Changpeng Zhao

Opinion: Crypto exchanges keep failing, so why do we still trust Changpeng Zhao?

New data indicates Binance’s stablecoin, BUSD, has been undercollateralized at times by more than $1 billion. Yet, few have questioned CEO Changpeng Zhao. Opinion Own this piece of history Collect this article as an NFT Cryptocurrency has faced more than its fair share of catastrophes, nearly all of which seemed as though they might end or at least seriously impede the continued growth of the sector. Yet despite the many “teachable moments,” the social layer of crypto refuses to learn its lesson and continues to place its trust in the hands of individuals rather than fully utilize the technologies it claims to support. Since the early days of the industry, crypto has faced major blows at the hands of centralized actors — Mt. Gox, which handled 70% of global Bitcoin transactions, lost track...

Crypto Biz: Did Michael Saylor buy the Bitcoin bottom for once?

Business intelligence firm MicroStrategy is showing no signs of backing down on its Bitcoin gambit. Right around the time that Sam Bankman-Fried was being exposed as a fraud, MicroStrategy was scooping up more Bitcoin (BTC) — this time, the firm bought as close to the bottom as it’s ever gotten. While Bitcoin can always go lower, seeing a MicroStrategy buy around $17K is refreshing. Interestingly, MicroStrategy also sold some BTC earlier this month — but not for the reason you think (more on that below.) The final Crypto Biz newsletter of 2022 discusses MicroStrategy’s Bitcoin buy, Fidelity Investments’ foray into the metaverse, Changpeng Zhao’s response to haters and the collective woes of Bitcoin miners. MicroStrategy adds to Bitcoin stake despite steep loss Business intelligence firm Mi...

CZ addresses reasons behind Binance’s recent FUD

Binance CEO Changpeng “CZ” Zhao took to Twitter on Dec. 23 to share his perspective on the reasons behind the recent fear, uncertainty, and doubt (FUD) surrounding the crypto exchange. According to CZ in the thread, Binance’s FUD is primarily caused by external factors – not by the exchange itself. One of the reasons mentioned by the CEO was that part of the crypto community hates centralization. “Regardless if a CEX helps with crypto adoption at a faster rate, they just hate CEX,” he noted. CZ also pointed out that Binance has been seen as competition by many industry players, with increasingly lobbying against the exchange and “loaning sums of money to small media that’s worth many times the media outlet’s market value, including buying the...

Kazakhstan central bank recommends a phased CBDC rollout between 2023-25

Kazakhstan, the world’s third-largest Bitcoin (BTC) mining hub after the United States and China, found feasibility in launching its in-house central bank digital currency (CBDC), a digital tenge. The National Bank of Kazakhstan (NBK) revealed the finding following the completion of the second phase of testing. In late October, Binance CEO Changpeng’ CZ’ Zhao announced that Kazakhstan’s CBDC would be integrated with BNB Chain, a blockchain built by the crypto exchange. The country’s primary motivation for conducting studies on CBDC was to test its potential to improve financial inclusion, promote competition and innovation in the payments industry and increase the nation’s global competitiveness. The pilot research focused on offline payments and pr...

Abnormal token price movements on Binance not hack-related, confirms CZ

Crypto exchange Binance began investigating suspicious behavior on its platform after noticing abnormal price movements for certain trading pairs involving Sun Token (SUN), Ardor (ARDR), Osmosis (OSMO), FUNToken (FUN) and Golem (GLM) tokens. Nearly 40 minutes into the investigation, Binance CEO Changpeng ‘CZ’ Zhao revealed that the price movements “appears to be just market behavior.” On Dec. 11 at 3:10 am ET, Binance issued a notice about abnormal price movements for some trading pairs. The exchange began an investigation to narrow down suspicious accounts responsible for the issue. To investors’ relief, Binance’s investigation did not point to the possibility of compromised accounts or stolen API keys. Based on our investigations so far, this appears to be just market behavior. One guy d...

