Company News

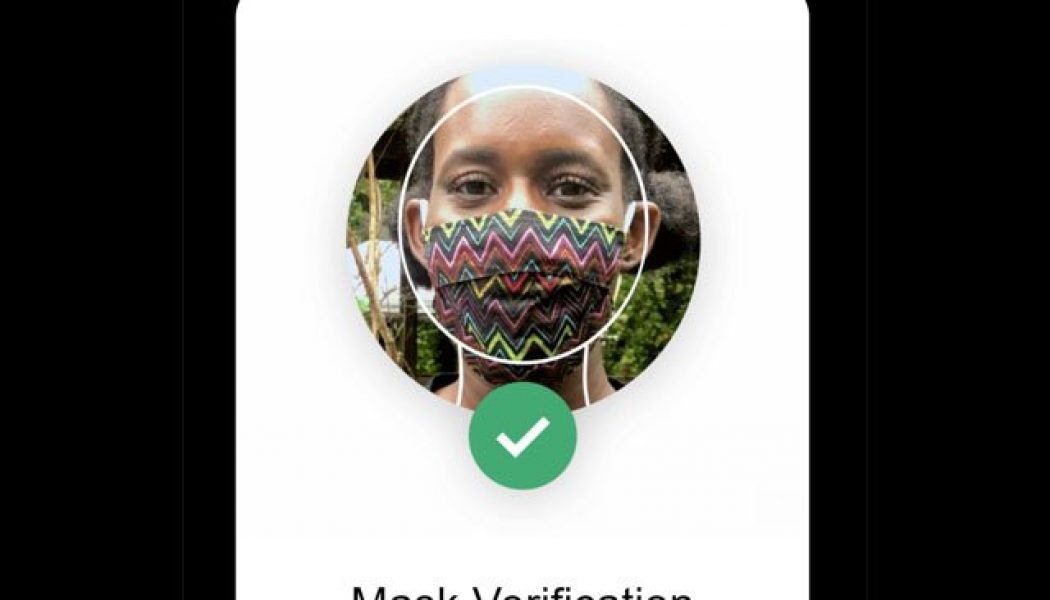

Uber to Crack Down on Mask Wearing in South Africa

Sourced from CNet. Uber South Africa has launched its Mask Verification tool in an attempt to ensure all passengers wear a mask when taking a ride. Passengers may be required to take a selfie while the mask verification tool ‘detects whether a mask is within the frame of the portrait and allows access to Uber if this is the case,’ reports MyBroadBand. “Masks are mandatory for riders and drivers, and both of you can leave feedback if the other isn’t wearing one,” reads an email from Uber to its South African users. “If we receive feedback about anyone consistently violating our mask policy, they will be blocked from the Uber app.” /* custom css */ .tdi_3_f66.td-a-rec-img{ text-align: left; }.tdi_3_f66.td-a-rec-img img{ margin: 0 auto 0 0; } Uber Cash Digital Wallet Launched in Sub-Saharan A...

Unpacking Intelligent Infrastructure in the Modern Data Centre

As the world’s largest IT companies realise the importance of ‘intelligent infrastructure’ in the modern data centre, the race is on between storage competitors to provide products and solutions that are actually truly intelligent, and not merely standard infrastructure. So says Marcel Fouché, Networking and Storage General Manager at value-added distributor Networks Unlimited Africa, which partners in South Africa with Tintri, a provider of intelligent infrastructure for virtualised and non-virtualised enterprise IT environments. He clarifies, “In order to get to grips with this challenging issue, Tintri recently held a free webcast to unpack the differences between intelligent and standard infrastructure, looking at the topic from the perspectives of the customer, the vendor and th...

LexisNexis Tournament Sparks Learner Interest in Coding

More than 400 learners from over 80 schools across the country participated in a virtual tournament held from 19 to 26 September 2020 which used gamification to introduce them to basic coding concepts and social issues such as ocean conservation. Professor Jean Greyling, associate professor in Computing Sciences at Nelson Mandela University, said the BOATS tournament was a partnership between the university’s Department of Computing Science, legal technology company LexisNexis South Africa and non-profit organisation, Leva Foundation, which empowers previously disadvantaged youth by providing employable skills development. “During the tournament, learners logged in from home to access the BOATS Android mobile coding app. They were taken through multiple-choice questions that edu...

Canal+ Acquires 6.5% Stake in MultiChoice

Image sourced from The Vanguard Nigeria MultiChoice has revealed that Groupe Canal+ SA – a French media company – has acquired 6.5% of Group’s ordinary shares. The African entertainment company emphasised that Canal+ would have to accept reduced voting rights of shares as it’s a foreign entity. “Shareholders should take note that, pursuant to a provision of the MultiChoice memorandum of incorporation, MultiChoice is permitted to reduce the voting rights of shares in MultiChoice (including MultiChoice shares deposited in terms of the American Depositary Share (“ADS”) facility) so that the aggregate voting power of MultiChoice shares that are presumptively owned or held by foreigners to South Africa (as envisaged in the MultiChoice memorandum of incorporation) will not exceed 20% of the tota...

T-Systems and Fortinet to Launch Cyber Security Academy in South Africa

T-Systems and Fortinet have teamed up to launch a Cyber Security Academy that’s accessible to local South African youth. The new Academy is expected to include Fortinet’s Network Security Expert (NSE) certifications, helping participants build cybersecurity awareness skills and ultimately tackle the global cybersecurity workforce shortage. “Cybersecurity has become a top C-level priority across the globe with skills in high demand. With the addition of this focus to our ICT Academy, we are empowering participants with new skills that will make them even more employable,” explains Marcus Karuppan, ICT Academy Manager at T-Systems South Africa. “T-Systems has been a Fortinet partner for many years. Building on our relationship, we are now collaborating with them to focus on cybersecurity ski...

FNB Introduces QR Code Payments to all Speedpoint Devices

Sourced from Htxt.Africa FNB has revealed that shoppers across South Africa will now be able to make QR code payments at all standalone sale terminals. The bank says that this forms part of the ongoing expansion of its payments ecosystem and integrated App-based QR code, aimed at accelerating the adoption of digital payment solutions in the country. FNB Merchant Services CEO, Thokozani Dlamini says given the challenges we are currently facing globally due to the COVID -19 pandemic, it was essential that FNB fast-track the rollout of QR code payments for enhanced convenience and safety. “Added to the cost-effective, convenient and efficient payment process of contactless payments, both consumers and merchants will have peace of mind from a safety perspective, as physical contact will be lim...