Cardano

Price analysis 6/10: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, AVAX, SHIB

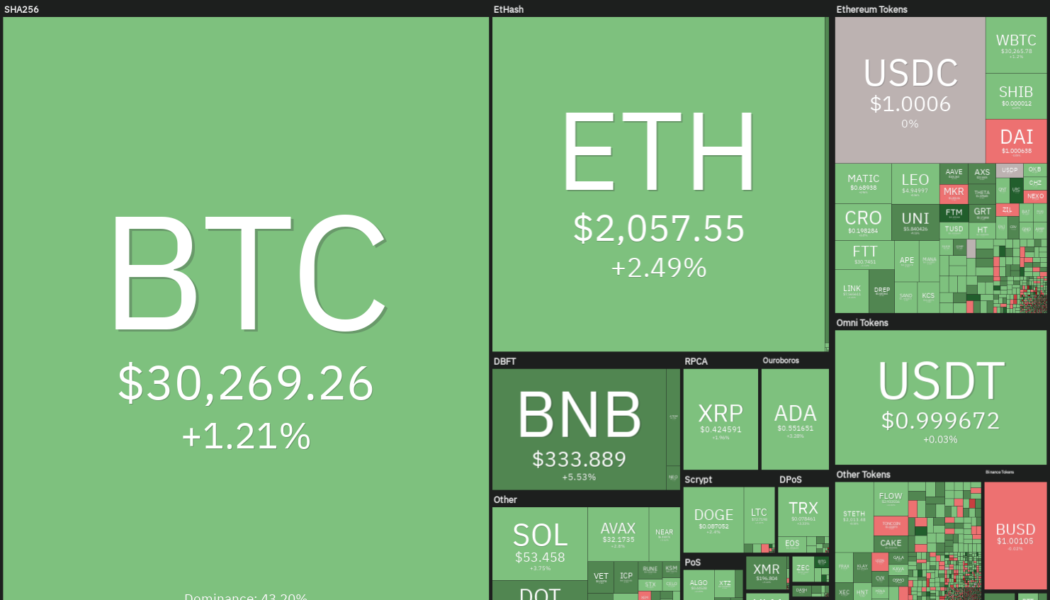

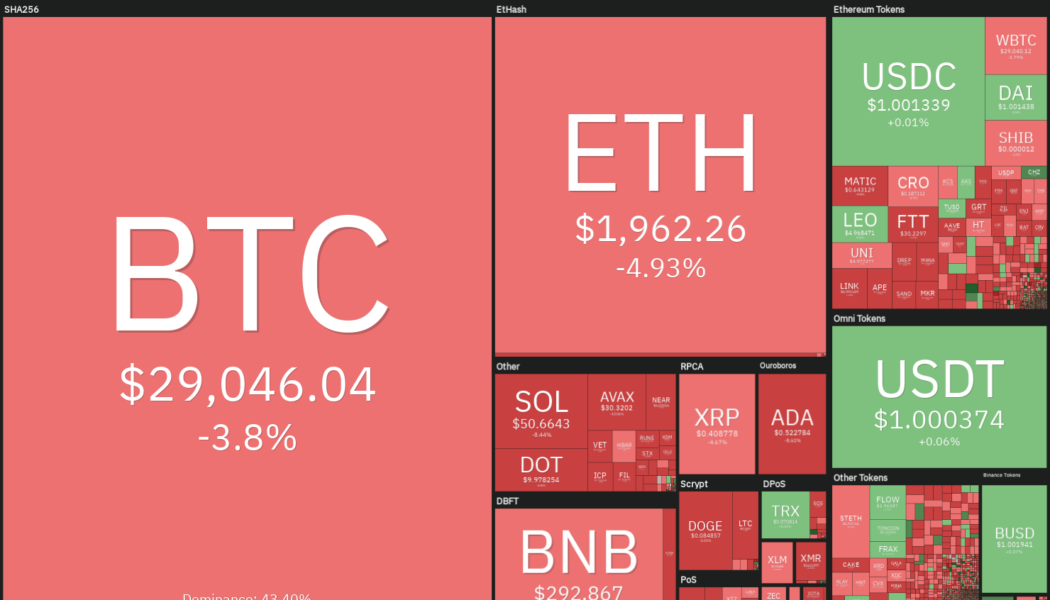

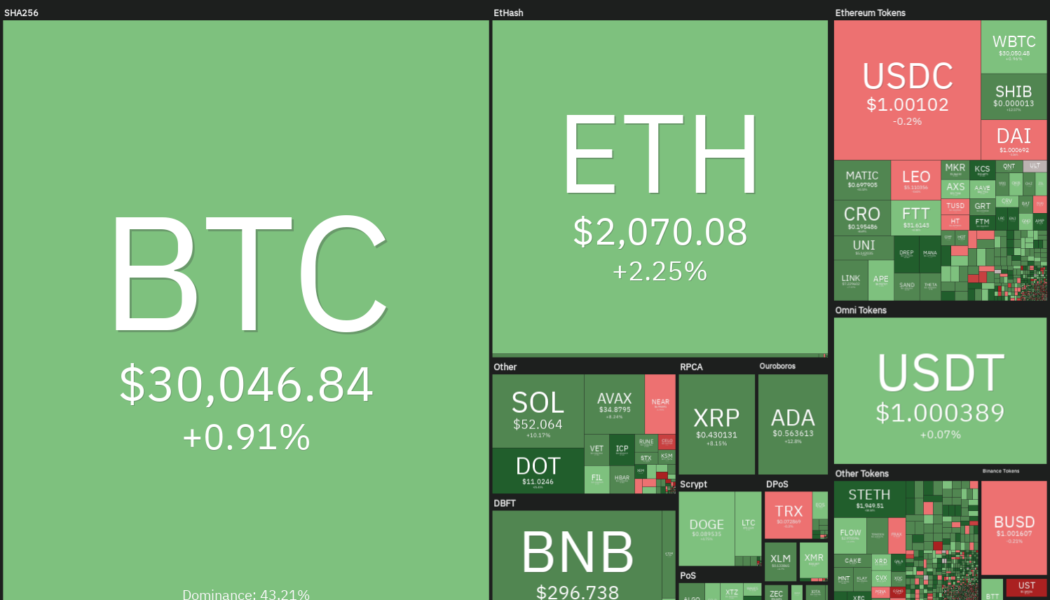

The United States equities markets tumbled on June 10 after the Consumer Price Index (CPI) report showed inflation soaring 8.6% from a year ago, the highest increase since 1981. The latest figures show that talks of inflation having peaked were premature and according to Bloomberg, investors are pricing in the key interest rate of 3% by the end of the year. Continuing its tight correlation with the S&P 500, Bitcoin (BTC) dipped below $30,000 on June 10. Analysts are still divided about the near-term price action but Fundstrat co-founder Tom Lee said in an interview with CNBC that Bitcoin may have already bottomed. However, Lee seems to have toned down his expectations as he said that Bitcoin could “remain flat for the year, possibly up.” Daily cryptocurrency market performance. So...

Ethereum 2.0 vs. the top Ethereum killers|The Market Report

“The Market Report” with Cointelegraph is live right now. On this week’s show, Cointelegraph’s resident experts give you the details about Ethereum 2.0, its main competitors, and how they differ from each other. To kick things off, we break down the latest news in the markets this week. Here’s what to expect in this week’s markets news breakdown: Bitcoin ‘Bart Simpson’ returns as BTC price dives 7% in hours: Bitcoin (BTC) price action failed to crack $32,000 and headed back to square one, sparking $60 million of long liquidations in the process. How much longer will we stay in the current price range? What is it going to take for Bitcoin to break out from here? Bad day for Binance with SEC investigation and Reuters exposé: The United States Securities and Exchange Commission...

