Cointelegraph Consulting

Building the blockchain industry despite market drops and regulation threats

“The cryptocurrency market is the only truly free market that exists in the financial universe,” said Dan Tapiero, CEO of 10T Holdings, during a recent video discussion with Cointelegraph Research. A major concern of venture capital (VC) and investment firms as of late has been centered around regulation from different countries around the globe. While the theme of the discussion was on regulation, the conversation also touched upon how these different members of the crypto space see the future of the industry. Investors undaunted by regulation Each of the panel members brought their own perspective: Dan Tapiero’s 10T Holdings is a mid-stage private equity investment firm and has decades of experience. Smiyet Belrhiti is the managing partner for Keychain Ventures, which provides inst...

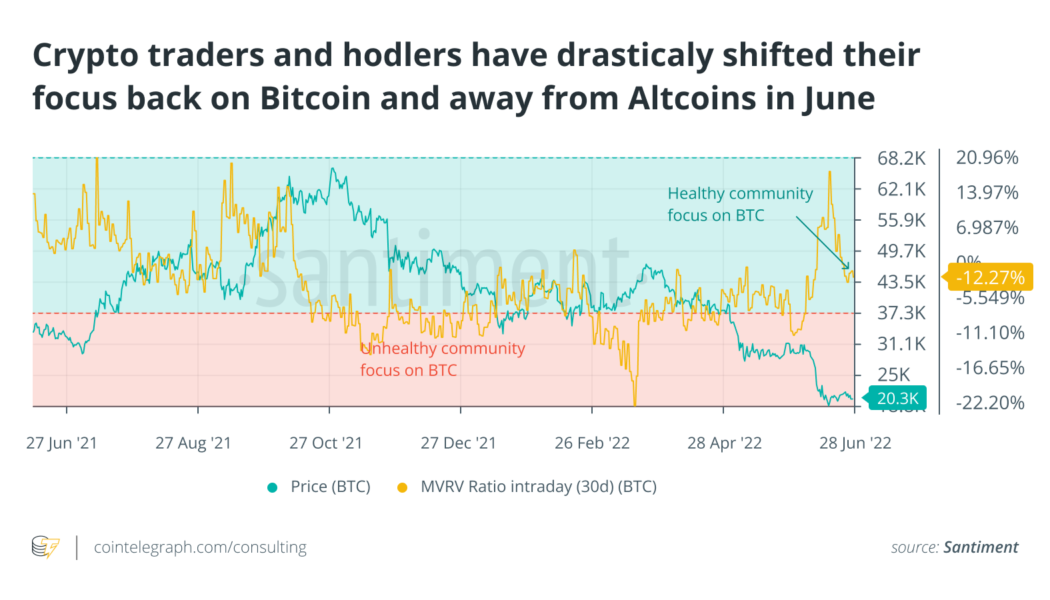

June gloom takes on a new meaning in another 2022 down month

The market cap of Bitcoin (BTC) dropped another 33% in June, which is now beginning to numb the Twitter community. On the upside, many crypto traders who wanted out did so fairly aggressively from March to May. But, the less optimistic news is that the stagnancy in address activity may need to change for prices to get a running start on recovery. Unlike April and May, the altcoin pack didn’t struggle tremendously more than Bitcoin. BTC’s 33% drop was pretty middle of the road in terms of corrections. In a vacuum, crypto bulls would prefer seeing altcoins continuing to lag, pushing more traders back toward Bitcoin as a relative “safe haven.” Nevertheless, June was a tale of two halves. June 1-15 saw a massive 25% further downswing for Bitcoin. Comparatively, June 16-30 was looking up until ...

