CBDC

Going cashless: Norway’s digital currency project raises privacy questions

The small Nordic country of Norway may not be particularly notable on the global crypto map. With its 22 blockchain solution providers, the nation doesn’t stand out even at the regional level. However, as the race to test and implement central bank digital currencies (CBDCs) accelerates every day, the Scandinavian nation is taking an active stance on its own national digital currency. In fact, it was among the first countries to begin the work on a CBDC back in 2016. Dropping cash In recent years, amid a rise in cashless payment methods and concern over cash-enabled illicit transactions, some Norwegian banks have moved to remove cash options altogether. In 2016, Trond Bentestuen, then an executive at major Norwegian bank DNB, proposed to stop using cash as a means of payment in the c...

Digital Dollar Project urges US to take action on CBDC development

The Digital Dollar Project (DDP) released a new version of its white paper “Exploring a U.S. CBDC” on Jan. 18. The project expanded the paper in order to examine central bank digital currency projects internationally, though its focus is still on the United States. The DDP introduced its “champion model” of an intermediated wholesale and retail CBDC in the first version of the paper in May 2020. Since that time, CBDC projects worldwide have increased from 35 to 114. The updated DDP paper retained the core tenets of the champion, such as those on privacy and monetary policy, and it discussed technological advancements of recent years. The new ideas in the report mainly revolved the authors’ warnings about the United States falling behind in CBDC research and leade...

EU finance ministers’ group releases statement on political aspects of digital euro

The finance ministers from the eurozone countries have released a statement on the introduction of the digital euro after a meeting in Brussels. The Eurogroup meets regularly to discuss political dimensions of the potential digital currency, it said. The Jan. 16 statement coincides with the release of a European Central Bank (ECB) “stock taking” document detailing the progress of digital euro design. The Eurogroup statement addressed the need for the European Central Bank and European Commission to inform the Eurogroup and EU member states of developments in the creation of the digital euro, which is in its investigative phase. The statement said: “The Eurogroup considers that the introduction of a digital euro as well as its main features and design choices requires political decisions th...

Mexico’s digital peso delayed, launch date unclear

More than a year after it was announced, Mexico’s proposed central bank digital currency (CBDC) is still in the initial phase and unlikely to meet its 2024 launch date. According to local media reports, Mexico’s central bank, known as Banxico, is working on legal, administrative and technological requirements for the peso’s digital version. In December 2021, the local government announced its plan to introduce a national digital currency, noting in a tweet that the “new technologies and next-generation payment infrastructure” would improve Mexico’s financial inclusion. While that tweet mentioned a launch in 2024, a year later, authorities are avoiding predicting a launch date. “The result of this initial phase entails the preparation of a budget that is currentl...

China’s CBDC wallet resorts to ages-old tradition to boost adoption

China’s wallet app for its digital yuan central bank digital currency (CBDC) introduced a feature for users to send money in an electronic version of traditional “red packets” to try to attract new users. The new feature was released over the weekend, around one month ahead of the Chinese New Year on Jan. 22, as reported by the South China Morning Post on Dec. 26. The “red packets,” called hongbao in China, are traditionally used for gifting money around the Chinese New Year and other celebrations as a gesture of good luck. The rising use of digital payments has seen virtual red envelopes offered by popular local services such as WeChat Pay and Alipay. Reportedly, the e-CNY app allows a red packet to be sent to only one person, or a “lucky draw” can be set up for a group of people who will...

How crypto could be good for CBDC and vice versa: Industry exec explains

Cryptocurrencies like Bitcoin (BTC) could potentially find some mutually beneficial interactions with central bank digital currencies (CBDCs), according to one industry executive. While crypto is often associated with financial freedom, the concept of CBDC is frequently seen as the exact opposite. But this doesn’t mean that there cannot be a balance between the two, according to Itai Avneri, chief operating officer and deputy CEO at the crypto trading platform INX. CBDCs and regulated cryptocurrencies could potentially complement each other in the future as the two types of digital currencies have their own benefits, Avneri said in an interview with Cointelegraph on Dec. 22. Comparing CBDCs to regulated primary offerings, Avneri suggested that allowing or enabling crypto funds to participa...

