CPI

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...

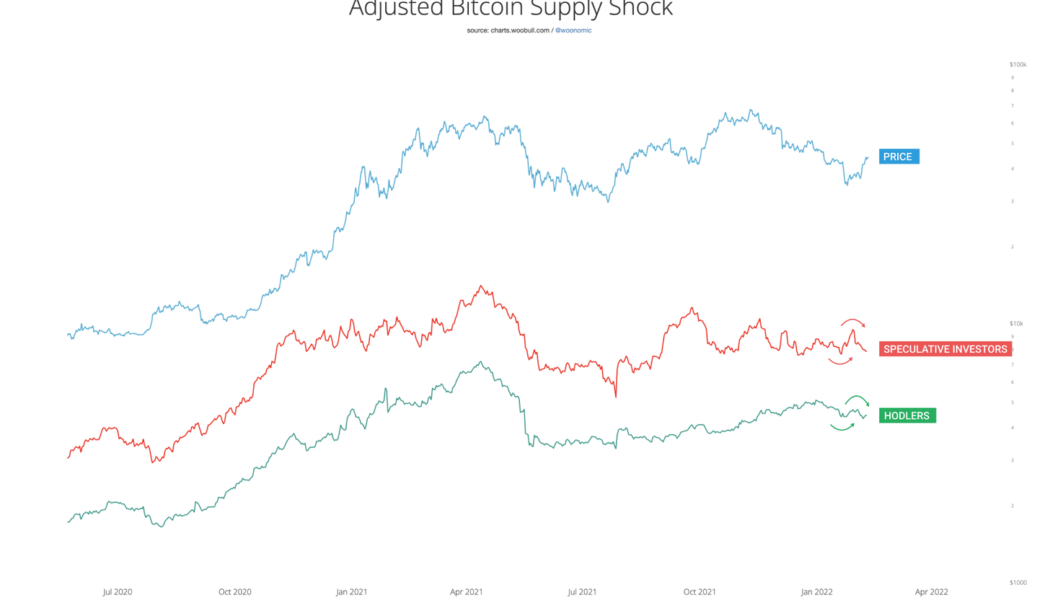

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

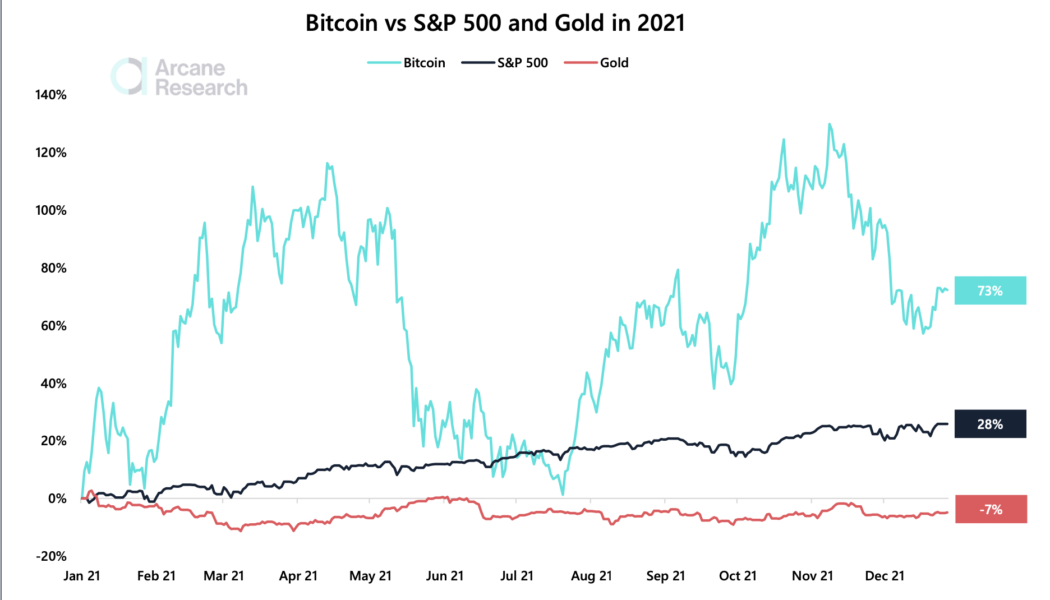

What BTC price slump? Bitcoin outperforms stocks and gold for 3rd year in a row

Bitcoin (BTC) may be down over 30% from its record high of $69,000, but it has emerged as one of the best-performing financial assets in 2021. BTC has bested the United States benchmark index the S&P 500 and gold. Arcane Research noted in its new report that Bitcoin’s year-to-date performance came out to be nearly 73%. In comparison, the S&P 500 index surged 28%, and gold dropped by 7% in the same period, which marks the third consecutive year that Bitcoin has outperformed the two. Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView At the core of Bitcoin’s extremely bullish performance was higher inflation. The U.S. consumer price index (CPI) logged its largest 12-month increase in four decades this November. “Most economists didn’t see the hig...

Nigeria’s inflation drops to 17.93 percent

The Consumer Price Index (CPI) which measures inflation dropped to 17.93 per cent (year-on-year) in May compared to 18.12 per cent in the preceding month, according to the National Bureau of Statistics (NBS). The 0.19 per cent decline in the headline index, makes it the second consecutive month that the rate had sustained its downward trajectory after 18 months of inflationary pressures on the economy. According to the CPI figures for May which was released by the statistical agency Tuesday, food inflation dropped to 22.28 per cent from 22.72 per cent in April. Price moderation was recorded in bread, cereals, milk, cheese, eggs, fish, soft drinks, coffee, tea and cocoa, fruits, meat, oils and fats and vegetables. On month-on-month basis, the food sub-index declined to 1.05 per cent in May ...

Nigeria’s inflation rate hits 17.33 percent

The consumer price index, which measures the rate of increase in the price of goods and services, increased to 17.33 percent in February. This is the highest point since April 2017. According to the CPI/Inflation report released by the National Bureau of Statistics (NBS) on Tuesday, the food inflation stood at 21.79 percent, the highest point since the 2009 data series began. According to the NBS, food inflation also grew by 21.79 percent year-on-year compared to 20.57 percent recorded in January. The headline inflation for month-on-month also increased to 1.89 percent from 1.83 percentage points. It explained that the upward movement in food inflation was caused by increases in the prices of bread, cereals, fish, potatoes, yam and other tubers, vegetables, meat, oils and fats, fruits and ...

NBS: Inflation rises to 12.34 percent in April

The National Bureau of Statistics (NBS) says the Consumer Price Index (CPI), which measures inflation, increased by 12.34 per cent year-on-year in April 2020. The NBS made this known in its latest CPI and Inflation Report for the month of April released on Thursday. It stated that this figure showed 0.08 per cent points higher than the rate recorded in March 2020 which was 12.26 percent. It explained that month-on-month basis, the headline index increased by 1.02 per cent in April 2020 and this was 0.18 per cent rate higher than the rate recorded in March 2020 which was 0.84 per cent. According to the bureau, the composite food index rose by 15.03 per cent in April 2020 compared to 14.98 per cent in March. “This rise in the food index was caused by increases in prices of potatoes, yam and ...

- 1

- 2