Central Bank

‘Something sure feels like it’s about to break’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week in an uncertain place facing uncertain times — is $40,000 now resistance? The largest cryptocurrency has just closed a fourth red weekly candle in a row, something that has not happened since June 2020. As cold feet over the macro market outlook continues to be the norm, there seems little to comfort bulls as the week gets underway — and Bitcoin is not done selling off yet. On the back of $4,000 in losses over the past four days alone, price targets now focus on retests of liquidity levels further towards $30,000. It is not all doom and gloom — long-term hodlers and key participants such as miners are showing a more positive stance when it comes to Bitcoin as an investment. With that in mind, Cointelegraph takes a look at the forces at work when it comes to ...

ECB executive board member talks about current state of digital euro CBDC research

European Central Bank executive board member Fabio Panetta provided an overview of the central bank’s current research on a retail central bank digital currency Friday when he spoke at the IESE Business School Banking Initiative Conference on Technology and Finance. Panetta said the issuance of central bank digital currencies, or CBDCs, is “likely to become a necessity,” but warned that “they should not become a source of financial disruption that could impair the transmission of monetary policy in the euro area.” A key to maintaining financial stability during the introduction of digital currency, Panetta said, would be to give commercial banks a role in the process. This would allow the banks to continue providing front-end services as the central bank benefitted from their experience in...

Sweden’s central bank completes second phase of e-krona testing

The Swedish central bank’s digital currency project, a proposed CBDC, known as the e-krona has successfully finished its second phase of trials. According to Riksbank, the nation’s central bank, the asset is now technically ready to be integrated into banking networks and facilitate transactions. During the second phase of the e-krona pilot project — which began in February 2021 — the CBDC was investigated on the matter of its technical ability to function within the country’s existing digital banking infrastructure. Participating banks included Handelsbanken and Tietoevry. The report indicated that the e-krona could indeed be successfully exchanged for fiat money and used in transactions, both online and offline. This phase of testing also brought legal clarity to the project ...

