Central Bank

US Virginia Senate allows state banks to offer crypto custody services

The Senate of Virginia in the United States unanimously approved a bill amendment request that now allows traditional banks operating in the Commonwealth of Virginia to provide virtual currency custody services. Delegate Christopher T. Head introduced the bill (House Bill No. 263) back in January 2022, seeking an amendment to allow eligible banks to offer crypto custody services: “A bank may provide its customers with virtual currency custody services so long as the bank has 26 adequate protocols in place to effectively manage risks and comply with applicable laws.” The bill passed Senate with a sweeping 39-0 vote and is waiting to be signed into law by Governor of Virginia Glenn Youngkin. Banks that intend to offer this service to clients will need to adhere to three specific requir...

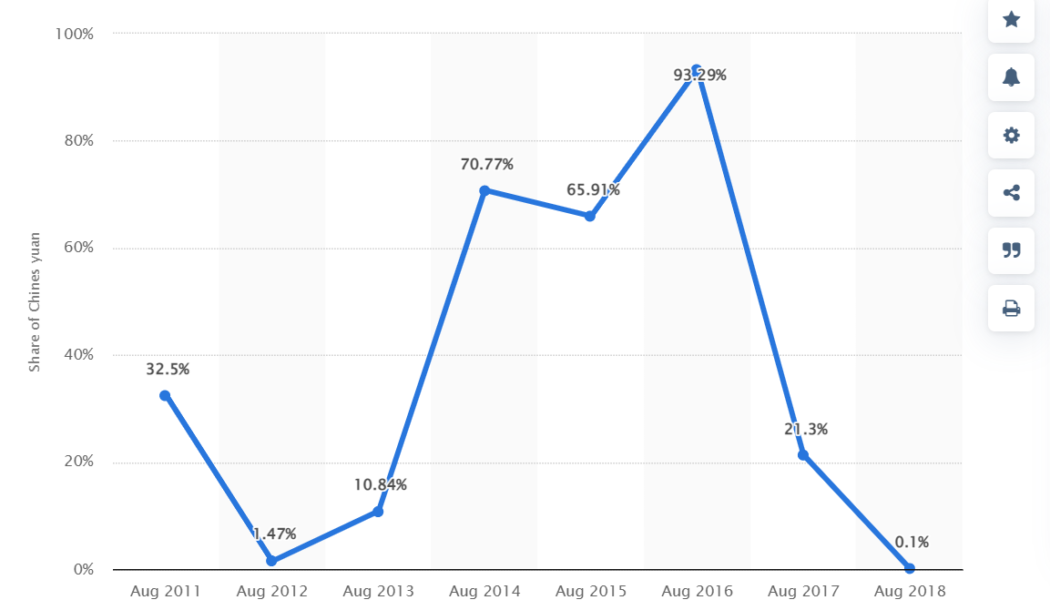

China’s share in Bitcoin transactions declined 80% post crackdown: PBoC

People’s Bank of China, the central bank of the country, claimed in a recent note that China’s share in the global Bitcoin (BTC) transactions has rapidly dropped from over 90% to 10%. The Financial Stability Bureau of the Chinese central bank released a comprehensive note on Wednesday discussing the impact of the crypto crackdown on the financial markets. The official notice claimed that all peer-to-peer exchanges in the country had been eradicated, which eventually curbed the hype around digital currency transactions. A Google translated version of the note read: “The global proportion of Bitcoin transactions in China dropped rapidly from more than 90% to 10%. Severely cracked down on illegal financial activities such as disorderly handling of finance and crackdown on illegal fund-r...

Russia’s Finance Ministry introduces digital currency bill, brushes off Central Bank’s objections

Russia’s Ministry of Finance has upped the stakes in its drawn-out showdown against the country’s Central Bank by formally introducing a bill that proposes to regulate digital assets rather than banning them. On Feb. 21, the Ministry introduced a draft of the federal law “On digital currency” to the government. This stage of the legislative process precedes the bill’s introduction to the parliament for consideration. The agency cited the “formation of a legal marketplace for digital currencies, along with determining rules for their circulation and range of participants” as the rationale for the initiative. Emphasizing that the bill does not seek to endow digital currencies with legal tender status, its authors define cryptocurrencies as an investment vehicle. The bill proposes a licensing...

