crypto blog

Miami-Dade gains right to remove FTX name from Heat arena

Miami-Dade County will soon start to remove FTX’s advertising brand from the NBA’s Miami Heat arena, after granting the right from a United States bankruptcy judge in Delaware on Jan. 11, the Associated Press reports. County officials negotiated in 2021 a $135 million deal with the crypto exchange for renaming rights to the Miami Heat’s arena as FTX Arena until 2040. A number of entrances, the roof of the arena, the basketball court, the security polo shirts, as well as many of the cards employees use to access the facility are branded with FTX logos. Following FTX’s bankruptcy filing, officials in Miami-Dade filed on Nov. 22 a motion to terminate the naming rights agreement. As part of that deal, the Heat were to receive $2 million annually beginning in June 2021. ...

Ooki DAO misses lawsuit response deadline, default judgment on the cards

The Commodity Futures Trading Commission (CFTC) has begun the process of getting a default judgment in its case against Ooki DAO after the latter missed the deadline to respond to the lawsuit. According to a Jan. 11 court filing, the regulator has requested the court for an “entry of default” against the decentralized autonomous organization (DAO), stating it had missed the deadline to “answer or otherwise defend” as instructed by the summons. If approved, the entry of default will establish Ooki DAO has failed to plead or defend itself in court and will no longer be able to answer or respond to the suit. An “entry of default” is the first step in the process of gaining a default judgment — a ruling handed down by the court when the defe...

From Bernie Madoff to Bankman-Fried: Bitcoin maximalists have been validated

Long before Bitcoin (BTC), Bernie Madoff sat atop the longest-running, largest fraud in history. The rise and real-time fall of Sam “SBF” Bankman-Fried, former CEO of crypto exchange FTX, were expedited in comparison. While the similarities are profound, the storyline is not: Create organizations under false pretenses, develop relationships with people in authority positions, defraud clients, survive as long as possible, and try not to get caught. Madoff advisers experienced a “liquidity” problem in 2008, around late November into early December, where the fund was unable to meet client redemption requests. On its surface, the fourth-quarter timing of the Madoff collapse more than a decade ago appears eerily similar to FTX’s 2022 implosion. Bitcoiners who hold their keys will never experie...

Venom Foundation in Partnership With Iceberg Capital Launches $1 Billion Venom Ventures Fund

Abu Dhabi, Abu Dhabi, 11th January, 2023, Chainwire Venom Foundation, the first Layer-1 blockchain licensed and regulated by the Abu Dhabi Global Market (ADGM), and Iceberg Capital, an ADGM regulated investment manager, officially announce that they have partnered to launch a $1 billion venture fund called Venom Ventures Fund (VVF). The blockchain-agnostic fund will invest in innovative protocols and Web3 dApps, focusing on long-term trends such as payments, asset management, DeFi, banking services, and GameFi. It aims to become the leading supporter of the next-generation digital technologies and entrepreneurs. Venom Ventures Fund (VVF) will leverage Iceberg Capital’s network, expertise, and capabilities to offer incubation programs and access to an extensive industry network. Furthermore...

Metacade Raised $1.6M in Their First 6 Weeks – Is It One of the Best Metaverse Projects of 2023?

Metaverse projects that attract a lot of attention in their presale phase can quickly become hot topics for crypto fans. This early attention often indicates that the project will be a sound, longer-term investment. Metacade is one of the new metaverse projects attracting admiring glances after selling out its beta phase in just over three weeks. Metacade has raised more than $1 million already, and early investors seeking quick profits are flocking to the exciting new metaverse project. Metacade is bucking the bearish crypto market trend The year 2022 has undeniably been a tough year across crypto markets. Many well-established coins sank dramatically in value and, in many cases, hit all-time lows. With the collapse of the world’s second-largest crypto exchange, FTX, still fresh in i...

Nigerian innovator launches first active Bitcoin Lightning node in the country

The Lightning Network has struck the earth in one of the most challenging operating environments. Lagos, the capital of Nigeria — Africa’s most populous country — welcomed a new Bitcoin Lightning Network (LN) node this week, a vital step to better connect the continent to the layer-2 payments network that sits atop Bitcoin. The node runs on an old laptop powered by a diesel generator, as Lagos regularly experiences energy and electricity blackouts. Megasley’s diesel generator and laptop running the node. Source: Megasley In a discussion with Cointelegraph, Megasley, who operates the first Nigerian Lightning node of 2023 and the first active Lightning node in the country (other nodes are dormant), shared his vision for bringing instant, low-cost payments to Africa thanks to the LN. ”L...

