Coinbase

Is asymmetric information driving crypto’s wild price swings?

It has long been believed that investors possessing inside knowledge help drive cryptocurrencies’ price volatility, and a number of academic papers have been published on this topic. This is why Coinbase’s intention to regularly publish in advance a catalog of tokens being assessed for listing on its prominent trading platform is noteworthy. Coinbase’s plans, announced in an April 11 blog along with 50 crypto projects “under consideration” for Q2 2022, could help tamp down the pervasive speculation that surrounds small-cap tokens. Meanwhile, this can help alleviate industry concerns about “information asymmetry,” which typically occurs when one party to a transaction — a seller, for instance — is much better informed than another transactional party, such as a buyer. Last week’s pre-...

Coinbase exploration report leads to over 100% price gains for MITX, KROM and BDP

United States-based cryptocurrency exchange Coinbase sent waves across the cryptocurrency ecosystem on Apr. 11 when it released a list of 50 crypto assets that were under consideration for listing in the second quarter of 2022 in a bid to increase the transparency of its listing process. Responses to the release were mixed and led to some allegations of insider trading by crypto sleuths, while a majority of crypto traders took a deeper dive into the list in an attempt to discover diamonds in the rough. Following a week’s worth of trading that saw many of the tokens on the list experience pump-and-dumps, the dust is beginning to settle revealing Morpheus Labs (MITX), Kromatika (KROM) and Big Data Protocol (BDP) as the top three gainers from the Coinbase announcement. Morpheus Labs Mor...

Binance and Coinbase silent on Bitcoin Lightning: Community tries to understand why

The Bitcoin Lightning Network integration started to take off among the cryptocurrency exchanges worldwide. However, some of the world’s largest crypto trading platforms seemingly are not in the hurry to integrate the protocol. Last week, Robinhood crypto trading app became the latest major industry player to announce the Lightning integration, following in the footsteps of BitPay and the Kraken crypto exchange. As the main goal of the Lightning integration is to reduce the cost of Bitcoin (BTC) transactions and accelerate the network transfers, one may wonder what cryptocurrency exchanges have still not added the Lightning support. Binance, Coinbase and FTX stay silent on Lightning Not everyone is happy with the pace of Bitcoin LN adoption. David Coen, a software quality assurance te...

Coinbase to bring BAYC NFTs to the big screens via a short film trilogy

The Degen Trilogy is a three-film trilogy set to air during NFT.NYC this June There are also plans for a series based on Mutant Ape Yacht Club NFTs Crypto exchange Coinbase has announced that it is collaborating with Bored Ape Yacht Club (BAYC) to create a short animated film based on its NFT characters. Coinbase revealed the news via a tweet shared yesterday, alongside a link leading to the trilogy’s website, plastered with the inscriptions’ Something is Coming.’ Titled The Degen Trilogy, the animated film will be produced by a Hollywood director, with the series set to make its silver screen debut at the NFT.NYC event planned for June 20 – 23. BAYC owners who wish that their NFT characters take part in the film can forward their submissions for selection by the director. Community input ...

Leading centralized exchanges extend market share in 2022

The top centralized cryptocurrency exchanges have reached all-time highs for market share this year as the trading volume in crypto consolidates onto the platforms of only a few trusted companies. These named “top-tier” crypto exchanges have increased their market share from 89% in August 2021 to 96% in February 2022, according to data collected by United Kingdom analytics company CryptoCompare published on Monday. The firm analyzed over 150 active centralized exchanges, ranking them on security, number of assets available, regulatory compliance, Know Your Customer checks and more, grading them from a top score of AA to a low of F, with “top tier” receiving a grade B or above. A total of 78 exchanges received a “top tier” grade, with Coinbase, Gemini, Bitstamp and Binance as the only four ...

