crypto blog

Cure for the itch: Deputizing blockchain to fight public corruption

Puerto Rico recently announced that it may be looking for a blockchain solution to fight government corruption, particularly after a Puerto Rican mayor pleaded guilty to accepting a cash bribe of more than $100,000. But could a distributed digital ledger really make an impact in the unincorporated United States territory’s struggle against public fraud and wrongdoing? It might if it were done in tandem with other public efforts, governance experts tell Cointelegraph. Puerto Rico could gain, too, by heeding lessons from other countries that implemented blockchain to fight corruption in recent years, including Georgia, India and Colombia, and it shouldn’t be reluctant to bring in outside help, though much of the key work should still be done by local agencies. Puerto Rico shouldn’t exp...

Traders delay $100K Bitcoin prediction, but still expect a blow-off top in 2022

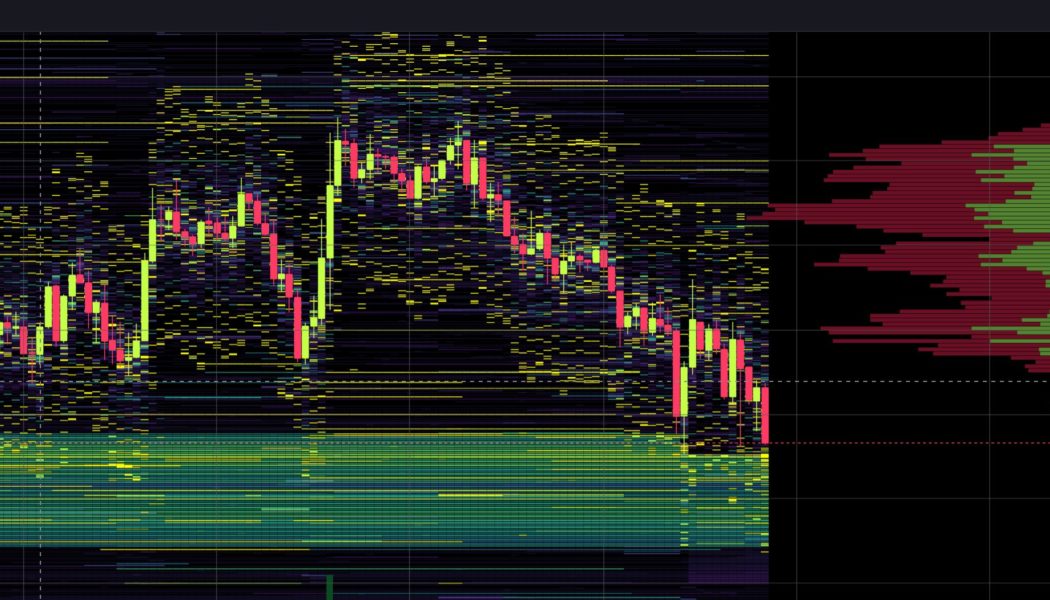

Bullish traders that drank the “Bitcoin to $100,000 by year-end” Kool-Aid are now coming to terms with the fact that there may be no Santa Claus rally to wrap up 2021. At the moment, the pipe dream has morphed into simple hopes that the top cryptocurrency can at least finish the year above $50,000. Data from Cointelegraph Markets Pro and TradingView shows that the bounce in price seen in BTC following remarks from Federal Reserve Chair Jerome Powell has pretty much evaporated and over the past 48-hours the price has swept fresh lows at $45,500 and from the look of things, the price could drop even further. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what traders think about Bitcoin’s current price action and what could be in store for the remainder o...

Listing frenzy! Coinbase adds nearly 100 crypto assets for trading in 2021

As of today, Coinbase has 139 tradable assets. The exchange added a whopping 83 assets to its trading list in 2021, nearly double the number of assets it had accumulated in the eight years since its founding. Is this rapid expansion a simple cash-grab? Are any of these lesser-known tokens and coins securities? Is this irresponsible or overly ambitious? What does this rapid expansion of assets by Coinbase mean? A money grab? I feel the answer to the first question is an emphatic “No!” Coinbase is making a lot of money on trading fees, but its token list expansion is not about the money. Coinbase started out with a small booth at a conference “just trying to make something that customers wanted,” pitching T-shirts and a hosted Bitcoin (BTC) wallet. Now, Coinbase is the second-largest c...

A tale of two NFTs: Could Bored Ape Yacht Club flip CryptoPunks?

Rising from its modest minting price of 0.08 Ether (ETH), Bored Ape Yacht Club (BAYC) has climbed to nonfungible-token (NFT) stardom, competing with one of the earliest examples of Larva Labs CryptoPunk NFT. Given its steady but amplified growth, BAYC has many crypto natives speculating that its collection will eventually “flip” CryptoPunks, and there are several reasons to back it. Tip-toeing around which collection is the top NFT contender, the competition between these two collections is driven by several factors. With an existing divide between mainstream media adoption and the IP rights granted to its owners, the BAYC and CryptoPunks collection also have a disparate amount of unique holders. This is important because the amount of unique holders is often indicative of a wider sp...