Top 5 cryptocurrencies to watch this week: BTC, ADA, XLM, XMR, MANA

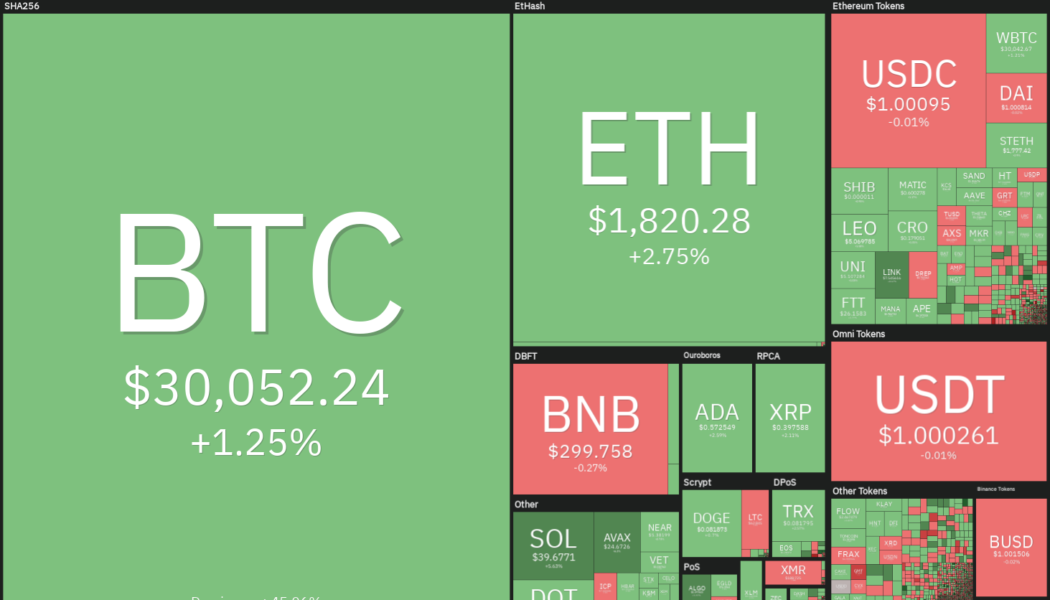

The bears are trying to extend Bitcoin’s (BTC) record of nine consecutive red weekly candles to ten weeks, but the bulls are trying to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former CEO of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the range of $25,000 to $27,000. On-chain data from Glassnode shows that smart money may have started accumulating Bitcoin. The net outflows from major cryptocurrency exchanges reached 23,286 Bitcoin on June 3, the highest since May 14. Crypto market data daily view. Source: Coin360 Another positive sign of accumulation is that investment into Bitcoin exchange-traded products (ETPs) was strong in May and has only risen further in the first two days of June, according to an Arcane Research report. The...

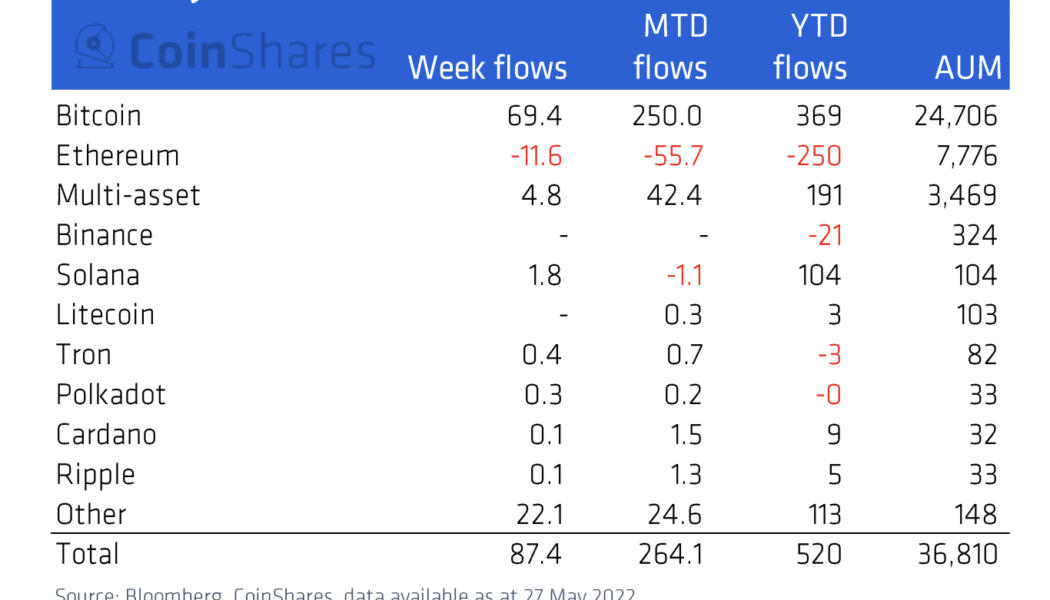

3 reasons Ethereum price risks 25% downside in June

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...

Total crypto market cap risks a dip below $1 trillion if these 3 metrics don’t improve

The total crypto market capitalization has ranged from $1.19 trillion to $1.36 trillion for the past 23 days, which is a relatively tight 13% range. During the same time, Bitcoin’s (BTC) 3.5% and Ether’s (ETH) 1.6% gains for the week are far from encouraging. To date, the total crypto market is down 43% in just two months, so investors are unlikely to celebrate even if the descending triangle formation breaks to the upside. Total crypto market cap, USD billion. Source: TradingView Regulation worries continue to weigh investor sentiment, a prime example being Japan’s swift decision to enforce new laws after the Terra USD (UST) — now known as TerraUSD Classic (USTC) — collapse. On June 3, Japan’s parliament passed a bill to limit stablecoin issuing to licensed banks, registered money t...