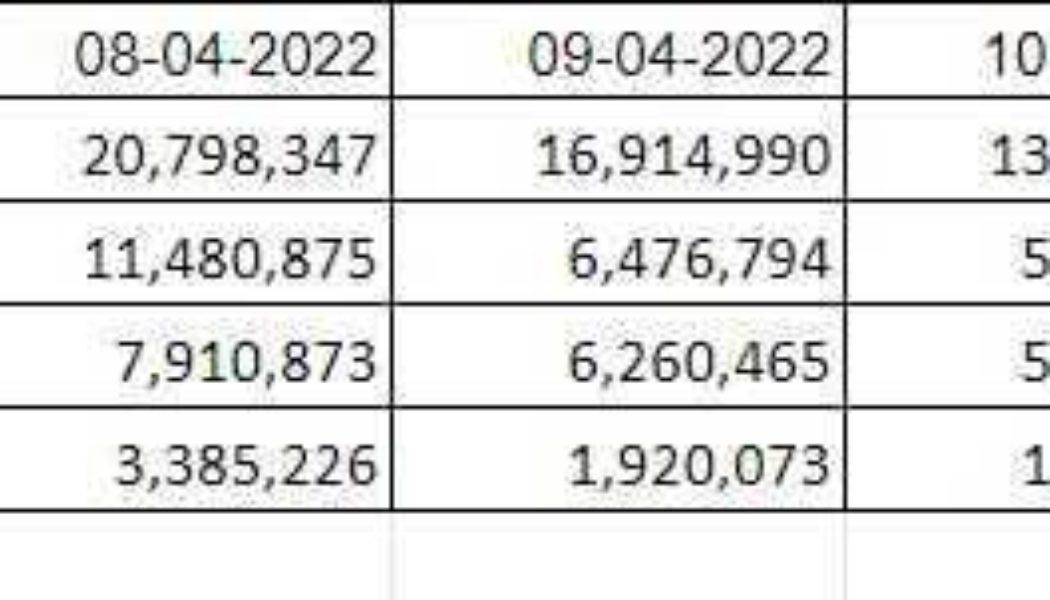

Indian crypto exchanges’ volume plunges down as 30% tax goes into effect

Fresh data on Indian crypto exchanges’ trading volume reveals a significant decline in trading practices among Indians just ten days after the tax rule implementation. India’s new 30% crypto tax rule came into effect on April 1, despite many stakeholders and exchange operators warning against its ill effects. A research data report shared by Indian blockchain analytic firm Crebaco with Cointelegraph shows that trading volume on top Indian crypto exchanges has declined as high as 70% in the past 10 days. Crypto Trading Volume on Major Indian Exchanges Source: Creabaco The trading volume on WazirX, the leading crypto exchange in India, declined from $47.8 million on April 1 to $13.2 million on April 10. CoinDCX’s trading volume dropped from $12.16 million to $5.76 million, ...

Weekly Report: Robinhood wallet goes live, Binance has both feet in Dubai and more

Here are the top headlines that you might have missed from the last week throughout to the weekend: Block, Blockstream and Tesla collaborate to achieve scaled Bitcoin mining using entirely renewable energy Abu Dhabi grants Binance in principal approval as a digital assets broker-dealer Robinhood’s crypto wallet is live but does not support NFTs and some cryptocurrencies, including Solana and Tether Pether Thiel terms Buffet, Dimon, and Fink as members of the “finance gerontocracy” holding back Bitcoin Coinbase has halted deposits via India’s UPI payment instrument Blockstream and Block launch a joint solar-powered Bitcoin mining initiative in Texas Blockstream co-founder Adam Beck on Friday announced during the Bitcoin 2022 Conference in Miami that his firm was launching a collaborative ve...

Solana NFT marketplace integration and DApp metrics shine even after SOL’s 20% drop

Solana (SOL) price reached $143.50 on April 2 after an incredible 82% rally over a 20 day period. This positive performance can be attributed to recent NFT markets-related news and a marketwide bounce, but the current 22.7% decline could have investors confused. Solana/USDT at FTX. Source: TradingView The rally started after Coinbase Wallet added support for SOL and other Solana-based blockchain tokens on March 18. The crypto exchange also outlined plans to “further integrate” with Solana by connecting the Coinbase Wallet with the decentralized applications (DApps) and nonfungible tokens (NFTs) hosted on the network. The expectation of OpenSea’s integration of the Solana network also excited investors. This means Solana will join Ethereum, Polygon and Klaytn as the ...

Coinbase to reportedly buy the $2.2B Brazilian unicorn behind Mercado Bitcoin

Coinbase is set to continue its global acquisition strategy, reportedly buying the Brazilian company 2TM, the parent company of Mercado Bitcoin. According to information from Estadão, the third-largest newspaper read by Brazil’s 212 million populace, the Coinbase acquisition could be complete by next month. Negotiations for the purchase have been taking place over the course of 2022. Mercado Bitcoin is Latin America’s largest crypto brokerage, whose parent company, 2TM cemented its unicorn status as a billion-dollar company in 2021. Valued at $2.2 billion, 2TM has also pursued an acquisition strategy, particularly in lusophone countries. 2TM’s Mercado Bitcoin snapped up Portuguese CriptoLoja, a Lisbon-based crypto exchange in January. The 2TM holding company umbrella now covers ...

