Central Bank

Bank of Japan to trial digital yen with three megabanks

Despite Japan’s uncertainty on whether to issue a central bank digital currency (CBDC), the Bank of Japan (BoJ) continues experimenting with a potential digital yen. The Japanese central bank has started a collaboration with three megabanks and regional banks to conduct a CBDC issuance pilot, the local news agency Nikkei reported on Nov. 23. The pilot aims to provide demo experiments for the issuance of Japan’s national digital currency, the digital yen, starting in spring 2023. As part of the trial, the BoJ is expected to cooperate with major private banks and other organizations to detect and solve any issues related to customer deposits and withdrawals on bank accounts. According to the report, the pilot will involve testing the offline functionality of Japan’s possible CBDC, targeting ...

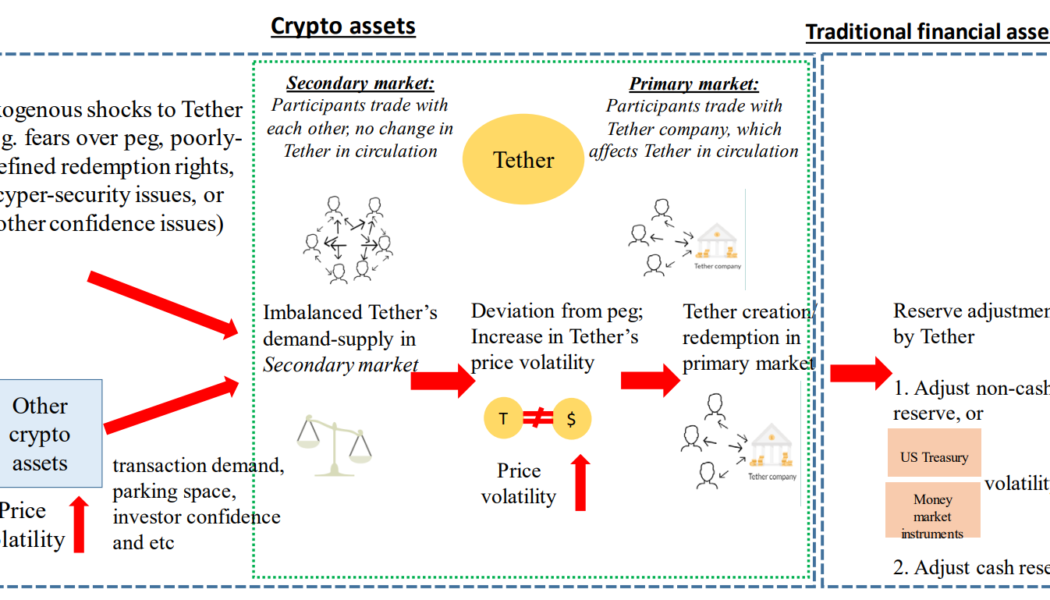

Hong Kong believes stablecoin volatility can spillover to traditional finance

The fall of crypto giants this year reignited questions about the stability of cryptocurrencies and their impact on fiat ecosystems. Hong Kong Monetary Authority (HKMA) assessed the situation and found that the instabilities of crypto assets, including asset-backed stablecoins, can potentially spill over to the traditional financial system. The HKMA assessment on asset-backed stablecoins pointed out the risks of liquidity mismatch, negatively impacting their stability during “fire-sale” events. A fire sale event relates to a momentary price fluctuation when investors can purchase stablecoins cheaper than their market price — a phenomenon noticed during the Terra (LUNA) crash. According to Hong Kong’s central bank, the interconnection of crypto assets has made the crypto ecosystem more vuln...

CBDCs are a declaration of war against the banking system claims economist

CBDCs are a declaration of war against the banking system, Richard Werner — development economist and professor at De Montfort University — told Cointelegraph at Web Summit on Nov. 4. Known for his quantitative easing theory, published almost 30 years ago, Werner is an advocate for a decentralized economy. In an exclusive interview with Cointelegraph’s editor-in-chief Kristina Lucrezia Cornèr, he discussed the challenges that surround decentralization, the role of central banks, and how blockchain can help promote transparency in economies. This interview was part of Cointelegraph’s extensive coverage at Web Summit in Lisbon — one of the world’s leading tech conferences. Cointelegraph: Do you think that a decentralized financial system is actually possible? Richard Werner:...

