Changpeng Zhao

Binance users support 0-fee trading despite CZ’s wash trading concerns

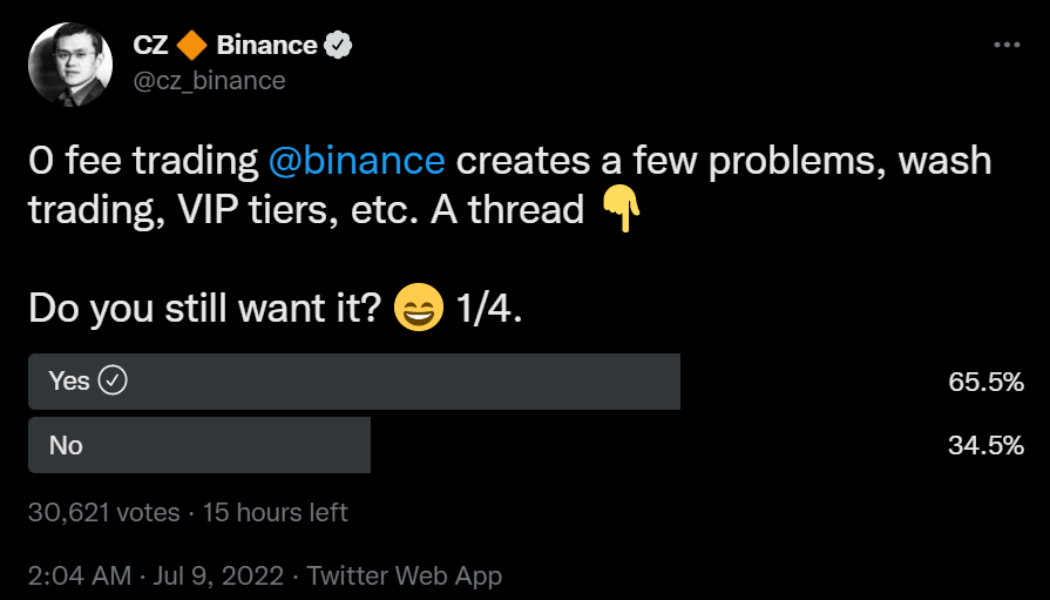

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

‘Bad’ crypto projects should not be bailed out says Binance founder CZ

Binance founder and CEO Changpeng “CZ” Zhao argues that “bad” crypto projects should be left to fail and not receive bailouts from crypto firms with healthy cash reserves. In a June 23 blog post, CZ said that firms that have been poorly operated, poorly managed or have released poorly designed products shouldn’t receive bailouts — and should instead be left to crumble: “In short, they are just ‘bad’ projects. These should not be saved. Sadly, some of these ‘bad’ projects have a large number of users, often acquired through inflated incentives, ‘creative marketing, or pure Ponzi schemes.” “Further, in any industry, there are always more failed projects than successful ones. Hopefully, the failures are small, and the successes are large. But you get the idea. Bailouts here don’t make s...

Binance CEO plans to leverage crypto winter

Binance CEO, Changpeng Zhao, commonly known as “CZ,” said in a recent interview that a potential crypto winter is good for business. When asked how Binance will fare during the current crypto winter following reports of recruitment freezes at Gemini and Coinbase, he answered confidently. “It’s not the first time we’ve gone through a crypto winter. If we are in a crypto winter, it would be my third and Binance’s second. So it’s not the first time we’ve been through this.” Some climbing ahead. Not the first time, won’t be the last. We will get there. — CZ Binance (@cz_binance) June 13, 2022 Changpeng Zhao has undertaken what is, for many exchanges, a hairy endeavor — recruiting new staff during a bear market to take advantage of the next possible bull market. “Right now is much b...

Do Kwon shares LUNA burn address but warns ‘LUNAtics’ against using it

The recent Terra revival plan announced by Do Kwon, the co-founder and CEO of Terraform Labs, received mixed reactions as many questioned the effectiveness of a hard fork in reviving the fallen prices of Terra (LUNA) and TerraUSD (UST) tokens. Instead, the part of the community recommended burning LUNA as the most plausible way to achieve a comeback. Kwon’s proposal to preserve the Terra ecosystem involves hard forking the existing Terra blockchain without the algorithmic stablecoin and redistributing a new version of the LUNA tokens to investors based on a historical snapshot before the death spiral. However, several crypto entrepreneurs, including Changpeng “CZ” Zhao, opined that: “Reducing supply should be done via burn, not fork at an old date, and abandon everyone who tried to rescue ...

Binance CEO CZ to support Terra community but expects more transparency

Changpeng “CZ” Zhao, the CEO of crypto exchange Binance, recently questioned the idea of hard forking the Terra blockchain as a means to revive the once-thriving LUNA and UST ecosystems. Following up on the same, CZ revealed his perspective on the appropriate course of action for falling projects across the crypto community. “This won’t work,” said CZ while dismissing the validators’ idea of a hard forking to TERRA2, which would involve providing a new version of LUNA to all holders based on a snapshot of the holdings before the market collapsed. CZ suggested: “Reducing supply should be done via burn, not fork at an old date, and abandon everyone who tried to rescue the coin. I don’t own any LUNA or UST either. Just commenting.” Instead, he suggested that the Terra community should f...

