Cardano

Price analysis 9/14: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

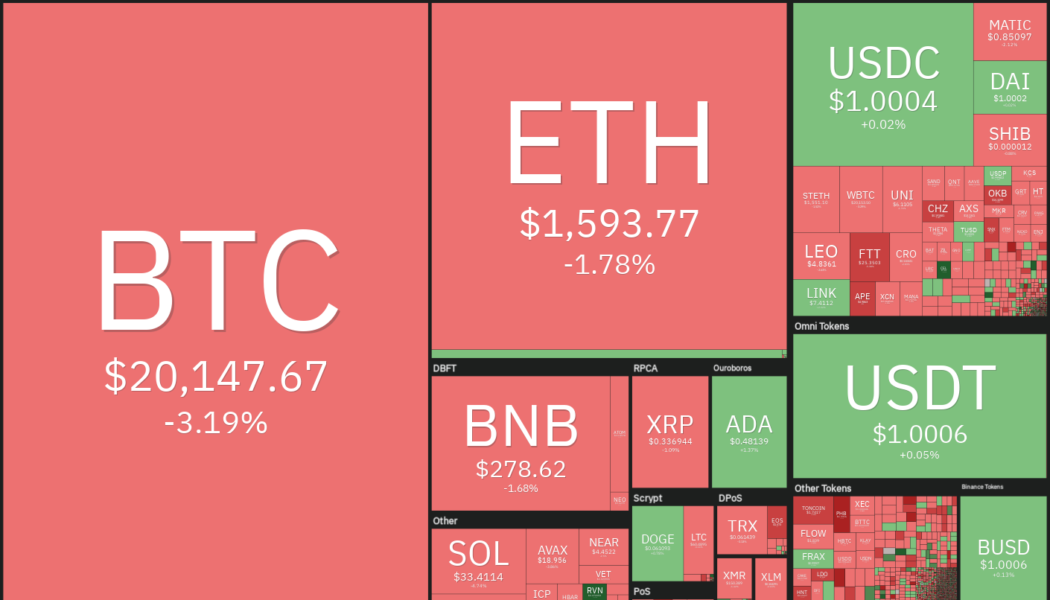

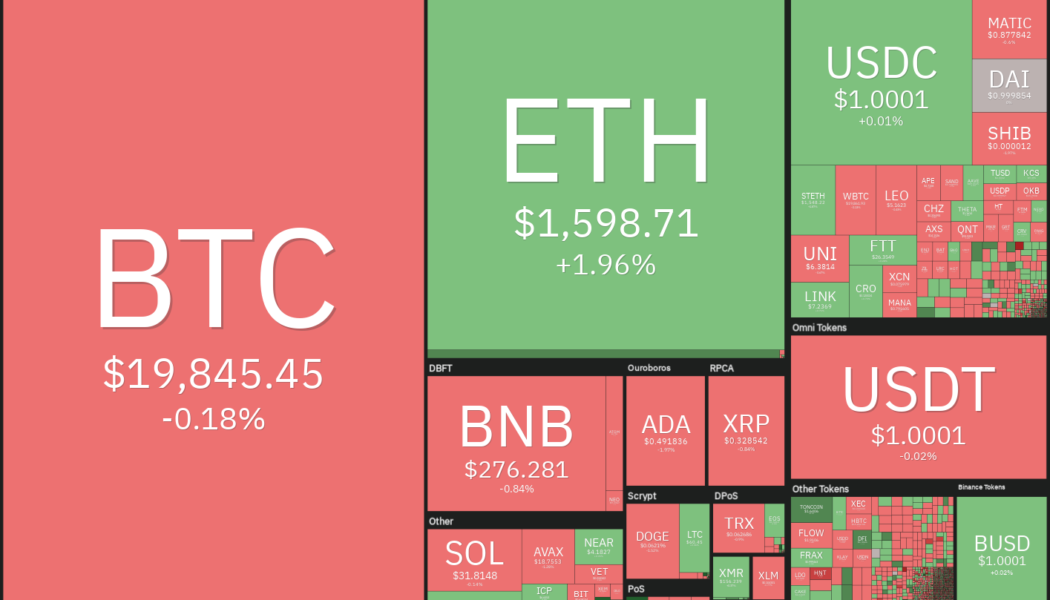

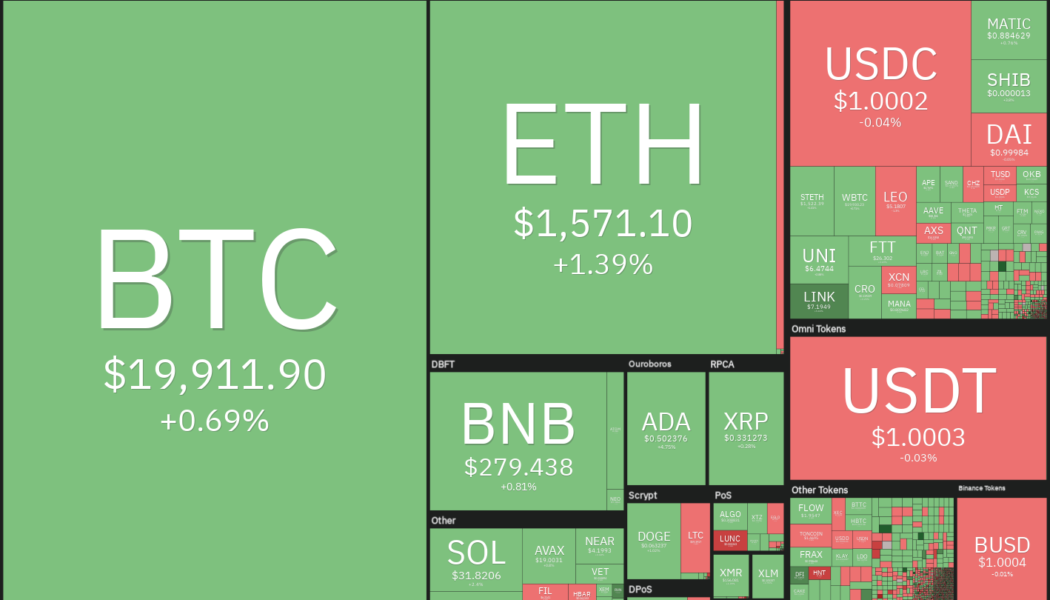

The United States equities markets and the cryptocurrency markets had been rising leading up to the Sept. 13 release of the August consumer price index data, but the rally fell apart once the data showed inflation rising, rather than falling. The negative data dashed any hope of a Federal Reserve pivot in the near term and it triggered a sharp decline in risky assets. The market capitalization of U.S. stocks plunged by about $1.6 trillion on Sept. 13 and the market cap of the cryptocurrency markets slipped below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 Statistician and independent market analyst Willy Woo, believes that Bitcoin (BTC) may have to fall further before it reaches the maximum pain experienced during previous bottoms. Woo expects Bitcoin price to dec...

Price analysis 9/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The cryptocurrency markets have been quiet over the weekend. The sideways price action continues on Sept. 5 and there are unlikely to be any fresh triggers from the United States equities markets, which are closed for Labor Day. However, the bullish picture for cryptocurrencies looks clouded as the energy crisis in Europe sent the euro to a two-decade low versus the U.S. dollar. Meanwhile, the U.S. dollar index (DXY) which has an inverse correlation with the equities markets and cryptocurrencies soared above 110 for the first time since June 2002. Daily cryptocurrency market performance. Source: Coin360 A positive sign among all the mayhem is that Bitcoin (BTC) has not given up much ground over the past few days and continues to trade near the psychological level of $20,000. This suggests ...

