Coinbase

US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in one week

Bitcoin (BTC) has flooded out of exchanges in the past week as users become wary of security and regulatory scrutiny. Data from on-chain monitoring resource Coinglass shows United States exchanges in particular seeing heavy BTC balance reductions. U.S. exchanges lead BTC exodus In the wake of the FTX scandal, efforts to draw attention to the risk involved in custodial BTC storage stepped up on social media. Users appeared to heed the warning, withdrawing over $3 billion in cryptocurrency in the week immediately following the solvency debacle and ordering record numbers of hardware wallets. The aftermath of FTX is only just beginning, meanwhile, and as regulators plan investigative action and more attention to crypto as a whole, investors angst continues to grow. The data shows the trend is...

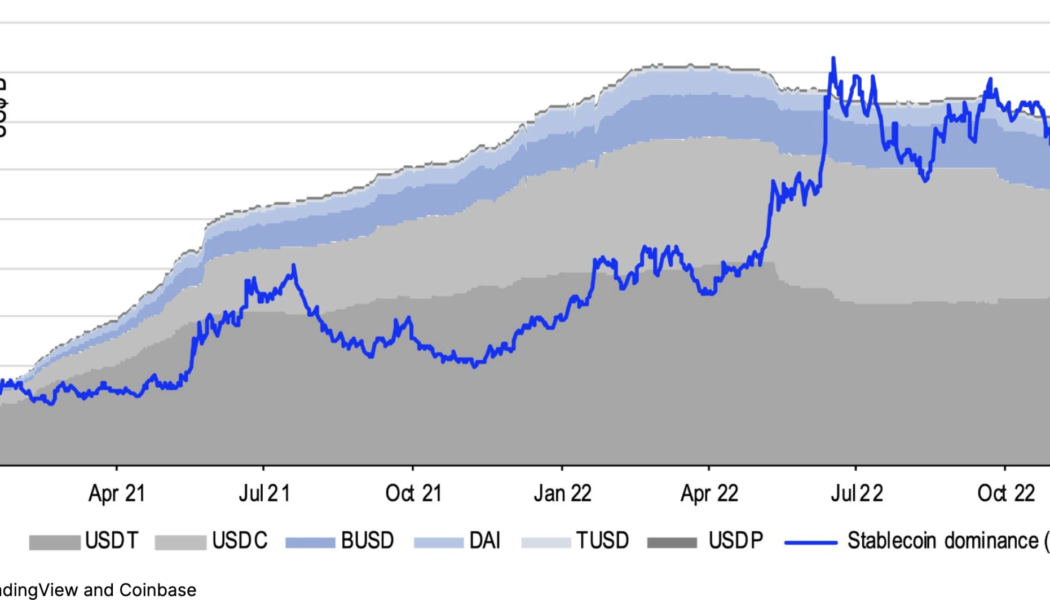

FTX crisis could extend crypto winter to the end of 2023: Report

The FTX crisis has deterred investor confidence and created a liquidity crisis in the crypto market, which could very well extend the crypto winter until the end of 2023, according to a new report. A research report from Coinbase analyzing the fallout in the crypto ecosystem in the wake of the FTX collapse noted that the implosion of the world’s third-largest crypto exchange has created a liquidity crisis that may contribute to an extended crypto winter. Many institutional investors in FTX had their investments stuck on the platform after it filed for bankruptcy on Nov. 11. The FTX implosion has also deterred investors and large buyers away from the crypto ecosystem. Coinbase highlighted that the stablecoin dominance has reached a new high of 18%, indicating that the liquidity crisis might...

Moonvember kicks off with sweeping staff layoffs across crypto

The crypto and tech industry has seen a slew of staff cuts this week against a backdrop of difficult market conditions, though on a positive note, some are bucking the trend. Crypto companies, including crypto exchanges, venture capital firms and blockchain developers, have been forced to reduce headcount in order to stay nimble amid the bear market. Some, however, have done the opposite, opening up offices in new locations and markets. It comes a few weeks after multiple high-level executives, such as OpenSea’s former chief financial officer, Kraken’s co-founder Jesse Powell and Ripple Labs’ engineering director, have all made headlines for either exiting or stepping down from their roles in the space. Stripe cuts around 1,000 staff Patrick Collison, CEO of payments processor Stripe...

MakerDAO community votes to approve custody of $1.6B USDC with Coinbase

Institutional prime broker platform for crypto assets Coinbase Prime announced on Oct 24th that it had entered into a partnership with MakerDAO — the largest single holder of USDC — to become a custodian of $1.6 billion worth of the stablecoin. The MakerDAO community voted to approve this custodianship which will allow its community to earn a 1.5% reward on its USDC while holding funds with a leading institutional custodian. The program described the following yield schedule for the USDC onboarded by @MakerDAO: • 1% APY on the first 100 million USDC. • 0.1% more APY on each 100 million USDC thereafter. • Rewards are not to exceed 1.5% APY. 3/ — Maker (@MakerDAO) October 24, 2022 According to Coinbase Prime, this move will not only accrue tangible benefits to the MakerDAO community but also...

Fidelity to beef up crypto unit by another 25% with 100 new hires

$4.5 trillion asset management firm Fidelity Investments is reportedly set to hire another 100 people to bolster the firm’s growing digital assets division — a stark contrast to the recent squeezing out of crypto-talent. A Fidelity representative told Bloomberg on Oct. 22 that the firm has begun a new round of hiring which will bring the Fidelity Digital Asset’s headcount to around 500 by the end of the first quarter of 2023. A search on Fidelity’s job board currently shows 74 live results for digital asset-related positions, which cover areas relating to blockchain technology, business analysis, customer service, finance and accounting, product development, and corporate services including compliance. Almost all of the current listings are based in the United States — wi...

