crypto blog

The NFT world is gradually bridging the gap between niche and mainstream

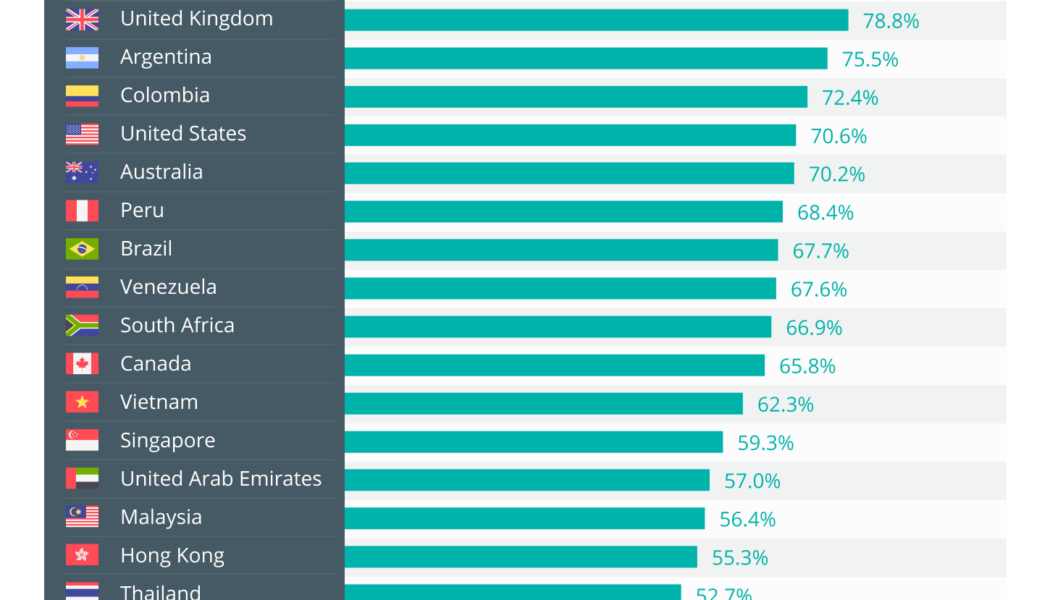

It is no secret that nonfungible tokens (NFTs) are still a niche subject. Despite their rapid surge in popularity during 2021, there is still a significant percentage of people who do not know what an NFT is. Reflecting on the graph below, it is evident that a lot of work needs to be done for NFTs to truly hit the mainstream. However, it is clear from recent months that there is potential for this to happen, and there have been many signs of awareness and adoption which I will discuss in this article. Celebrities Celebrities have been a key proponent in the rise of NFTs. Initially, the NFT space began with artists, creators and traders, all of whom set the foundations for what the NFT space is today. Since then, notable figures have also entered the space, whether it be via creating their ...

