Cardano

Price analysis 1/17: SPX, DXY, BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT

Risk assets have started the new year on a strong note. The S&P 500 (SPX) and the Nasdaq closed in the positive for the second successive week and also notched their best weekly performance since November. Bitcoin (BTC) led the recovery in the crypto markets with a sharp 21% rally last week. That sent the Bitcoin Fear and Greed Index into the neutral territory of 52 on Jan. 15, its highest since April 5, 2022. However, the index has given back its gains and is again back into the Fear zone on Jan. 17. Daily cryptocurrency market performance. Source: Coin360 The strong rally in Bitcoin has divided analysts’ opinions. While some expect the rally to be a bull trap, others believe that the up-move could be the start of a new bull market. The confirmation of the same will happen...

Price analysis 1/6: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

The United States December nonfarm payrolls report showed a growth of 223,000 jobs, above the market’s expectation of an increase of 200,000 jobs. While this shows that the economy remains strong, market observers shifted their focus to the slower wage growth of 0.3% for the month, below economists’ expectation of 0.4%. In addition, the euro zone’s headline inflation dropped from 10.1% in November to 9.2% in December. Both economic data boosted hopes that the central bank’s aggressive rate tightening may slow down. This triggered a rally in the U.S. and European stock markets. Daily cryptocurrency market performance. Source: Coin360 However, the reaction in the cryptocurrency space remains muted, with Bitcoin (BTC) continuing to trade inside a narrow range. The crypto investors...

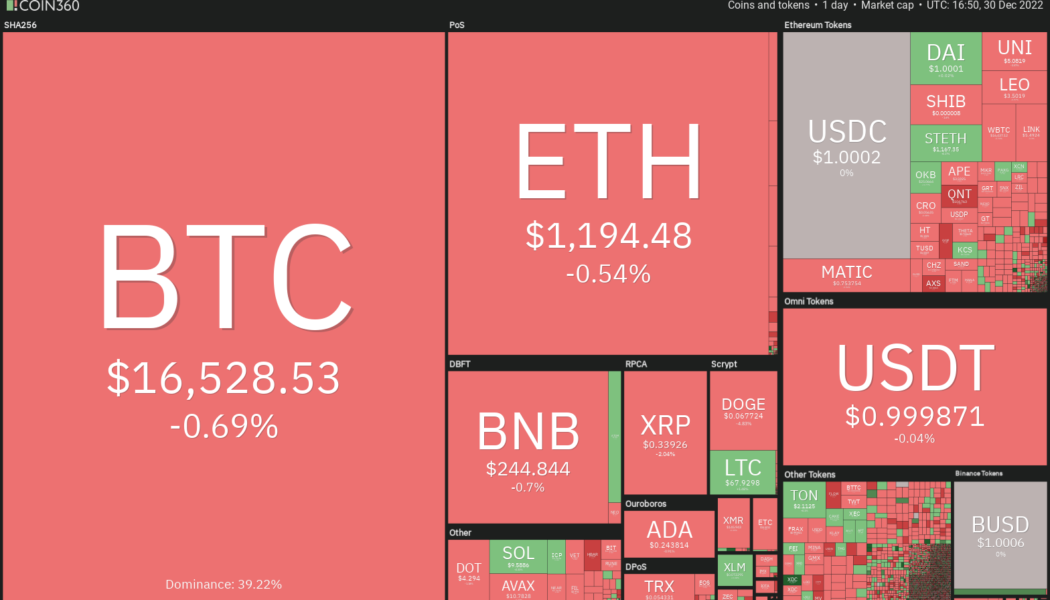

Price analysis 12/30: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Investors have faced a tumultuous year in 2022 as stocks, bonds, and the cryptocurrency sector have all witnessed sharp declines. As of Nov. 30, the performance of a traditional portfolio comprising 60% stocks and 40% bonds has been the worst since 1932, according to a report by Financial Times. The next big question troubling crypto investors is whether the pain in Bitcoin (BTC) is over or will the downtrend continue in 2023. Analysts seem to be divided in their opinion for the first quarter of the new year. While some expect a drop to $10,000 others anticipate a rally to $22,000. Daily cryptocurrency market performance. Source: Coin360 While the near-term remains uncertain, research and trading firm Capriole Investments said in its latest edition of the Capriole Newsletter that Bitcoin c...