BTC starts 2022 all over again — 5 things to know in Bitcoin this week

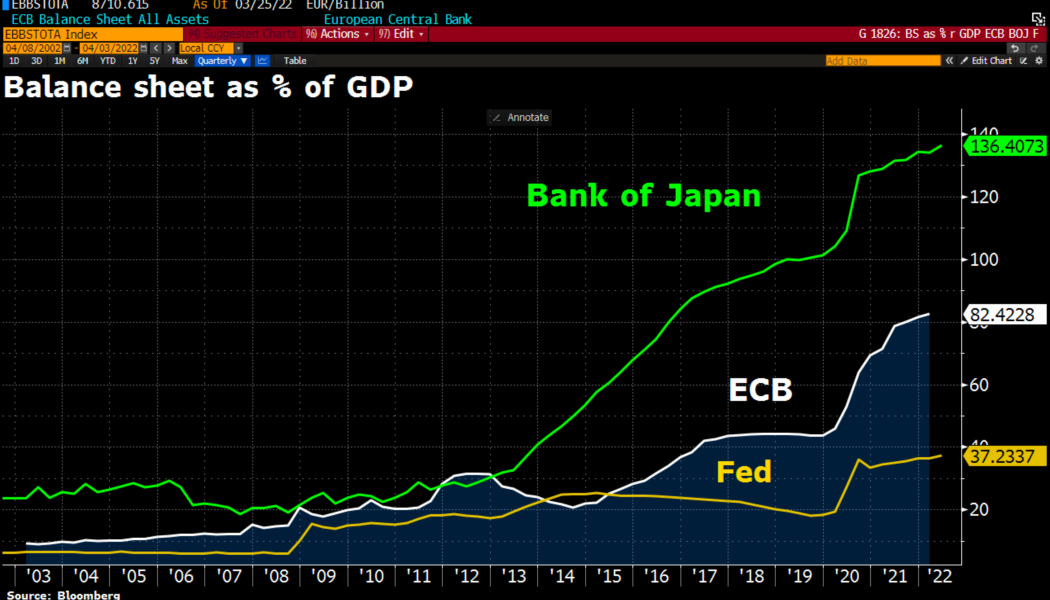

Bitcoin (BTC) starts a new week and a new quarter as if it were starting the new year — at just over $46,000. In what will seem like some serious deja-vu for hodlers, BTC/USD is at practically the same level it was on Jan. 1, 2022. Price action has been quiet — too quiet, perhaps — in recent days, but behind the declining volatility, there are signs that the market is busy deciding future direction. From macro to on-chain, there are in fact plenty of cues to keep an eye on in April, amid a backdrop of Bitcoin — at least so far — retaining its yearly open price as support. Cointelegraph takes a look at five of these factors as they pertain to BTC price performance over the coming week. Inflation meets fresh money printing There has been much talk of the end of the post-COVID “easy money” pe...

Why the rise of a Bitcoin standard could deter war-making

Alex Gladstein, the CSO at the Human Rights Foundation, says that if Bitcoin was adopted as a global reserve currency, nation-states would be less incentivized to start wars. According to Gladstein, the U.S. was able to sustain its “forever wars” in Iraq and Afghanistan mainly by borrowing capital. That was possible largely because of the Federal Reserve’s monetary policy, which has been keeping interest rates relatively low through quantitative easing. “We literally print money, we sell bonds to the open market for a promise to pay in the future and we use the income from the bond sales to pay for these wars.”, explained Gladstein in a latest interview with Cointelegraph. Unlike fiat currency, Bitcoin’s total supply is immutable. That ...

From taxes to electricity, blockchain adoption is growing in Austria

Austria has been actively transforming into an attractive location for providers of blockchain-based products, with the government itself experimenting with the technology and trying to create a legal basis upon which companies can use it. With regard to blockchain-based applications in the economy, however, Austria is still in the experimental phase, with most firms still running pilot projects. Still, politicians and economists alike see potential for select industries. Public administration reform via blockchain The Austrian government is quite open to blockchain innovations, cryptocurrencies aside, and has supported various projects in the public and private sectors. In 2019, a consortium of public administration institutions founded the Austrian Public Service Blockchain (APSB)....