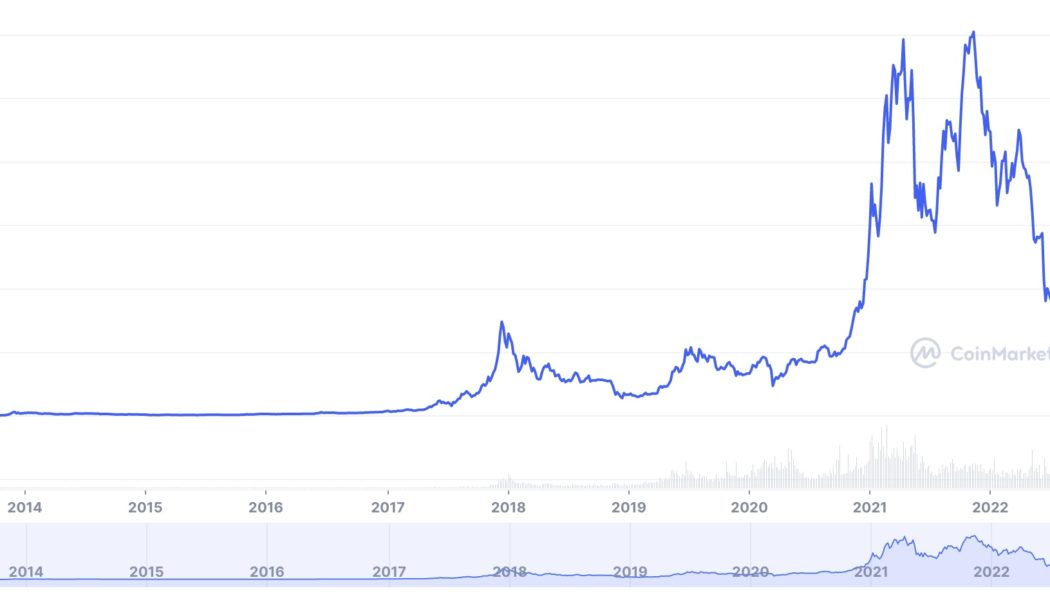

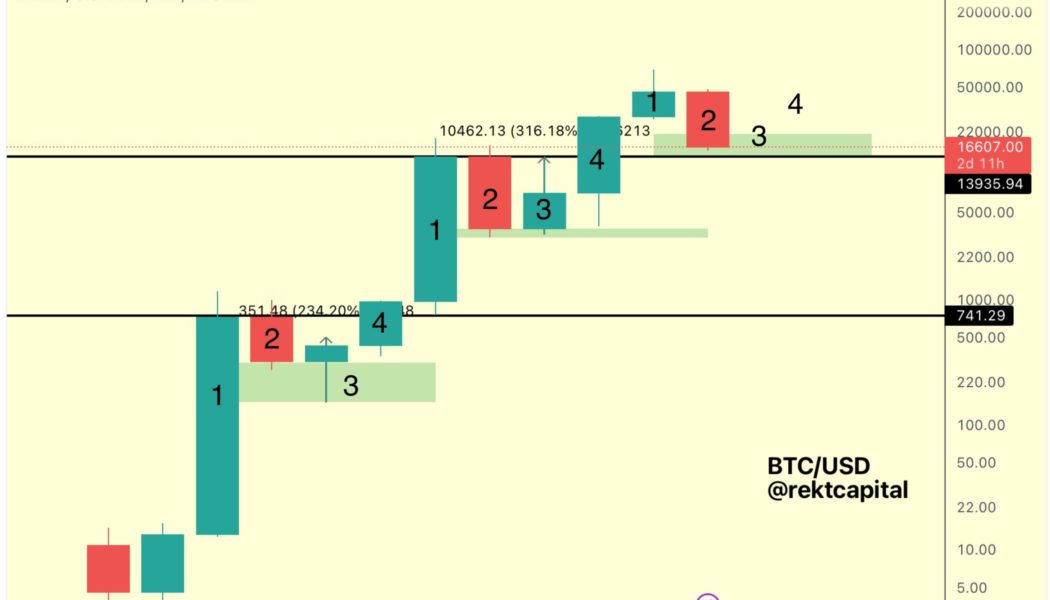

Bitcoin gained 300% in year before last halving — Is 2023 different?

