CME

CME Group launches euro-denominated Bitcoin and Ether futures

Derivatives marketplace Chicago Mercantile Exchange Group has launched trading for Bitcoin euro and Ether euro futures contracts. In a Monday announcement, CME Group said that it launched contracts for euro-denominated Bitcoin (BTC) and Ether (ETH) futures sized at 5 BTC and 50 ETH per contract. Both contracts will be listed on CME, cash-settled and based on the CME CF Bitcoin-Euro Reference Rate and CME CF Ether-Euro Reference Rate, respectively. “Our new Bitcoin Euro and Ether Euro futures will provide institutional clients, both within and outside the U.S., with more precise and regulated tools to trade and hedge exposure to the two largest cryptocurrencies by market cap,” said CME Group global head of equity and FX products Tim McCourt. First announced on Aug. 4, the euro-denomin...

How Bitcoin’s strong correlation to stocks could trigger a drop to $8,000

The Bitcoin (BTC) price chart from the past couple of months reflects nothing more than a bearish outlook and it’s no secret that the cryptocurrency has consistently made lower lows since breaching $48,000 in late March. Bitcoin price in USD. Source: TradingView Curiously, the difference in support levels has been getting wider as the correction continues to drain investor confidence and risk appetite. For example, the latest $19,000 baseline is almost $10,000 away from the previous support. So if the same movement is bound to happen, the next logical price level would be $8,000. Traders are afraid of regulation and contagion On July 11, the Financial Stability Board (FSB), a global financial regulator including all G20 countries, announced that a framework of recommendations for the crypt...

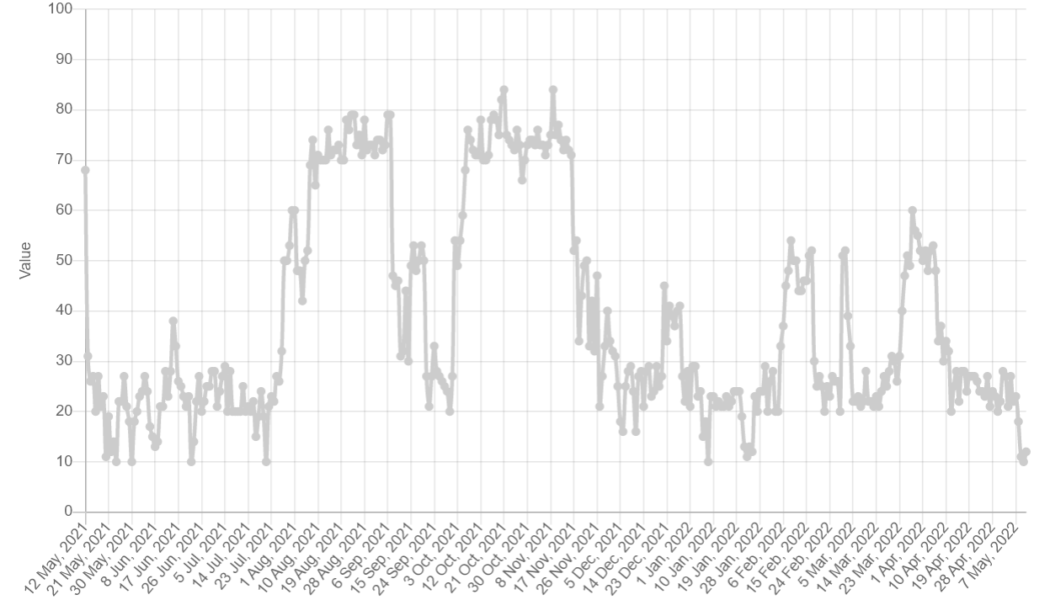

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

CFTC commissioner appoints crypto-experienced CME Group director as chief counsel

Kristin Johnson, one of five commissioners currently serving at the United States Commodity Futures Trading Commission, or CFTC, has announced that a CME Group executive director with experience in crypto will be joining her staff. In a Thursday announcement, Johnson said Bruce Fekrat will be her chief counsel at the CFTC starting on June 1. Fekrat worked as an executive director and associate general counsel at the CME Group for more than eight years, where he was lead regulatory counsel for issues including digital assets. During his time at the derivatives marketplace, he regulated cryptocurrency reference rates and helped in the development of financial products including Bitcoin (BTC) and Ether (ETH) derivatives. Nominated by U.S. President Joe Biden in September 2021, Johnson was swo...