Binance suspends trader’s account after complaints on Twitter

Crypto exchange Binance closed a trader account on Dec. 9 after a user complained about the exchange’s response for alleged funds theft. Binance CEO Changpeng “CZ” Zhao said the firm does not want to service “unreasonable” clients. A user by the name of CoinMamba on Twitter started complaining about the lost funds on Dec. 8, claiming that a leaked API key tied to crypto trading firm 3Commas was used “to make trades on low cap coins to push up the price to make profit.” The trader claims in a series of tweets that Binance was unable to provide him with appropriate support: Have talked to Binance support and so far they are refusing to do anything to help me with the situation, saying that is my fault. Not sure how the API was leaked, and whose fault is this. — CoinMamba (@coinmamba) Decembe...

CZ and SBF duke it out on Twitter over failed FTX/Binance deal

Binance CEO Changpeng Zhao, or CZ, and former FTX CEO Sam Bankman-Fried, or SBF, have revealed new details about the failed agreement between the exchanges during FTX’s liquidity crisis in November. In a Dec. 9 Twitter thread, CZ referred to Bankman-Fried as a “fraudster,” saying Binance exited its position in FTX in July 2021 after becoming “increasingly uncomfortable with Alameda/SBF.” According to the Binance CEO, SBF was “unhinged” at the exchange pulling out — a claim that prompted an online response from the former FTX CEO. Bankman-Fried criticized CZ for his public admonition of FTX, adding details about the negotiations between the exchanges amid FTX’s reported “liquidity crunch” in November prior to the firm filing for bankruptcy. SBF said at the time that FTX had reached a ...

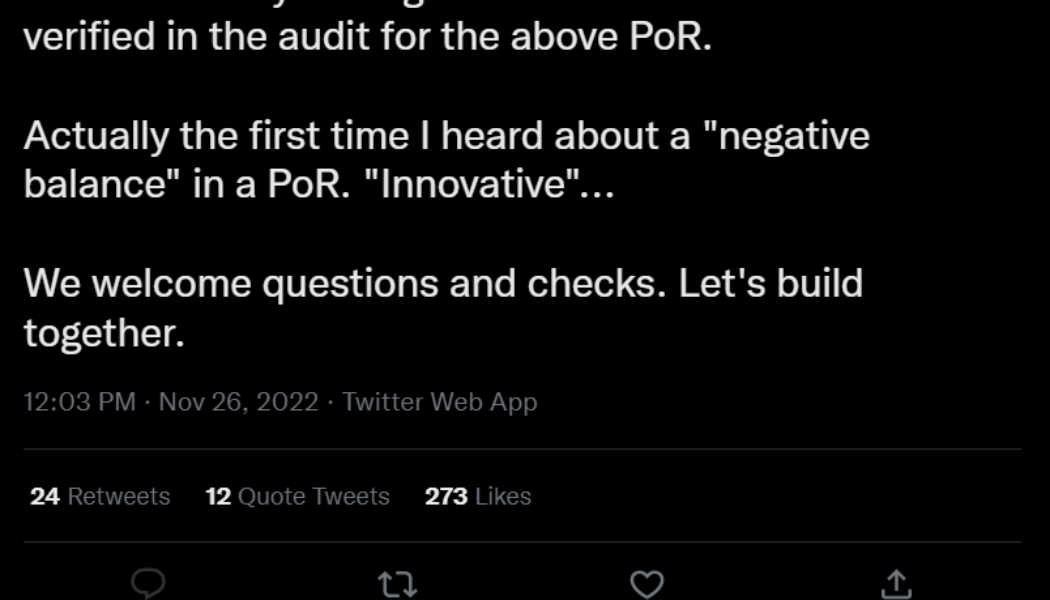

Binance proof-of-reserves is ‘pointless without liabilities’: Kraken CEO

Disclaimer: The article has been updated to reflect Binance CEO CZ’s response to the concerns raised by Kraken CEO Jesse Powell. The collapse of the crypto exchange FTX revealed the importance of proof-of-reserves in avoiding situations involving the misappropriation of users’ funds. While exchanges have proactively started sharing wallet addresses to prove the existence of users’ funds, several entrepreneurs, including Kraken CEO and co-founder Jesse Powell, called the practice “pointless” as exchanges fail to include liabilities. According to Powell, a complete proof-of-reserve audit must include the sum of client liabilities, user-verifiable cryptographic proof that each account was included in the sum and signatures proving the custodian’s control over the wallets. Whil...

