Circle

What is USD Coin (USDC), fiat-backed stablecoin explained

USDC offers instant payments, saves users from the cryptocurrency market’s price volatility and is audited by a regulated auditing firm, making it a transparent stablecoin. However, it does not offer price appreciation opportunities, and investors may incur high transaction and withdrawal fees while dealing with USDC. One of the key advantages of the USD Coin is the speed of the transaction. Usually, one must wait a long time to send and receive USD because institutions such as banks and their complex procedures slow down the processing of transactions. Nonetheless, USDC allows instant clearing and settlement of payments. In addition, stablecoins like USDC saves users from the price volatility of cryptocurrencies, as leading American financial institutions ensure that Circle&...

Coinbase takes a shot at Tether, encourages users to switch to USDC

United States-based cryptocurrency exchange Coinbase has asked its customers to convert their Tether-issued USDT (USDT) stablecoin to USD Coin (USDC), a USD-pegged stablecoin issued by Circle and co-founded by Coinbase in 2018. The cryptocurrency exchange suggested that USDC is a much more secure alternative in the wake of the FTX collapse saga and has also exempted any fee on the conversion of USDT to USDC on its platform. The firm said: “We believe that USD Coin (USDC) is a trusted and reputable stablecoin, so we’re making it more frictionless to switch: starting today, we’re waiving fees for global retail customers to convert USDT to USDC.” Stablecoins started out as an onboarding tool for the crypto exchanges in the early days of crypto, but today they have become a key mark...

USDC issuer Circle terminates SPAC merger with Concord

Circle, the issuer of USD Coin (USDC), announced the mutual termination of its proposed merger with the special purpose acquisition company (SPAC) Concord Acquisition on Dec. 5. The deal was announced in July 2021 with a preliminary valuation of $4.5 billion and was then amended in February 2022 when Circle’s valuation ballooned to $9 billion. USDC is currently the second-largest stablecoin in circulation, with a market capitalization of $43 billion. Under the terms of the agreements, Concord had until Dec. 10 to consummate the transaction or seek a shareholder vote for an extension. However, it appears that Concord chose to have the time limit lapse instead. As told by Circle CEO Jeremy Allaire: “Concord has been a strong partner and has added value throughout this process, and we w...

Blockchain interoperability goes beyond moving data from point A to B — Axelar CEO Sergey Gorbunov

Cross-chain communication between blockchains is more than just moving data from point A to B, but how it can connect applications and users for enhanced experiences and fewer gas fees in Web3, outlined Sergey Gorbunov, Axelar Network co-founder and CEO, speaking to Cointelegraph’s business editor Sam Bourgi on Sept. 28 at Converge22 in San Francisco. As the crypto industry has developed over the past few years, blockchain interoperability has seen a surge in demand, attracting venture capital and welcoming players, such as Axelar, which reached unicorn status in February. According to Gorbunov, the company, founded in 2020, started with a premise that cross-chain and multichain capabilities would come to define the crypto space. “The idea is not just to talk about how to...

