Celsius

Vermont’s financial regulator alleges Celsius and its CEO made ‘false and misleading claims’

The Vermont Department of Financial Regulation, or DFR, alleged crypto lending platform Celsius Network and CEO Alex Mashinsky misled state regulators about the firm’s financial health and its compliance with securities laws. In a Wednesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Vermont’s financial regulator said Celsius and Mashinsky “made false and misleading claims to investors” which allegedly downplayed concerns about volatility in the crypto market, encouraging retail investors to leave their funds on the platform or make new investments. According to the state regulator, Celsius and its CEO “lacked sufficient assets to repay its obligations” despite claiming the firm had enough funds in its reserves to mitigate the risk of insolvency. The DFR c...

Celsius files to reopen withdrawals for a minority of customers

Beleaguered crypto lender Celsius Network has filed a motion with the United States Bankruptcy Court yesterday to allow customers with digital assets held in certain accounts to be withdrawn. There’s a catch, however, as the motion will only apply to Custody and Withold Accounts and for custodied assets worth $7,575 or less in value. Celsius has structured their Custody and Withhold Accounts, which essentially serve as storage wallets, in a way that still enables users to maintain legal ownership of cryptocurrency. This ownership however is not extended to assets held in accounts that offer annual crypto earnings or borrowing services (Earn and Borrow accounts). The community response to the motion has been mixed, with creditors happy that Celsius Network has conceded funds held in i...

Celsius calls out Prime Trust in court, alleging firm didn’t turn over $17M in crypto

Crypto lending platform Celsius Network has filed a lawsuit claiming that custodian Prime Trust failed to turn over roughly $17 million worth of cryptocurrency. In a Tuesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Celsius’ legal team brought a complaint against Prime Trust, alleging the company did not return $17 million worth of crypto assets in June 2021 when it terminated its relationship with the lending firm. According to Celsius, Prime Trust acted as crypto custodian for New York- and Washington-based users from 2020 through mid-2021, returning $119 million in crypto following the end of the business arrangement but holding back some funds: 398 Bitcoin (BTC), 3,740 Ether (ETH), 2,261,448 USD Coin (USDC) and 196,268 Celsius (CEL). “Upon the commence...

Data shows Bitcoin and altcoins at risk of a 20% drop to new yearly lows

After the rising wedge formation was broken on Aug. 17, the total crypto market capitalization quickly dropped to $1 trillion and the bulls’ dream of recouping the $1.2 trillion support, last seen on June 10, became even more distant. Total crypto market cap, USD billion. Source: TradingView The worsening conditions are not exclusive to crypto markets. The price of WTI oil ceded 3.6% on Aug. 22, down 28% from the $122 peak seen on June 8. The United StatesTreasuries 5-year yield, which bottomed on Aug. 1 at 2.61%, reverted the trend and is now trading at 3.16%. These are all signs that investors are feeling less confident about the central bank’s policies of requesting more money to hold those debt instruments. Recently, Goldman Sachs chief U.S. equity strategist David Ko...

Court filings reveal Celsius will run out of money by October

Embattled crypto lender Celsius Network is on track to run out of money by October, according to the firm’s latest Chapter 11 documents. Filed on Aug. 14 to the U.S. Bankruptcy Court of the Southern District of New York, Celsius highlighted that it is expected to reach negative liquidity by October 2022 to approximately $34 million. The lending platform, which held the trust of many across the world with life savings and retirement funds, was revealed to be in a much worse financial position than originally suggested in July. Court documents revealed this week that Celsius’ three-month cash flow forecast, which shows steep declining liquidity, indicates the company will experience an approximate 80% drop in liquidity funds from August to September. The forecast predicts Celsius will contin...

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break. Total crypto market cap, USD billion. Source: TradingView Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figur...

