Celsius

Contagion: Genesis faces huge losses, BlockFi’s $1B loan, Celsius’s risky model

It’s been another day of watching the ripples of contagion spread through the crypto market. With Three Arrows Capital being ordered into liquidation by a British court, details have also emerged today of BlockFi liquidating a $1B loan to 3AC, and the fallout from the insolvency was partly to blame for lending firm and market maker Genesis Trading facing losses of “a few hundred million dollars.” Withdrawals remain suspended at the possibly insolvent lending and borrowing platform Celsius, which was revealed to have had a highly risky 19 to 1 assets-to-equity ratio before it ran into liquidity troubles this year. Celsius’ risky business According to documents reviewed and reported on by the Wall Street Journal (WSJ) on June 29, Celsius was operating on very fine and risky margins as ...

Celsius Network hires advisers ahead of potential bankruptcy: Report

Crypto lending platform Celsius Network has reportedly onboarded advisers from a management consulting firm in advance of the company possibly facing bankruptcy. According to a Friday report from the Wall Street Journal, Celsius hired an unknown number of restructuring consultants from the firm Alvarez & Marsal to advise the platform on potentially filing for bankruptcy. The report followed one from June 14, which said Celsius had hired lawyers in an attempt to restructure the company amid its financial issues. Steady lads https://t.co/5YAdmq5kt8 — Ben McKenzie (@ben_mckenzie) June 24, 2022 Celsius has been at the forefront of discussions in the media around significant volatility in the market amid the crypto lending platform’s decision to pause “all withdrawals, swaps and transfers b...

Voyager Digital cuts withdrawal amount as 3AC contagion ripples through DeFi and CeFi

The Singapore-based crypto venture firm Three Arrows Capital (3AC) failed to meet its financial obligations on June 15 and this caused severe impairments among centralized lending providers like Babel Finance and staking providers like Celsius. On June 22, Voyager Digital, a New York-based digital assets lending and yield company listed on the Toronto Stock exchange, saw its shares drop nearly 60% after revealing a $655 million exposure to Three Arrows Capital. Voyager offers crypto trading and staking and had about $5.8 billion of assets on its platform in March, according to Bloomberg. Voyager’s website mentions that the firm offers a Mastercard debit card with cashback and allegedly pays up to 12% annualized rewards on crypto deposits with no lockups. More recently, on June 2...

Ethereum risks another 60% drop after breaking below $1K to 18-month lows

The price of Ethereum’s native token, Ether (ETH), careened below $1,000 on June 18 as the ongoing sell-off in the crypto market continued despite the weekend. Ether reached $975, its lowest level since January 2021, losing 80% of its value from its record high in November 2021. The decline appeared amid concerns about the Federal Reserve’s 75 basis points rate hike, a move that pushed both cryptocurrencies and stocks into a strong bear market. “The Federal Reserve has barely started raising rates, and for the record, they haven’t sold anything on their balance sheet either,” noted Nick, an analyst at data resource Ecoinometrics, warnings that “there is bound to be more downside coming.” ETH/USD weekly price chart. Source: TradingView Ethereum...

Market selling might ease, but traders are on the sidelines until BTC confirms $20K as support