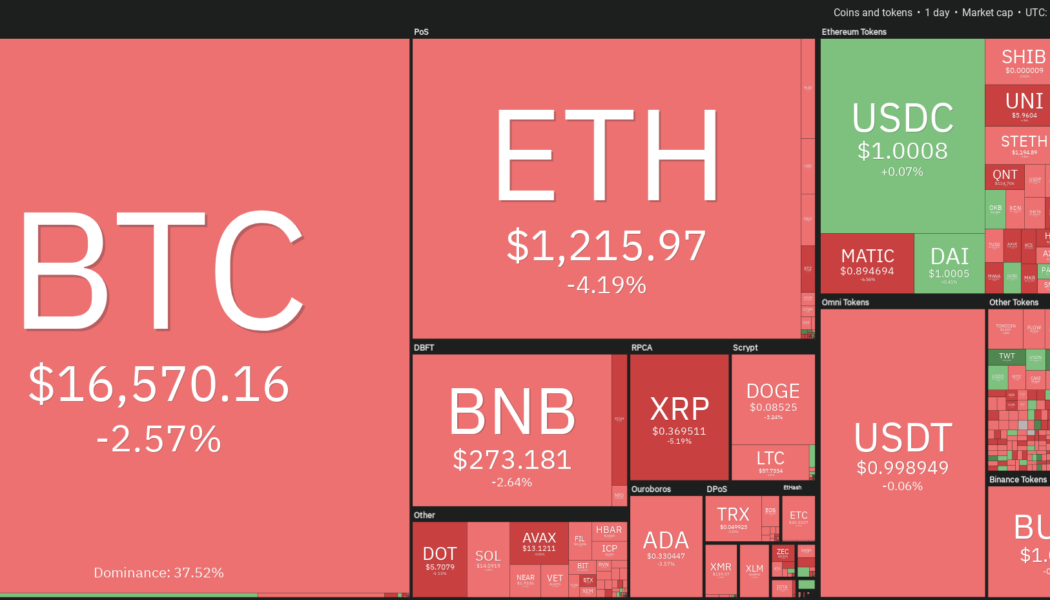

Price analysis 12/28: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Gold has been an outperformer in 2022 compared to the United States equities markets and Bitcoin (BTC). The yellow metal is almost flat for the year while the S&P 500 is down more than 19% and Bitcoin has plunged roughly 64%. The sharp fall in Bitcoin’s price has hurt both short-term and long-term investors alike. According to Glassnode data, 1,889,585 Bitcoin held by short-term holders was at a loss as of Dec. 26 while the loss-making tally of long-term holders was 6,057,858 Bitcoin. Daily cryptocurrency market performance. Source: Coin360 In spite of gold’s good showing and Bitcoin’s dismal performance in 2022, billionaire investor Mark Cuban continues to favor Bitcoin over gold. While speaking on Bill Maher’s Club Random podcast, Cuban told Maher, “If you have gold, you’re dum...

Metacade (MCADE), Cardano (ADA) and Solana (SOL) Price Forecast for Q1 2023

The year 2023 is shaping up to be an exciting time for cryptocurrency investors, with several projects set to make significant moves in the market. This article will dive into the factors likely to influence the first-quarter prices of Metacade, Cardano, and Solana, offering price forecasts and an outlook for each. What is Metacade (MCADE)? Metacade is a new play-to-earn (P2E) community hub that aims to play a pivotal role in the future of gaming. It’s a place for anyone looking to connect with like-minded gamers, explore the fast-growing GameFi space, and discover how to earn more from P2E gaming. On the platform, you’ll find forums, reviews, leaderboards, alpha, and an entire virtual arcade designed specifically for Web3. One of the key aspects of Metacade is its communi...

Price analysis 12/23: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

Bitcoin (BTC) is on track to end the year with a loss of about 65%. This would mark the third negative year for Bitcoin with the other two being 2014 and 2018. In comparison, the S&P 500 has fared much better but that is also down close to 20% in 2022. Although cryptocurrency prices have seen deep cuts this year, traders have continued to plow money into the space. An online survey conducted by Blockchain.com shows that 41% of the respondents bought crypto this year and 40% plan to purchase crypto in the next year. Daily cryptocurrency market performance. Source: Coin360 However, a sustained recovery in risk-assets may happen only after inflation shows signs of cooling. That would raise expectations of a pivot by the United States Federal Reserve from its aggressive monetary ...

Price analysis 12/21: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

As the year comes to an end, investors will be keenly watching for a Santa Claus rally on Wall Street as many believe that if the rally does not happen, the next year may either remain flat or turn negative. Jurrien Timmer, director of global macro at asset management giant Fidelity Investments, tweeted on Dec. 19 that the United States equities markets may remain “sideways” and choppy in 2023. He expects “one or more retests of the 2022 low, but not necessarily much worse than that.” Daily cryptocurrency market performance. Source: Coin360 The cryptocurrency market has been largely correlated with the S&P 500 in 2022. Unless both markets decouple, the sideways or negative action in the equities markets may not bode well for the cryptocurrency market. Analysts remain divided on t...