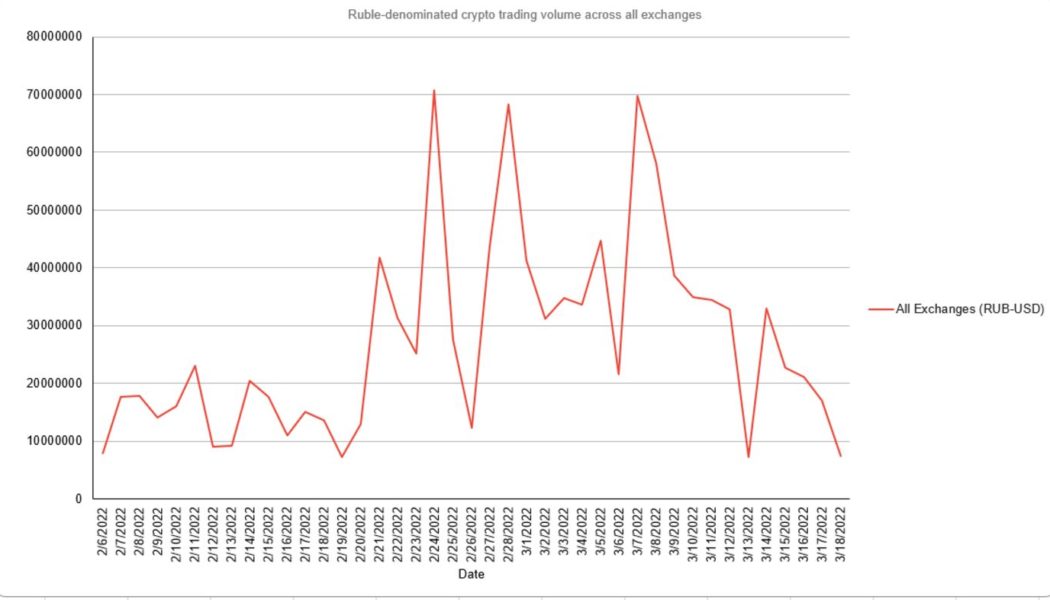

Crypto trading in rubles falls even as ECB warns again on sanctions

The President of the European Central Bank, Christine Lagarde has reiterated warnings that Russian individuals and businesses are using cryptocurrencies to skirt sanctions. However, as of March 18, daily ruble-denominated crypto trading volume was sitting at just $7.4 million, down over 50% from recent figures and a peak of $70 million on March 7, according to data from Chainalysis. This amount represents a tiny slither of the total global crypto market volume, with Bitcoin’s total daily volume generally fluctuating between $20 billion and $40 billion. In a presentation at the Bank for International Settlements Innovation Summit on Tuesday, the crypto skeptic Lagarde said that European financial authorities had seen the “volumes of rubles into stable, into cryptos, at the moment [is at] th...

Bitcoin is ‘not regulated’ — Honduras’ central bank pushes back against legal tender rumors

The Central Bank of Honduras, or BCH, addressed rumors regarding the country potentially adopting Bitcoin as legal tender like its neighbor El Salvador — and the answer seems to be negative. In a Wednesday statement, Honduras’ central bank said “for the time being” Bitcoin (BTC) was not regulated in the country and not recognized as legal tender in many others. The BCH reiterated its authority under Honduras’ constitution that it was the only authorized “issuer of banknotes and coins” considered to be legal tender in the country. “BCH does not supervise or guarantee operations carried out with cryptocurrencies as means of payment,” said the central bank, according to a translated statement. “Any transaction carried out with these types of virtual assets is the responsibility an...

Ireland’s central bank follows UK’s example in warning of crypto advertisements

The Central Bank of Ireland issued a warning to consumers about the risks around crypto investments in addition to “misleading” advertisements, including those pushed by influencers on social media. In a Tuesday notice, Ireland’s central bank said the warning was part of a campaign organized by the European Supervisory Authorities, made up of the European Securities and Markets Authority, the European Banking Authority, and the European Insurance and Occupational Pensions Authority. The Central Bank of Ireland said that cryptocurrencies were “highly risky and speculative” for retail investors and warned people to be mindful of “the risks of misleading advertisements, particularly on social media, where influencers are being paid to advertise crypto assets.” “In Ireland and across the EU we...

Central Bank of Russia tightens P2P transactions monitoring, including those in crypto

The Central Bank of Russia (CBR) recommended that the nation’s commercial banks ramp up monitoring users’ transactions that could be aimed at circumventing CBR’s “special economic measures to counter the outflow of foreign currency abroad,” local media reported on Thursday. The recommendation includes closer oversight over crypto trading, which is named among the vehicles for withdrawing capital from Russia. The letter, sent to the banking organizations by CBR’s vice chairman Yuri Isaev on Wednesday, directs them to pay closer attention to the instances of their clients’ “unusual behavior.” This includes “abnormal” transactional activity and uncommon patterns of expenditures. Any withdrawals of money via digital currencies should also attract increased attention, the letter spec...

RBI seemingly wants to ban cryptocurrencies, but not for the reasons you might think

On Thursday, the Reserve Bank of India, or RBI, the country’s central bank, published a critical bulletin regarding the cryptocurrency industry. While the report praised the innovative distributed ledger technology associated with digital currencies, the RBI dismissed arguments calling for the regulation of such assets and called for an outright ban. RBI’s core concerns were related to cryptocurrencies threatening the country’s financial sovereignty. The RBI wrote: “Historically, private currencies have resulted in instability and therefore, have evolved into fiat currencies over centuries. The retrograde step back to private currencies cannot be taken simply because technology allows it without considering the dislocation it causes to society’s leg...

Bank of Israel issues draft guidelines on cryptocurrency AML/CFT

On Friday, the Bank of Israel published a draft regulation on Anti-Money-Laundering and Combatting the Financing of Terrorism (AML/CFT) risk management for the banks facilitating crypto-to-fiat transactions. The move hints at the Israeli government’s preparations to legalize and regulate the relationship between banks and virtual currency service providers (VASPs). The document cites the customers’ increased involvement with digital assets as the rationale for the new policy: “In view of the increase in customer activity in virtual currencies, and the resulting increase in customer requests to transfer money […] the Banking Supervision Department today published a draft circular dealing with managing AML/CFT risks derived from the provision to customers of payment services relat...