Bitcoin bears lack ‘balls’ to continue selling into 2022 — analyst

Bitcoin (BTC) bears will probably be too “stoneless” to keep prices down much longer, fresh BTC price analysis argues. In a Twitter series published Dec. 18, popular account Light summarized the events which led to Bitcoin’s recent 39% correction. Sheep in bear’s clothing A combination of macro factors and smart action from big players left retail investors holding the bags in both Bitcoin and altcoins, Light explained. This was apparent before the comedown from $69,000 accelerated into December’s liquidation cascade — smart money knew that such levels were unsustainable, and reacted accordingly. “25% of derivatives OI was closed or liquidated. Billions upon billions lost. If people were cautious before, they were now properly risk averse,” the acc...

SBI Group launches crypto-asset fund for Japanese investors

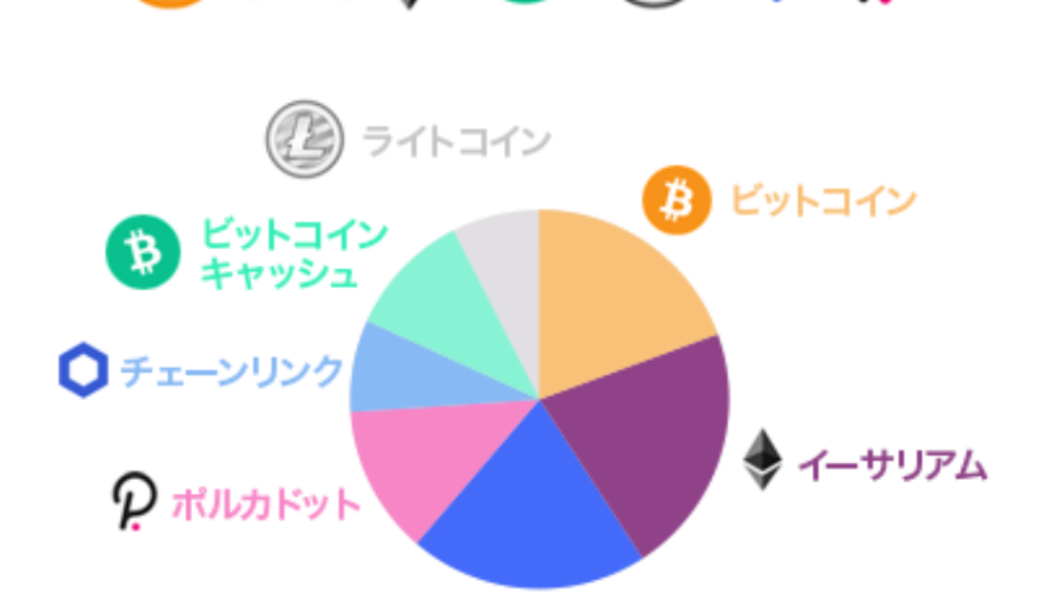

Tokyo’s biggest finserv firm, SBI Group, will now allow general Japanese investors to purchase cryptocurrencies via its newly launched ‘crypto asset fund’. The fund is composed of seven cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Bitcoin Cash (BCH), Chainlink (LINK) and Polkadot (DOT). The crypto-asset fund, to be traded and operated by the SBI Alternative Fund, was established on Dec. 02 with a dedicated capital of 5 million yen, worth approximately $45,000 at the time of writing. However, the company may choose to release the capital in smaller break-ups of 1 million yen each. Source: SBI According to the official statement, investors will be required to go through an application process that includes an anonymous partnership agreement with SBI Al...

Avalanche eyes 60% rally as AVAX price breaks out of bull flag

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week. Dubbed “bull flag,” the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole’s height. AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag’s upper trendline (around $85) on Dec. 15. AVAX/USD daily price chart featuring Bull Flag ...

2021: The dawn of democratized launchpads

Those that were around in 2017 likely remember the initial coin offering (ICO) craze, which saw swathes of new projects emerge — many of which generated staggering returns for participants in a matter of weeks or months. Although many ICO-funded projects turned out to be duds, a small proportion grew and evolved to become the current heavyweight blockchain platforms, including Ether (ETH), Filecoin (FIL), Polkadot (DOT) and Cardano (ADA) — each of which are among the top 30 largest crypto assets by market capitalization. The average ICO generated a whopping 1,320% profit for short-term investors, making them among the most attractive investment opportunities in recent years — despite their less than stellar long-term performance on the whole. But there was a major problem. Not only w...