Bitcoin (BTC) is facing a “bottoming candle” in 2023, but BTC price action is still more than able to surprise the market. In a tweet on Jan. 11, popular trader and analyst Rekt Capital predicted that BTC/USD could see “decent upside” this year. Chart teases serious Bitcoin upside potential Analyzing Bitcoin’s four-year market cycles around block subsidy halving events, Rekt Capital drew attention to 2023 being the deadline for its next “bottoming candle.” With the next halving due in 2024, the coming 12 months should see a price floor, followed by a rally as the event draws nearer. 2024 thus forms the fourth candle in Bitcoin’s current cycle, and 2023 the third. “Candle 3 is a Bottoming Candle in the BTC Four Year Cycle. But it can still generate decent upside,” Rekt Capital commented. Th...

Three Arrows Capital creditors express frustration with bankruptcy process during call

Kyle Davies, the co-founder of bankrupt hedge fund Three Arrows Capital (3AC), disclosed via a Twitter thread on Jan. 11 the creation of a 3AC creditors group amid complaints from creditors over bankruptcy costs. According to Davies, creditors continue to express frustration with the ongoing costs and handling of assets during the bankruptcy process, suggesting that “intercreditor disputes are delaying the process, and the estate value is not being maximized.” Today we held an ad hoc 3AC creditor meeting. All creditors are open to join and this will be a regular meeting. Here is an overview of the points discussed: 0/n — Kyle Davies (@KyleLDavies) January 11, 2023 The group’s first meeting discussed several topics, including ways to reduce “ongoing legal costs, pursue claims on a contingen...

Binance approved to offer crypto services to Swedish customers

The Swedish Financial Supervisory Authority, one of the country’s financial regulatory agencies, has granted the local arm of crypto exchange Binance approval to manage and trade digital currencies. According to a Jan. 11 announcement, Binance said following “months of constructive engagement” with the financial regulator, the Swedish FSA granted Binance Nordics AB registration status on Jan. 10. This decision effectively allows Swedish residents to access Binance’s crypto services. “Sweden fully adopts EU laws and has further local requirements, so we have been careful to ensure that Binance Nordics AB has adopted risk and AML policies to match this exacting standard,” said Roy van Krimpen, Binance’s lead in the region. ”Our next big task will be the successful migration and launch ...