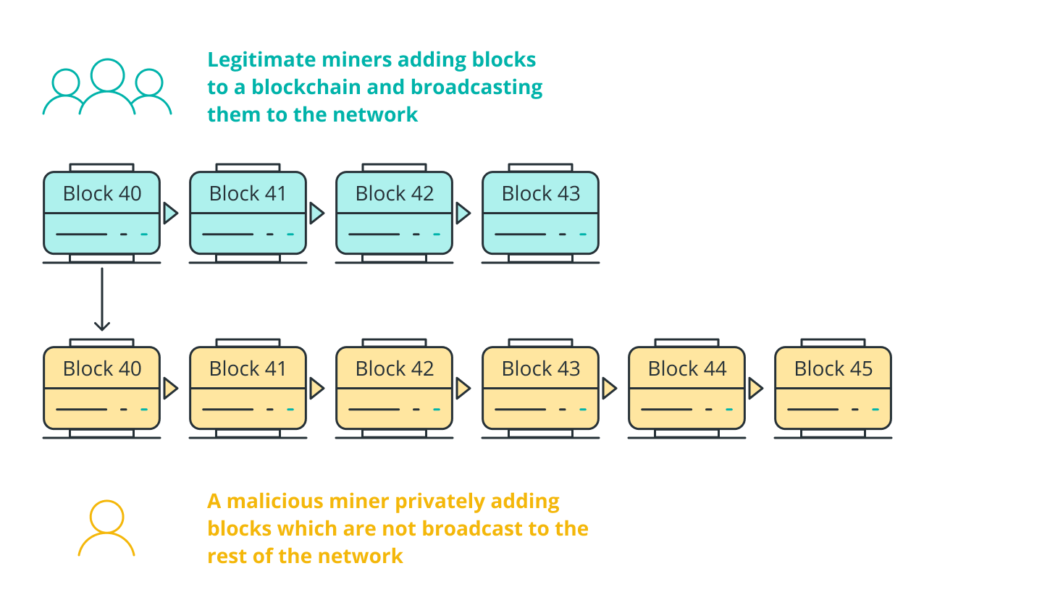

Inside the blockchain developer’s mind: Proof-of-burn blockchain consensus

Cointelegraph is following the development of an entirely new blockchain from inception to mainnet and beyond through its series, Inside the Blockchain Developer’s Mind. In previous parts, Andrew Levine of Koinos Group discussed some of the challenges the team has faced since identifying the key issues they intend to solve, and outlined three of the “crises” that are holding back blockchain adoption: upgradeability, scalability and governance. This series is focused on the consensus algorithm: Part one is about proof-of-work, part two is about proof-of-stake and part three is about proof-of-burn. In the first article in the series, I explored proof-of-work (PoW) — the OG consensus algorithm — and explained how it works to bootstrap decentralization but also why it is inefficient. In ...

Bitcoin book for American policymakers gets 5x funding on Kickstarter

A group of eight Bitcoin (BTC) enthusiasts launched a Kickstarter campaign to publish an educational book for America’s federal policymakers, to reduce their reliance on the traditional media narrative on cryptocurrencies. The campaign managed to attract $23,151 in funding, nearly five times the goal of $5,000. The book was conceptualized soon after the United States House of Representatives passed the $1.2 trillion bipartisan infrastructure bill, which mandates stringent reporting requirements for the crypto community. According to the authors: “We set out to write a book to help policymakers understand where Bitcoin users are from and what they care about. We want to dispel the notion that it’s a nerd money and show how it’s impacting so many people in America.” Possibl...

Polkadot envisions Web3 disruption with multiple parachain launches

Open-source blockchain platform Polkadot announced the launch of its first parachains (or parallelized chain) aimed at improving the interoperability between multiple blockchains. According to the announcement, the Polkadot team invested five years into the development of the parachains, which were allocated to teams via auctions, namely, Acala, Moonbeam, Parallel Finance, Astar, and Clover. With individual blockchains running in parallel within the Polkadot ecosystem, the auction winners will be able to lease slots on Polkadot’s Relay Chain for up to 96 weeks at a time. Developed by Polkadot Founder and Ethereum co-founder Gavin Wood, the Relay Chain helps in coordinating the consensus and communication between parachains: “And as the ecosystem grows, especially with nascent e...

Bitcoin tests yearly moving average as $100K by Christmas needs ‘small miracle’

Bitcoin (BTC) prepared a showdown with a key moving average (MA) price trend on Dec. 19 with time running out for a strong 2021 close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “I vote we bounce and stay bull” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading at $47,000 Sunday, still firmly in an established range. That price is currently the location of Bitcoin’s one-year MA trendline, an important historical line in the sand that has enabled considerable upside if BTC/USD preserves it as support. “The 1yr MA is a pretty important bitcoin bull/bear pivot level historically and we are sat right on it now,” Philip Swift, creator of on-chain data resource Look Into Bitcoin, commented. “I vote we bounce and st...

The battle of banks vs. DeFi is a win for individual crypto investors

The state of banking and finance today presents a complex labyrinth that even seasoned bankers struggle to navigate. Despite appearances, there is a method to this madness. As Nobel Prize winners like Muhammad Yunus and Joseph Stiglitz have cautioned in the past: central banking, in particular, has morphed to keep the status quo in check. Or, in the words of Mike Maloney, an expert on monetary history and economics: It is “the biggest scam in the history of mankind.” Maloney reasons that giving a small group of unelected individuals the keys to the monetary printing press will undoubtedly rot away the buying power of workers’ savings, for the benefit of the few who benefit from asset price inflation. In the wake of the global financial crisis and devastating bank runs around the worl...

From DeFi year to decade: Is mass adoption here? Experts Answer, Part 1

Dominik is the co-founder and chairman of the Iota Foundation, an open-source distributed ledger and cryptocurrency designed for the Internet of Things. “The biggest difference between crypto in 2017 and crypto in 2022 is the establishment of tangible business models and use cases within our ecosystem thanks to DeFi. We no longer have to wait for external parties such as large companies to drive adoption. We can do it ourselves with applications that introduce much-needed innovation to the base level of our economy — finance. 2021 has been a tremendous year for early-stage validation and growing excitement toward DeFi’s potential. But it’s still early stages. DeFi isn’t yet comparable to fintech companies like Revolut or N26 (2 million to 5...

