Chainalysis

10,000 BTC moves off crypto wallet linked to Mt. Gox hack

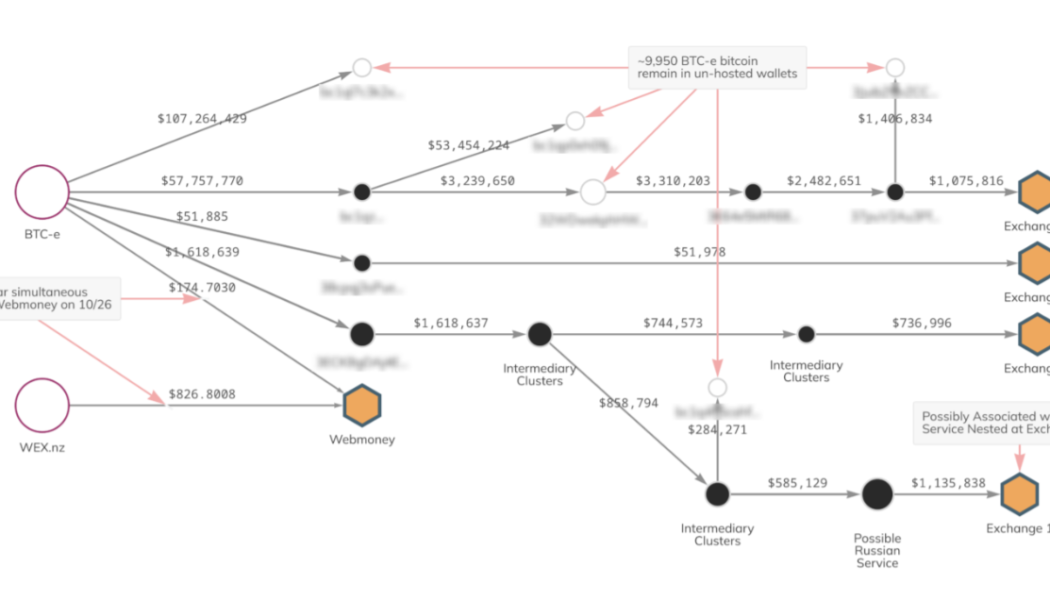

A crypto wallet belonging to the shutdown crypto exchange BTC-e has just moved 10,000 Bitcoin (BTC), currently worth over $165 million, to various exchanges, personal wallets, and other sources on Nov. 23. A Nov. 23 Chainalysis report suggested while this withdrawal is the largest made by BTC-e since April 2018, BTC-e and WEX — an exchange which is thought to be BTC-e’s successor — both sent small amounts of BTC to Russian electronic payments service Webmoney on Oct. 26 before making a test payment on Nov. 11, then transferring out a further 100 BTC on Nov. 21. The movement of BTC belonging to BTC-e and WEX wallets. Image: Chainalysis Of the total amount sent, 9,950 BTC is thought to still be located in personal wallets, while the rest was moved through intermediaries before ending up at f...

