BTC

Bitcoin sees ‘non-stop’ end-of-year buying as 10K BTC leaves Coinbase in a single day

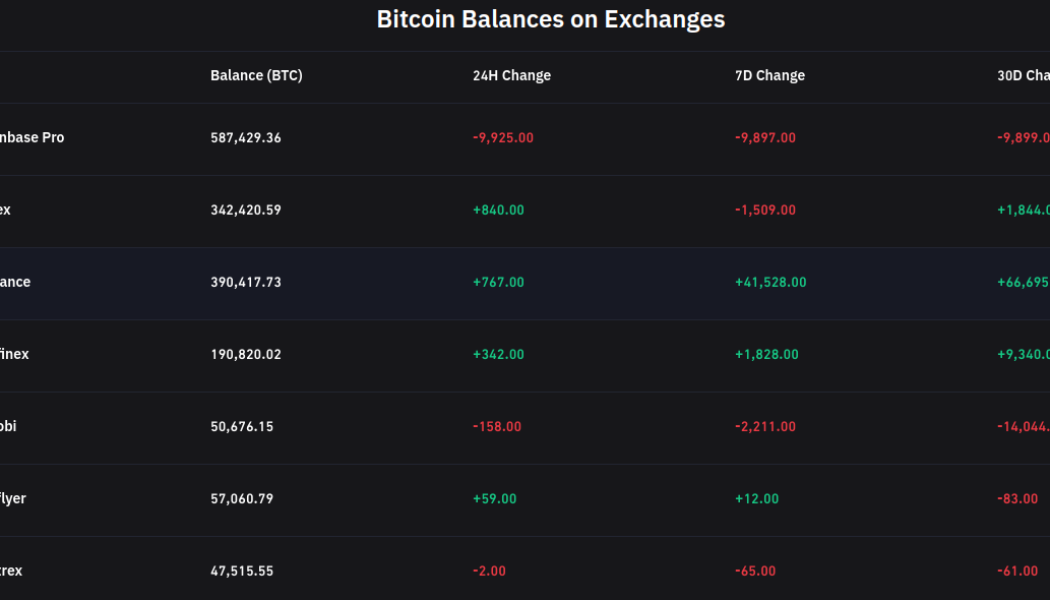

Almost 10,000 Bitcoin (BTC) left major United States-based exchange Coinbase on Dec. 30 in a sign that investor appetite is returning to the sphere. Data from on-chain monitoring resource Coinglass shows Coinbase’s professional trading arm, Coinbase Pro, shedding 9,925 BTC in the 24 hours to New Year’s Eve. Binance adds 66,000 BTC in December The buy-in, which runs in contrast to rising or flat balances on other major exchanges, marks a conspicuous short-term trend shift. The latter half of December has been characterized by platforms such as Binance and OKEx seeing increased inflows of BTC — something commentators feared could be a forewarning of a sell-off. While such a mass sale of BTC has not yet occurred, not everyone believes that it will stay that way. At the same time, the ex...

Missed out on hot crypto stocks in 2021? It paid just to buy Bitcoin and Ethereum, data shows

