Chainalysis

‘Less sophisticated’ malware is stealing millions: Chainalysis

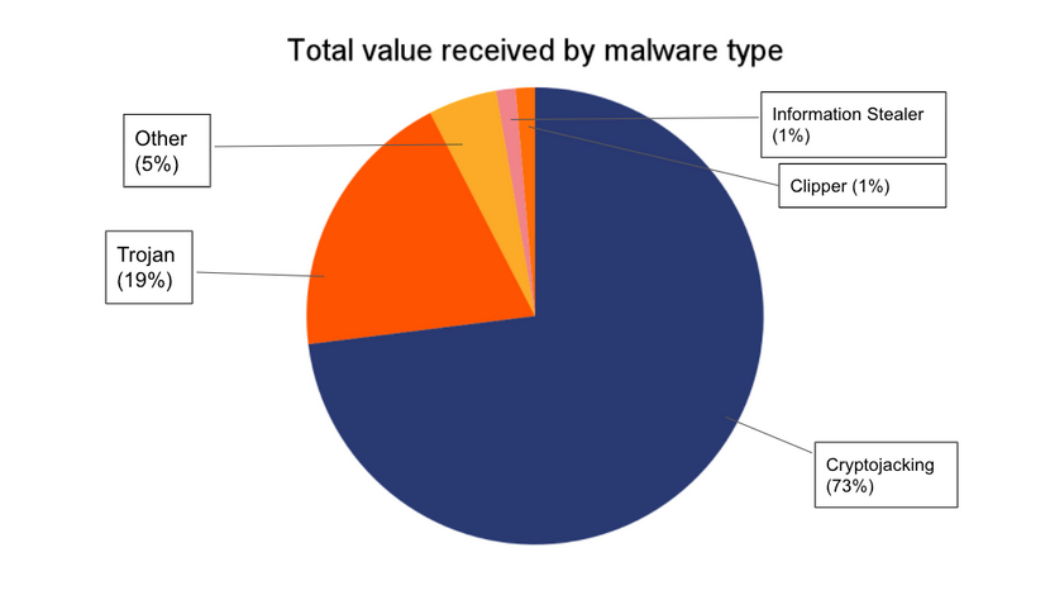

Cryptojacking accounted for 73% of the total value received by malware related addresses between 2017 and 2021, according to a new malware report from blockchain analysis firm Chainalysis. Malware is used to conduct nefarious activity on a victim’s device such as a smartphone or PC after being downloaded without the victim’s knowledge. Malware-powered crime can be anything from information-stealing to denial-of-service (DDoS) attacks or ad fraud on a grand scale. The report excluded ransomware, which involves an initial use of hacks and malware to leverage ransom payments from vicitms in order to halt the attacks. Chainalysis stated: “While most tend to focus on high-profile ransomware attacks against big corporations and government agencies, cybercriminals are using less sophisticated typ...

‘Less sophisticated’ malware is stealing millions: Chainalysis

Cryptojacking accounted for 73% of the total value received by malware related addresses between 2017 and 2021, according to a new malware report from blockchain analysis firm Chainalysis. Malware is used to conduct nefarious activity on a victim’s device such as a smartphone or PC after being downloaded without the victim’s knowledge. Malware-powered crime can be anything from information-stealing to denial-of-service (DDoS) attacks or ad fraud on a grand scale. The report excluded ransomware, which involves an initial use of hacks and malware to leverage ransom payments from vicitms in order to halt the attacks. Chainalysis stated: “While most tend to focus on high-profile ransomware attacks against big corporations and government agencies, cybercriminals are using less sophisticated typ...

Report finds crypto crime resulted in $14 billion worth of losses in 2021

Chainalysis findings show that there is currently more than $10 billion in illicit money (mostly stolen) held in crypto wallets A new report from the blockchain data platform Chainalysis has revealed that crime involving cryptocurrencies last year hit an all-time high of $14 billion. This figure is almost twice the sum ($7.8 billion) recorded in 2020. This upsurge in funds lost to fraudulent activity was, however, majorly attributed to the growth of the crypto markets. The markets saw transaction volumes rise by more than 550% to reach $15.8 trillion. The $14 billion sum lost represents just a mere figure of 0.15% of all the blockchain transactions seen in 2021. “We had an explosion in the amount of on-chain activity (in 2021). It’s just that the amount of crime didn’t gr...

- 1

- 2