Remittances drive ‘uneven, but swift’ crypto adoption in Latin America

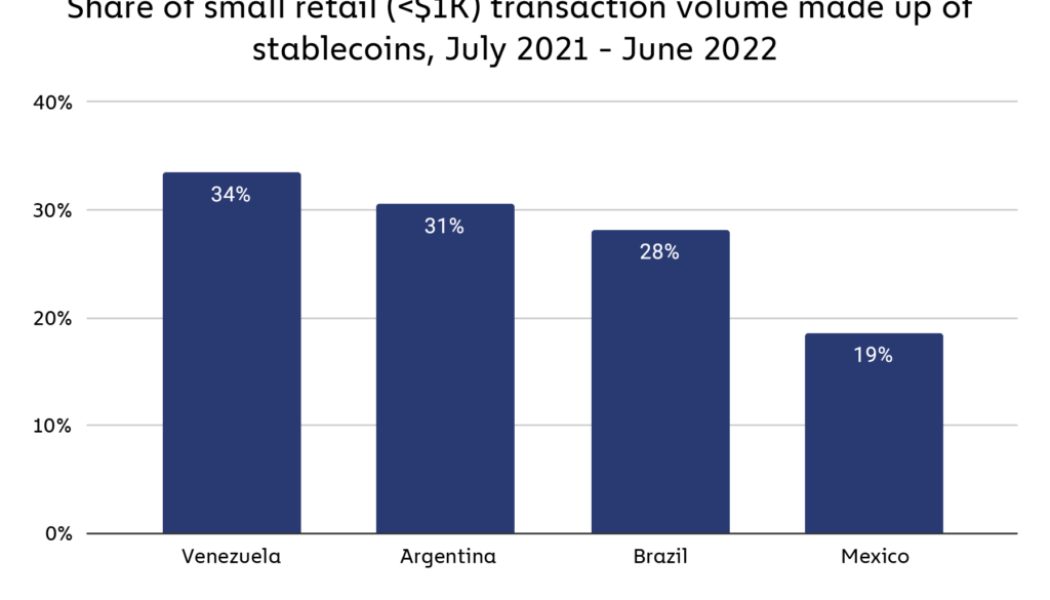

Remittance payments, fiat fears, and profit-chasing have been the three most significant drivers of crypto adoption in Latin America, according to a new report. The seventh-largest crypto market in the world saw the value of cryptocurrencies received by individuals rocket 40% between July 2021 to June 2022, reaching $562 billion, according to an Oct. 20 report from Chainalysis. Part of the surge was attributed to remittances, with the region’s overall remittance market estimated to have reached $150 billion in 2022. Chainalysis noted that crypto-based service adoption was “uneven, but swift.” The firm pointed to one Mexican exchange operating in the “world’s largest crypto remittance corridor” which processed over $1 billion in remittances between Mexico and the Unite...

