Central Bank

Going cashless: Norway’s digital currency project raises privacy questions

The small Nordic country of Norway may not be particularly notable on the global crypto map. With its 22 blockchain solution providers, the nation doesn’t stand out even at the regional level. However, as the race to test and implement central bank digital currencies (CBDCs) accelerates every day, the Scandinavian nation is taking an active stance on its own national digital currency. In fact, it was among the first countries to begin the work on a CBDC back in 2016. Dropping cash In recent years, amid a rise in cashless payment methods and concern over cash-enabled illicit transactions, some Norwegian banks have moved to remove cash options altogether. In 2016, Trond Bentestuen, then an executive at major Norwegian bank DNB, proposed to stop using cash as a means of payment in the c...

Bank of Thailand to allow first virtual banks by 2025

Bank of Thailand has disclosed plans to allow virtual banks to operate in the country for the first time. Financial firms will be able to provide services by 2025, a Bloomberg report shows. The “Consultation Paper on Virtual Bank Licensing Framework” published by the central bank says that applications will be available later in 2023 allowing virtual banks to act as financial services providers. The move focuses on increasing competition and boosting Thailand’s economic growth. The Bank of Thailand will issue three different licenses for interested companies by 2024. There are at least 10 parties interested in granting permissions, the report states. Regulations and supervision for virtual banks will be the same as those for traditional commercial banks under the licensing framework....

Mexico’s digital peso delayed, launch date unclear

More than a year after it was announced, Mexico’s proposed central bank digital currency (CBDC) is still in the initial phase and unlikely to meet its 2024 launch date. According to local media reports, Mexico’s central bank, known as Banxico, is working on legal, administrative and technological requirements for the peso’s digital version. In December 2021, the local government announced its plan to introduce a national digital currency, noting in a tweet that the “new technologies and next-generation payment infrastructure” would improve Mexico’s financial inclusion. While that tweet mentioned a launch in 2024, a year later, authorities are avoiding predicting a launch date. “The result of this initial phase entails the preparation of a budget that is currentl...

Macroeconomic data points toward intensifying pain for crypto investors in 2023

Undoubtedly, 2022 was one of the worst years for Bitcoin (BTC) buyers, primarily because the asset’s price dropped by 65%. While there were some explicit reasons for the drop, such as the LUNA-UST crash in May and the FTX implosion in November, the most important reason was the U.S. Federal Reserve policy of tapering and raising interest rates. Bitcoin’s price had dropped 50% from its peak to lows of $33,100 before the LUNA-UST crash, thanks to the Fed rate hikes. The first significant drop in Bitcoin’s price was due to growing market uncertainty around potential rate hike rumors in November 2021. By January 2022, the stock market had already started showing cracks due to the increasing pressure of imminent tapering, which also negatively impacted crypto prices. BTC/USD daily price chart. ...

US federal agencies release joint statement on crypto asset risks and safe practices

United States federal bank regulatory agencies started off the new year with a statement on crypto assets looking back at the troubles of the crypto sector in 2022. The Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) released a joint statement on Jan. 3 on past problems and their efforts to maintain sound banking practices in spite of those challenges. “It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system,” the agencies stated. They identified eight specific risks, including fraud, volatility, contagion and similar familiar issues. Related: Approach with caution: US banking regulator’s crypto warning The agencies also noted that, “B...

How crypto could be good for CBDC and vice versa: Industry exec explains

Cryptocurrencies like Bitcoin (BTC) could potentially find some mutually beneficial interactions with central bank digital currencies (CBDCs), according to one industry executive. While crypto is often associated with financial freedom, the concept of CBDC is frequently seen as the exact opposite. But this doesn’t mean that there cannot be a balance between the two, according to Itai Avneri, chief operating officer and deputy CEO at the crypto trading platform INX. CBDCs and regulated cryptocurrencies could potentially complement each other in the future as the two types of digital currencies have their own benefits, Avneri said in an interview with Cointelegraph on Dec. 22. Comparing CBDCs to regulated primary offerings, Avneri suggested that allowing or enabling crypto funds to participa...

