Core Scientific

NY law firm investigates potential ‘securities fraud’ at Core Scientific

A New York-based law firm says it has begun an investigation into whether Bitcoin miner Core Scientific and its leadership potentially engaged in “securities fraud and other unlawful business practices” which led to its stock price falling on several occasions. According to securities class action firm Pomerantz LLP, the investigation was prompted by a report from Culper Research in 2022, which alleged that Core Scientific had “wildly oversold” its mining and hosting businesses in 2021 and also waived a 180-day lockup period of over 282 million shares, making them “free to be dumped” in Mar. 2022. This report suggested that insiders at Core Scientific had “abandoned any pretense of care for minority shareholders,” noting ...

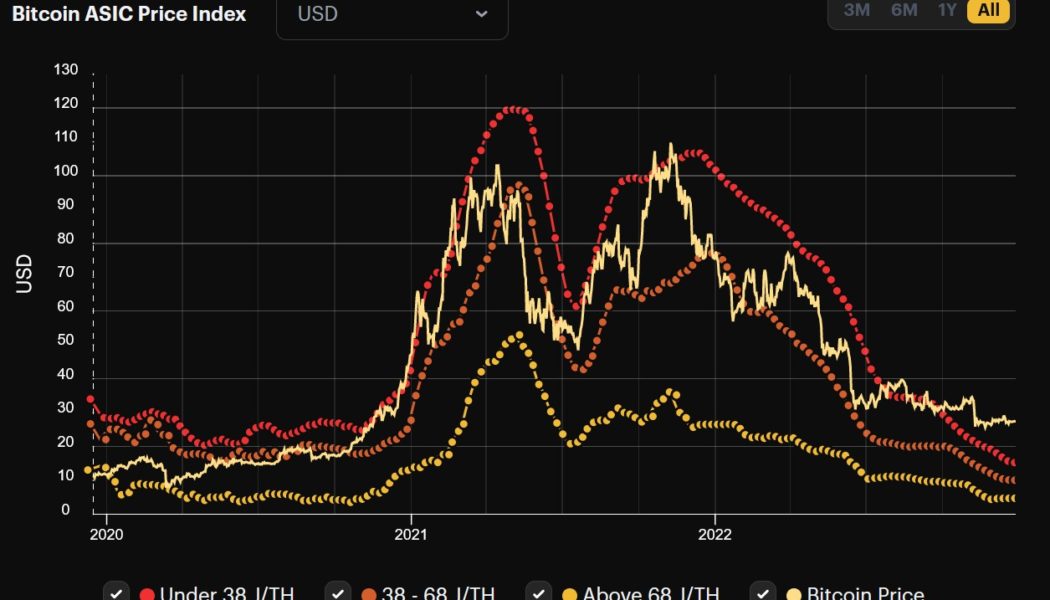

Bitcoin ASIC miner prices hovering at lows not seen in years

Bitcoin (BTC) ASIC miners — machines optimized for the sole purpose of mining Bitcoin — are currently selling at bottom-of-the-barrel prices not seen since 2020 and 2021, in what is being viewed as another sign of a deepened crypto bear market. According to the latest data from Hashrate Index, the most efficient ASIC miners, those generating at least one terahash per 38 joules of energy, have seen their prices fall 86.82% from May. 7, 2021 peak of $119.25 per terahash down to $15.71 as of Dec. 25. Miners in these category include Bitmain’s Antminer S19 and MicroBTC’s Whatsminer M30s. The same statement holds true for the mid-tier machines, with prices now averaging out at $10.23 after falling a massive 89.36% from its peak price of $96.24 on May. 7, 2021. However, the least efficient machi...

Core Scientific may consider bankruptcy following uncertain financial condition: Report

Bitcoin mining firm Core Scientific is reportedly considering a potential bankruptcy amid a group of its convertible bondholders consulting restructuring lawyers. According to a Nov. 1 report from Bloomberg Law, the Core Scientific bondholders worked with legal firm Paul Hastings following a United States Securities and Exchange Commission filing suggesting financial distress. The Oct. 26 filing indicated that the mining company was unable to meet its financial obligations in late October and early November, citing the low price of Bitcoin (BTC), rising costs of electricity, an increase in the global BTC hash rate and legal issues with crypto lending firm Celsius. Core Scientific claimed in an Oct. 19 court filing that Celsius owed the firm more than $2.1 million for post-petition charges,...

Celsius bankruptcy case Trustee slams $3M employee bonus motion

The United States Trustee overseeing the Celsius Chapter 11 bankruptcy case, William Harrington, has objected to a Celsius motion that would see 62 of its 275 employees paid a retention bonus totaling $2.96 million. The Trustee has blasted Celsius in its supporting statement for the objection filed on Oct. 27, noting: “It defies logic, not to mention the Bankruptcy Code, that a company where the majority of its functions are no longer providing services, would now propose a multi-million dollar bonus scheme.” For the “bonus motion,” as it is aptly named, to receive approval, the Trustee claims that Celsius must show that the bonuses are reasonable based on the facts of the case. Without any identifiable metrics, the Trustee says Celsius has failed to do so. While the objection does not inf...