Clarity pushed back: Russian government fails to forge a consolidated stance on crypto regulation

On Feb. 18, the Russian Ministry of Finance kicked off public consultations on the rules of cryptocurrency issuance and transactions. While a welcome development, it is less than the country’s crypto space had expected to get. Earlier in the week, the government announced that by Feb. 18, a bill containing the finance ministry and central bank’s consolidated position on crypto regulation would be drafted. Updated estimates suggest that it will take at least another month for draft legislation to see the light. The main reason for the delay appears to be the central bank’s renewed resistance, which just several days ago seemed to have been overcome. Here is a roundup of the latest twists in this rocky ride. Round 1: Central bank’s ban proposal On Jan. 20, the Central Bank of Russia (CBR) is...

Here’s how much digital yuan used at Olympics, according to PBoC

The 2022 Winter Olympics participants, visitors and organizers could be spending more than $300,000 in China’s digital yuan every day, according to new reports citing officials from the People’s Bank of China. The e-CNY, China’s central bank digital currency (CBDC), is being used to make 2 million yuan ($316,000) or more worth of payments each day, PBoC’s Digital Currency Research Institute director-general Mu Changchun said. The official provided the data during a webinar hosted by the Atlantic Council, Reuters reported Tuesday. “I have a rough idea that there are several, or a couple of million digital yuan of payments every day, but I don’t have exact numbers yet,” Mu said, adding that there was no breakdown yet of the number of transactions made by Chinese nationals and foreign a...

Hungary’s central bank chief wants EU-wide crypto trading and mining ban

György Matolcsy, Governor of the Hungarian National Bank, has proposed a blanket ban on all cryptocurrency trading and mining operations across the European Union. Governor Matolcsy cited the recent crypto ban imposed by China in a blog post shared by the Hungarian central bank a.k.a. Magyar Nemzeti Bank (MNB) titled “Time has come to ban crypto trading and mining in the EU.” He also pointed out the Russian central bank’s proposal that calls for a blanket ban on domestic cryptocurrency trading and mining. Reciprocating the proposals for a crypto ban, Matolcsy said: “I perfectly agree with the proposal and also support the senior EU financial regulator’s point that the EU should ban the mining method used to produce most new bitcoin.” The governor strongly believes in cryptocurrency’s...

Singapore saw 13x jump in crypto investments in 2021: KPMG

Singapore has seen a tenfold increase in crypto-related investments last year worth $1.48 billion, up from $110 million in 2020, according to KPMG’s Pulse of Fintech report. As per the study, the city-state has long been recognized as a center of cryptocurrency activity, with over $1.48 billion in investment completed last year alone. KPMG suggests that the increase is in part due to government efforts to stimulate the capital market, such as establishing a special-purpose acquisition company (SPAC) listing framework to position the country as a choice location where fast-growing firms and unicorns can go public. This year, regulators are ramping up their efforts to regulate speculative digital assets. Even as authorities impose even more regulation, KPMG forecasts that Singapor...

Law Decoded: Russia flounders, America competes, IMF keeps fuming, Jan. 24–31

One of the most fascinating implications of the collision between traditional political institutions and the crypto space is how it can reveal the glaring lack of cohesion within power systems that otherwise look monolithic. Digital assets reside in a parallel policy dimension where neither a centralized consensus nor a clear rulebook exists, leading to a surprising variety of voices and opinions emerging in the absence of a politically coordinated course. Last week, a rare lively policy debate broke out in Russia in the aftermath of its central bank’s attempt to promote a hardline stance on crypto. One does not often see such a public interagency disagreement on substantive issues. Below is the concise version of the latest “Law Decoded” newsletter. For the full breakdown of policy develo...

Central bank overkill: Russia’s proposed crypto ban and why everyone’s against it

On Jan. 20, the Central Bank of Russia (CBR) issued a report summarizing its position on digital assets and proposing a ban on any crypto trading and mining operations in the country. Although the CBR’s strict position on the matter was never a secret, such a bold statement triggered waves of fear, uncertainty, and doubt — otherwise known as FUD — across the board, given Russians’ high rates of involvement in the global digital assets market. Yet, there are reasons to doubt the ultimate effectiveness of the CBR’s hardline bidding, both in terms of its enforceability and its acceptance by other power centers, including legislators and siloviki (securocrats). The picture gets even more complicated for the central bank, as a high-ranking official within another major center of economic ...

