Cardano

Price analysis 10/21: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

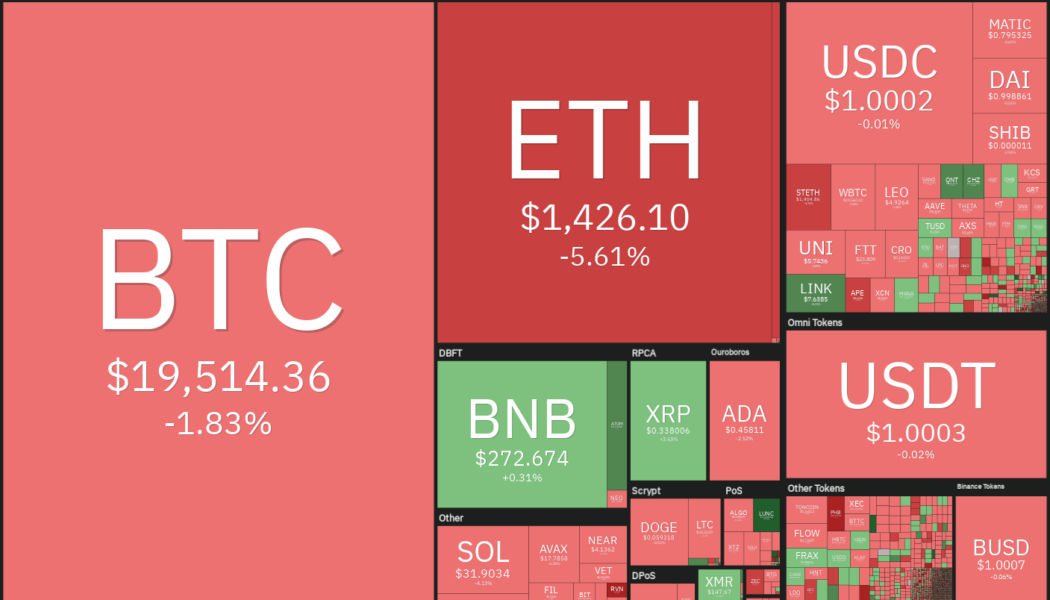

The 10-year Treasury yield in the United States rose to its highest level since 2008. Although this type of rally is usually negative for risky assets, the U.S. stock markets recovered ground after the Wall Street Journal reported that some officials of the Federal Reserve were concerned about the pace of the rate hikes and the risks of over-tightening. While it is widely accepted that the U.S. will enter a recession, a debate rages on about how long it could last. On that, Tesla CEO Elon Musk recently said on Twitter that the recession could last “probably until spring of ‘24,” and added that it would be nice to spend “one year without a horrible global event.” Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s (BTC) price has witnessed a massive drop from its all-time hig...

Cardano price chart paints ‘Burj Khalifa’ with 7-month losing streak — More losses ahead?

Cardano (ADA) price is in the process of painting its seventh red monthly candle in a row as the token fell to its lowest level since February 2021. The trend saw ADA’s price rising nearly 800% to $3.16 between February 2021 and September 2021, followed by a complete wipeout of those gains entering October 2022. Amusingly, the entire price action took the shape of the “Burj Khalifa,” the world’s tallest skyscraper in Dubai. Ada Khalifa pic.twitter.com/KE2SxTO3bN — Trader_J (@Trader_Jibon) October 19, 2022 ADA price eyes 35% price crash The ADA price correction began primarily in the wake of a similar downtrend across the cryptocurrency market, led by the Federal Reserve’s aggressive interest rate hikes to tame rising inflation. Even an optimistic Cardano netwo...

Price analysis 10/14: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, MATIC

The United States Consumer Price Index (CPI) increased 8.2% annually in September, beating economists’ expectations of an 8.1% rise. The CPI print lived up to its hype and caused a sharp, but short-term increase in volatile risk assets. The S&P 500 oscillated inside its widest trading range since 2020 and Bitcoin (BTC) also witnessed a large intraday range of more than $1,323 on Oct. 13. However, Bitcoin still could not shake out of the $18,125 to $20,500 range in which it has been for the past several days. Daily cryptocurrency market performance. Source: Coin360 Both the U.S. equities markets and Bitcoin tried to extend their recovery on Oct. 14 but the higher levels attracted selling, indicating that the bears have not yet given up. Could the increased volatility culminate wit...

Price analysis 9/30: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The United States equities markets have been under a firm bear grip for a large part of the year. The S&P 500 and the Nasdaq Composite have declined for three quarters in a row, a first since 2009. There was no respite in selling in September and the Dow Jones Industrial Average is on track to record its worst September since 2002. These figures outline the kind of carnage that exists in the equities market. Compared to these disappointing figures, Bitcoin (BTC) and select altcoins have not given up much ground in September. This is the first sign that selling could be drying up at lower levels and long-term investors may have started bottom fishing. Daily cryptocurrency market performance. Source: Coin360 In the final quarter of the year, investors will continue to focus on the inflat...