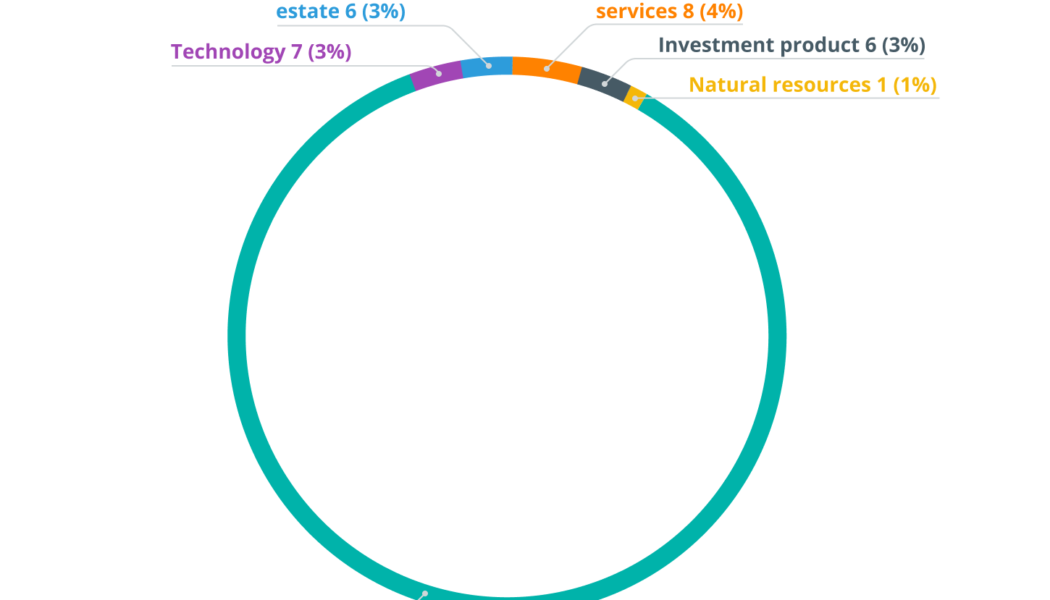

Blockchain investments are disrupting the real estate industry: Report

The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library from the industry leader in tokenization. The report, from Security Token Market and sister company Security Token Advisors, covers the rapidly emerging asset-backed real estate tokenization industry. It has information on the developing shifts in the industry and is a must for any firm or business with a portfolio that encompasses real estate. The tokenized real estate industry is growing rapidly amid the current market frenzy. With investors looking for a more secure investment that utilizes emerging technology, the demand for blockchain-based investment opportunities backed by real-world as...

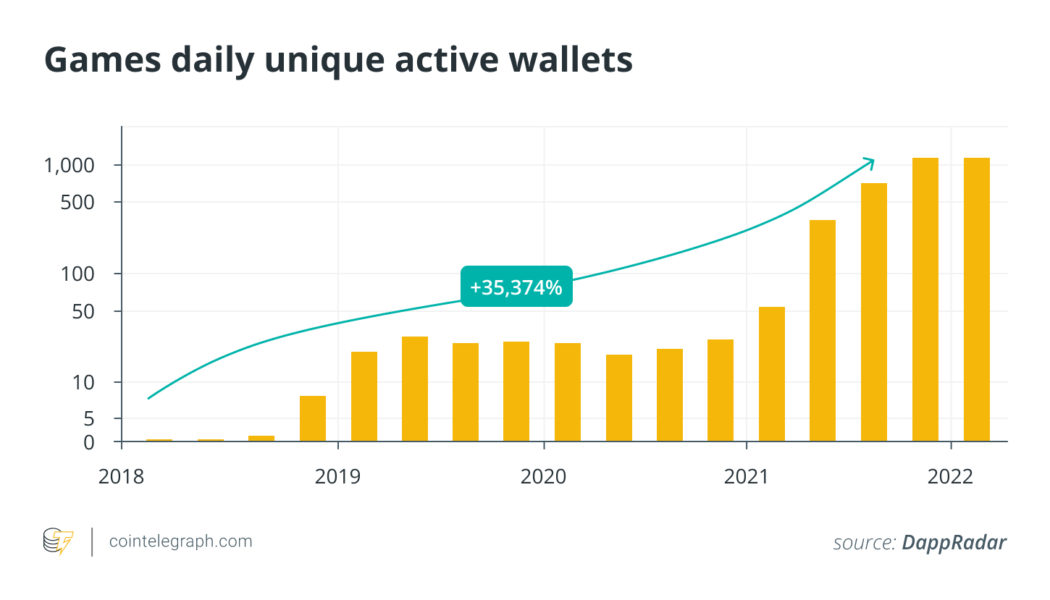

GameFi is showing signs of a mature landscape: Report

Blockchain games are set to overtake decentralized finance (DeFi) as the number one contributor to decentralized application (DApp) activity in terms of uniquely active wallets. A new 18-page report by DappRadar surveys the nascent ecosystem behind this rise. Although still dwarfed by the traditional gaming industry, blockchain games, sometimes dubbed GameFi, have seen an early spurt of exponential growth, according to the report’s data. “The evolution of blockchain games” report, which discusses play-to-earn (P2E) as a new paradigm for gaming, is available on the Cointelegraph Report Terminal to purchase. It details how the play-to-earn model gained traction in the COVID-19 pandemic when players from emerging economies were seeking new sources of income. In Q2 of 2021, which was not...