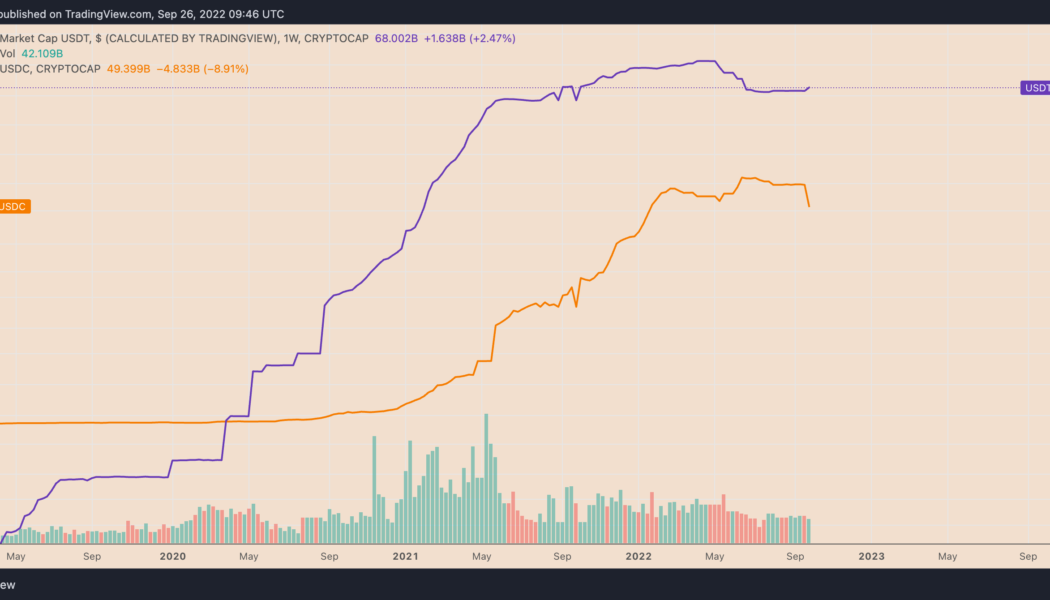

3 reasons why USDC stablecoin dropping below $50B market cap is Tether’s gain

The market capitalization of USD Coin (USDC), a stablecoin issued by U.S.-based payment tech firm Circle, has dropped below $50 billion for the first time since January 2022. On the weekly chart, USDC’s market cap, which reflects the number of U.S. dollar-backed tokens in circulation, fell to $49.39 billion on Sep. 26, down almost 12% from its record high of $55.88 billion, established merely three months ago. USDC versus USDT weekly market cap chart. Source: TradingView In contrast, the market cap of Tether (USDT), which risked losing its top stablecoin position to USDC in May, crossed above $68 billion on Sep. 26, albeit still down 17.4% from its record high of $82.33 billion in May 2022. The divergence between USDT and USDC shows investors’ renewed preference...

TORN price sinks 45% after U.S. Treasury sanctions Tornado Cash — Rebound ahead?

Tornado Cash (TORN) has lost almost half its market valuation two days after being slapped with sanctions by the U.S. Treasury Department. The department accused Tornado Cash, a crypto mixer platform, of laundering more than $7 billion in cryptocurrencies, including a stash of $455 million allegedly stolen by North Korea-based hackers. Immediate reactions were followed by U.S.-based crypto companies, including Circle and Coinbase. In a controversial move, the popular crypto firms blocked the movements of their jointly-issued stablecoin USDC tied to Tornado Cash’s blacklisted smart contracts. TORN price drops 45% The news prompted traders to limit their exposure to TORN, Tornado Cash’s native token. On the daily chart, TORN’s price has slipped by approximately 45...

Tether also confirms its throwing weight behind the post-Merge Ethereum

Hot on the heels of an official announcement from USD Coin (USDC) issuer Circle Pay, stablecoin giant Tether has now also officially confirmed its support behind Ethereum’s upcoming Merge upgrade and switch to a Proof-of-Stake (PoS) consensus mechanism-based blockchain. The announcement came on the same day as its stablecoin competitor, who pledged they will only support Ethereum’s highly anticipated upgrade. In an Aug. 9 statement, Tether labeled the Merge one of the “most significant moments in blockchain history” and outlined that it will work in accordance with Ethereum’s upgrade schedule, which is currently slated to go through on Sept. 19. “Tether believes that in order to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, it’s imp...

Circle freezes blacklisted Tornado Cash smart contract addresses

Crypto data aggregator Dune Analytics said that, on Monday, Circle, the issuer of the USD Coin (USDC) stablecoin, froze over 75,000 USDC worth of funds linked to the 44 Tornado Cash addresses sanctioned by the U.S. Office of Foreign Assets Control’s Specially Designated Nationals and Blocked Persons (SDN) list. Tornado Cash is a decentralized application, or DApp, used to obfuscate the trail of previous cryptocurrency transactions on the Ethereum blockchain. All U.S. persons and entities are prohibited from interacting with the virtual currency mixer’s USDC and Ethereum smart contract addresses on the SDN list. Penalties for willful noncompliance can range from fines of $50,000 to $10,000,000 and 10 to 30 years imprisonment. An estimated $437 million worth of assets, cons...