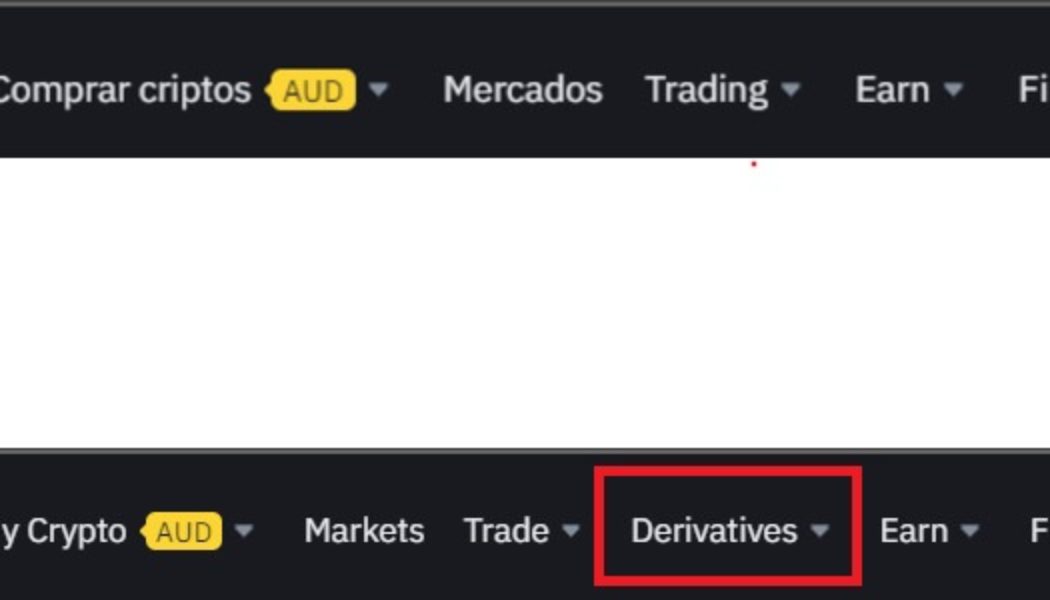

Binance reportedly halts crypto derivatives service in Spain

Binance stands as one of the most persistent crypto exchanges when it comes to gaining regulatory approval and operational licenses from regulators across the world. In this effort to operate as a fully licensed financial institution, the exchange has stopped offering it’s crypto derivatives services in Spain as it reportedly awaits approval from the Spanish regulator, Comisión Nacional del Mercado de Valores (CNMV). As evidenced by Binance’s official Spanish website, the crypto exchange removed the derivatives drop-down menu, which is still available on the global version. According to local news publication La Información, the move to hide derivatives offering in Spain comes as a way to comply with the requirements set by CNMV, a.k.a. the National Securities Market Commission....

Binance receives in-principle approval to operate in Abu Dhabi

Binance, the world’s biggest crypto exchange in terms of trading volume, received in-principle approval to operate in Abu Dhabi, marking its third regulatory approval in the Middle Eastern region after Bahrain and Dubai. The in-principle approval from the Abu Dhabi Global Market (ADGM) allows Binance to operate as a broker-dealer in digital assets including cryptocurrencies — marking yet another milestone for the crypto exchange, which envisions to operate as a fully-licensed firm. @binance, one of the world’s leading #blockchain and #cryptocurrency platforms, received an IPA from the #ADGM Financial Services Regulator Authority. pic.twitter.com/jhHenzaahE — Abu Dhabi Global Market (@ADGlobalMarket) April 10, 2022 ADGM serves as an international financial free zone within the c...

President Bukele hits out at Bitcoin Bond ‘FUD’ as CZ jets in to El Salvador

El Salvador President Nayib Bukele took to Twitter on Wednesday evening, hitting out at a Reuters report claiming Binance CEO Changpeng Zhao (CZ) was flying in to save El Salvador’s Bitcoin Bond. “Please don’t spread Reuter’s FUD,” Bukele tweeted to his 3.6 million followers, rebuking the claim that CZ was flying in to assist after the $1 billion bond offering, originally scheduled for mid-March, was postponed until September. He was responding to a tweet on the subject by Bitcoin Magazine, which has now deleted the post. I’m a fan of @BitcoinMagazine, please don’t spread @Reuters FUD. The #Bitcoin Volcano Bonds will be issued with @bitfinex. The short delay in the issuance is only because we are prioritizing internal pension reform and we have to send that to congress before. https://t.co...

Reuters: Binance was withholding information from regulators, repeatedly shunned own compliance department

In a report published on Friday, Reuters laid out the findings of its investigation into the regulatory compliance practices of Binance, the world’s largest cryptocurrency exchange by trading volume. The authors suggest the existence of a recurring pattern whereby the company’s CEO Changpeng Zhao, while proclaiming its openness to government oversight, ran an organization that systematically denied regulators’ requests for financial and corporate structure information and shirked proper client background checks. The reported findings are based on the accounts of Binance’s former senior employees and advisers, as well as the review of documents such as internal correspondence and confidential messages between several national regulators and the company. According to the document, several hi...

- 1

- 2