Cashless Payments Africa

How COVID-19 Has Driven a Cashless World Through Contactless Payments

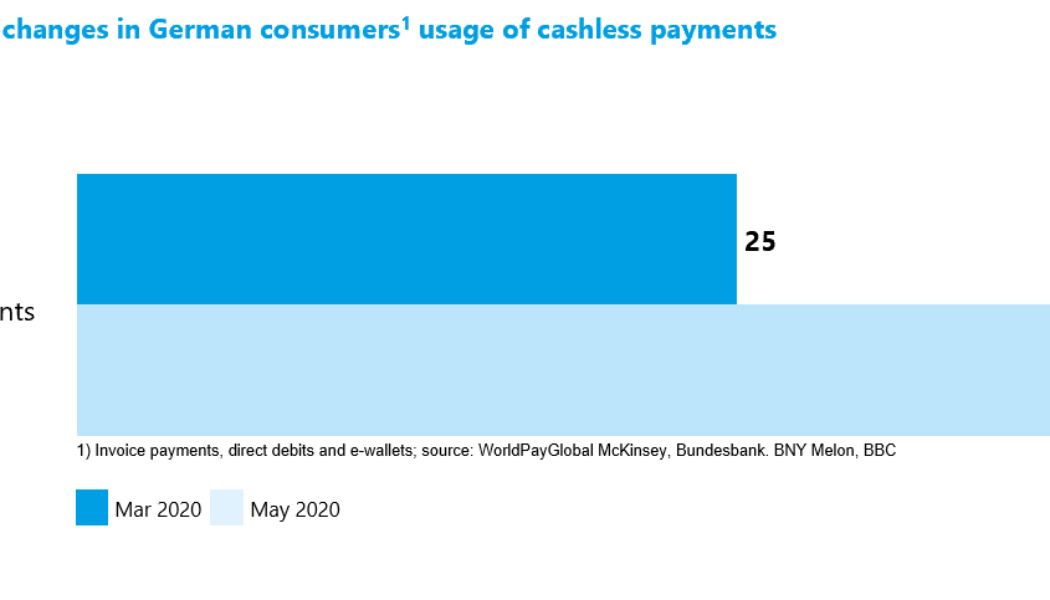

Image sourced from PYMNTS. /* custom css */ .tdi_4_560.td-a-rec-img{ text-align: left; }.tdi_4_560.td-a-rec-img img{ margin: 0 auto 0 0; } Driven by the COVID-19 pandemic, contactless payments have become the world’s preferred payment method. In addition to being safer from a viral transmission perspective, contactless payments are also faster, and integrating multiple contactless payment methods assists small businesses to better maintain financial liquidity. While choice in payment methods boosts Customer Experience (CX), we still have a way to go before South Africa fully embraces cashless payments. This will necessitate educating the population on card security and business owners on the benefits of contactless payments and the reduction of cash on hand. Formal vs Informal Trading /* c...

Is Africa Heading towards a Cashless Society?

Sourced from Redbubble and iStock. Cash may have traditionally been king, but Covid-19 has contributed to a faster pace of digital payment adoption. Recently, two global fintech players discussed the emergence of a plethora of digital payments and debated if cash is on its way out. Omosalewa Adeyemi, Head of Global Partnerships and Expansion at Flutterwave and Nicolas Vonthron, co-CEO of Mama Money; explored the future of payments and banking in an increasingly digital world. Sending money home during the lockdown Vonthron says Mama Money’s digital offering grew five times during lockdown as users look for ways to send money home online following sudden border closures. “There are 5 million migrants in South Africa who came to find a better future for their families. At Mama Money, w...