Contagion

FTX will be the last giant to fall this cycle: Hedge fund co-founder

While the FTX crisis is continuing to unfold, the former head of risk at Credit Suisse believes the exchange’s fall from grace should be the last catastrophic event — at least in this market cycle. CK Zheng, the former head of valuation risk at Credit Suisse and now co-founder of crypto hedge fund ZX Squared Capital said that FTX’s fall was part of a “deleveraging process” that began after the COVID-19 pandemic and further accelerated after the fall of Terra Luna Classic (LUNC), formerly Terra (LUNA). “When LUNA blew up a few months ago, I expected a huge amount of deleveraging process to kick in,” said Zheng, who then speculated that FTX should be last of the “bigger” players to get “cleaned up” during this cycle. Before its collapse, FTX was the third largest crypto exch...

Contagion only hit firms with ‘poor balance sheet management’ — Kraken Aus boss

The crypto contagion sparked by Terra’s infamous implosion this year only spread to companies and protocols with “poor balance sheet management” and not the underlying blockchain technology, says Kraken Australia’s managing director Jonathon Miller. Speaking with Cointelegraph, the Australian crypto exchange head argued that sectors such as Ethereum-based decentralized finance (DeFi) revealed its fundamental strength this year by weathering severe market conditions: “Some of the contagion that we saw across some of the lending models in the space, [was in] this traditional finance kind of lending model sitting on top of crypto. But what we didn’t see is a kind of catastrophic failure of the underlying protocols. And I think that’s been recognized by a lot of people.” “Platforms...

Better days ahead with crypto deleveraging coming to an end: JPMorgan

The historic deleveraging of the cryptocurrency market could be coming to an end, which could signal the close of the worst of the bear market, according to a JPMorgan analyst. In a Wednesday note, JPMorgan strategist Nikolaos Panigirtzoglou highlighted increased willingness of firms to bail out companies, and a healthy pace of venture capital funding in May and June as the basis for his optimism. He said key indicators support the assessment: “Indicators like our Net Leverage metric suggest that deleveraging is already well advanced.” The deleveraging of major crypto firms, where their assets have been sold either willingly, in a rush, or via liquidation, began largely in May when the Terra ecosystem collapsed and wiped out tens of billions of dollars. Since then, crypto lende...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

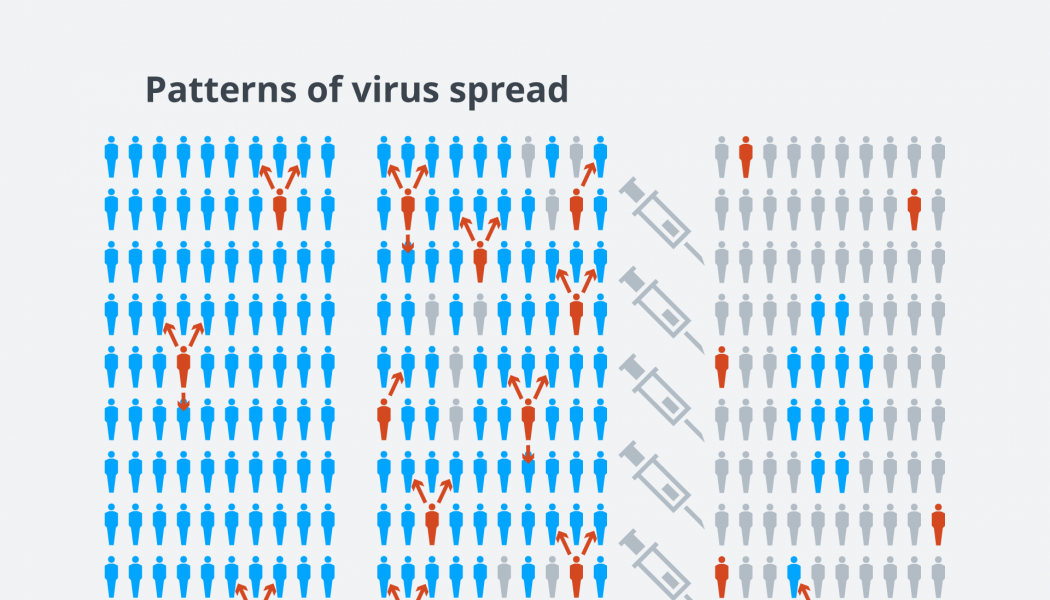

Over 40 million people recover from coronavirus

More than two-thirds of the over 58 million people infected by COVID-19 across the world have recovered from the disease after treatment. The post Over 40 million people recover from coronavirus appeared first on TODAY. You Deserve to Make Money Even When you are looking for Dates Online. So we reimagined what a dating should be. It begins with giving you back power. Get to meet Beautiful people, chat and make money in the process. Earn rewards by chatting, sharing photos, blogging and help give users back their fair share of Internet revenue.