Taliban had a ‘massive chilling effect’ on Afghan crypto market: Report

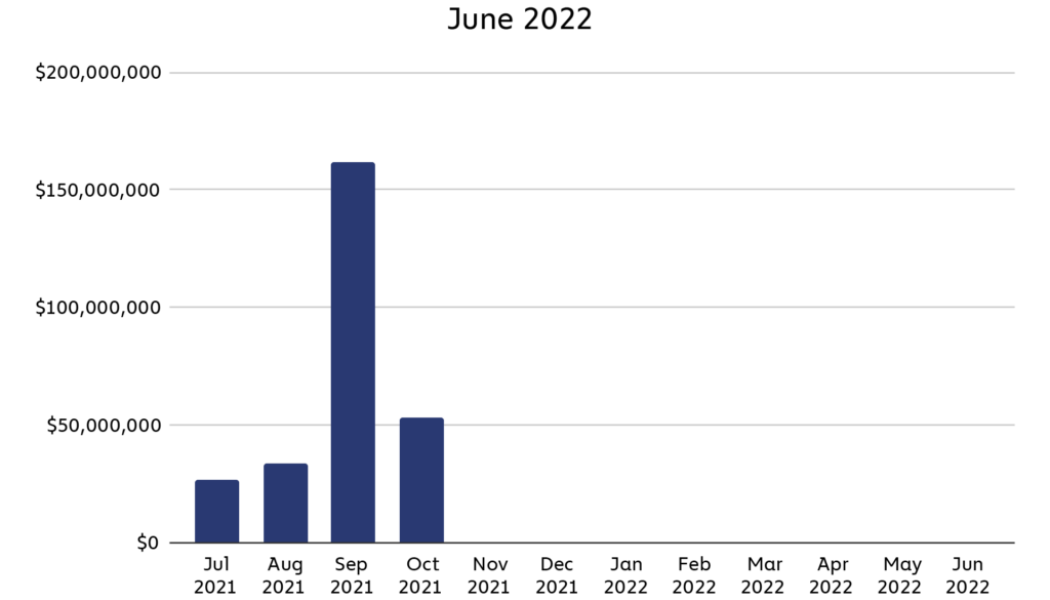

The Taliban’s takeover of Afghanistan has had a “massive chilling effect” on the local cryptocurrency market, bringing it to an effective “standstill,” according to a recent report. Blockchain analytics firm Chainalysis in an Oct. 5 report stated the Middle East and North Africa (MENA) region saw the largest crypto market growth in 2022 but noted that Afghani crypto dealers had three options: “flee the country, cease operations, or risk arrest.” The report states after the Taliban seized power in August 2021, crypto value received in August and September that year spiked to a peak of over $150 million, then fell sharply the following month. Before the takeover, Afghani citizens would on average receive $68 million per month in crypto value mainly used for remittances. That ...

NFTs ‘biggest on-ramp’ to crypto in Central, Southern Asia and Oceania — report

Nonfungible tokens (NFTs) may be the biggest driver of crypto adoption in Central, Southern Asia, and Oceania (CSAO), a new report has found. According to a Sept. 21 Chainalysis post titled “Crypto Adoption Steadies in South Asia, Soars in the Southeast,” NFT-related actions accounted for 58% of all web traffic going to cryptocurrency services from this region in the second quarter of 2022. Meanwhile another 21% of traffic in the quarter went to websites of play-to-earn (P2E) blockchain games, with major titles including Axie Infinity, STEPN and Battle Infinity. Chainalysis noted that P2E blockchain games are “intimately related” to NFTs, as most P2E games feature in-game items in the form of NFTs that can be sold on marketplaces like MagicEden and OpenSea, thus meaning: ...

Ether price could ‘decouple’ from other crypto post Merge — Chainalysis

Crypto analytics firm Chainalysis has suggested that the price of Ether (ETH) could decouple from other crypto assets post-Merge, with staking yields potentially driving strong institutional adoption. In a Sept. 7 report, Chainalysis explained that the upcoming Ethereum upgrade would introduce institutional investors to staking yields similar to certain instruments such as bonds and commodities, while also becoming much more eco-friendly. The report said ETH staking is expected to offer a 10-15% yield annually for stakers, therefore making ETH an “enticing bond alternative for institutional investors” considering that treasury bonds yields offer much less in comparison. “Ether’s price could decouple from other cryptocurrencies following The Merge, as its staking rewards will make...

Chainalysis tips Australia will crack down on misleading crypto ads

Chainalysis’ head of international policy Caroline Malcolm expects Australia’s new rules governing crypto advertising, promotion and consumer safeguards to follow a similar path to the United Kingdom when they come into place within the next year. “I think we’re more likely to see something along the lines of the UK model which is really focusing on a crackdown on misleading advertising or advertising which doesn’t present the risks alongside the opportunities.” During the Chainalysis Links event in Sydney on June 21, Malcolm told Cointelegraph that this meant treating crypto products and services in a similar way to financial products and services when it comes to advertising and promotion. In March, U.K.’s Advertising Standards Authority (ASA) released new guidanc...

Evidence doesn’t back claims of Russia using crypto to evade sanctions, says Chainalysis CEO

Chainalysis chief Jonathan Levin has said there’s no evidence of ‘systemic’ use of crypto to skirt sanctions The CEO also explained how Chainalysis’ recently-released sanctions compliance tools enable businesses to screen for interaction with sanctioned addresses Amid the ongoing invasion of Ukraine by the Kremlin, the question of whether cryptocurrencies could be used to evade economic sanctions has been up for debate. Blockchain tracking and analytics firm Chainalysis CEO and co-founder Jonathan Levin has given his opinion on the matter in a recent interview with Bloomberg Technology. Levin spoke to Emily Chang and Sonali Basak about the new free sanctions screening tools recently announced by Chainalysis. He explained that the tools are meant to help organisations and businesses ensure ...