Retail investors are buying Bitcoin while whales are selling says Ecoinometrics

As Bitcoin (BTC) price struggles to retake $50K, the number of Bitcoin addresses holding less than 1BTC has been increasing. Since hitting an all-time high above $69K, Bitcoin has seen a drastic drop that has sent it struggling below $50,000. On December 4, BTC dropped to its three-month low of $42,333 rising fears that the coin could drop below $40K. Addresses with less than 1BTC responsible for the current BTC price Data obtained by crypto-focused newsletter Ecoinometrics after evaluating the change in Bitcoin amounts across small and rich wallet groups shows that the bounce back from $42K to the current price is being attributed to the increased buying activity among the addresses holding less than 1BTC. The addresses holding 1000BTC to 10,000BTC are said to have done very little in sup...

Finance Redefined: 83% of 7-figure Millennials own crypto, Sen. Warren criticizes DeFi, Dec. 10–17

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. As the market attempted to recover from last week’s pummeling, decentralized finance (DeFi) was once again the topic of discussion in high-profile U.S. governmental offices. Read on to learn more about this news and much more from the world of decentralized finance. What you’re about to read is the smaller version of this newsletter designed for brevity. For the full version of DeFi’s developments over the last week, drop your email below. Senator Warren warns about supposed DeFi dangers Senator Elizabeth Warren publicly scrutinized the decentralized finance sector this week in a hearing with the Senate Banking Committee. Speaking on the topic of “Stablecoins: How Do They Work, How Are They Us...

Genius Yield raises $118M via ISPO in first 48 hours

On Dec. 15, Genius Yield, a decentralized automated market maker and liquidity management protocol built on the Cardano (ADA) blockchain, announced the launch of its initial stake pool offering, or ISPO. The fundraising will continue for six months until June 15, 2022. At the time of publication, more than 95.8 million ADA, worth approximately $118 million at the time of writing, have been delegated to the stake pools. In an ISPO, blockchain enthusiasts stake their cryptos in a protocol and receive tokens of the new project they fund as rewards. After a lockup period, investors can then reclaim their staked cryptos. By utilizing this method, investors not only harvest yields, but they also, on paper, get back their initial investments. Of course, the setup is still susceptible to ris...

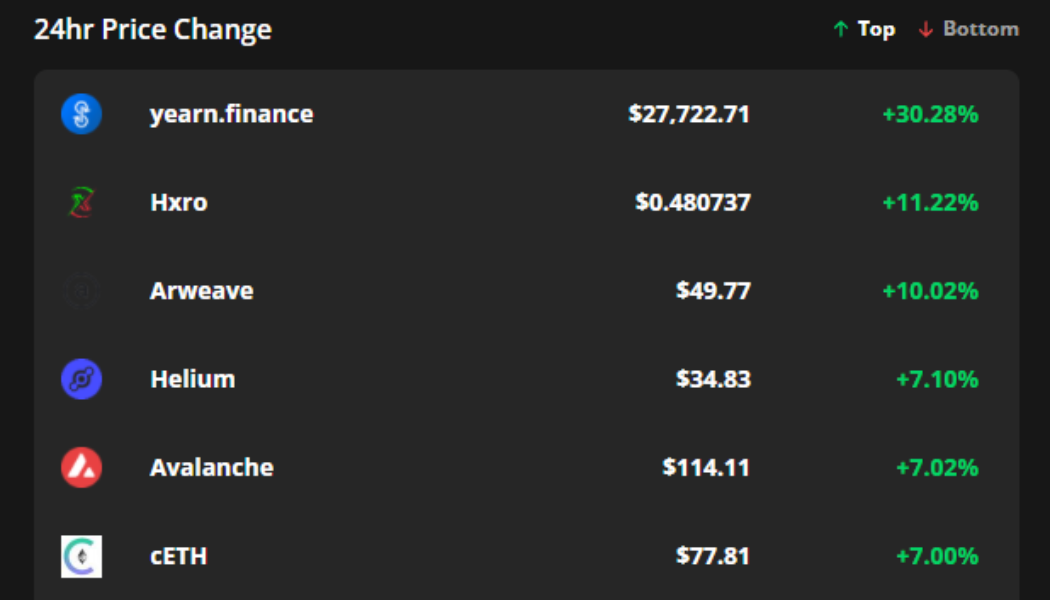

YFI, HXRO and AR post gains even as Bitcoin price dips to $45.5K

Bitcoin (BTC) bulls took another beating on Dec. 17 as a midday onslaught dropped the price to $45,500. The price did manage a quick bounce back to $47,000 but sweeping a new daily low could be a sign that additional downside is in store. Amid the wider market downturn, several altcoins provided weary traders with a source of refuge as token buybacks and increased network activity helped bolster their prices and provide shelter from the storm. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Yearn.finance (YFI), Hxro (HXRO) and Arweave (AR). YFI benefits from token buybacks Yearn.finance is a decentralized finance (DeFi) aggregator service that ...