Celsius Network

3 reasons why the FTX fiasco is bullish for Bitcoin

The “Bitcoin-is-dead” gang is back and at it again. The fall of the FTX cryptocurrency exchange has resurrected these infamous critics that are once again blaming a robbery on the money that was stolen, and not the robber. “We need regulation! Why did the government allow this to happen?” they scream. For instance, Chetan Bhagat, a renowned author from India, wrote a detailed “crypto” obituary, comparing the cryptocurrency sector to communism that promised decentralization but ended up with authoritarianism. Perhaps unsurprisingly, his column conveniently used a melting Bitcoin (BTC) logo as its featured image. Hi all,“Crypto is now dead: FTX, a cryptocurrency exchange, collapsed last week, proving a lot of cool guys horribly wrong,” my colum...

Celsius Network’s bungling showed why centralization can’t protect privacy

In Celsius Network’s recent court filing, the billion-dollar centralized finance (CeFi) platform exposed more than 14,000 pages of customer identity and on-chain transaction data without user consent — a prescient reminder that privacy absent decentralization is no privacy at all. As part of its bankruptcy proceedings, CeFi lending giant Celsius Network disclosed names and on-chain transaction data of tens of thousands of its customers in an Oct. 5 court filing. While Celsius’ user base complied with standard Know Your Customer (KYC) procedures in order to open personal accounts with the CeFi platform, none consented to nor could have anticipated a mass disclosure of this scope or scale. In addition to doxxing the multi-million dollar withdrawals of Celsius founder Alex Mashinsky and chief...

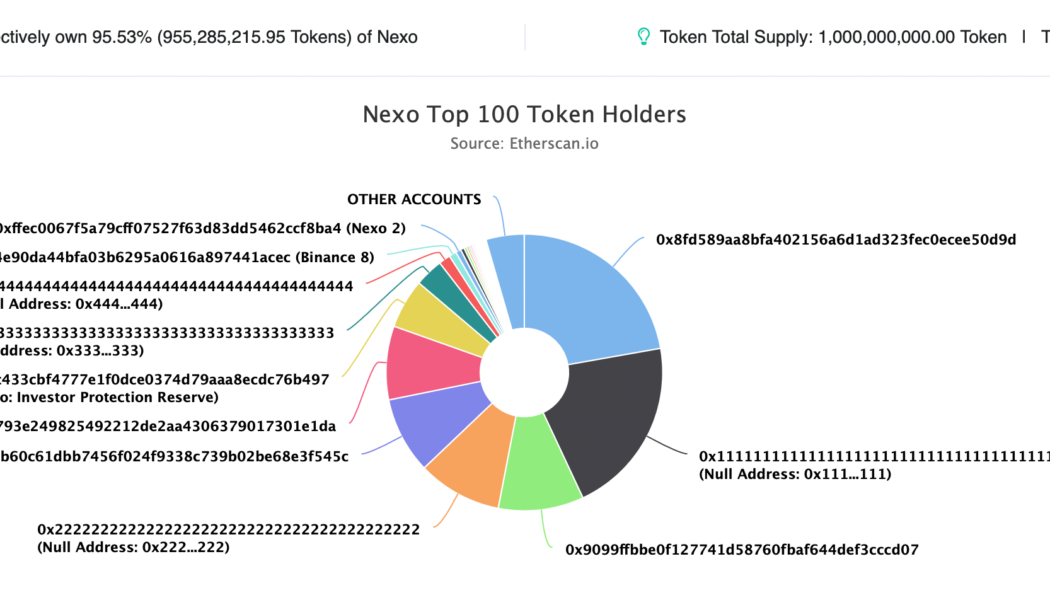

NEXO risks 50% drop due to regulatory pressure and investor concerns

Crypto lending firm Nexo is at risk of losing half of the valuation of its native token by the end of 2022 as doubts about its potential insolvency grow in the market. Is Nexo too centralized? For the unversed: Eight U.S. states filed a cease-and-desist order against Nexo on Sep. 26, alleging that the firm offers unregistered securities to investors without alerting them about the risks of the financial products. In particular, regulators in Kentucky accused Nexo of being insolvent, noting that without its namesake native token, NEXO, the firm’s “liabilities would exceed its assets.” As of July 31, Nexo had 959,089,286 NEXO in its reserves — 95.9% of all tokens in existence. “This is a big, big, big problem because a very basic market analysis demonstrates that Nexo would be...

Celsius co-founder declares his equity is ‘worthless’ in court

A Celsius Network co-founder has moved in court to declare the entirety of his equity stake in the embattled crypto company as “worthless.” In a Monday document to the United States Bankruptcy Court, law firm Kirkland & Ellis LLP filed a declaration on behalf of Celsius Co-Founder Daniel Leon, confirming his status as a substantial shareholder and declaring that his 32,600 common shares are now considered worthless. #CelsiusNetwork #CelsiusBankruptcy Here’s a new one — a declaration of “wothlessness” was just filed by Daniel Leon , one of the cofounders. The Declaration was filed by K&E. https://t.co/OHldovdhBZ — David Adler (@DavidJAdler1991) September 5, 2022 A declaration that a particular stock or common share is “worthless” generally occurs when shareholders in a company...