Here are 3 altcoins that could surge once Bitcoin flips $35K to support

Bitcoin (BTC) and the wider cryptocurrency market are taking a breather after the rally on May 31. Meanwhile, most altcoins remain severely oversold, with most between 70% and 90% below their all-time highs. Total altcoin index capitalization What is clear is that fear is everywhere and blood is in the water. Risk-on markets are suffering worldwide, but it is exactly these kinds of conditions that create opportunities where professional money accumulates and adds to positions. Let’s take a look at three altcoins that could be positioned for a rebound if the broader market enters a new uptrend. ADA could be setting up for an 80% surge Cardano (ADA) has a significantly bullish update coming very soon. The much anticipated Vasil hard fork, which increases performance and adds more Plutu...

Price analysis 5/30: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

After creating the dubious record of nine successive red weekly closes, Bitcoin (BTC) is attempting to make amends by starting a price recovery to end the losing streak. Analysts have repeatedly said that investors should not fear a bear market because it is one of the best times to invest in fundamentally strong projects in preparation for the next bull phase. CryptoQuant CEO Ki Young Ju highlighted that unspent transaction outputs (UTXOs) that are older than six months reflect 62% of the realized cap, which is similar to the level seen during the March 2020 crash. Hence, Ki said that Bitcoin may be close to forming a cyclic bottom. Daily cryptocurrency market performance. Source: Coin360 In the current bearish environment, it is difficult to fathom a Bitcoin rally to $250,000 ...

Crypto funds under management drop to a low not seen since July 2021

Digital asset investment products saw $141 million in outflows during the week ending on May 20, a move that reduced the total assets under management (AUM) by institutional funds down to $38 billion, the lowest level since July 2021. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, Bitcoin (BTC) was the primary focus of outflows after experiencing a decline of $154 million for the week. The removal of funds coincided with a choppy week of trading that saw the price of BTC oscillate between $28,600 and $31,430. BTC/USDT 1-day chart. Source: TradingView Despite the sizable outflow, the month-to-date BTC flow for May remain positive at $187.1 million, while the year-to-date figure stands at $307 million. On a more positive note, the multi-asset cat...

Price analysis 5/23: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

The United States equity markets are attempting a recovery after weeks of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto market to recover, but they anticipate Bitcoin (BTC) to spend some time in a range before “a real breakout.” The seven-day moving average of the on-chain transaction volume tracked by Glassnode hit a nine-month low on May 23. This suggests that Bitcoin’s lackluster price action in 2022 has led to reduced participation from traders. Daily cryptocurrency market performance. Source: Coin360 While signs of a short-term recovery are visible, a sustained recovery could be difficult because the macro conditions remain challenging. International Monetary Fund managing director Kristalina Georgieva wrote in a blog post...

Price analysis 5/18: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

On May 17, United States Federal Reserve Chairman Jerome Powell told the Wall Street Journal that the 50-basis-point rate hikes would continue until inflation is under control. Powell’s emphasis on a hawkish policy suggests that monetary conditions are likely to remain tight in 2022, which could limit the upside in risky assets. On-chain market intelligence firm Glassnode said that historically, Bitcoin (BTC) has bottomed out when the price breaks below the realized price. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s price stayed below the realized price for anywhere between 114 to 299 days. This suggests that if macro situations are not favorable, a quick recovery is unlikely. Daily cryptocurrency market performance. Source: Coin360 While the curre...

Ethereum in danger of 25% crash as ETH price forms classic bearish technical pattern

Ethereum’s native token Ether (ETH) looks ready to undergo a breakdown move in May as it forms a convincing “bear pennant” structure. ETH price to $1,500? ETH’s price has been consolidating since May 11 inside a range defined by two converging trendlines. Its sideways move coincides with a drop in trading volumes, underscoring the possibility that ETH/USD is painting a bear pennant. Bear pennants are bearish continuation patterns, meaning they resolve after the price breaks below the structure’s lower trendline and then falls by as much as the height of the previous move downside (called the flagpole). ETH/USD two-hour price chart. Source: TradingView As a result of this technical rule, Ether risks closing below its pennant structure, followed by additional mo...

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...