Court

South Korea seizes $104M from Terra co-founder suspecting unfair profits

While crypto exchange FTX stole the limelight from other fallen ecosystems, South Korean authorities continue their efforts to bring closure to the victims of the year’s first crypto crash — Terraform Labs. Nearly six months after the Terra (LUNA) blockchain was officially halted, South Korean authorities froze approximately $104.4 million (140 billion won) from co-founder Shin Hyun-seong based on suspicion of unfair profits. The decision to freeze Shin’s asset worth over $104 million was approved by the Seoul Southern District Court, which was based on a request from the prosecutors. The claim related to Shin’s involvement in selling pre-issued Terra (LUNA) tokens to unwary investors. Based on suspicion of profiting from unwarranted LUNA sales, the district court froze the allegedly stole...

You have our swords: 12 independent entities pledge legal support for Ripple

Fintech firm Ripple is garnering more support from the crypto and finance industry in its ongoing battle with the United States Securities and Exchange Commission (SEC). On Nov. 4, Ripple CEO Brad Garlinghouse proudly tweeted that the number of companies, developers, exchanges, associations and investors officially supporting the firm has reached 12. The pile of amicus briefs being filed is mounting up according to Ripple Labs general counsel Stuart Alderoty. An amicus brief is a legal document filed in appeals cases to aid the court by providing extra relevant information or arguments. These briefs are filed by amicus curiae, a Latin phrase that translates to “friend of the court.” “It’s unprecedented (I’m told) to have this happen at this stage,” Garlinghouse exclaimed. For those of you ...

Celsius Network defaults on payments to Core Scientific, causing financial unrest

Crypto lender Celsius Network’s legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the court filings, Celsius alleges that Core Scientific delayed mining rig deployment and supplied them with less power than required under their contract. Celsius is reportedly seeking a court order holding Core in contempt and ordering it to fulfill its obligations. Meanwhile, Core requested the court to compel Celsius to pay pa...

Rex Orange County Charged With 6 Counts of Sexual Assault in the U.K.

British singer-songwriter Rex Orange County has been charged with six counts of sexual assault in his native U.K., Billboard has confirmed. The charges stem from an accusation that the artist (born Alexander O’Connor) twice assaulted a woman in the West End on June 1. That was allegedly followed by four additional assaults against the same woman the following day: once in a taxi and three more times at his home in London’s Notting Hill district. On Monday (Oct. 10), O’Connor denied all counts during an appearance at Southwark Crown Court in London. He has been set free on unconditional bail ahead of a provisional trial date on Jan. 3. The news was first reported by The Sun. “Alex is shocked by the allegations which he denies and looks forward to clearing his name in court,” said a represen...

Accused ‘shadow banker’ Reggie Fowler seeks a 6-month sentencing delay

Reggie Fowler, a former NFL team owner and alleged “shadow banker” who might face up to 30 years of imprisonment, asked the court of the Southern District of New York for a six-month adjournment. Technically, it was Fowler’s lawyer Ed Sapone who requested an “unusually long adjournment,” justifying it with his “serious medical condition” as well as with the necessity to obtain information relevant to the case from financial institutions, entities and individuals located in Europe. According to independent journalist Amy Castor, who reported this development, Sapone made his request on Saturday — three days before the scheduled sentencing. As the prosecutors didn’t protest the adjournment, it will grant Fowler at least six months of freedom. He now resides in Arizona on ba...

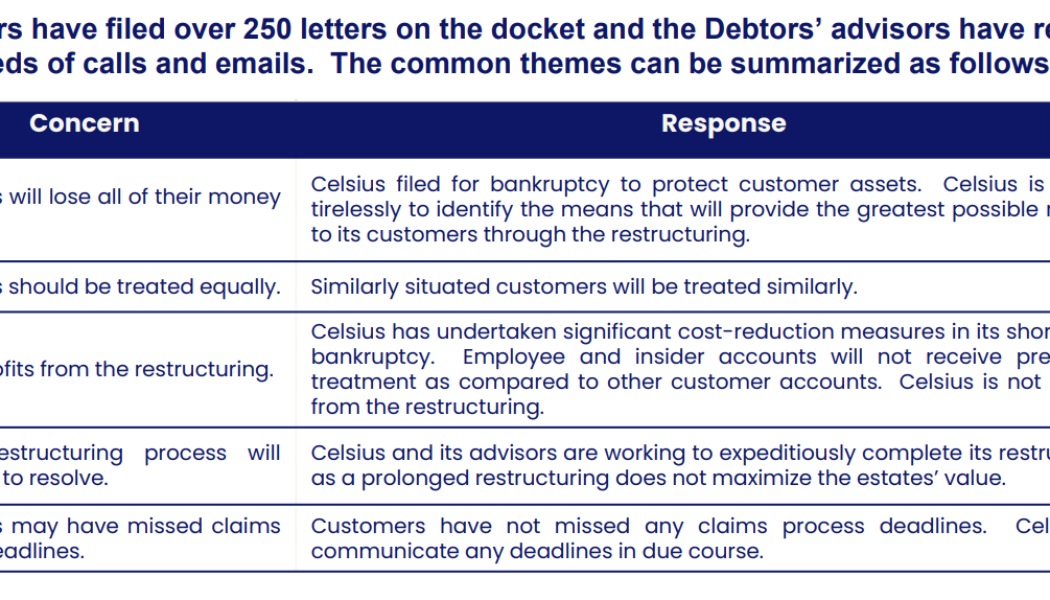

Tens of Celsius clients ask US court to recover $22.5M in crypto

The bankrupt cryptocurrency lender Celsius is facing more legal issues as disgruntled clients are taking action to recover their funds after the platform froze withdrawals in June. An ad hoc group of 64 custodial account holders at Celsius on Wednesday filed a complaint with the U.S. Bankruptcy Court for the Southern District of New York in order to recover their assets. According to court documents, the creditors are seeking to recover a total of more than $22.5 million worth of cryptocurrency assets collectively held in Celsius’ custody service. The ad hoc group is represented by bankruptcy-focused law firm Togut, Segal & Segal. The plaintiffs noted that Celsius has “not honored any withdrawals from any programs,” including custody services. According to the complaint, that contradic...

