Coronavirus News

Understanding African Markets During COVID-19

Sourced from iStock. We are living in unprecedented times. COVID-19 has swept throughout the world, and governments globally have taken drastic measures to stop the spread in an attempt to save lives. In February 2020, as African countries watched Asia and Europe begin the implementation of lockdown, a study by Survey54, an automated mobile-led data collection platform, found that approximately 80% of Africans interviewed felt almost immune to the virus as they were yet to hear of any confirmed cases on the continent. This did not last long and by Mid-March, lockdown procedures were initiated across Africa. Despite the swift response, lockdown came with many challenges that drastically affected a continent which heavily depends on the informal sector. With roughly 90% of Africans now conce...

Cashless and Contactless Payments Beyond COVID-19

The emergence of COVID-19 has made the need for digitising payments more critical than ever before and for this to be a success, electronic payments need to offer similar benefits to those afforded by cash. Globally, economies are in various stages of development having either started developing, replaced or are busy replacing daily batch payment systems with real-time systems that execute payments in seconds with the flexibility to meet the needs of the future digital economy. The drive towards digital payments and lowering the reliance on cash is not new to South Africa’s payments market. There are several mechanisms already in place to enable this and banks, card companies, fintechs and retailers are all involved in rolling out digital, non-touch payment mechanisms. Contactless cards us...

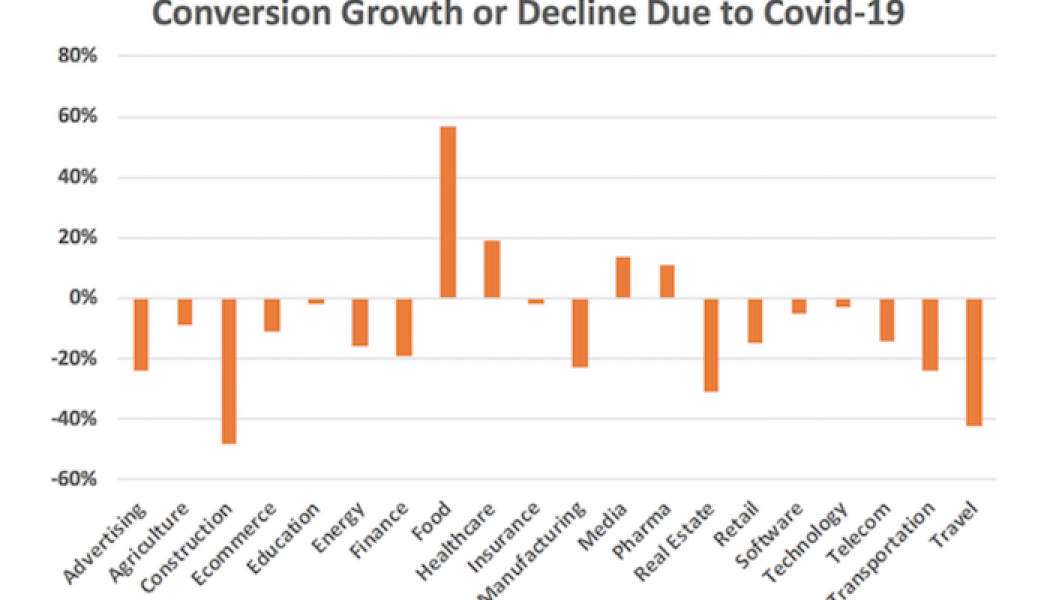

How to Adapt your Marketing Strategy for the COVID Era

Good marketing relies on a thorough understanding of your target market, but when much of what you knew about your customers is suddenly no longer relevant, a major shift is needed. With the onset of the coronavirus, almost every aspect of what was considered typical daily life was upended literally overnight – people confined to their homes, anxious about the future and their financial security. “The most important question you should be asking is: ‘How best can I connect with my customers during a crisis?’” says Gavin Knox-Grant, marketing guru and director of Karbon Media. “It’s not only during the pandemic that business will be different,” says Knox-Grant, “the way in which we all conduct business will be forever changed.” /* custom css */ .tdi_3_556.td-a-rec-img{ text-align: left; }.t...

To Emerge from COVID-19 Businesses Will have to “Re-Think” Traditional Models

Sourced from Tech Loot Traditional models of business funding need a re-think if South Africa’s small businesses and entrepreneurs are to emerge from the financially crippling “winter of coronavirus” into a spring of growth and rejuvenation. Accepting that downturns, recessions and economic crises are inevitable, one needs to shift the focus into building “Zebra” companies – sustainable businesses with steady growth, strong balance sheets and cash flows, and able to withstand downturns – rather than “Unicorns that will die without the next round of funding”, says University of Stellenbosch Business School (USB) Senior Extraordinary Lecturer, Daniel Strauss. “In the past, we had a mindset of ‘or’ – we either had a traditional SMME that was funded through debt or we had a start-up that was f...

Platform Simplifies Access to COVID-19 Interventions in Nigeria

Sourced from Mail & Guardian. Beating Corona Nigeria, the country’s leading virtual intervention database has restructured its model to help disadvantaged Nigerians in need of interventions connect with the relevant non-profits. The platform itself kicked off last month, 9 April, and has recorded a massive amount of data. It continues to actively connect interveners to the people who need access to interventions. After recommendations to resolve the platform’s challenges with making interventions accessible, the database was pivoted towards a new model. With this pivot, the intervention database properly complements the core of the platform’s mission. Some of the major updates on the platform now allows for a search bar that can enable interventions to be easily found, a breakdown of a...