Kazakhstan central bank recommends a phased CBDC rollout between 2023-25

Kazakhstan, the world’s third-largest Bitcoin (BTC) mining hub after the United States and China, found feasibility in launching its in-house central bank digital currency (CBDC), a digital tenge. The National Bank of Kazakhstan (NBK) revealed the finding following the completion of the second phase of testing. In late October, Binance CEO Changpeng’ CZ’ Zhao announced that Kazakhstan’s CBDC would be integrated with BNB Chain, a blockchain built by the crypto exchange. The country’s primary motivation for conducting studies on CBDC was to test its potential to improve financial inclusion, promote competition and innovation in the payments industry and increase the nation’s global competitiveness. The pilot research focused on offline payments and pr...

Brazil could cement its status as an economic leader thanks to 2024 CBDC move

As of 2022, more than 30 million Brazillian citizens have no bank accounts, and no credit or debit cards. What’s wrong here? For roughly a decade, Brazil has been passing legislation aimed at changing the situation. However, the results have fallen short of expectations. To better understand the reason, let’s take a step back to look at a historical perspective. The Brazilian banking industry has always been extremely concentrated, historically due to the country’s macroeconomic volatility, the bank’s legacy technology and stringent oversight. At one point in time, the regulator needed some reliable “bulwarks” to build the local financial system and deal with scale. Concentration was an inevitable flipside of that strategy. However, in the past few years, the balance started to shift, with...