Court filings reveal Celsius will run out of money by October

Embattled crypto lender Celsius Network is on track to run out of money by October, according to the firm’s latest Chapter 11 documents. Filed on Aug. 14 to the U.S. Bankruptcy Court of the Southern District of New York, Celsius highlighted that it is expected to reach negative liquidity by October 2022 to approximately $34 million. The lending platform, which held the trust of many across the world with life savings and retirement funds, was revealed to be in a much worse financial position than originally suggested in July. Court documents revealed this week that Celsius’ three-month cash flow forecast, which shows steep declining liquidity, indicates the company will experience an approximate 80% drop in liquidity funds from August to September. The forecast predicts Celsius will contin...

Celsius Network is bankrupt, so why is CEL price up 4,000% in two months?

Crypto lending platform Celsius Network has an approximately $1.2 billion gap in its balance sheet, with most liabilities owed to its users. In addition, the firm has filed for bankruptcy protection, so its future looks bleak. Still, Celsius Network’s native utility token CEL has soared in valuation by over 4,100% in the last two months, reaching around $3.93 on Aug. 13 compared to its mid-June bottom of $0.093. In comparison, top coins Bitcoin (BTC) and Ether (ETH) rallied 40% and 130% in the same period. CEL/USD daily price chart. Source: TradingView Takeover rumors behind CEL explosion? Technically, the price rally made CEL an excessively valued token in early August when its relative strength index (RSI) crossed above the 70 threshold. Takeover rumors appear to be behind CEL̵...

California regulator investigating crypto interest accounts

The California Department of Financial Protection and Innovation (DFPI) has warned consumers to “exercise extreme caution” when dealing with interest-bearing crypto-asset accounts. The DFPI stated that it is investigating multiple crypto interest account providers to determine whether they are “violating laws under the Department’s jurisdiction.” In a July 12 note, the DFPI emphasized that crypto-interest account providers “are not governed by the same rules and protections as banks and credit unions” and that some platforms are “preventing customers from withdrawing from and transferring between their accounts.” “The Department warns California consumers and investors that many crypto-interest account providers may not have adequately disclosed risks customers face when they deposit crypt...

XRP price technical breakdown boosts chances of a 40% drop by July

Ripple (XRP) price stares at potential losses in the coming weeks as it breaks out of a “descending triangle” pattern, with its bias skewed toward the downside. Major XRP breakdown underway To recap, XRP started forming the technical structure after reaching $1.98 in April 2021, its second-highest level to date. In doing so, the token trended lower inside a range defined by a falling resistance trendline and a horizontal support trendline. On May 16, 2022, XRP broke below the triangle’s support trendline, accompanying a decent increase in trading volumes. The move confirmed the descending triangle as a bearish reversal indicator. Meanwhile, as a rule of technical analysis, XRP now risks extending its downside move by as much as the triangle’s maximum height whe...

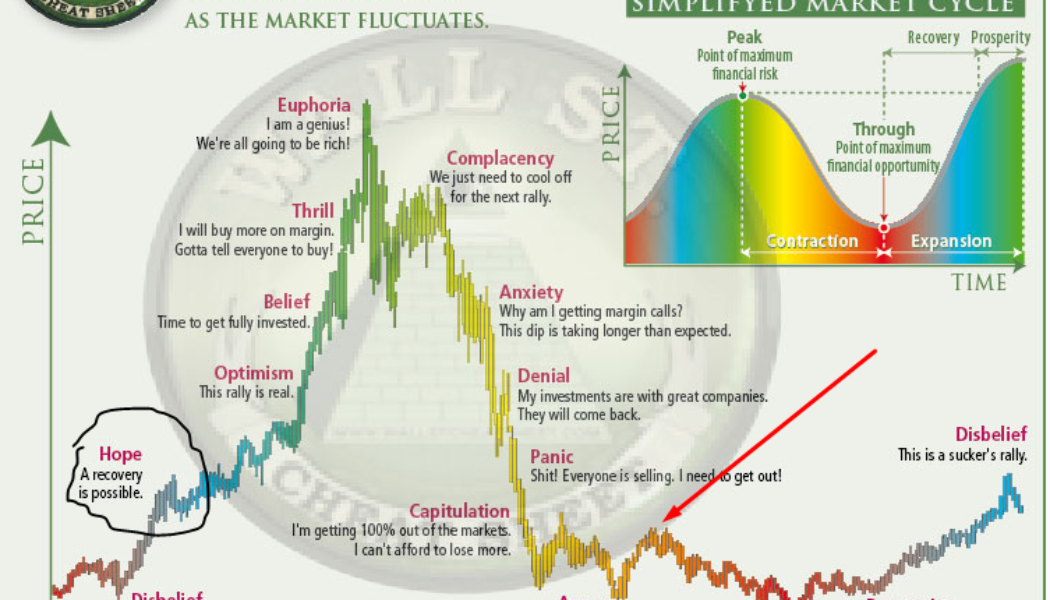

Ethereum crashed by 94% in 2018 — Will history repeat with ETH price bottoming at $375?

Ethereum’s native token Ether (ETH) is showing signs of bottoming out as ETH price bounced off a key support zone. Notably, ETH price is now holding above the key support level of the 200-week simple moving average (SMA) near $1,196. The 200-week SMA support seems purely psychological, partly due to its ability to serve as bottom levels in the previous Bitcoin bear markets. Independent market analyst “Bluntz” argues that the curvy level would also serve as a strong price floor for Ether where accumulation is likely. He notes: “BTC has bottomed 4x at the 200wma dating back to 2014. [Probably] safe to assume it’s a pretty strong level. Sure we can wick below it, but there [are] also six days left in the week.” ETH/USD weekly pric...