Cardano Vasil upgrade ready with all ‘critical mass indicators’ achieved

The Cardano Vasil upgrade is set to take place in less than 24 hours on Sept. 22, with the Cardano team noting all three “critical mass indicators” needed to trigger the upgrade are now met. A Sept. 21 update on Twitter by the company behind Cardano, Input Output Hong Kong (IOHK) states within the last 48 hours 13 cryptocurrency exchanges had confirmed their readiness for the hard fork, representing over 87% of Cardano’s (ADA) liquidity. With this latest addition we have met all 3 critical mass indicators: 39 exchanges upgraded (87,59% by liquidity)Over 98% of mainnet blocks are now being created by the Vasil node (1.35.3)The top Cardano #DApps by TLV have confirmed they have tested and are ready — Input Output (@InputOutputHK) September 21, 2022 Of the top exchanges for ADA liquidity, Coi...

Coinbase Cloud debuts Web3 developer platform

Blockchain infrastructure platform Coinbase Cloud has officially rolled out its Web3 developer platform, allowing users to build new decentralized applications free of charge. The new developer platform, dubbed Node, allows users to create and monitor Web3 applications while accessing the Ethereum blockchain and indexers, the company disclosed Wednesday. While Node offers a tiered subscription model, the free plan includes access to advanced APIs that allow for the creation of decentralized applications and nonfungible token (NFT) applications. Coinbase Cloud claims that Node enables faster creation of Web3 applications while reducing both complexity and cost. This feeds into the platform’s broader service offerings, which include all-in-one access to payments, identity, trading and ...

Coinbase is fighting back as the SEC closes in on Tornado Cash

On Sept. 8, Coinbase announced it was bankrolling a lawsuit against the United States Treasury Department. The cryptocurrency exchange is funding a lawsuit brought by six people that challenges the sanctions on Tornado Cash. And on Sept. 9, Securities and Exchange Commission (SEC) Chair Gary Gensler announced he was working hard with Congress to create legislation to increase cryptocurrency regulations. But these two stories are not mutually exclusive. The sequence of events proves that governments are purely reactive rather than proactive when it comes to decentralized finance (DeFi). Tornado Cash was sanctioned by the Office of Foreign Assets Control (OFAC) back in August. OFAC claimed the smart contract mixer has helped to launder more than $7 billion worth of cryptocurrency since ...

Coinbase to educate users on policies held by local politicians with new app integration

On Sept. 14, Coinbase co-founder and CEO Brian Armstrong announced the company’s plans to begin integrating crypto policy efforts into its app. According to him, this will help the company’s 103 million verified users know where their local political leaders and representatives stand when it comes to cryptocurrency. 1/ Starting today, Coinbase will begin integrating our crypto policy efforts right into our app. These will help our 103M verified users get educated on the crypto positions held by political leaders where they live. pic.twitter.com/3GqWZIioZQ — Brian Armstrong (@brian_armstrong) September 14, 2022 Coinbase will rely on some of the data compiled by the Crypto Action Network — a 501(c)(4) organization dedicated to promoting the growth and security of cryptocurrency. Specif...

Brother of former Coinbase employee pleads guilty to charges related to insider trading: Report

Nikhil Wahi, who was arrested for allegedly working with his brother and an associate on a scheme to commit insider trading using crypto, has reportedly entered a guilty plea for wire fraud conspiracy charges. According to a Monday report from Reuters, Wahi admitted to authorities during a virtual hearing that he used confidential information obtained from Coinbase to make profits from trading crypto. Wahi’s brother Ishan worked as a product manager at Coinbase, during which time he allegedly shared information regarding the launch dates of tokens with his brother and an associate, Sameer Ramani. The trio allegedly used the insider information to make roughly $1.5 million in gains from trading 25 different cryptocurrencies between 2021 and 2022. “I knew that it was wrong to receive C...

Buterin and Armstrong reflect on proof-of-stake shift as Ethereum Merge nears

Ethereum co-founder Vitalik Buterin and Coinbase CEO Brian Armstrong believe that a gradual mind shift and important community contributions led to their backing of Ethereum’s upcoming move from a proof-of-work (PoW) to aproof-of-stake (PoS) consensus. The two industry titans joined Coinbase protocol specialist Viktor Bunin on the Around the Block podcast for an enlightening discussion centered on The Merge, which is set to take place in mid-September 2022. Buterin reflected on his history of considering proof-of-stake as a potential consensus mechanism for the Ethereum blockchain, which was initially met with skepticism due to a number of unsolved problems that made it seemingly unviable. According to the Ethereum co-founder, one of the project’s first blog posts in 2014 proposed an...

Coinbase says it will ‘evaluate any potential forks’ following the Merge

Cryptocurrency exchange Coinbase has updated its information related to Ethereum transitioning to proof-of-stake to include forks that could arise. In a Thursday update to an Aug. 16 blog post, Coinbase said it would evaluate any potential forks in the Ethereum blockchain on a “case by case basis.” The crypto exchange previously said it planned to ‘briefly pause’ Ether (ETH) and ERC-20 token deposits and withdrawals during the Merge, expected to occur between Sept. 10 and 20. “Should an ETH PoW fork arise following The Merge, this asset will be reviewed with the same rigor as any other asset that is listed on our exchange,” said Coinbase. Rest assured, all potential forked tokens of Ethereum, including PoW forks, will go through the same strict listing review process that is do...