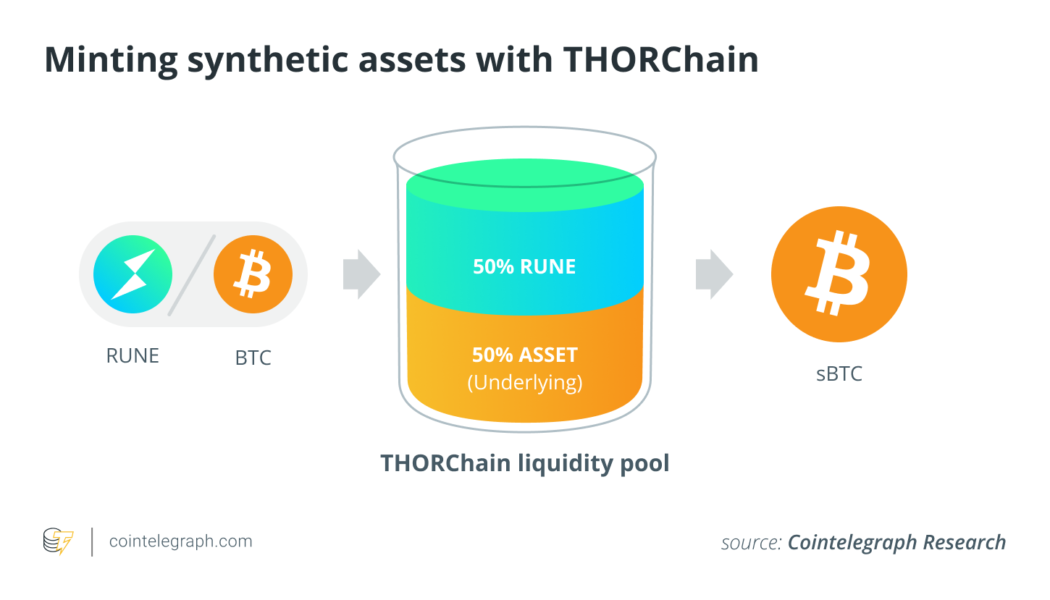

RUNE rally: A closer look at THORChain’s new synthetic assets

THORChain (RUNE) has appreciated nearly 41% in the past seven days, according to the data from Cointelegraph Markets Pro, and its recent price action is even leading the entire crypto market in the first quarter of 2021. Its mainnet launch, which was originally slated last year, is one of the main factors that led to its recent price surge. But, the other factor that provided added momentum is the integration of synthetic assets to its network. Why was this such a huge deal, and what are its implications for THORChain going forward? THORChain is often compared to Uniswap since it provides users a way for traders to swap different tokens. The only difference is THORChain lets users trade layer-1 coins in a decentralized manner, whereas Uniswap is limited to only the tokens that are of the E...