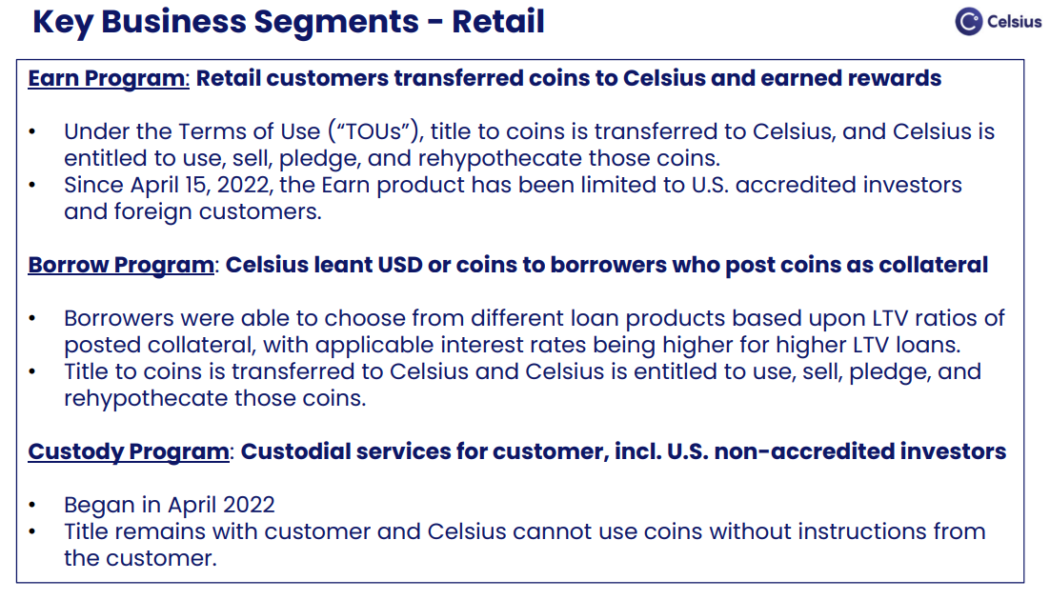

Celsius bankruptcy proceedings show complexities amid declining hope of recovery

The Celsius Network is one of many crypto lending firms that has been swept up in the wake of the so-called “crypto contagion.” Rumors of Celsius’ insolvency began circulating in June after the crypto lender was forced to halt withdrawals due to “extreme market conditions” on June 13 and eventually filed for chapter 11 bankruptcy a month later on July 13. The crypto lending firm showed a balance gap of $1.2 billion in its bankruptcy filing, with most liabilities owed to its users. User deposits made up the majority of liabilities at $4.72 billion, while Celsius’ assets include CEL tokens as assets valued at $600 million, mining assets worth $720 million and $1.75 billion in crypto assets. The value of the CEL tokens has drawn suspicion from some in the crypto community, however, as t...

For greater good: NY judge allows Celsius to mine, sell Bitcoin

Not even 24 hours after revealing a three-month cash flow forecast that threatens total exhaustion of funds, a New York judge allowed crypto lender Celsius Network to mine and sell Bitcoin (BTC) during its bankruptcy. Since July 2022, Celsius Networks stands at the crosshair of United States officials after reports of bankruptcy surfaced, which risks losing the live savings of numerous crypto investors. Last week many got very upset with me as I said @CelsiusNetwork would run out of money & solutions needed to be acted upon faster. I was told I don’t understand Chapter 11. They have now confirmed they run out of money by October. https://t.co/CyzjgKpId7 pic.twitter.com/vBIRIGEmG2 — Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) August 15, 2022 During the second day of the case h...

Crypto lender Hodlnaut seeks judicial management to avoid forced liquidation

Singapore-based crypto lending platform Hodlnaut is seeking judicial management to manage its ongoing liquidity crisis and avoid the forced liquidation of assets in the current bear market. The crypto lender informed its users in a Tuesday announcement that they have applied to the Singapore High Court to be placed under judicial management. The firm said: “We are aiming to avoid a forced liquidation of our assets as it is a suboptimal solution that will require us to sell our users’ cryptocurrencies such as BTC, ETH and WBTC at these current depressed asset prices. Instead, we believe that undergoing judicial management would provide the best chance of recovery.” Judicial management is a law in Singapore that allows financially troubled firms to rehabilitate themselves. Und...

Zipmex gets 3 month protection in Singapore amid halted withdrawals

Cryptocurrency exchange Zipmex has gotten a chance to sort out liquidity issues as a court in Singapore has granted the firm with more than three months of creditor protection. Singapore’s High Court has ruled to give each of the five Zipmex entities a moratorium until Dec. 2, 2022 to come up with a restructuring plan, Bloomberg reported on Monday. The action aims to protect Zipmex from potential creditor lawsuits during the moratorium period after the exchange abruptly halted crypto withdrawals on its platform in mid-July. The cryptocurrency has since resumed partial withdrawals from Zipmex’s trade wallet but is yet to resume all withdrawals. Zipmex sought creditor protection for a period of six months subsequently after halting withdrawals, filing five moratorium applications on July 27....