Weekly Report: Stripe introduces crypto and NFTs support, Goldman Sachs to offer OTC bilateral crypto options

Here are the top headlines from the cryptocurrency space that you might have missed this week: Multinational bank Goldman Sachs wants to offer new OTC crypto options Goldman Sachs is now among several Wall Street banks looking to offer crypto options. The financial services and investment bank revealed this week it has intentions to soon start availing over-the-counter bilateral crypto options for enterprise clients. A recent report by Bloomberg, citing a person familiar with the matter, detailed that the American banking giant is looking to sink its claws deeper into cryptocurrencies. The news outlet said that the individual, who preferred to remain anonymous, observed that Goldman Sachs isn’t the only Wall Street bank exploring bilateral options. The said options enable crypt...

BNY Mellon announces Chainalysis partnership to track customer crypto transactions

Bank of New York Mellon has partnered with Chainalysis to enhance its crypto risk management Chainalysis software provides a plethora of services, including flagging high-risk transactions Having added support for Bitcoin back in February last year, America’s oldest bank is now making further moves to enhance its custodial suite of services for crypto. BNY Mellon announced yesterday that it has partnered with blockchain software company Chainalysis to track its customer’s crypto transactions. BNY Mellon, the largest custodian bank globally with $46.7 trillion in assets, sought the services of Chainalysis to track and analyse crypto products easily. The bank believes this will help it manage the legal risks that come with dealing in them. Tracking customers’ crypto A...

4% of crypto whales are criminals and they have $25B between them: Chainalysis

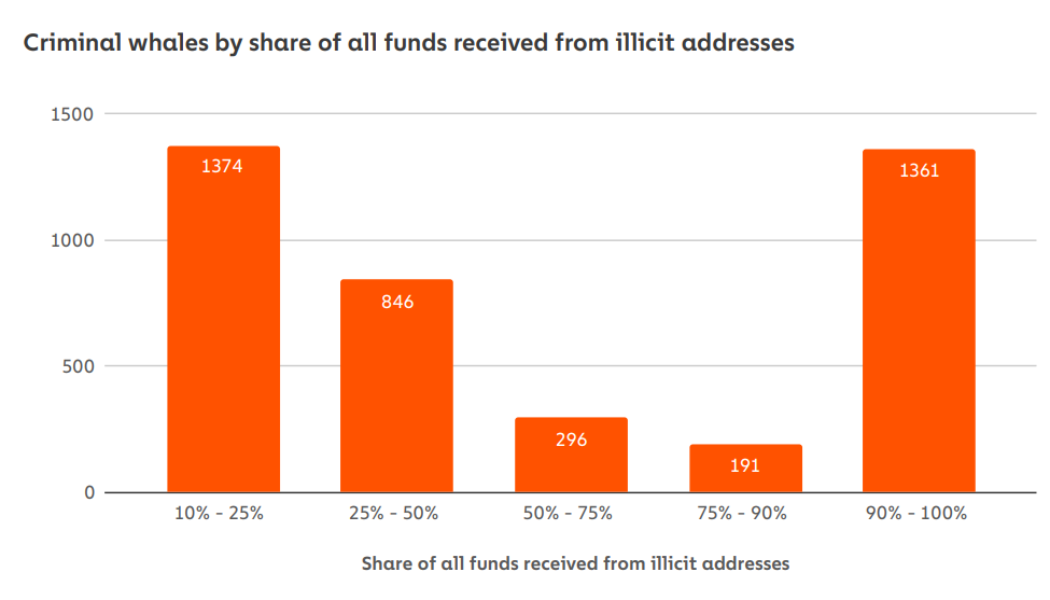

Chainalysis data shows that 4068 criminal whales (roughly 4% of all whales) are hodling more than $25 billion worth of cryptocurrency between them. The blockchain analytics firm defines criminal whales as any private wallet that holds more than $1 million worth of crypto with over 10% of the funds received from illicit addresses tied to activity such as scams, fraud and malware. The data is from the “Criminal Balances” section of the Crypto Crime Report that explores criminal activity on the blockchain over 2021 and early 2022. The wide-ranging report also covers topics such as Ransomware, Malware, Darknet markets and NFT related crime. “Overall, Chainalysis has identified 4,068 criminal whales holding over $25 billion worth of cryptocurrency. Criminal whales represent 3.7% of all cryptocu...