Singapore bank DBS uses DeFi to trade FX and state securities

DBS Bank, a major financial services group in Asia, is applying decentralized finance (DeFi) for a project backed by Singapore’s central bank. DBS has started a trading test of foreign exchange (FX) and government securities using permissioned, or private, DeFi liquidity pools, the firm announced on Nov. 2. The development is part of Project Guardian, a collaborative cross-industry effort pioneered by the Monetary Authority of Singapore (MAS). Conducted on a public blockchain, the trade included the purchase and sale of tokenized Singapore government securities (SGS), the Singapore dollar (SGD), Japanese government bonds and the Japanese yen (JPY). The project has shown that trading on a private DeFi protocol enables simultaneous operations of instant trading, settlement, clearing and cust...

Singapore MAS proposes to ban cryptocurrency credits

The Monetary Authority of Singapore (MAS) is introducing proposals to better regulate the cryptocurrency industry in the aftermath of the bankruptcy of the Singaporean crypto hedge fund Three Arrows Capital (3AC). The central bank of Singapore has issued two consultation papers on proposals for regulating the operations of digital payment token service providers (DPTSP) and stablecoin issuers under the Payment Services Act. Published on Oct. 26, both consultation papers aim to reduce risks to consumers from crypto trading and improve standards of stablecoin-related transactions. The first document includes proposals for digital payment token (DPT) services or services related to major cryptocurrencies like Bitcoin (BTC), Ether (ETH) or XRP (XRP). According to the authority, “any form of ...

The Caribbean is pioneering CBDCs with mixed results amid banking difficulties

The Caribbean region is in a tough situation for banking. The 35 nations comprising the region face challenges common to many tiny economies, such as dollarization and dependence on foreign trade and remittances. In addition, the increasingly common banking practice called de-risking is taking a heavy toll. So, it is probably no coincidence that the region is also at the forefront of digital currency adoption. Carmelle Cadet, the founder and CEO of banking solutions company Emtech, is a native of Haiti who has experience working with central banks in Haiti and Ghana. Her company is also a member of the new Digital Dollar Project Technical Sandbox Program that is exploring aspects of a United States central bank digital currency (CBDC). Cadet spoke to Cointelegraph about her experienc...

BIS marks CBDC pilot as ‘successful’ with $22M transacted

A multi-jurisdictional central bank digital currency (CBDC) pilot has been marked “successful” by the Bank for International Settlements (BIS) after a month-long test phase that facilitated $22 million worth of real-value cross-border transactions. The central banks of Hong Kong, Thailand, China and the United Arab Emirates took part in the pilot program along with 20 commercial banks from those regions. More than $12 million worth of value was issued onto the test platform, which facilitated 164 foreign exchange transactions and cross-border payments between the participating firms totaling over $22 million worth of value, according to a Tuesday LinkedIn post from the BIS. Graphic from the BIS on the CBDC pilot. Source: LinkedIn Daniel Eidan, an adviser and solution architect at the BIS,&...

New regulatory bill grants Uruguayan Central Bank control over the nation’s crypto industry

The Uruguayan government has introduced legislation to the parliament that accelerates the regulation of the crypto space in the country and establishes the central bank as the regulatory authority. Introduced on Sept 5, the bill strives to clarify the country’s regulatory framework for cryptocurrency assets, stating that all companies that provide digital asset-related services, including initial coin offerings (ICOs) are under the supervision of the Superintendency of Financial Services (SSF), a central bank entity. Cryptocurrency exchanges, custody services and any financial services relating to these digital assets should also adhere to Anti-Money Laundering regulations and best practices. Additionally, the document defined four types of digital assets: stablecoins, governan...

