Central Bank

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Russia plans to roll out digital ruble across all banks in 2024

The Bank of Russia continues working towards the upcoming adoption of the central bank digital currency (CBDC), planning an official digital ruble rollout in a few years. According to the Bank of Russia’s latest monetary policy update, the authority will begin to connect all banks and credit institutions to the digital ruble platform in 2024. That would be an important year for Russia as the country is expected to hold presidential elections in March 2024 and incumbent President Vladimir Putin has the constitutional right to get re-elected. By that time, the central bank expects to complete “real money” customer-to-customer transaction trials as well as the testing of customer-to-business and business-to-customer settlements. In 2023, the Bank of Russia also intend to conduct beta testing ...

CBDC may threaten stablecoins, not Bitcoin: ARK36 exec

Central bank digital currencies (CBDCs) do not pose any direct threat to cryptocurrencies like Bitcoin (BTC) but are still associated with risks in relation to stablecoins, one industry executive believes. According to Mikkel Morch, executive director at the digital asset hedge fund ARK36, a state-backed digital currency like the U.S. dollar doesn’t necessarily have to be a competitor to a private or a decentralized cryptocurrency. That’s because the use cases and value proposition of the decentralized digital assets “often go beyond the realm of simple transactions,” Morch said in a statement to Cointelegraph on Thursday. The exec referred to Federal Reserve Chair Jerome Powell who earlier this year hinted that the United States government would not stop a “well regulated, privately issue...

BIS to launch market intelligence platform amid stablecoin, DeFi collapse

The Bank for International Settlements (BIS) Innovation Hub announced the launch of a new set of projects targeting various aspects of traditional and crypto payments — including a cryptocurrency market intelligence platform and security for retail central bank digital currency (CBDC). BIS’s cryptocurrency market intelligence platform will be launched under the Eurosystem Centre initiative, which aims to provide vetted data about crypto projects. One of the key drivers for the project’s commencement is the collapse of numerous stablecoins projects and decentralized finance (DeFi) lending platforms such as Terra (LUNA) and Decentralized USD (USDD). As explained in the official announcement: “The project’s goal is to create an open-source market intelligence platform to shed light on m...

The crypto industry must do more to promote encryption, says Meltem Demirors

“I like to call myself a future, or aspiring, cult leader,” Meltem Demirors, chief strategy officer of CoinShares — a publicly listed investment firm managing around $5 billion in assets — told Cointelegraph. Demirors, who first entered the Bitcoin (BTC) space in late 2012, further mentioned that it has been “fun to see how big the crypto sector has become,” noting that people from all walks of life are now interested in the cryptocurrency space. As such, Demirors explained that “crypto cults” are bringing people together in a positive manner, especially since it gives people a sense of purpose and belonging. When it comes to regulations — one of the most important topics facing the crypto industry today — Demirors expressed skepticism. “Having been in this industry professiona...

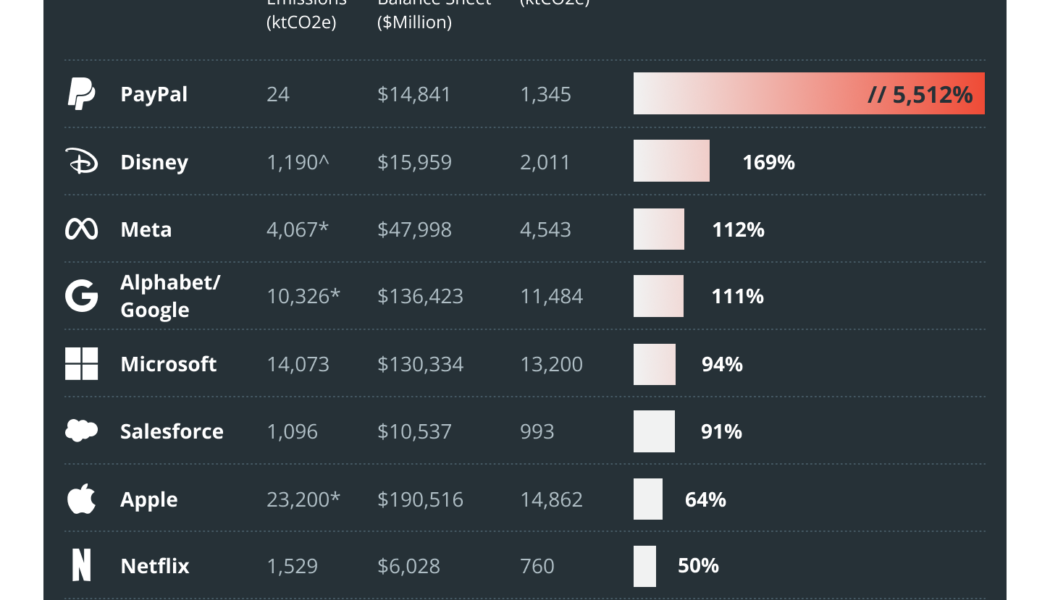

Bitcoin and banking’s differing energy narratives are a matter of perspective

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities. The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions. The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the...

