crypto blog

Silvergate gets more bad news as Moody’s slashes its ratings

Things seem to be going from grim to grimmer at Silvergate Bank, with a hit to its Moody’s rating and a selloff by Ark Invest. The bank already experienced a run and has been tied to the FTX collapse. Ark Invest, the investment vehicle of Cathy Wood, sold off more than 400,000 shares of parent company Silvergate Capital, worth $4.3 million on Jan. 6, leaving it with a mere 4,000 shares, according to various media reports. Those shares lost 43% of their value the previous day. Moody’s Investors Service also reacted to the situation at the bank, downgrading its ratings of Silvergate Capital and the bank. The bank’s long-term deposit rating was downgraded from Baa2 (“lower-medium grade”) to Ba1 (“junk”) and its long-term issuer rating from Ba2 to B1 (both “junk”), with a negative outloo...

SuperRare cuts 30% of staff as growth slows during crypto winter

Non-fungible token (NFT) marketplace SuperRare has announced a 30% staff-member cut as CEO John Crain explained that the firm mistakenly over-hired during the last bull market. In a Jan. 7 tweet, Crain shared a screenshot of his message to SuperRare’s Slack channel announcing the 30% cut, stating that he had “some tough news to share.” “Startups are a balancing act of managing rapid growth while doing everything possible to conserve limited resources. During the recent bull run, we grew in tandem with the market” he noted, adding that: “In recent months it’s become clear that this aggressive growth was unsustainable: we over-hired, and I take full ownership of this mistake.” I have some tough news to share: pic.twitter.com/iLDKqgyhQa — SuperRare John (@SuperRareJohn) January 6, 2023 Crain ...

Bluechip NFT project Moonbirds signs with Hollywood talent agents UTA

The NFT-focused company was founded by early-stage Facebook and Twitter investor Kevin Rose, and designer Justin Mezzell in February 2022. The company also has the Proof Collective and Oddities NFT collections in its catalog. Announcing the move via Twitter on Jan. 6, Rose suggested that the goal of the deal is to get the Moonbirds brand known on a “global” mainstream scale, as opposed to just being recognized as a big hitter in the Web3 space. “What does UTA bring to the table? They are 1,400 people strong, with divisions in film, television, music, video games, sports, books, branding and licensing, speaking, marketing, fine arts, broadcast, and more,” he said. PROOF, the company behind the top-tier NFT project Moonbirds, has signed a representation deal with major Hollywood talent agent...

FTX collapse may boost ‘further trust’ in crypto ecosystem — Nomura exec

The winds of crypto winter may be still blowing, but it doesn’t seem to be stopping venture capital firms from piling into cryptocurrencies. In fact, recent events influenced by the bear market, such as the collapse of FTX, could bring “further trust into the ecosystem,” according to Jez Mohideen, co-founder and CEO at Laser Digital, the recently launched digital assets arm of the Asian giant Nomura Holdings. “More traditional players are entering the space who can help to regulate the sector. This means players who understand regulation as well as the importance of clients’ aggregation, stability, and execution,” explained Mohideen, a long-time participant in the venture sector and former director at Barclays and partner at the hedge fund Brevan H...

$3.9 billion lost in the cryptocurrency market in 2022: Report

Immunefi, a bug bounty and security services platform for the Web3 ecosystem, published a report on Jan. 6 revealing that the crypto industry lost a total of 3.9 billion dollars in 2022. According to the report, hacks were found to be the main cause of the losses, accounting for 95.6% of the total, with fraud, scams, and rug pulls comprising the remaining 4.4%. Immunefi also found that decentralized finance (DeFi) was the most targeted sector, suffering 80.5% in losses, compared to centralized finance (CeFi) which suffered a loss of 19.5%. According to the report: “DeFi has suffered $3,180,023,103 in total losses in 2022, across 155 incidents. This number represents a 56.2% increase compared to 2021, when DeFi lost $2,036,015,896, in 107 incidents.” BNB and Ethereum were the mos...

NFT project accepted $3M to move its collection to Polygon

The team behind y00ts and DeGods were paid $3m to move their collections off Solana and onto Polygon, according to a January 6 announcement from the company. The statement was made on Discord and copied to Twitter by Frank III, founder of the two projects. Here is a screenshot of our latest @y00tsNFT Discord announcement. pic.twitter.com/qWxjBsexv6 — Frank III (@frankdegods) January 6, 2023 The developers had previously announced on Dec. 27 that the projects would be moving to Polygon. This was widely seen as a possible death blow to the Solana network, as the network was already under pressure due to fallout from the collapsed FTX exchange. However, there was no evidence at the time that the y00ts team had received money in exchange for making the move Let’s check the temperature on #sola...

Mastercard partners with Polygon to launch Web3 musician accelerator program

Global payments giant Mastercard is ramping up its exposure blockchain tech yet again, after announcing a Polygon-based accelerator program to help musicians build their careers via Web3. The firm announced the “Mastercard Artist Accelerator” program via a Jan. 7 blog post, outlining that from this spring, it will connect five emerging musicians from across the globe with mentors that will help them set up their brand in the Web3 music space. “The artists will gain exclusive access to special events, music releases and more. A first-of-its-kind curriculum will teach the artists how to build (and own) their brand through Web3 experiences like minting NFTs, representing themselves in virtual worlds and establishing an engaged community,” the post reads. The prog...