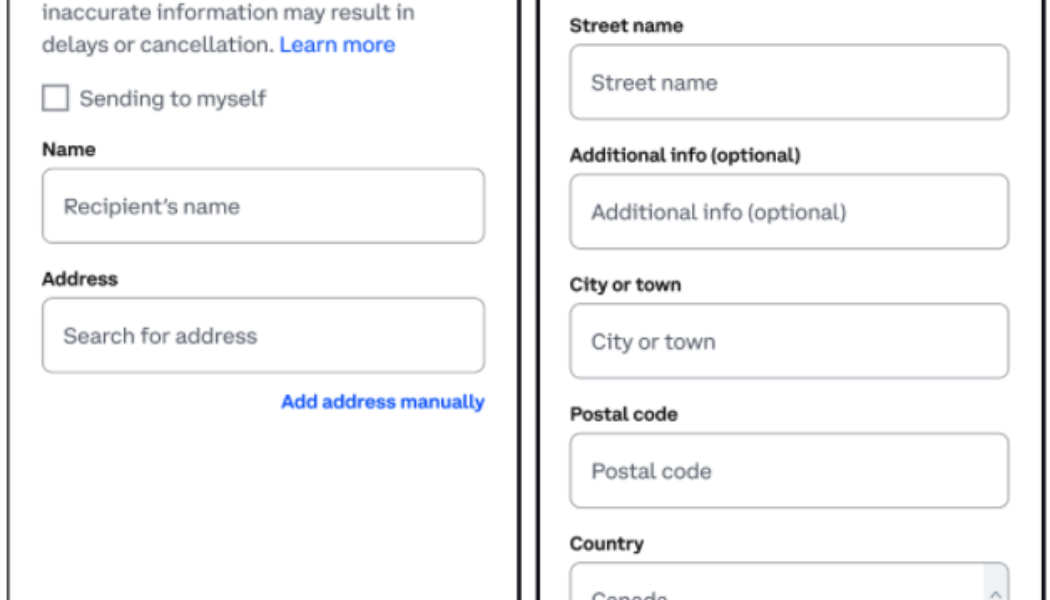

Coinbase to track off-platform crypto transfers in Canada, Singapore, Japan

Citing compliance with local jurisdictions, crypto exchange Coinbase announced to soon collect additional information from users based in Canada, Singapore and Japan. Effective from April 1, Coinbase users from Canada, Singapore and Japan will be required to provide additional information while sending cryptocurrencies to a different (non-Coinbase) platform. However, while Singaporean and Japanese investors will be required to share additional information about the recipient for every single off-platform transaction, Canadians sending less than $801 (1,000 CAD) will be exempted from this requirement. Screenshot of Coinbase requesting recipient information from Canadian users. Source: Coinbase As shown in the above screenshot, Canadian users will need to share the full name and ...

Finance Redefined: Hoskinson talks about DApps, Coinbase Cloud launches Avalanche tools and more

The week was filled with ups and downs for the decentralized finance (DeFi) space, with several tokens registered new weekly highs. Cardano founder admitted he was wrong about his bold prediction on the number of decentralized applications (DApps) in the Cardano ecosystem, and Coinbase Cloud released a new developer tool suite for the Avalanche blockchain. SushiSwap community introduced a new proposal for a legal structure to mitigate risks for token holders and members of the Sushi protocol. We had another week another DeFi exploit with Li Finance becoming the latest victim. On the price side, most DeFi tokens in the top 100 registered double-digit gains, and the total value locked (TVL) in the DeFi market blossomed to over $130 billion. Charles Hoskinson cheekily admits he was wrong abou...

Support for the Solana Ecosystem Introduced on Coinbase

Coinbase, the largest crypto trading platform in the United States, has rolled out support for the Solana ecosystem. A slew of new tokens and features are now becoming available to Coinbase users. “Over the past year, there has been an explosion of interest in web3 and decentralized applications including NFTs and decentralized finance (DeFi),” reads a Coinbase blog post. “One of the blockchain networks that has seen a major increase in use is Solana, which has since built a vibrant community of developers and users alike. The update makes it easier to keep track of cryptos from different networks without the need to manage multiple wallet apps.” Rising interest in Solana According to the crypto exchange, one of the main reasons for the rising interest in Solana over the past year is that ...