A range-break from Bitcoin could trigger buying in ADA, ATOM, FIL and EOS this week

The decline in the United States equities markets last week extended the market-wide losing streak to three consecutive weeks. The Nasdaq Composite fell for six days in a row for the first time since 2019. The markets negative reaction to a seemingly positive August jobs report suggests that traders are nervous about the Federal Reserve’s future steps and its effects on the economy. Weakness in the U.S. equities markets pulled Bitcoin (BTC) back below $20,000 on Sept. 2 and bears sustained the price below the level during the weekend. This pulled Bitcoin’s market dominance to just under 39% on Sept. 4, its lowest level since June 2018, according to data from CoinMarketCap. Crypto market data daily view. Source: Coin360 Although the sentiment remains negative and it is difficult to call a b...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...

Cardano gets listed on Robinhood but ADA bulls are running out of steam, risking 40% drop

ThCardano (ADA) market has witnessed back-to-back pieces of good news since Aug. 31, from its listing on Robinhood, a U.S.-based retail investment platform, to the release of its first lending and borrowing protocol, Aada Finance. Additionally, Cardano developer IOHK stated that they are close to clinching “three critical mass indicators” that would lead to the launch of their long-awaited Vasil hard fork in September. Vasil aims to improve Cardano’s scalability and transaction throughput through pipelining. The upgrade could also improve the decentralized application (DApp) and smart contract capabilities by changing the Plutus script, a programming language used for smart contracts on the Cardano blockchain. This week, we’re well on our way to hitting our...

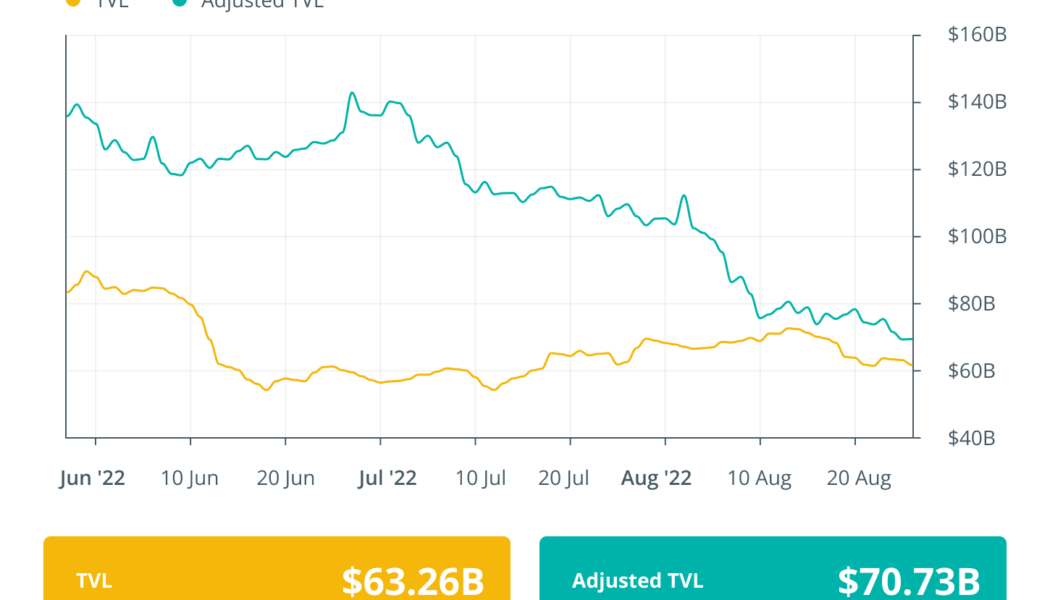

Hacker tries to exploit bridge protocol, fails miserably: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, there were some major developments in the run-up to the upcoming Ethereum Merge slated for Sept. 15. Bitfinex became the latest crypto exchange to throw its support behind the chain split token. While DeFi bridge hacks have become a norm this year, developers behind Rainbow Bridge managed to foil an exploit attempt within seconds, leading to the hacker losing their safety deposit. The Tornado Cash developer who was arrested last week was sent to 90-day judicial custody awaiting charges. It didn’t go down well with the crypto community, who have actively rallied behind the developer and have accused...