The number of crypto billionaires is growing fast, here’s why

Satoshi Nakamoto has more than 1 million BTC, making him the largest Bitcoin holder. He is followed by the founders of Grayscale and Binance, who together have about the same amount of BTC as Satoshi Nakamoto. When looking at the largest Bitcoin holders, there are a few parties that stand out. Of course, Satoshi Nakamoto, with a total of 1,100,000 BTC, has more significant holdings than number two and three holders of Bitcoin, namely Grayscale and Binance. These companies have over 600,000 BTC and 400,000 BTC, respectively, numbers that most Bitcoin investors can only dream of. Behind these top three Bitcoin holders are the cryptocurrency exchanges Bitfinex and OKX, both of which hold over 200,000 BTC. Then, with MicroStrategy and Block.one, there are two more parties that own more than 10...

Binance vs. FTX: CZ calls out ‘bad players’ for crypto exchange jitters

The CEO of crypto exchange Binance, Changpeng ‘CZ’ Zhao, raised concern for traders after learning about the infamous phenomenon of trade jitters on other crypto exchanges. Jitters in crypto trading relate to a trade event wherein an investor’s buy or sell order gets stuck and moves down in the list, allowing newer trade orders to go through. Just learned a new word, jitters. On 1 particular exchange, sometimes your orders will be stuck for a bit, and a few other orders will get in front of you. Apparently, this happens often enough on this exchange that the traders coined a term for it, jitters. (Front running) — CZ Binance (@cz_binance) August 19, 2022 While CZ’s concerns against jitters did not explicitly target any particular exchange, the crypto community on Twitter assumed it w...

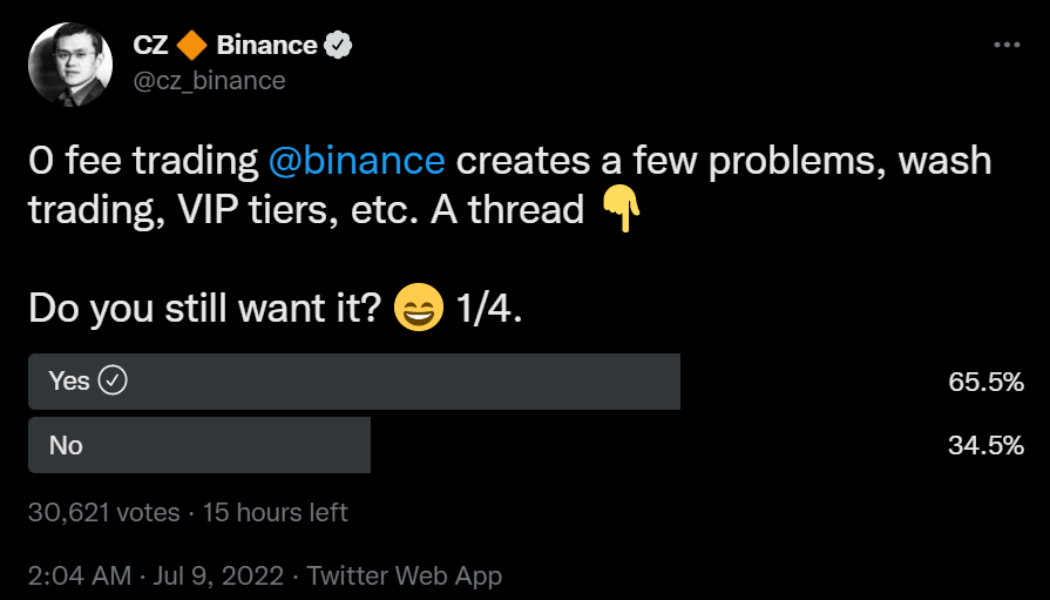

Binance users support 0-fee trading despite CZ’s wash trading concerns

Both traditional and crypto investors consider trading fees as one of the most significant liabilities when it comes to investing over exchanges. So no wonder when Changpeng “CZ” Zhao, the founder and CEO of Binance, asked investors about their interest in trading on the crypto exchange with no fees, the response was a resounding yes despite the inherent risks pointed out by the entrepreneur. Binance stands as the biggest crypto exchange, outdoing its nearest competition FTX by 10x in terms of the trading volume. Zhao, known for implementing features based on community feedback, reached out over Twitter to gauge investor sentiment regarding the complete removal of trading fees. 0 fee trading @binance creates a few problems, wash trading, VIP tiers, etc. A thread Do you still want it? 1/4. ...

- 1

- 2