Vibe killers: Here are the countries that moved to outlaw crypto in the past year

Last week, Pakistan’s Sindh High Court held a hearing on the legal status of digital currencies that might lead an outright ban of cryptocurrency trading combined with penalties against crypto exchanges. Several days later, the Central Bank of Russia called for a ban on both crypto trading and mining operations. Both countries could join the growing ranks of nations that moved to outlaw digital assets, which already include China, Turkey, Iran and several other jurisdictions. According to a report by the Library of Congress (LOC), there are currently nine jurisdictions that have applied an absolute ban on crypto and 42 with an implicit ban. The authors of the report highlight a worrisome trend: the number of countries banning crypto has more than doubled since 2018. Here are the ...

Decentralized and traditional finance tried to destroy each other but failed

The year 2022 is here, and banks and the traditional banking system remain alive despite decades of threatening predictions made by crypto enthusiasts. The only endgame that happened— a new Ethereum 2.0 roadmap that Vitalik Buterin posted at the end of last year. Even though with this roadmap the crypto industry would change for the better, 2021 showed us that crypto didn’t destroy or damage the central banks just like traditional banking didn’t kill crypto. Why? To be fair, the fight between the two was equivalently brutal on both sides. Many crypto enthusiasts were screaming about the coming apocalypse of the world’s financial systems and described a bright crypto future ahead where every item could be bought with Bitcoin (BTC). On the other hand, bankers rushed t...

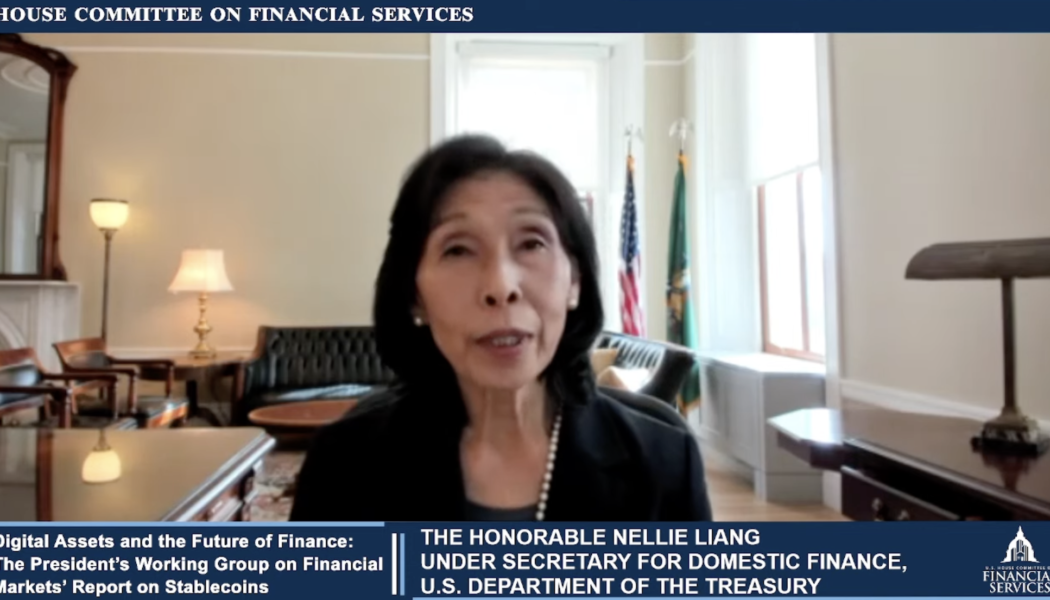

Law Decoded: First-mover advantage in a CBDC conversation, Jan. 10–17

Last week saw an unlikely first move in the opening narrative battle around a prospective U.S. central bank digital currency: Congressperson Tom Emmer came forward with an initiative to legally restrict the Federal Reserve’s capacity to issue a retail CBDC and take on the role of a retail bank. This could be massively consequential as we are yet to see a similarly sharp-cut expression of an opposing stance. As a matter of fact, it is not even clear whether other U.S. lawmakers have strong opinions on the matter other than, perhaps, condemning privately issued stablecoins as a digital alternative to the dollar. By framing a potential Fed CBDC as a privacy threat first, Emmer could tilt the conversation in the direction that is friendly to less centralized designs of digital money. Below is ...