carri...