Kazakhstan central bank recommends a phased CBDC rollout between 2023-25

Kazakhstan, the world’s third-largest Bitcoin (BTC) mining hub after the United States and China, found feasibility in launching its in-house central bank digital currency (CBDC), a digital tenge. The National Bank of Kazakhstan (NBK) revealed the finding following the completion of the second phase of testing. In late October, Binance CEO Changpeng’ CZ’ Zhao announced that Kazakhstan’s CBDC would be integrated with BNB Chain, a blockchain built by the crypto exchange. The country’s primary motivation for conducting studies on CBDC was to test its potential to improve financial inclusion, promote competition and innovation in the payments industry and increase the nation’s global competitiveness. The pilot research focused on offline payments and pr...

Central Banks to set standards on banks’ crypto exposure – BIS

A global standard for banks’ exposure to crypto assets has been endorsed by the Group of Central Bank Governors and Heads of Supervision (GHOS) of the Bank for International Settlements (BIS). The standard, which sets a limit of 2% on crypto reserves among banks, must be implemented on January 1, 2025, according to an official announcement on Dec. 16. The report, dubbed “Prudential treatment of cryptoasset exposures”, introduces the final standard structure for banks regarding exposure to digital assets, including tonenized traditional assets, stablecoins and unbacked cryptocurrencies, as well as feedback from stakeholders collected in a consultation launched in June. The Basel Committee on Banking Supervision noted the report will soon be incorporated as a new chap...

Dutch central bank says KuCoin is not licensed and ‘illegally offering services’

The central bank of the Netherlands, De Nederlandsche Bank, has issued a warning to investors using KuCoin, saying the exchange was operating without legal registration. In a Dec. 15 announcement, the central bank said that MEK Global Limited, or MGL, which does business in the Netherlands as KuCoin, was not in compliance with the country’s Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT) regulations. De Nederlandsche Bank added the crypto firm was “illegally offering services” as well as “illegally offering custodian wallets” for users. “Customers of MGL are not in violation,” said the bank. “However, this may increase the risk of customers becoming involved in money laundering or terrorist financing.” DNB warns against MEK Global Limited, doing business as K...