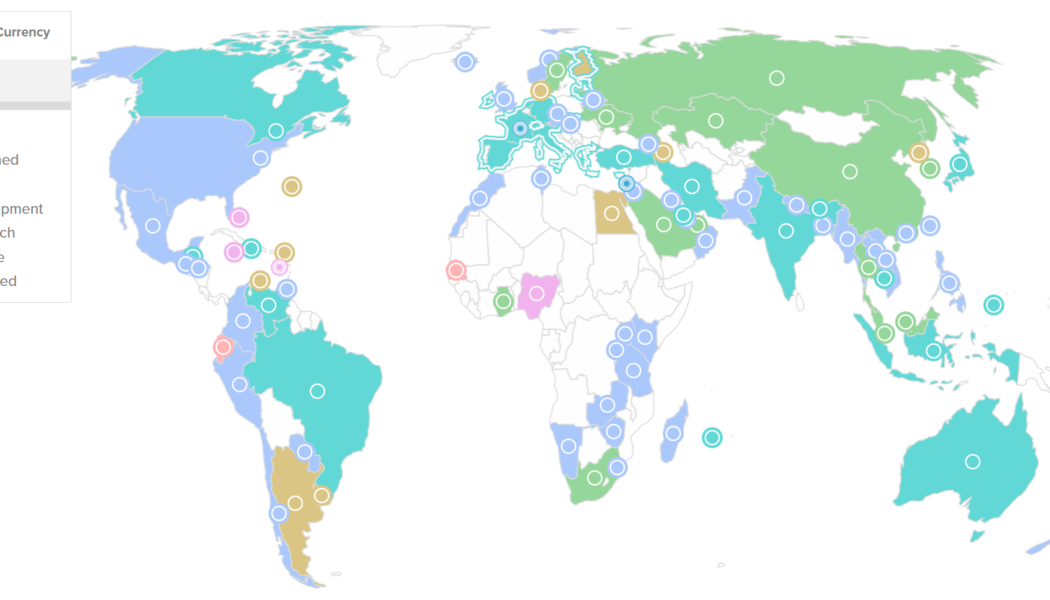

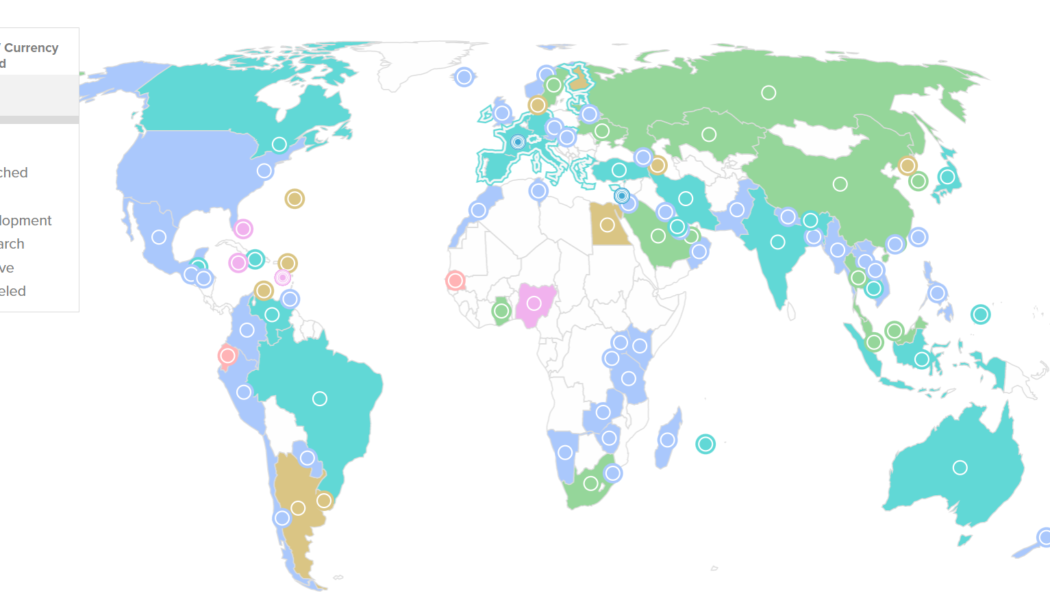

The impact of CBDCs on stablecoins with Bitget’s Gracy Chen

For over 14 years, central banks worldwide have seen blockchain technology deliver highly secure, immutable, verifiable and transparent financial ecosystems, starting with the Bitcoin network. Central bank digital currencies (CBDCs) stood out as one of the ways for fiat currency to harness a part of what cryptocurrencies achieve today. To not only keep up with rising inflation and cut down on operational costs but also to counter money laundering and related concerns, 98 of 195 countries — representing over 95% of global GDP — have either launched or are researching and developing their own versions of CBDC. Global CBDC initiatives overview. Source: Atlantic Council With CBDCs joining the race to dominate the future of finance, the relevance of the stablecoin ecosystem — cryptocurrencies b...

Pakistan launches new laws to expedite CBDC launch by 2025

Regulators worldwide see central bank digital currencies (CBDCs) as a way to enhance fiat capabilities by inheriting the financial prowess of technologies that power cryptocurrencies. Pakistan joined this list by announcing new regulations to ensure the launch of an in-house CBDC by 2025. The State Bank of Pakistan (SBP) signed in new laws for Electronic Money Institutions (EMIs) — non-bank entities offering digital payment instruments — to ensure the timely issuance of a CBDC in the next three years. The World Bank helped Pakistan design the new regulations, according to local media Arab News. In addition to timeline adherence for the CBDC launch, the regulations warrant preventive measures against money laundering and terror financing while considering consumer protection and reporting r...

Clearing company tests out securities transaction settlements on blockchain networks

The Digital Dollar Project (DDP) and the Depository Trust & Clearing Corporation (DTCC) released the results of their Security Settlement Pilot project Nov. 30. The project tested a simulated digital U.S. dollar in transactions with tokenized securities on a blockchain network under real-world conditions. The project was designed “to better understand the implications of a U.S. Central Bank Digital Currency (CBDC) on post-trade settlement,” especially on DvP (delivery versus payment) settlements, sometimes called atomic settlements, that ensure securities transfers only take place simultaneously or nearly simultaneously with payment. No U.S. CBDC has been developed or even authorized yet. DTCC managing director Jennifer Peve wrote in her company’s foreword: “These efforts, which ...

Bank of Japan to trial digital yen with three megabanks

Despite Japan’s uncertainty on whether to issue a central bank digital currency (CBDC), the Bank of Japan (BoJ) continues experimenting with a potential digital yen. The Japanese central bank has started a collaboration with three megabanks and regional banks to conduct a CBDC issuance pilot, the local news agency Nikkei reported on Nov. 23. The pilot aims to provide demo experiments for the issuance of Japan’s national digital currency, the digital yen, starting in spring 2023. As part of the trial, the BoJ is expected to cooperate with major private banks and other organizations to detect and solve any issues related to customer deposits and withdrawals on bank accounts. According to the report, the pilot will involve testing the offline functionality of Japan’s possible CBDC, targeting ...