Price Analysis 9/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The United Kingdom is in focus following the British pound’s fall to a new all-time low against the United States dollar. The sell-off was triggered by the aggressive tax cuts announced by Prime Minister Liz Truss’s government. The 10-year gilt yields have soared by 131 basis points in September, on track for its biggest monthly increase since 1957, according to Reuters. The currency crisis and the soaring U.S dollar index (DXY) may not be good news for U.S. equities and the cryptocurrency markets. A ray of hope for Bitcoin (BTC) investors is that the pace of decline has slowed down in the past few days and the June low has not yet been re-tested. Daily cryptocurrency market performance. Source: Coin360 That could be because Bitcoin’s long-term investors do not seem to be panicking. Data f...

Charles Hoskinson and ETH dev get into a war of words post-Vasil upgrade

Charles Hoskinson, the founder of Cardano and co-founder of Ethereum blockchain, got into a war of words with Ethereum developers on the implementation of proof-of-stake (PoS) consensus via Merge. On Sunday, Web3 investor Evan Van Ness shared an unpopular opinion claiming that the Ethereum Merge could have been shipped earlier. Vitalik Buterin, the co-founder of Ethereum, agreed to Van Ness’s comments and said they should have implemented NXT-like chain-based PoS. Hoskinson joined in the conversation claiming the Ethereum developers should have implemented snow white protocol instead to ensure a faster migration to proof-of-stake (PoS) consensus. You should have just implemented snow white with Elaine’s help. It would have saved you a heck of a lot of pain and effort. — Charles Hoski...

Price analysis 9/23: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The S&P 500 index has declined about 5% this week while the Nasdaq Composite is down more than 5.5%. Investors fear that the Federal Reserve’s aggressive rate hikes could cause an economic downturn. The yield curve between the two-year and 10-year Treasury notes, which is watched closely by analysts for predicting a recession, has inverted the most since the year 2000. Among all the mayhem, it is encouraging to see that Bitcoin (BTC) has outperformed both the major indexes and has fallen less than 4% in the week. Could this be a sign that Bitcoin’s bottom may be close by? Daily cryptocurrency market performance. Source: Coin360 On-chain data shows that the amount of Bitcoin supply held by long-term holders in losses reached about 30%, which is 2% to 5% below the level that coinci...

Fork, yeah! Cardano Vasil upgrade goes live

After several months of delays, the Cardano Vasil upgrade and hard fork has finally gone live as of Thursday at 9:44 pm UTC, bringing “significant performance and capability” enhancements to the blockchain. The success of the Cardano mainnet hard fork was announced by blockchain company Input Output Hong Kong (IOHK) on Twitter on Thursday, while others also observed the hard fork tick over in a live Twitter Spaces with Cardano co-founder Charles Hoskinson. #Vasil mainnet HFC event successful! We’re happy to announce that today, at 21:44:00 UTC, the IOG team, in collaboration with the @CardanoStiftung, successfully hard forked the Cardano mainnet via a HFC event, thus deploying new #Vasil features to the chain.1/5 — Input Output (@InputOutputHK) September 22, 2022 IOHK previously stated the...

Cardano Vasil upgrade ready with all ‘critical mass indicators’ achieved

The Cardano Vasil upgrade is set to take place in less than 24 hours on Sept. 22, with the Cardano team noting all three “critical mass indicators” needed to trigger the upgrade are now met. A Sept. 21 update on Twitter by the company behind Cardano, Input Output Hong Kong (IOHK) states within the last 48 hours 13 cryptocurrency exchanges had confirmed their readiness for the hard fork, representing over 87% of Cardano’s (ADA) liquidity. With this latest addition we have met all 3 critical mass indicators: 39 exchanges upgraded (87,59% by liquidity)Over 98% of mainnet blocks are now being created by the Vasil node (1.35.3)The top Cardano #DApps by TLV have confirmed they have tested and are ready — Input Output (@InputOutputHK) September 21, 2022 Of the top exchanges for ADA liquidity, Coi...

Price analysis 9/21: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

The Federal Reserve hiked rates by 75 basis points on Sept. 21 and Fed Chair Jerome Powell projected another 125 basis points increase before the end of the year. If that happens, it will take the benchmark rate to 4.4% by the end of the year, which is sharply higher than the June estimates of 3.8%. The Fed also intimated that it only expects rate cuts to be considered in 2024. The expectation of higher rates pushed the 2-year Treasury to 4.1%, its highest level since 2007. This could attract several investors who are looking for safety in this uncertain macro environment. Higher rates are also likely to reduce the appeal of risky assets such as stocks and cryptocurrencies and may delay the start of a new uptrend. Daily cryptocurrency market performance. Source: Coin360 Even though Bitcoin...

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Ethereum Merge: Community reacts with memes, GIFs and tributes

It’s been less than a day since Ethereum’s historic transition to proof-of-stake, with most of the crypto community still abuzz with excitement following the successful Merge. On Sept. 15 at 06:42:42 UTC, the last Ethereum block using the old proof-of-work consensus mechanism was mined. Replacing it is an energy-efficient proof-of-stake consensus mechanism. Many crypto enthusiasts and climate advocates worldwide have been thrilled by the positive impact it will have on the environment and thus, crypto’s reputation. Others have just been in awe of the technological feat of upgrading an entire blockchain network without any stoppages. Ethereum Ethereum30 minutes ago Now pic.twitter.com/cyQb3pAdtt — WolfOfEthereum.eth ️ (@Crypto_Wolf_Of) September 15, 2022 Uniswap Labs founder and CEO ...