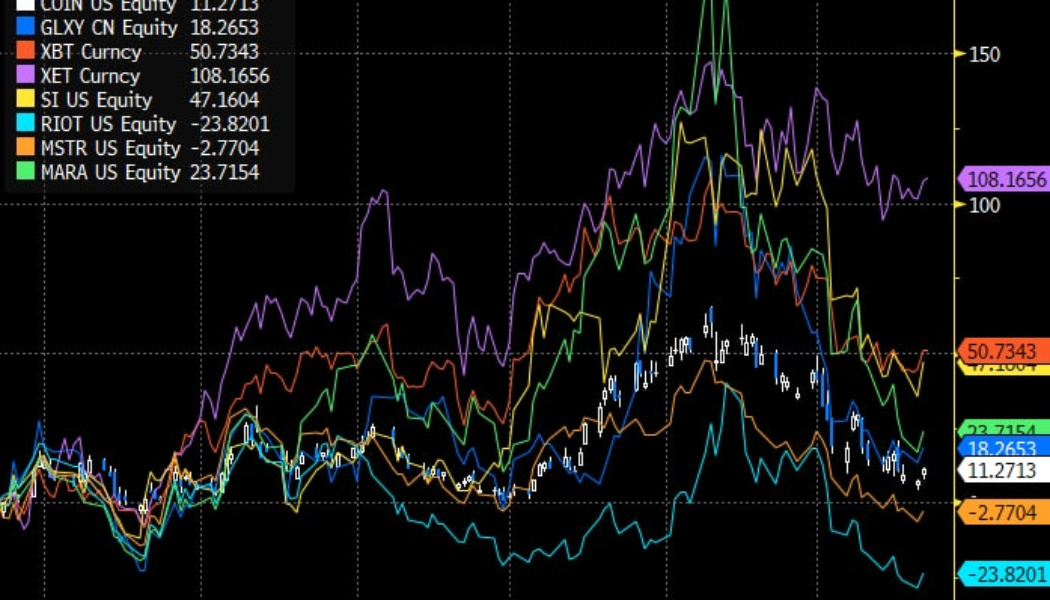

Bitcoin (BTC) may have fluctuated in price this year, but BTC remains a better play than the biggest crypto stocks. New data currently circulating shows that for all the growth in the industry surrounding Bitcoin, it still pays simply to buy and hold. Stocks fail to compete with BTC, ETH Looking at the stock performance of firms with the largest BTC allocations on their balance sheets, it becomes immediately apparent that it was more profitable to hold BTC than those equities — at least this year. “Buying crypto stocks to outperform coins is hard,” Three Arrows Capital CEO Zhu Su commented alongside comparative performance data from Bloomberg. Both Bitcoin and Ether (ETH) have fared significantly better than stocks from companies, such as MicroStrategy (MSTR) and Coinbase (COIN), despite t...

Bears pull Bitcoin’s end of year expectations down from $100K to $50K

Please be aware that some of the links on this site will direct you to the websites of third parties, some of whom are marketing affiliates and/or business partners of this site and/or its owners, operators and affiliates. We may receive financial compensation from these third parties. Notwithstanding any such relationship, no responsibility is accepted for the conduct of any third party nor the content or functionality of their websites or applications. A hyperlink to or positive reference to or review of a broker or exchange should not be understood to be an endorsement of that broker or exchange’s products or services. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products (e.g. contracts for d...

Avalanche eyes 60% rally as AVAX price breaks out of bull flag

Avalanche (AVAX) strengthened its case for a potential upside run towards $160 in the coming sessions as it broke out of a classic bullish pattern earlier this week. Dubbed “bull flag,” the pattern emerges when the price consolidates lower/sideways between two parallel trendlines (flag) after undergoing a strong upside move (flagpole). Later, in theory, the price breaks out of the channel range to continue the uptrend and tends to rise by as much as the flagpole’s height. AVAX went through a similar price trajectory across the last 30 days, containing a roughly 100% flagpole rally to nearly $150, followed by over a 50% flag correction to $72, and a breakout move above the flag’s upper trendline (around $85) on Dec. 15. AVAX/USD daily price chart featuring Bull Flag ...

Retail investors are buying Bitcoin while whales are selling says Ecoinometrics

As Bitcoin (BTC) price struggles to retake $50K, the number of Bitcoin addresses holding less than 1BTC has been increasing. Since hitting an all-time high above $69K, Bitcoin has seen a drastic drop that has sent it struggling below $50,000. On December 4, BTC dropped to its three-month low of $42,333 rising fears that the coin could drop below $40K. Addresses with less than 1BTC responsible for the current BTC price Data obtained by crypto-focused newsletter Ecoinometrics after evaluating the change in Bitcoin amounts across small and rich wallet groups shows that the bounce back from $42K to the current price is being attributed to the increased buying activity among the addresses holding less than 1BTC. The addresses holding 1000BTC to 10,000BTC are said to have done very little in sup...