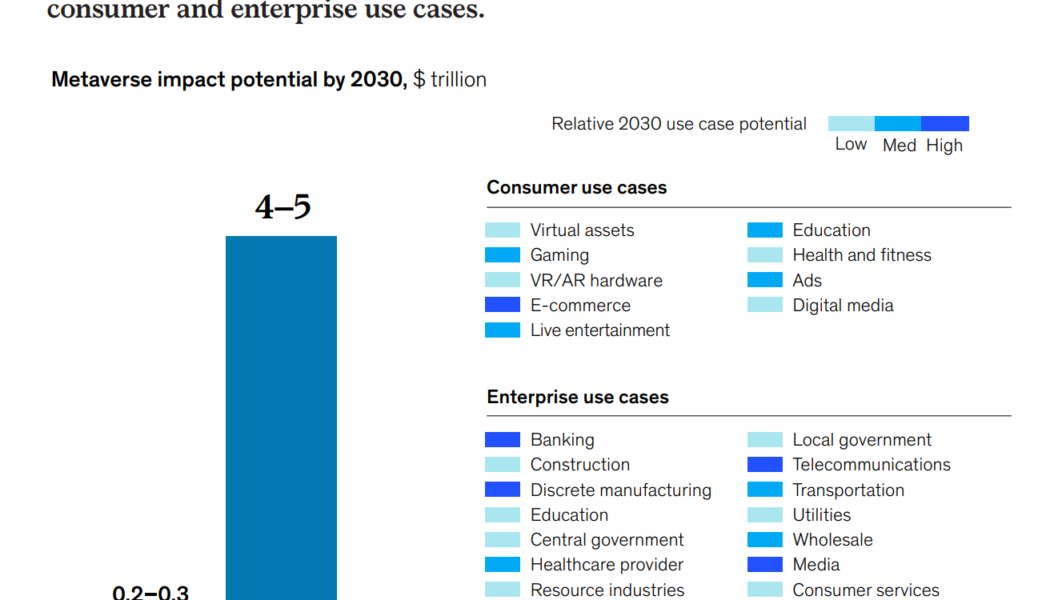

Crypto companies aim to build trust within future products and services

The cryptocurrency ecosystem underwent a turbulent year in 2022. Criticism inside and outside of the crypto industry was fueled following the collapse of FTX, Celsius, Three Arrows Capital and the Terra ecosystem. A number of losses have been recorded from these events. Blockchain analytics firm Chainalysis released a report in December of last year, which noted that the depegging of Terra’s stablecoin, Terra USD Classic (USTC), saw weekly-realized losses peak at $20.5 billion. Findings further show that the subsequent collapse of Three Arrows Capital and Celsius in June 2022 saw weekly-realized losses reach $33 billion. While these events may have resulted in a loss of trust within the crypto ecosystem, it’s important to point out that blockchain technology and cryptocurrency have n...

Binance joins association to address compliance with global sanctions

Binance has become one of the first crypto firms to join the Association of Certified Sanctions Specialists, orACSS, in an effort to stay in compliance with global sanctions. In a Jan. 6 announcement, Binance said its team of sanctions compliance personnel would be undergoing training as part of the certification process at ACSS. According to the association’s website, the group offered an examination addressing “knowledge and skills common to all sanctions professionals in varied employment settings.” “The blockchain industry is still in its early years, and it’s our priority to continue upholding the highest level of compliance amid a fast-evolving space,” said Binance’s global head of sanctions, Chagri Poyraz. “At the end of the day, we want to continue setting the industry standard for...

Marathon Digital experiments with overclocking to increase competitive advantage

One of the largest Bitcoin mining operations in North America, Marathon Digital Holdings, has shared in an update that it has been experimenting with overclocking to increase its competitive advantage in the Bitcoin mining industry. Overclocking is the practice of increasing the clock speed of a computer’s central processing unit (CPU) or graphics processing unit (GPU) beyond the manufacturer’s rated maximum speed, potentially leading to improved performance in certain tasks. According to the company’s press release, it produced 475 BTC in December 2022, bringing its total mined Bitcoins in the fiscal year of 2022 to 4,144 BTC, a 30% increase from 3,197 BTC which was produced in 2021. Marathon’s Chairman and CEO, Fred Thiel commented on the company’s decision to experimen...

Ethereum’s Shanghai upgrade could supercharge liquid staking derivatives — Here’s how

The crypto market witnessed the DeFi summer of 2020, where decentralized finance applications like Compound and Uniswap turned Ether (ETH) and Bitcoin (BTC) into yield-bearing assets via yield farming and liquidity mining rewards. The price of Ether nearly doubled to $490 as the total liquidity across DeFi protocols quickly surged to $10 billion. Toward the end of 2020 and early 2021, the COVID-19-induced quantitative easing across global markets was in full effect, causing a mega-bull run that lasted almost a year. During this time, Ether’s price increased nearly ten times to a peak above $4,800. After the euphoric bullish phase ended, a painful cool-down journey was exacerbated by the UST-LUNA crash which began in early 2022. This took Ether’s price down to $800. A ray of hope eventually...