Bitcoin price can’t find its footing, but BTC fundamentals inspire confidence in traders

Bitcoin’s (BTC) sudden crash on Jan. 10 caused the price to trade below $40,000 for the first time in 110 days and this was a wake-up call to leveraged traders. $1.9 billion worth of long (buy) futures contracts were liquidated that week, causing the morale among traders to plunge. The crypto “Fear & Greed” index, which ranges from 0 “extreme fear” to 100 “greed” reached 10 on Jan. 10, the lowest level it has been since the Mar. 2020 crash. The indicator measures traders’ sentiment using historical volatility, market momentum, volume, Bitcoin dominance and social media. As usual, the panic turned out to be a buying opportunity because the total crypto market capitalization rose by 13.5%, going from a $1.85 trillion bottom to $2.1 trillion in le...

Interest wanes in Bitcoin futures ETF’s as contracts fall below 5K

After a stellar launch, interest has waned in the ProShares Bitcoin Strategy Exchange Traded Fund (BITO) which now has the lowest amount of CME contracts since Nov. 2021. The Bitcoin futures exchange traded fund (ETF) holds a total of 4,904 Chicago Mercantile Exchange (CME) futures contracts, according to the fund’s latest update from Jan. 11. A Bitcoin futures ETF allows investors to speculate on the future price of Bitcoin (BTC) without having to hold the asset themselves. BITO’s assets under management (AUM) figure has retraced to $1.16 billion from a high of $1.4 billion last Nov. This is about the same amount it held two days after its Oct. 18 launch when it became the fastest fund to reach $1 billion in AUM ever. Arcane Research discussed possible reasons for the BITO retrace i...

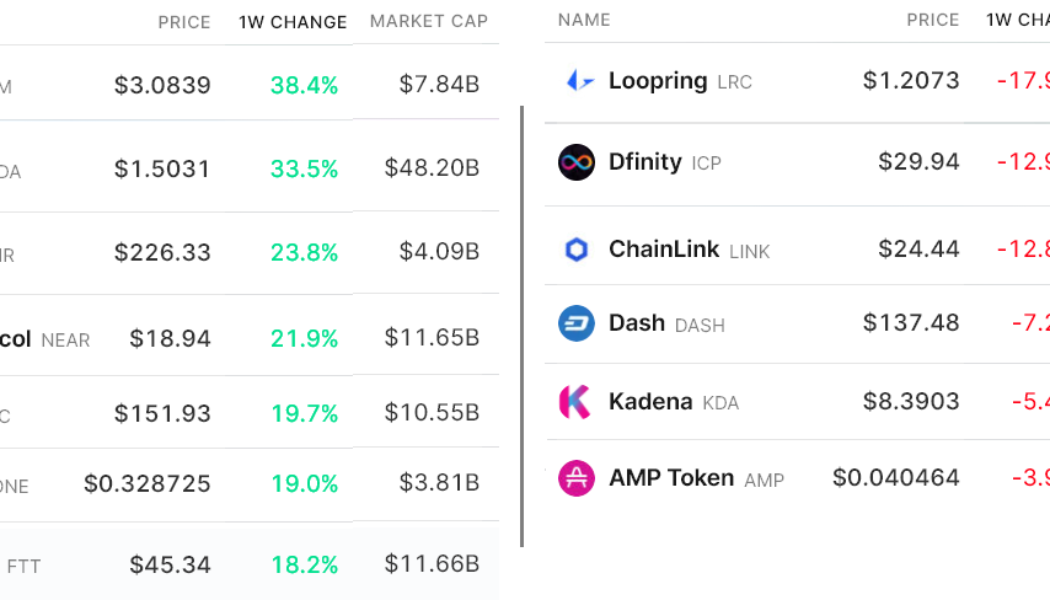

Crypto regulation is coming, but Bitcoin traders are still buying the dip

Looking at the Bitcoin chart from a weekly or daily perspective presents a bearish outlook and it’s clear that (BTC) price has been consistently making lower lows since hitting an all-time high at $69,000. Bitcoin/USD on FTX. Source: TradingView Curiously, the Nov. 10 price peak happened right as the United States announced that inflation has hit a 30-year high, but, the mood quickly reversed after fears related to China-based real estate developer Evergrande defaulting on its loans. This appears to have impacted the broader market structure. Traders are still afraid of stablecoin regulation This initial corrective phase was quickly followed by relentless pressure from regulators and policy makers on stablecoin issuers. First came VanEck’s spot Bitcoin ETF rejection by the U.S....