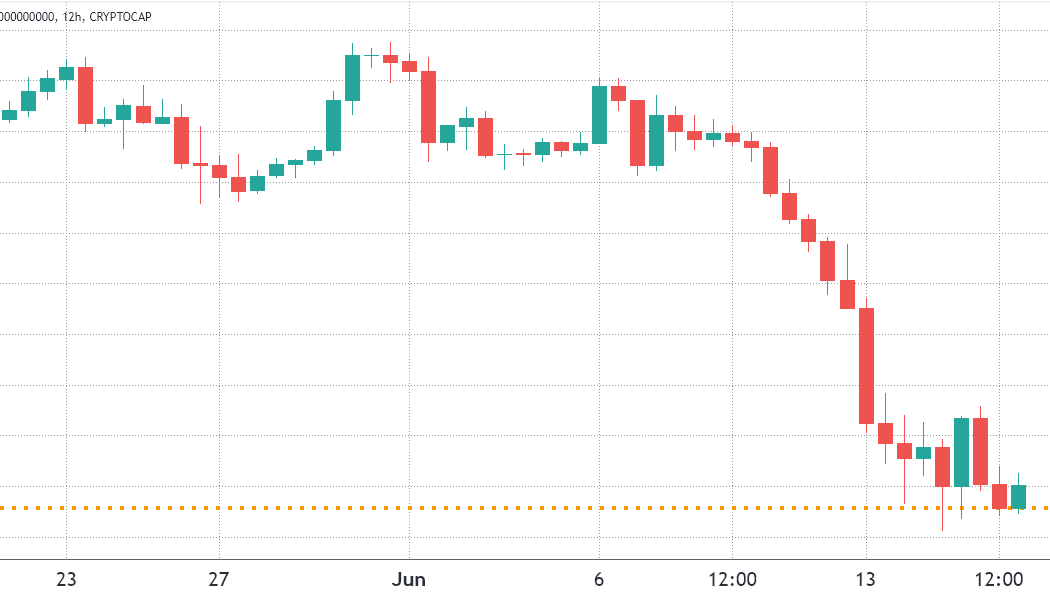

The total crypto market capitalization fell off a cliff between June 10 and 13 as it broke below $1 trillion for the first time since January 2021. Bitcoin (BTC) fell by 28% within a week and Ether (ETH) faced an agonizing 34.5% correction. Total crypto market cap, USD billion. Source: TradingView Presently, the total crypto capitalization is at $890 million, a 24.5% negative performance since June 10. That certainly raises the question of how the two leading crypto assets managed to underperform the remaining coins. The answer lies in the $154 billion worth of stablecoins distorting the broader market performance. Even though the chart shows support at the $878 billion level, it will take some time until traders take in every recent event that has impacted the market. For example, the U.S...

Mark Cuban says crypto crash highlights Warren Buffett’s wisdom

Billionaire crypto investor and owner of the Dallas Mavericks Mark Cuban says the current market downturn reminds him of a well-known adage uttered by Warren Buffett. Cuban sees a parallel between the rise and fall of crypto markets and projects, and the 91-year-old ‘Oracle of Omaha’s aphorism that: “Only when the tide goes out do you discover who’s been swimming naked.” Cuban’s observation was revealed during a June 16 interview with Fortune in which he discussed what he sees as flawed business models of some crypto projects that have fallen on hard times over the past two months. “In stocks and crypto, you will see companies that were sustained by cheap, easy money—but didn’t have valid business prospects—will disappear,” the Shark Tank investor said. “Like ...

BitBoy founder threatens class action lawsuit against Celsius

Just two weeks after appearing in an ask me anything (AMA) with Celsius founder Alex Mashinsky, crypto Youtuber Ben Armstrong has announced he intends to file a class action lawsuit against the lending platform and its chief executive. Armstrong made legal threats via Twitter on June 15, and has since provided more detail in multiple threads. His issue is centered on being unable to pay down loans with existing funds on the platform, and instead having to deposit new funds to pay the loans off: “[Our account rep] told us we had enough money in our account to pay off a loan. But we can’t use money in our account. We HAVE TO SEND CELSIUS MORE MONEY TO PAY IT OFF.” “Imagine an insolvent company that you can’t withdraw your money from ASKING YOU TO SEND THEM MORE MONEY,” he added. Armstrong st...

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

BTC price crashes to $20.8K as ‘deadly’ candles liquidate $1.2 billion

Bitcoin (BTC) came within $1,000 of its previous cycle all-time highs on June 14 as liquidations mounted across crypto markets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price hits 18-month lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $20,816, on Bitstamp, its lowest since the week of December 14, 2020. A sell-off that began before the weekend intensified after the June 13 Wall Street opening bell, with Bitcoin and altcoins falling in step with United States equities. The S&P 500 finished the day down 3.9%, while the Nasdaq Composite Index shed 4.7% ahead of key comments from the U.S. Federal Reserve on its anti-inflation policy. The worst of the rout was reserved for crypto, however, and with that, BTC/USD lost 22...

Crypto lender Celsius freezes withdrawals; rival Nexo offers a ‘helping hand’

Celsius halted withdrawals on Monday, noting that said the process back to normalcy could see delays Fellow crypto lending Nexo tabled an offer to ‘bail’ Celsius by taking up its qualifying assets Crypto lending platform Celsius is seeing the worst of the crypto markets and, in effect, announced on Monday morning that it paused redemptions citing severe “market conditions.” In what it termed a very important message to the community, Celsius justified that it took the decision in order to remain ‘fit’ to honor its withdrawal obligations to customers over time. “Acting in the interest of our community is our top priority. In service of that commitment and to adhere to our risk management framework, we have activated a clause in our Terms of Use that will allow for this process to take place...