China

In videos: 12 surreal man-made dive sites

From lost ancient cities to the world’s largest underwater theme park, these man-made dive sites are sure to intrigue At Atlas & Boots, we’ve dived some astonishing sites, from Steve’s Bommie in the Great Barrier Reef to the Sonesta plane wrecks in Aruba. We’re pretty hopeless at fish identification, so when it comes to diving, unless it’s a truly amazing reef system, we’re generally more interested in diving something new or unique (like an airplane or bommie). Enter the man-made dive site. We’ve scoured the Internet in search of videos of some of the most curious artificial dive sites out there – every one of which has now been added to our diving bucket list. Man-made dive sites From historic cities that have crashed into the ocean to artificial exhibitions installed ...

Bitcoin’s in a bear market, but there are plenty of good reasons to keep investing

Let’s rewind the tape to the end of 2021 when Bitcoin (BTC) was trading near $47,000, which at the time was 32% lower than the all-time high. During that time, the tech-heavy Nasdaq stock market index held 15,650 points, just 3% below its highest-ever mark. Comparing the Nasdaq’s 75% gain between 2021 and 2022 to Bitcoin’s 544% positive move, one could assume that an eventual correction caused by macroeconomic tensions or a major crisis, would lead to Bitcoin’s price being disproportionately impacted than stocks. Eventually, these “macroeconomic tensions and crises” did occur and Bitcoin price plunging another 57% to $20,250. This shouldn’t be a surprise given that the Nasdaq is down 24.4% as of Sept. 2. Investors also must factor in that the index’s historical 120-day vo...

Tech giant Meitu loses over $43M of its crypto investment in bear market

Hong Kong tech giant Meitu made headlines in April last year after it reported nearly $100 million in crypto holdings. However, with the advent of the bear market, the tech firm has lost nearly half of the valuation of its crypto holdings. According to a local media report, Meitu reported an impairment loss of over 300 million yuan, approximately $43.4 million, on their crypto holdings. An impairment loss is a loss in value of an asset when it falls below the carrying value of the investment. The financial filing revealed that the impairment loss has more than doubled from the last quarter, something the firm had anticipated earlier. The tech giant has said that its crypto holdings could impact the net loss of the company by the end of the first half of the year. In a July exchan...

Billboard China Announces Partnership With Tencent Music Entertainment Group

Billboard announced on Wednesday (Aug. 31) that the company has partnered with Tencent Music Entertainment Group to develop its new Billboard China brand. As the leading online music and audio entertainment platform in China, Tencent will work with Billboard to launch the “Chinese Music Gravity Project,” a pioneering initiative that will shine a spotlight on Chinese music artists through a series of engaging content collaborations and other features. By enlisting TME, Billboard will also share its global content — authoritative charts, expert recommendations, music news coverage and more — across the platform’s many channels, including QQ Music, Kugou Music, Kuwo Music and WeSing. As of late 2020, Tencent Music, which licenses Billboard China, controlled 77% of China’s streaming ...