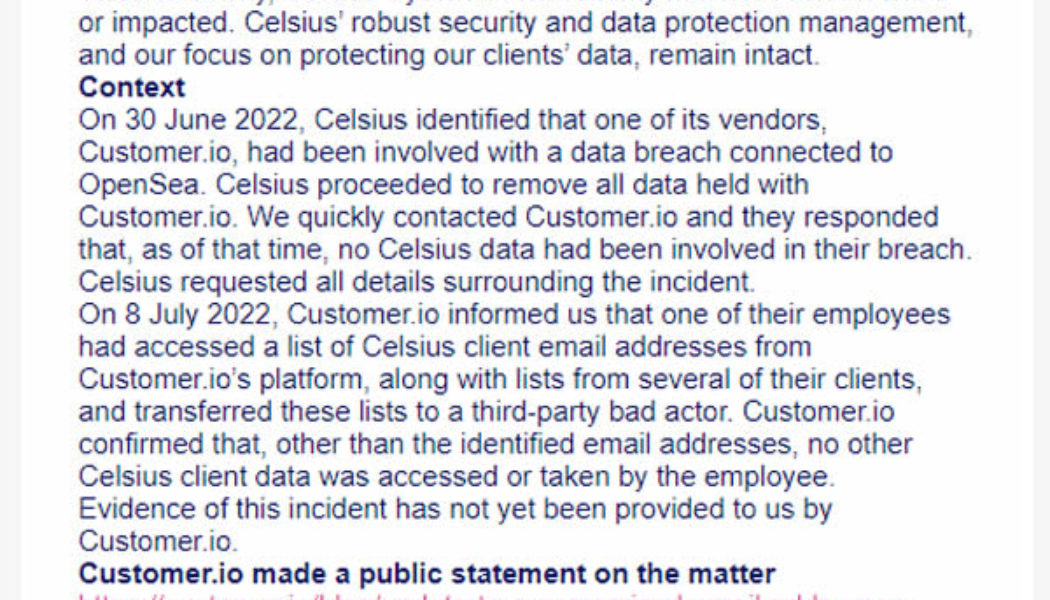

Phishing risks escalate as Celsius confirms client emails leaked

Celsius depositors should be on the lookout for phishing scams after the company revealed some of its customer data has been leaked in a third-party data breach. On July 26, Celsius sent an email to its customers informing them that a list of their emails had been leaked by an employee of one of its business data management and messaging vendors. According to Celsius, the breach came from an engineer at the Customer.io messaging platform who leaked the data to a third-party bad actor. “We were recently informed by our vendor Customer.io that one of their employees accessed a list of Celsius client email addresses,” said Celsius in its email to customers. The data breach is part of the same incursion that leaked OpenSea customer email addresses in June. Announcement from Celsius: “We ...

Investors shifting toward lower-risk crypto yields: Block Earner GM

Block Earner, an Australian fintech company, says the fall of Terra Luna in May has led to “positive surprises” for his company, with investors beginning to find their way toward the lower-risk crypto yield products they offer. Speaking to Cointelegraph, the company’s general manager Apurva Chiranewala revealed that the company has seen a surge of investors previously seeking double-digit returns but now wants a “less risky version” of those returns. “Given that the risks have gone up significantly for those returns, those guys have actually started coming in engaging with us because we look like the less riskier version of those double-digit return products.” Before their collapse, crypto lending platforms such as Celsius and Anchor Protocol offered annual percentage yields (APYs) o...

Crypto firms facing insolvency ‘forgot the basics of risk management’ — Coinbase

Department heads at Coinbase have weighed in on the market downturn amid solvency concerns around Three Arrows Capital, crypto lending firm Celsius, and Voyager Digital, saying the crypto exchange had “no financing exposure” to the companies. In a Wednesday blog post, Head of Coinbase Institutional Brett Tejpaul, Head of Prime Finance Matt Boyd, and Head of Credit and Market Risk Caroline Tarnok said Coinbase had not engaged in the “types of risky lending practices” exhibited by Three Arrows Capital, Celsius, and Voyager, claiming the firms were examples of practicing “insufficient risk controls.” According to the trio, crypto companies faced the possibility of insolvency caused by “unhedged bets,” large investments in Terra, and overleveraging with venture capital firms. “The issues here ...

BREAKING: Celsius reportedly filing for bankruptcy ‘imminently’

Crypto lending platform Celsius has reportedly filed for Chapter 11 bankruptcy, with its lawyers starting to notify individual U.S. state regulators as of Wednesday, July 13. The news was reported by CNBC and referred to an unnamed source, who asked not to be named as the proceedings were private. They said that the company planned to file the Chapter 11 paperwork “imminently.” It comes just days after the embattled lending platform replaced its previously hired law firm Akin Gump Strauss Hauer & Feld LLP with Kirkland & Ellis LLP, the same firm that assisted Voyager Digital with its bankruptcy filing last week. Earlier in the day, Celsius closed off the last of its DeFi debts owed to Compound, Aave, and Maker, reducing its initial debt of $820 million to just $0.013 over the cours...

Celsius vows to return from bankruptcy but expert fears repeat of Mt Gox

Crypto lending platform Celsius confirmed on July 13 that it has initiated Chapter 11 bankruptcy proceedings in the Southern District Court of New York. The announcement was shared on the company’s Twitter and shared with account holders via email on July 13, with a vow to “emerge from Chapter 11 positioned for success in the cryptocurrency industry.” According to Investopedia, a Chapter 11 bankruptcy allows a company to stay in business and restructure its obligations. Companies that have successfully reorganized under Chapter 11 include American Airlines, Delta, General Motors, Hertz, and Marvel according to an updated FAQ by Celsius. Danny Talwar, head of tax at crypto accounting software firm Koinly shared his concerns with Cointelegraph that the proceedings could mean investors and cu...

BnkToTheFuture unveils 3 proposals to rescue Celsius from oblivion

Celsius’ lead investor BnkToTheFuture has outlined three proposals to save Celsius from bankruptcy while finding a good outcome for shareholders and depositors with funds stuck on the platform. Shared on Twitter by BnkToTheFuture CEO Simon Dixon on June 30, the three distinct proposals include either two options of restructuring and relaunching Celsius, or potentially co-investing in the platform alongside wealthy Bitcoin Whales. “Proposal #1: A restructuring to relaunch Celsius and allow depositors to benefit from any recovery through financial engineering. Proposal #2: A pool of the most influential whales in Bitcoin to co-invest with the community. Proposal #3: An operational plan that allows a new entity and team to rebuild and make depositors whole.” Dixon previously referred to...