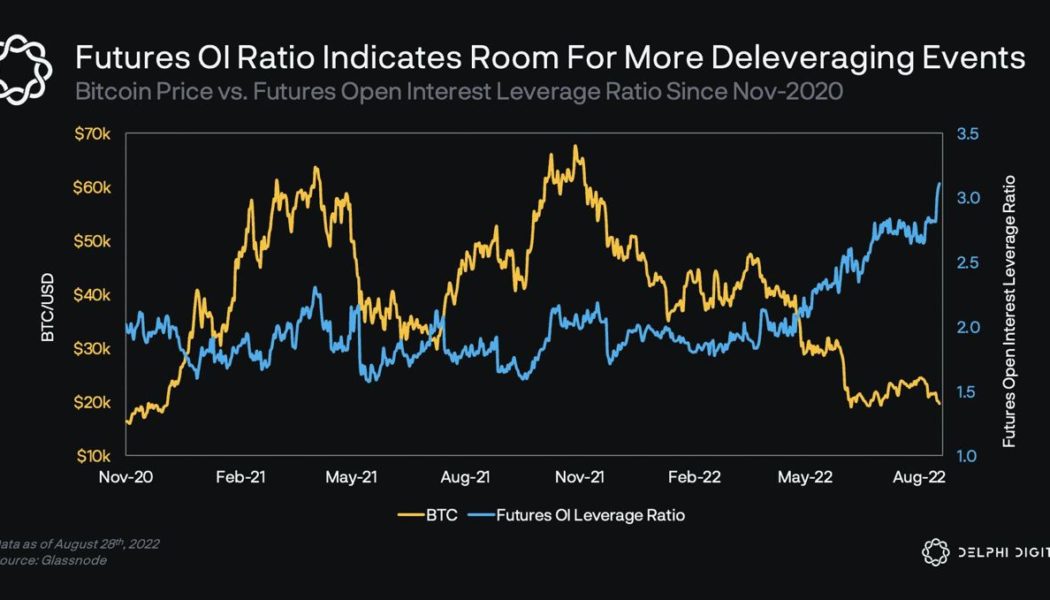

Bitcoin holds $20K, but analysts say BTC open interest leaves room for ‘more deleveraging’

Bitcoin (BTC) price continues to struggle at $20,000 and repeat dips under this level have led some analysts to project deeper downside in the short-term. Earlier in the week, independent market analyst Philip Swift tweeted that the Crypto Fear and Greed Index had dropped back to back to “Extreme Fear,” reflecting softening sentiment among investors. The market is not enjoying $BTC hanging around $20k. Back into Extreme Fear today. Live chart: https://t.co/Jr5151zN7I pic.twitter.com/UnztrZP7FP — Philip Swift (@PositiveCrypto) August 31, 2022 On Aug 29, analytics firm Delphi Digital highlighted Bitcoin open interest hitting a new record-high and said: “The Futures Open Interest Leverage Ratio for BTC reached its highest level ever recorded at more than 3% of BTC market cap, following ...

South Korean central bank eyes MiCA, says future regulations may allow ICOs again

The South Korean central bank has indicated that initial coin offerings (ICOs) will be allowed under the Digital Assets Framework Act, according to a local news report. That comprehensive legislation is expected to be introduced in 2023 and implemented the following year. The Bank of Korea (BOK) discussed ICOs in comments to a Korean translation of the European Union’s Markets in Crypto-Assets (MiCA) legislation released Monday. The BOK stated that the MiCA regulatory package protected users and investors without hindering innovation. “A balanced approach is needed to foster a sound market through the introduction of a crypto asset regulatory system to promote blockchain and crypto asset innovation while not hindering the development of related industries due to excessive regulation,...

A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming ‘buy’

Bitcoin (BTC) price remains pinned below $22,000 as the lingering impact of the Aug. 19 sell-off at $25,200 continues to be felt across the market. According to analysts from on-chain monitoring resource Glassnode, BTC’s tap at the $25,000 level was followed by “distribution” as profit-takers and short-term holders sold as price encountered a trendline resistance following a 23-consecutive-day uptrend that saw BTC trading above it’s realized price ($21,700). Bitcoin total inflows and outflows to all exchanges (USD). Source: glassnode The firm also noted that the “total inflows and outflows to all exchanges” metric shows exchange flows at multi-year lows and back to “late-2020 levels,” which reflects a “general lack of speculative interest.” Stocks and crypto clearly risk off until we...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...