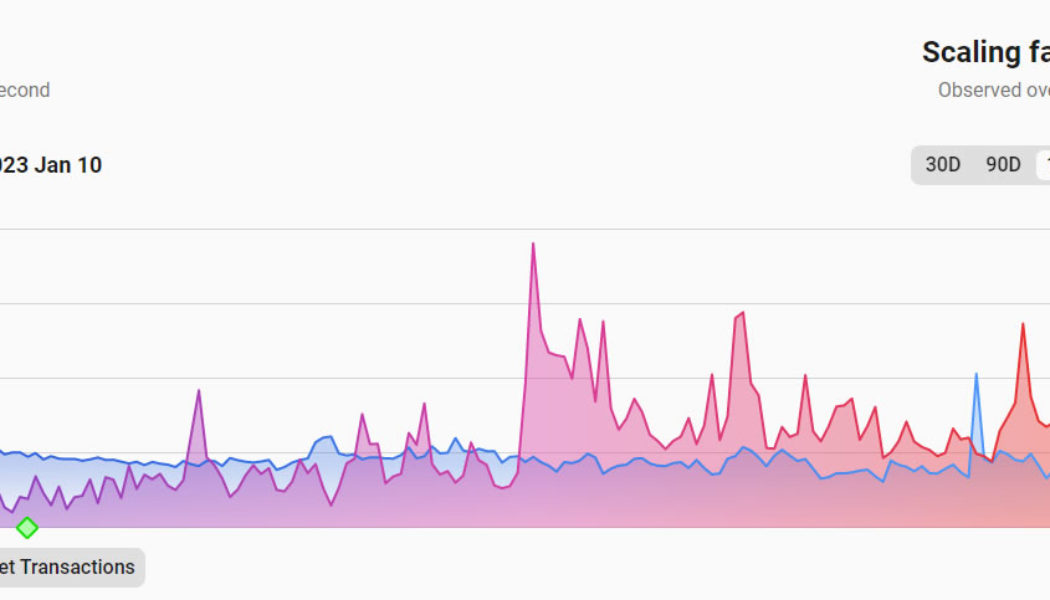

Optimism and Arbitrum flip Ethereum in combined transaction volume

Ethereum layer-2 on-chain activity has been increasing to the extent that the leading two networks now process more transaction volume than mainnet Ethereum. Layer-2 networks Arbitrum and Optimism have seen an increase in transactions over the past three months. Comparatively, aside from a few spikes, transactions on the Ethereum network have declined by around 33% since late October, according to Etherscan. This has enabled the two L2s combined to flip Ethereum for this metric, according to Dune Analytics data. The chart shows Ethereum processed over 1.06 million transactions on Jan. 10, whereas Arbitrum and Optimism combined processed over 1.12 million transactions. Additionally, Optimism has now surpassed Arbitrum in terms of daily transactions following a steady uptrend in activity sin...

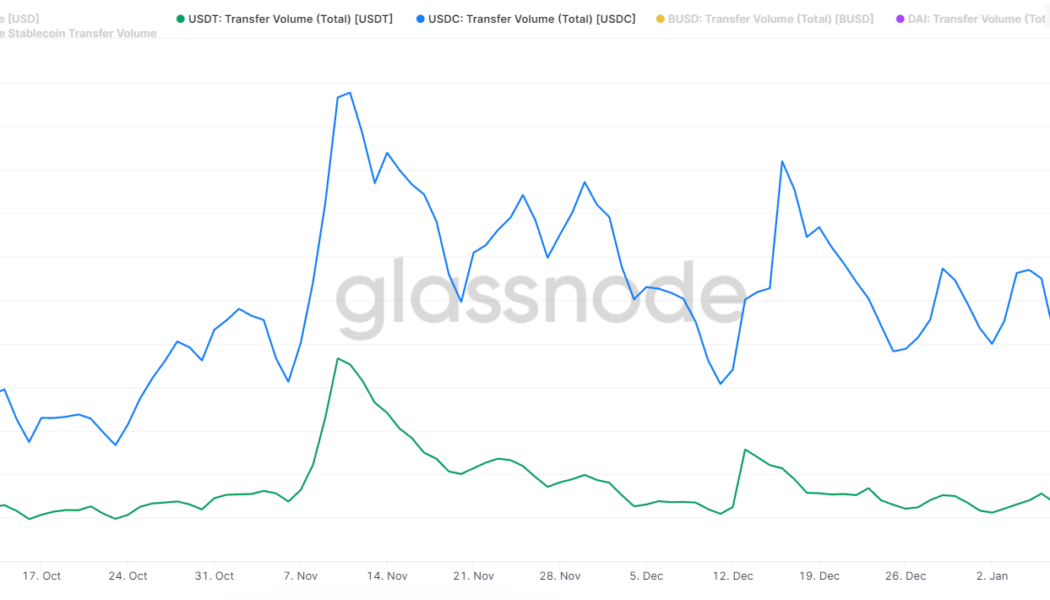

USDC transfer volume hit 5X USDT’s in fallout from FTX collapse

Stablecoin USD Coin (USDC) has grown in popularity since the collapse of FTX. It now frequently reaches daily transfer volumes four to five times that recorded by major competitor Tether (USDT) according to data from blockchain analytics firm Glassnode. That’s despite the market cap of USDT being $23 billion greater than USDC. As of Jan. 10, the difference was in USDC’s favor by a margin of four and a half times. Both stablecoins recorded surges in transfer volumes following an infamous tweet from Binance CEO Changpeng Zhao on Nov. 6 announcing Binance would liquidate its entire FTX Token (FTT) holdings. FTX went into bankruptcy soon after. Since then, USDC has been the preferred choice for crypto users, averaging over $12.5 billion more in transfer volume per day than USDT, according to G...

Bitcoin nodes data: Frankfurt houses the largest city-wide network

While the United States holds the biggest share of Bitcoin (BTC) hash rate contribution and ATM network, the city hosting the most reachable Bitcoin nodes — a crucial pillar of the Bitcoin network — is Frankfurt, Germany. Cast your vote now! Bitcoin nodes are a distributed network of computers that run the Bitcoin software and accept a set of proof-of-work (PoW) consensus rules to validate and broadcast transactions on the blockchain. Of the 43,706 nodes hosted across 134 countries, the U.S. hosts 9,999 (30.53%), while Germany ranks second with 4,529 (13.83%) nodes, according to data from Bitnodes. List of top 10 countries with most number of Bitcoin nodes. Source: Bitnodes However, when it comes to the contribution of individual cities, Frankfurt was found to host the largest nu...