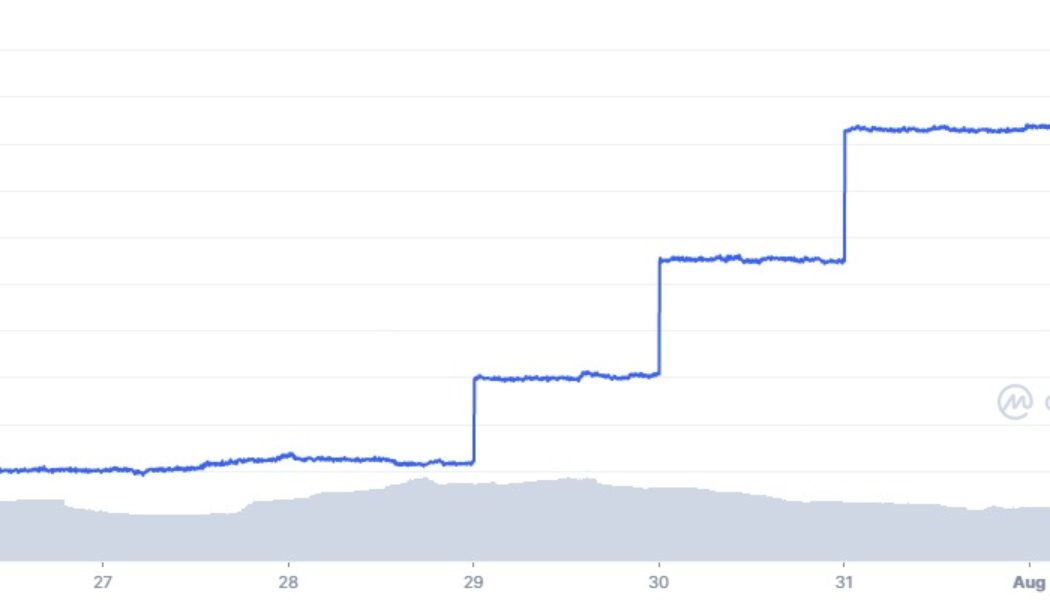

Tether supply starts to increase after three-month decline

The world’s largest stablecoin, Tether (USDT) has expanded its circulating supply following almost three months of reductions, in what could be a sign the crypto markets are slowly recovering. The first mint in almost three months occurred on July 29, and there have been three more, with the latest on August 2, according to CoinMarketCap. The USDT injections have been small, however, lifting Tether’s market cap by just 0.7% or just under $500 million. USDT market cap 7D – Coinmarketcap.com According to the Tether transparency report, there is now 66.3 billion USDT in circulation. This gives the stablecoin a total market share of around 43%. Tether supply reached an all-time high in early May when it topped 83 billion USDT. The collapse of the Terra ecosystem, resultant crypto c...

Circle CSO lays out policy principles for stablecoins in US

Dante Disparte, Circle’s chief strategy officer and head of global policy who has previously testified at congressional hearings, has called on United States lawmakers to balance the risks with developing a regulatory path for stablecoins. In a Monday blog post, Disparte named 18 principles Circle had established as part of its effort to shape stablecoin policy in the United States. Circle, the company behind USD Coin (USDC) with a reported $54 billion in circulation, highlighted privacy concerns, “a level playing field” between banks and non-banks over a U.S. dollar-pegged digital currency, how stablecoins can coexist alongside a central bank digital currency, and the need for regulatory clarity. “Harmonizing national regulatory and policy frameworks for dollar digital currencies advances...

Weekly Report: The latest on Panama’s crypto bill, Huobi to exit Thailand market, Circle launches a Euro-backed stablecoin, and more

Here are all the interesting headlines you missed outside the crypto market this week: Panama’s President vetoes crypto bill over money-laundering concerns Panama President Laurentino Cortizo on Thursday shot down a crypto bill introduced in September 2021 with a scope covering several cryptocurrencies, unlike El Salvador’s that major in Bitcoin. Cortizo partially vetoed the bill, citing non-compliance with the recent FAFT recommendation on fiscal transparency and prevention of money laundering. If the bill were to be approved, it would allow Panamanian natives to buy everyday goods and services using digital assets like Bitcoin, Ethereum, and Litecoin among other crypto coins. The bill would also make digital assets mainstream for settling taxes or any fee owed by the state. Additionally,...

Crypto Biz: An eye-opening chat with Mr. Wonderful, April 7–13, 2022

The past seven days have reminded me of how lucky I am to have forged a career in the Bitcoin (BTC) and cryptocurrency industry. Cointelegraph sent a contingency of reporters to the Bitcoin conference in Miami, where we got to chop it up with billionaires, business leaders and hedge fund managers. I had the privilege of sitting down with Canadian businessman and Shark Tank star Kevin O’Leary, who actually revealed most of his crypto portfolio. I also got to interview Bloomberg’s senior commodity strategist Mike McGlone, who shed light on crypto market volatility, as well as Mark Yusko of Morgan Creek Capital. Yusko and I laughed at traditional 60/40 portfolio strategies, and I got to ask him a curious question: Who in their right mind is buying bonds today? This week’s Crypto Biz giv...