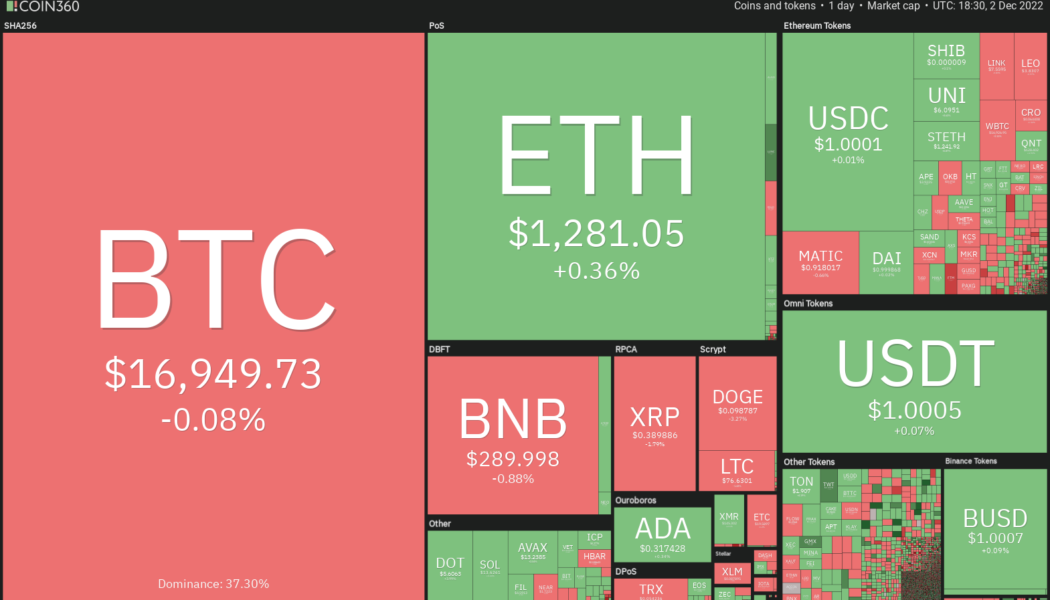

Price analysis 12/2: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

Non-farm payrolls in the United States rose by 263,000 in November, exceeding economists’ expectations of an increase of 200,000. Analysts believe that the numbers remain hot and do not allow much scope for the Federal Reserve to slow down its aggressive rate hikes. This is contrary to Fed Chair Jerome Powell’s remarks delivered at the Brookings Institution where he said that the central bank could reduce the pace of rate hikes “as soon as December.” That triggered a sharp rally in risk assets. After the latest jobs report, the market participants will closely watch the Fed’s comments and decision in its Dec. 13 and Dec.14 meeting. Daily cryptocurrency market performance. Source: Coin360 The Fed’s decision may also affect Bitcoin (BTC), which remains in a firm bear grip. Co...

Price analysis 11/25: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

FTX’s collapse dealt a major blow to the already fragile sentiment among cryptocurrency investors. Although a quick recovery is unlikely, Blockchain analysis firm Chainalysis said that the crypto universe could emerge stronger from this crisis. Chainalysis’ research lead Eric Jardine arrived at the conclusion after comparing FTX’s fall to that of Mt. Gox. Another calming statement came from Bloomberg Intelligence exchange-traded fund analyst James Seyffart, who said that there was a “99.9% chance” that the Grayscale Bitcoin Trust (GBTC) held the Bitcoin (BTC) it claimed. He added that GBTC was “unlikely” to be liquidated. Daily cryptocurrency market performance. Source: Coin360 The negative events of the past few days do not seem to have scared away the small investors who remain on an acc...

Leading Cardano stablecoin project shuts down after excruciating launch delays

On Nov. 24, Ardana, a leading decentralized finance (DeFi) and stablecoin ecosystem building on Cardano (ADA), abruptly halted development, citing “funding and project timeline uncertainty.” The project will remain open-source for builders while treasury balances and remaining funds will be held by Ardana Labs “until another competent dev team in the community comes forward to continue our work.” “Development on Cardano has been difficult with alot of funding going into tooling, infrastructure and security. This alongside the uncertainty around development completion has led to the best course of action being halting development of dUSD.” The move came as a shock to many due to the sudden nature of the announcement. However, it appears that issues were a...

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

Nifty News: GameStop NFT market goes live, Hong Kong’s NFT concept and more

The nonfungible token (NFT) marketplace for American video game retailer GameStop has officially gone live on Ethereum layer-2 blockchain ImmutableX, all part of the latest Web3 push from the gaming retailer. The pair first partnered in February to build the marketplace offering a $100 million grant for NFT content creators and tech developers before a public beta of the NFT marketplace debuted in July. With the Oct. 31 announcement of the full launch, GameStop’s market will allow for popular Web3 games on ImmutableX such as the role-playing game Illuvium and Gods Unchained to be accessed by users. GameStop has worked to launch a series of Web3-powered products over the past year, with a beta self-custody crypto wallet released in May that integrates with its NFT marketplace. In Marc...