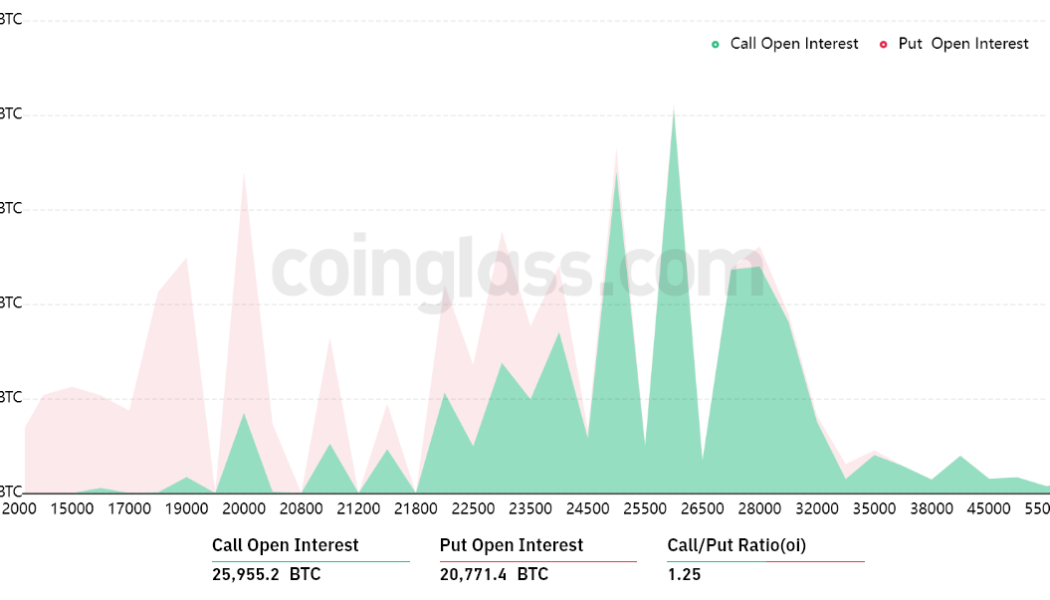

Data shows Bitcoin and altcoins at risk of a 20% drop to new yearly lows

After the rising wedge formation was broken on Aug. 17, the total crypto market capitalization quickly dropped to $1 trillion and the bulls’ dream of recouping the $1.2 trillion support, last seen on June 10, became even more distant. Total crypto market cap, USD billion. Source: TradingView The worsening conditions are not exclusive to crypto markets. The price of WTI oil ceded 3.6% on Aug. 22, down 28% from the $122 peak seen on June 8. The United StatesTreasuries 5-year yield, which bottomed on Aug. 1 at 2.61%, reverted the trend and is now trading at 3.16%. These are all signs that investors are feeling less confident about the central bank’s policies of requesting more money to hold those debt instruments. Recently, Goldman Sachs chief U.S. equity strategist David Ko...

Chinese mining giant Canaan doubles profits despite the blanket crypto ban

Major Chinese cryptocurrency miner manufacturer Canaan appears to have no issues with the local ban on crypto, as the company’s overall performance has continued to grow in 2022. Canaan officially announced its financial results for the second quarter of 2022 on Thursday, reporting a 117% increase in gross profit from the same period of 2021. According to the firm, the Q2 profits amounted to 930 million renminbi (RMB), or nearly $139 million. The company’s Q2 net income was 608 million RMB, or $91 million, or a 149% increase from 425 million RMB in the same period last year. Canaan noted that foreign currency translation adjustment in Q2 was an income compared to previous losses due to the U.S. dollar appreciation against RMB during Q2. Despite posting significant profits, Canaan has ...

Bank of China unveils new e-CNY smart contract test program for school education

According to local news outlet Sohu.com, on Tuesday, the state-owned Bank of China announced a new program to bridge primary school education with smart contracts. In a combined partnership with local education and financial authorities, parents residing in the city of Chengdu, located in China’s Sichuan province, will be able to enroll their children in after-school or extracurricular lessons using the digital yuan central bank digital currency, or e-CNY. Under the pilot test, parents start by paying a deposit to a private educational entity for a series of lessons. Afterward, a smart contract binds each lesson on a pro-rata basis to the deposit. This way, should their children miss a lesson, the e-CNY payment is automatically credited back to their account via smart contract. ...

Bank of China unveils new e-CNY smart contract test program for school education

According to local news outlet Sohu.com, on Tuesday, the state-owned Bank of China announced a new program to bridge primary school education with smart contracts. In a combined partnership with local education and financial authorities, parents residing in the city of Chengdu, located in China’s Sichuan province, will be able to enroll their children in after-school or extracurricular lessons using the digital yuan central bank digital currency, or e-CNY. Under the pilot test, parents start by paying a deposit to a private educational entity for a series of lessons. Afterward, a smart contract binds each lesson on a pro-rata basis to the deposit. This way, should their children miss a lesson, the e-CNY payment is automatically credited back to their account via smart contract. ...

Built to fall? As the CBDC sun rises, stablecoins may catch a shadow

There’s a ferment brewing with regard to central bank digital currencies (CBDCs), and most people really don’t know what to expect. Varied effects seem to be bubbling up in different parts of the world. Consider this: China’s e-CNY, or digital yuan, has already been used by 200 million-plus of its citizens, and a full rollout could happen as early as February — but will a digital yuan gain traction internationally? Europe’s central bank has been exploring a digital euro for several years, and the European Union could introduce a digital euro bill in 2023. But will it come with limitations, such as a ceiling on digital euros that can be held by a single party? A United States digital dollar could be the most awaited government digital currency given that the dollar is the world’s rese...

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break. Total crypto market cap, USD billion. Source: TradingView Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figur...