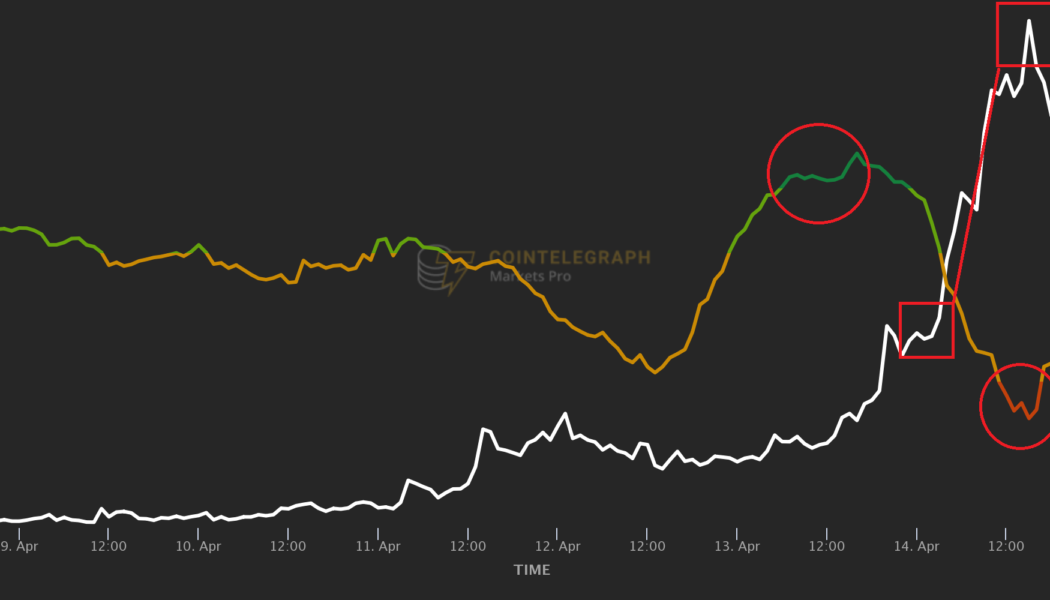

Overheated DOGE: 5 times crypto traders were warned before their assets tanked

Everybody loves a crypto bull market, but every green wave inevitably gives way to periods of sideways or downward movement. Skilled traders know that these phases of the market cycle can be rife with profit opportunities, too. Anticipating not only a digital asset’s upward price movements, but downturns and corrections can be useful when deciding on when to exit a position and lock in gains, as well helping to add toprofits by shorting crypto assets whose prices decline. In addition to a keen eye and common sense, anticipating price drops can be aided by data intelligence tools. One AI-driven indicator that can help investors see the signs of an upcoming dip early is the VORTECS™ Score, exclusively available to the members of Cointelegraph Markets Pro. Its job is to sift through ye...

SEC delays spot Bitcoin ETF decisions, Nike enters Metaverse arena, and a crypto exchange gets hacked: Hodler’s Digest, Dec. 12-18

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Russia to decide between blanket crypto ban and legalizing exchanges in 2022 A recent report shows that Russia could potentially see a countrywide ban on cryptocurrency. Alternatively, it’s possible that crypto trading via regulated exchanges may continue under strict oversight. On the one hand, Russia’s central bank is said to be behind a potential move to make crypto illegal in the country, according to Reuters. On the other hand, Anatoly Aksakov, who heads the Russian parliament’s Committee on Financi...

Tom Lee reiterates his bullish stance on the global stock market and prediction of BTC hitting $100K

The Fundstrat Global Advisors co-founder and head of research Tom Lee have maintained his bullish outlook about the crypto market and his Bitcoin prediction of hitting $100K. The Wall Street strategist affirmed that the global market was in an “everything rally” and the value of investment vehicles is expected to rise because of favorable economic conditions. Lee had predicted that Bitcoin would reach $100K before the year-end. And while speaking to CNBC this week, he reiterated his prediction was still intact besides his outlook for the stock markets. Global Stock market Lee cited the Federal Reserve Bank approach as the bullish driver for the global stock market. According to the analyst, FED’s confirmation that the interest rates would remain unchanged despite the risk that the COVID-19...

Bears pull Bitcoin’s end of year expectations down from $100K to $50K

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. contracts for d...