Cybercriminals made away with $602M in crypto ransom in 2021, Chainalysis reports

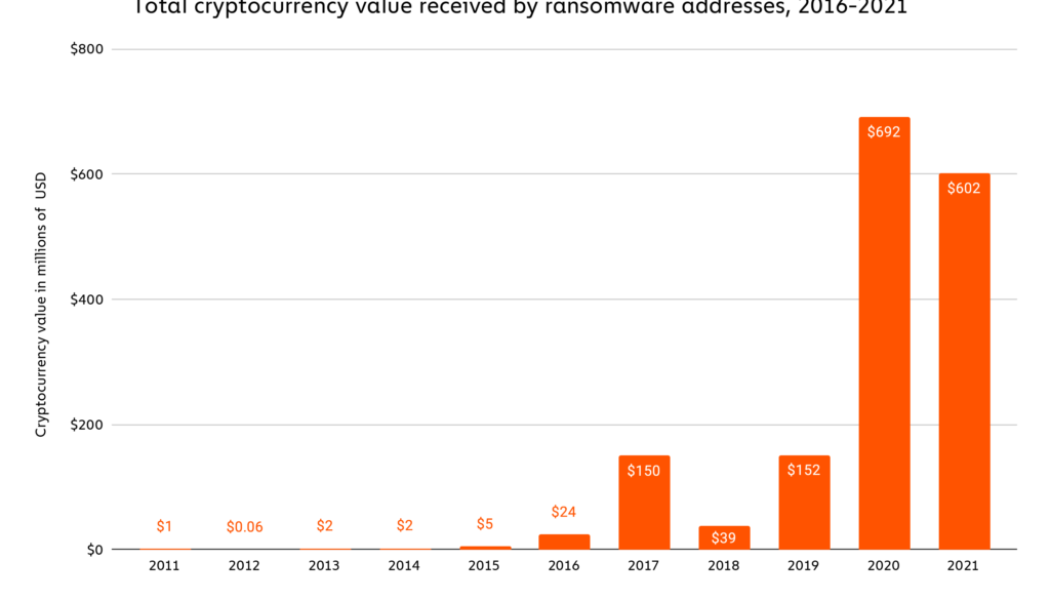

The blockchain forensics firm has said that with continued identification of more events, 2021 numbers could eclipse the figures recorded in 2020 The report also found that Russian-based Conti led in ransomware attacks last year Chainalysis’ recently released report on crime in cryptocurrencies in 2021 has indicated that 2021 ransomware payments reached $602 million, a figure less than 2020’s. On average, the amount paid per ransomware event was $118,000, compared to $88,000 in 2020 and $25,000 the year before. However, Chainalysis noted that the figure for 2020 (which has now been estimated to be $692 million) sat at $350 million at the time of publication of the previous report. However, other hacks events have since been identified hence the adjusted figure. Therefore, the r...

Ransomware crypto payments hit at least $602M last year: Chainalysis

A new report estimates that ransomware payments tallied at least $602 million in 2021 — but the actual total could be much higher. Blockchain analysis firm Chainalysis released new data on Feb. 10 about ransomware activity related to cryptocurrency in 2021. However it stated that the total value is likely to end up surpassing the $692 million taken in 2020. “In fact, despite these numbers, anecdotal evidence, plus the fact that ransomware revenue in the first half of 2021 exceeded that of the first half of 2020, suggests to us that 2021 will eventually be revealed to have been an even bigger year for ransomware.” Chainalysis believes 2021 will end of surpassing 2020. The average ransomware payment size reached a record high of $118,000 in 2021. This is a 26% increase from the average...

- 1

- 2