CBDCs can “kill” private crypto: India’s RBI deputy governor to IMF

In discussion with the International Monetary Fund (IMF), T Rabi Sankar, the deputy governor of the Reserve Bank of India (RBI), reflected an anti-crypto stance as he spoke about India’s potential to disrupt the crypto and blockchain ecosystem. Rabi Sankar started the conversation by highlighting the success of the Unified Payments Interface (UPI), India’s in-house fiat-based peer-to-peer payments system — which has seen an average adoption and transaction growth of 160% per anum over the last five years. “One of the reasons it is so successful is because it’s simple,” he added while comparing UPI’s growth with blockchain technology. According to Rabi Sankar: “Blockchain, which was introduced six-eight years before UPI started, even today is being referred to as a potentially revolut...

Brazil’s Federal Revenue now requires citizens to pay taxes on like-kind crypto trades

Brazil’s Federal Reserve (RFB) has declared that Brazilian investors in the crypto-asset market must pay income tax on transactions that involve the like-kind exchange of cryptocurrencies; for example, Bitcoin (BTC) for Ethereum (ETH). The RFB’s declaration was published in the Diário Oficial da União and was the result of a consultation made by a citizen of the country to the regulator. At the end of last year, the group issued an opinion in which it claimed that trading between cryptocurrency pairs is taxable even if there is no conversion to the real (Brazil’s national currency). Although it does not specify what can be understood as “profit,” since in the exchange of one crypto asset for another there is no capital gain in fiat currency, it points out...

Bank of Israel claims ‘public support’ for its CBDC project

Despite the fact that it still hasn’t made a final decision on the launch of the “digital shekel,” Israel’s central bank reported that the public feedback on the project is mainly positive. According to Reuters, on Monday, The Bank of Israel summarized the results of the public consultation on its central bank digital currency (CBDC) plans. It has received 33 responses from different sectors, with half of them coming from abroad and 17 from the domestic fintech community. While specifying that the final decision on the project’s fate is yet to be made, it claimed: “All of the responses to the public consultation indicate support for continued research regarding the various implications on the payments market, financial and monetary stability, legal and technological issues, and more....

90% of surveyed central banks are exploring CBDCs — BIS

A survey conducted by the Bank for International Settlements, or BIS, suggested that many central banks around the world are looking into rolling out a central bank digital currency, or CBDC. In a paper released on Friday, the BIS Monetary and Economic Department said 90% of 81 central banks surveyed from October to December 2021 were “engaged in some form of CBDC work,” with 26% running pilots on CBDCs and more than 60% doing experiments or proofs-of-concept related to a digital currency. According to the BIS, the increase in interest around CBDCs — up from roughly 83% in 2020 — may have been driven by a shift to digital solutions amid the COVID-19 pandemic as well as the growth in stablecoins and other cryptocurrencies. “Globally, more than two-thirds of central banks consider that they ...

Crypto Bahamas: Regulations enter critical stage as gov’t shows interest

The crypto community and Wall Street converged last week in Nassau, Bahamas, to discuss the future of digital assets during SALT’s Crypto Bahamas conference. The SkyBridge Alternatives Conference (SALT) was also co-hosted this year by FTX, Sam Bankman-Fried’s cryptocurrency exchange. Anthony Scaramucci, founder of the hedge fund SkyBridge Capital, kicked off Crypto Bahamas with a press conference explaining that the goal behind the event was to merge the traditional financial world with the crypto community: “Crypto Bahamas combines the crypto native FTX audience with the SkyBridge asset management firm audience. We are bringing these two worlds together to create a more equitable financial system.” Traditional finance eyes crypto as regulations take shape The combination of traditional ...

Cuban central bank makes it official: VASP licensing coming in May

In a move that could potentially foster the growth of Cuba’s nascent tech industry, the Banco Central de Cuba (BCC), the country’s central bank, will begin issuing licenses for Bitcoin (BTC) and other virtual asset services providers, or VASPs. According to the Official Gazette No. 43 published Tuesday, which includes a Central Bank of Cuba resolution, anyone wanting to provide virtual-asset-related services must acquire a license first from the central bank. It reads: “The Central Bank of Cuba, when considering the license request, evaluates the legality, opportunity and socioeconomic interest of the initiative, the characteristics of the project, the responsibility of the applicants and their experience in the activity.” Furthermore, the document states that those organizations that do n...