Price analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Federal Reserve Chairman Jerome Powell warned that the central bank will continue to use the “tools forcefully” to bring down inflation, which is close to its highest level in 40 years. He cautioned that the restrictive policy may remain for some time and warned that it could “bring some pain to households and businesses.” The United States equities markets reacted negatively to Powell’s comments with the Dow Jones Industrial Average dropping more than 600 points. The cryptocurrency markets also witnessed sharp selling with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Daily cryptocurrency market performance. Source: Coin360 Along with a not-so-supportive macro environment, Bitcoin’s historical data for September also presents a negative picture...

Cardano hard fork ‘ever closer’ as upgraded SPOs account for 42% of blocks

Input Output Hong Kong (IOHK), the blockchain company behind the Cardano network says the much anticipated Vasil hard fork is “ever closer” after revealing the state of three critical indicators that will trigger the mainnet update. In a Twitter thread posted on Aug. 25, IOHK shared its latest “rollout status” of the Vasil upgrade to its 265,800 followers, with updates on “three critical mass indicators” which will determine when the mainnet update will go ahead. This includes having 75% of mainnet blocks produced by nodes running 1.35.3, around 25 exchanges upgraded (representing 80% of liquidity) as well as the top ten key mainnet Dapps also having upgraded. on Thursday, the blockchain company noted that Stake Pool Operators (SPOs) running the latest node 1.35.3 now account fo...

Price analysis 8/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

Bitcoin (BTC) and several major cryptocurrencies have been trading sideways as traders avoid taking large bets before the United States Federal Reserve’s Jackson Hole Economic Symposium, which begins on Aug. 25. The volatility is likely to soar as investors get some clarity on the Fed’s stance in the next few days. On Aug. 23, a team led by Goldman Sachs chief economist Jan Hatzius said that Fed chair Jerome Powell could sound dovish when he speaks on Aug. 26, reiterating that the central bank may move at a slower pace in future meetings. The analysts expect the Fed to raise rates by 50 basis points in the September meeting, which would be less than the 75 bps hike done in June and July. Daily cryptocurrency market performance. Source: Coin360 Although the short-term price...

Price analysis 8/19: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) and most major altcoins witnessed a sharp sell-off on Aug. 19, but there does not seem to be a specific trigger for the sudden drop. The sharp fall resulted in liquidations of more than $551 million in the past 24 hours, according to data from Coinglass. Barring a V-shaped bottom, other formations generally take time to complete as buyers and sellers try to gain the upper hand. This tends to cause several random volatile moves that may be an opportunity for short-term traders, but long-term investors should avoid getting sucked into the noise. Daily cryptocurrency market performance. Source: Coin360 Glassnode data shows that investors who purchased Bitcoin in 2017 or earlier are just doing that by holding their positions. The percentage of Bitcoin supply dormant for at least ...

EOS price jumps 20% for biggest gain in 15 months — What’s fueling the uptrend?

EOS rose approximately 20% to reach $1.66 on Aug. 17 and was on track to log its best daily performance since May 2021. Initially, the EOS rally came in the wake of its positive correlation with top-ranking cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which gained over 2% and 3.75%, respectively. But, the upside move was also driven by a flurry of uplifting updates emerging from the EOS ecosystem. EOS/USD daily price chart. Source: TradingView EOS incentive program launch On Aug. 14, the EOS Network Foundation (ENF), a nonprofit organization that oversees the growth and development of the EOS blockchain, opened registrations for its upcoming Yield+ incentive program. The Yield+ is a liquidity incentive and reward program to attract decentralized finance (DeFi) application...

Price analysis 8/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) has been witnessing a tough battle between the bulls and the bears near the $25,000 level. A clear winner may not emerge in the short term due to a lack of a catalyst and because there is no major macroeconomic data scheduled for this week in the United States. Data points from Asia or Europe may increase volatility, but they are unlikely to start a new directional move. Anthony Scaramucci, founder and managing partner of Skybridge Capital, in an interview with CNBC, advised investors to ride out the current uncertainty in cryptocurrencies and “stay patient and stay long term.” He expects Bitcoin to reward investors immensely with a sharp uptrend over the next six years. Daily cryptocurrency market performance. Source: Coin360 Along with the focus on Bitcoin, investors are al...