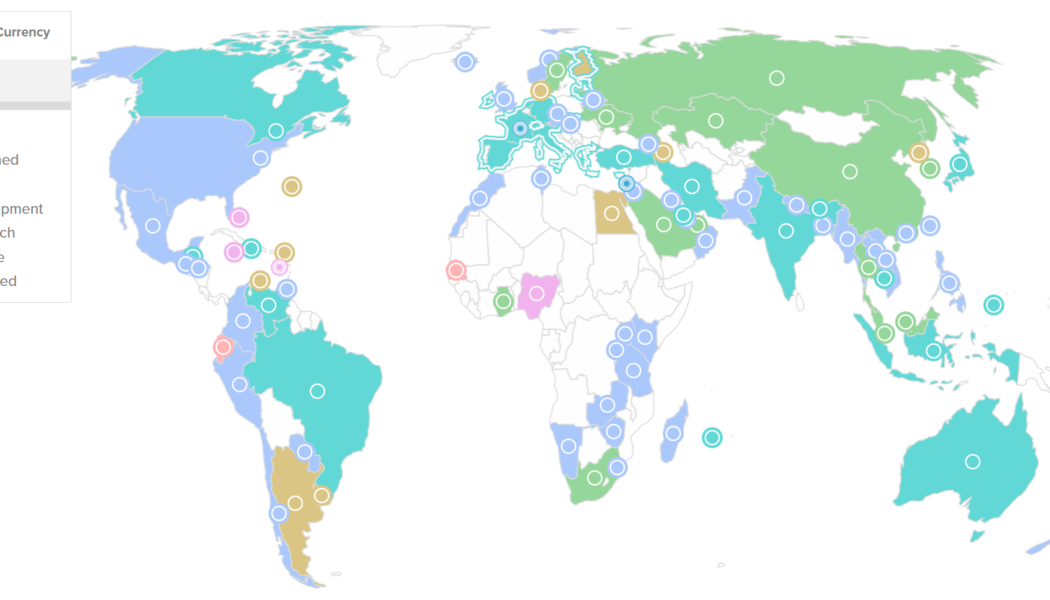

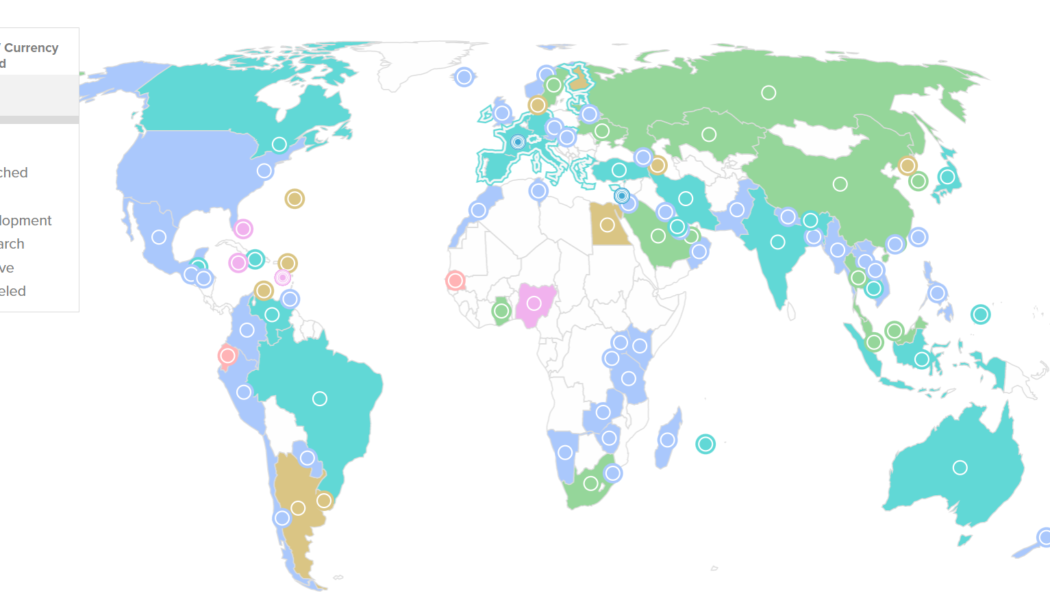

The impact of CBDCs on stablecoins with Bitget’s Gracy Chen

For over 14 years, central banks worldwide have seen blockchain technology deliver highly secure, immutable, verifiable and transparent financial ecosystems, starting with the Bitcoin network. Central bank digital currencies (CBDCs) stood out as one of the ways for fiat currency to harness a part of what cryptocurrencies achieve today. To not only keep up with rising inflation and cut down on operational costs but also to counter money laundering and related concerns, 98 of 195 countries — representing over 95% of global GDP — have either launched or are researching and developing their own versions of CBDC. Global CBDC initiatives overview. Source: Atlantic Council With CBDCs joining the race to dominate the future of finance, the relevance of the stablecoin ecosystem — cryptocurrencies b...

Brazilian crypto industry gets regulatory clarity amid global uncertainty

As the global crypto community is still licking its wounds from the FTX collapse, a liquidity crisis continues to spread around centralized exchanges and decentralized finance (DeFi) alike. It is soon to be decided whether the coming regulation triggered by FTX’s bankruptcy will bring a silver lining to crypto. The Chamber of Deputies of Brazil, the lower house of the country’s federal legislative body, has passed a regulatory framework that legalizes the use of cryptocurrencies as a payment method within the country. It is estimated that 10 million Brazilians, or about 5% of the population, trade crypto assets. The largest centralized exchange in Brazil is a local business called Mercado Bitcoin, with roughly three million users. International players like Coinbase or Gemini do not ...

Pakistan launches new laws to expedite CBDC launch by 2025

Regulators worldwide see central bank digital currencies (CBDCs) as a way to enhance fiat capabilities by inheriting the financial prowess of technologies that power cryptocurrencies. Pakistan joined this list by announcing new regulations to ensure the launch of an in-house CBDC by 2025. The State Bank of Pakistan (SBP) signed in new laws for Electronic Money Institutions (EMIs) — non-bank entities offering digital payment instruments — to ensure the timely issuance of a CBDC in the next three years. The World Bank helped Pakistan design the new regulations, according to local media Arab News. In addition to timeline adherence for the CBDC launch, the regulations warrant preventive measures against money laundering and terror financing while considering consumer protection and reporting r...