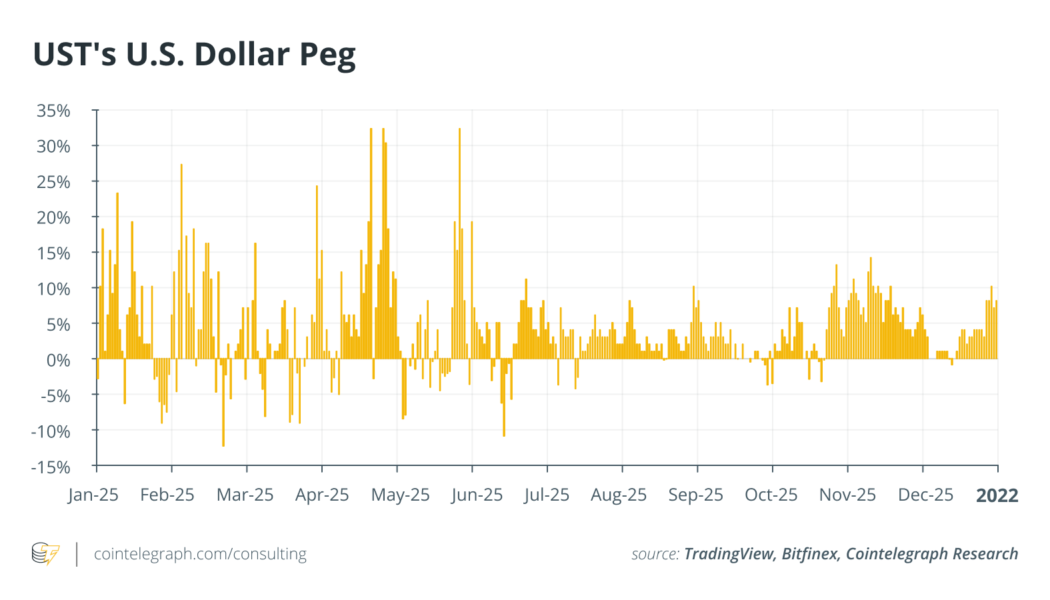

Cointelegraph Consulting: The bigger role of LUNA in Terra

In an interview, Do Kwon, co-founder and CEO of Terraform Labs, said that Terra’s ecosystem was built with several use cases such as savings, payments, investments and others that leverage its stablecoin assets. The previous Market Insights newsletter tackled Terra’s ecosystem growth in 2021 and how it got to hundreds of decentralized applications from just two at the beginning of last year. And all of it is grounded on Terra’s stablecoins and the protocol’s ability to maintain the stability of their peg. Yet the key ingredient for such stability is its primary staking asset, LUNA. On the surface, investors got to know LUNA because of its rapid price rise in 2021, but according to the project’s white paper, owning and holding LUNA is meant to represent something entirely mo...

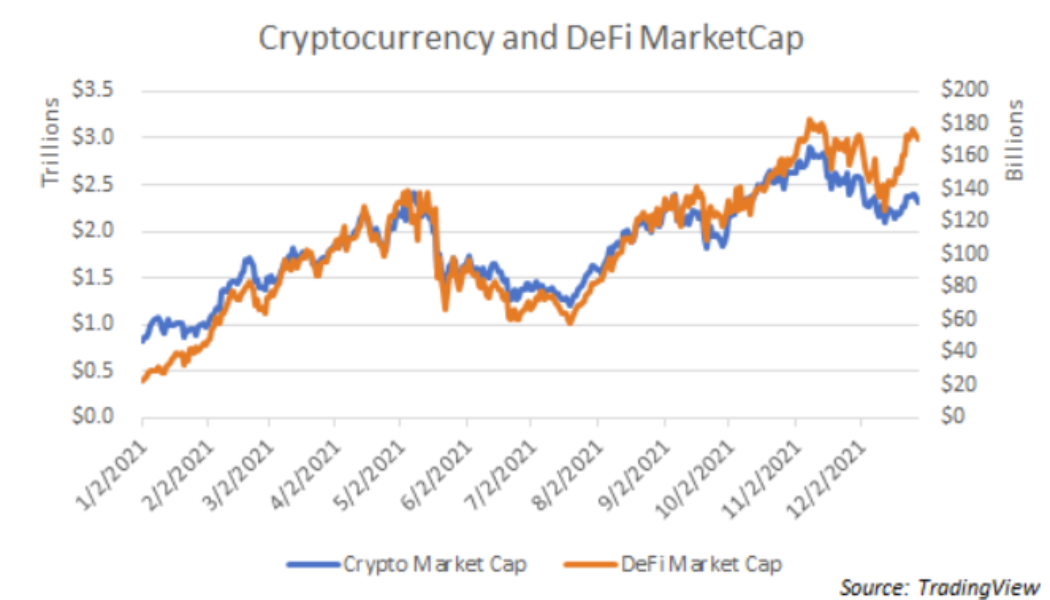

Cointelegraph Consulting: Crypto events of 2021 in retrospect

The year 2021 is coming to a close, and if there’s one way to describe how the cryptocurrency industry fared in the past 12 months, it would be momentous growth. Major cryptocurrencies shattered previous records, adoption grew, new sectors sprouted and novel blockchain use cases made significant breakthroughs. The Market Insight’s latest edition recalls the events covered in past issues as well as deep-dive topics in Cointelegraph Research’s industry reports. DeFi and Altcoins Two of the top gainers of 2021 were Solana (SOL) and Terra (LUNA). SOL gained 9,500%, while LUNA gained 13,000%. Significant investments and ecosystem growth catalyzed the immense gains for the two tokens. One could also argue that the two being billed as potential “Ethereum killers” had a part in contributing ...