BTC

Drake bets $1.3M in Bitcoin on Bengals vs. Rams Super Bowl match

Drake spends his time betting more than $1 million in Bitcoin (BTC) on Super Bowl matches when he’s not running through the six with his woes. The award-winning rapper recently shared that he placed BTC bets worth a total of $1.26 million on the upcoming Superbowl match between the Cincinnati Bengals and the Los Angeles Rams. Through the crypto sports betting platform Stake, the rapper bet over $471,000 for the Rams to be the winner, including overtime. Drake also expressed his confidence in the Rams’ wide receiver Odell Beckham Jr. The musician placed around $392,000 on Beckham Jr. having more than 62.5 receiving yards and another $392,000 on the wide receiver having over 0.5 anytime touchdowns. Drake wrote, “All bets are in on the family.” Beckham Jr. replied to the post, saying, “...

The US Federal Reserve is making some analysts bullish on Bitcoin again

Signs of a steady Bitcoin (BTC) price recovery emerged earlier this week as investors shifted away from the U.S. dollar on weaker-than-expected economic data. In detail, Bitcoin’s drop last week to below $33,000 met with a healthy buying sentiment that pushed its per token rate to as high as $39,300 on Feb. 1. As of Thursday, BTC’s price dipped below $37,000 but was still up 13% from its local bottom. Meanwhile, the U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, rose to 97.441 last Friday, logging its best level since July 2020. However, the index corrected by nearly 1.50% to over 96.00 by Feb. 3. DXY vs. BTC/USD daily price chart. Source: TradingView Some market analysts saw the dollar’s renewed weakness...

Willy Woo: ‘Peak fear’ but on-chain metrics say it’s not a bear market

Bitcoin analyst and co-founder of software firm Hypersheet Willy Woo believes that on-chain metrics show that BTC is not in a bear market despite observing “peak fear” levels. Speaking on the What Bitcoin Did podcast hosted by Peter McCormack on Jan. 30, Woo cited key metrics such as a strong number of long term holders (wallets holding for five months or longer) and growing rates of accumulation suggest that the market has not flipped the switch to bear territory: “Structurally on-chain, it’s not a bear market setup. Even though I would say we’re at peak fear. No doubt about it, people are really scared, which is typically […] an opportunity to buy.” I guess BTC is in demand lately pic.twitter.com/5h1IeMT2lK — Willy Woo (@woonomic) January 29, 2022 In the short term, Woo noted that ...

Kiss this: You can buy Gene Simmons’ Las Vegas mansion with crypto

Rock legend Gene Simmons says he will accept crypto payments for the sale of his $13.5 million mansion in Las Vegas. The iconic bassist and co-lead singer of Kiss will accept payments in or a combination of Bitcoin, Ethereum, Litecoin, Uniswap, Polkadot, Aave or Try.Finance according to hard rock news site, Blabber Mouth. Listing broker Evangelina Duke-Petroni from Berkshire Hathaway Home Services told the Las Vegas Review-Journal in a Feb 1 interview that any potential crypto payment for the property would have to be “verified through closing costs, including taxes and commissions.” The three-level mansion sprawls across over 11,000 square feet in the Ascaya luxury community overlooking the Las Vegas skyline. Rock legend @GeneSimmons is selling his home in Henderson’s Ascaya communi...

Bitcoin dodges ‘sub-$30K liquidity grab’ — Levels to watch now

Bitcoin (BTC) could still crash to $29,000 and lower, but price action is “healthier” than a week ago, the latest research concludes. In a fresh market update on Friday, analysts at trading suite Decentrader said that BTC price action is finally showing “green shoots of optimism.” Eyes on “near-term relief bounce” for BTC After a difficult week in which BTC/USD dipped to just under $33,000, market analysis is now focusing on the likely outcomes of the rangebound behavior seen over the past few days. For Decentrader, there is reason to be cautiously optimistic now where there was none a week ago. “We believe that the current derivatives landscape shift and this extremely negative sentiment backdrop does increase the potential for at least a near-term relief bounce,” analysts summarized. The...

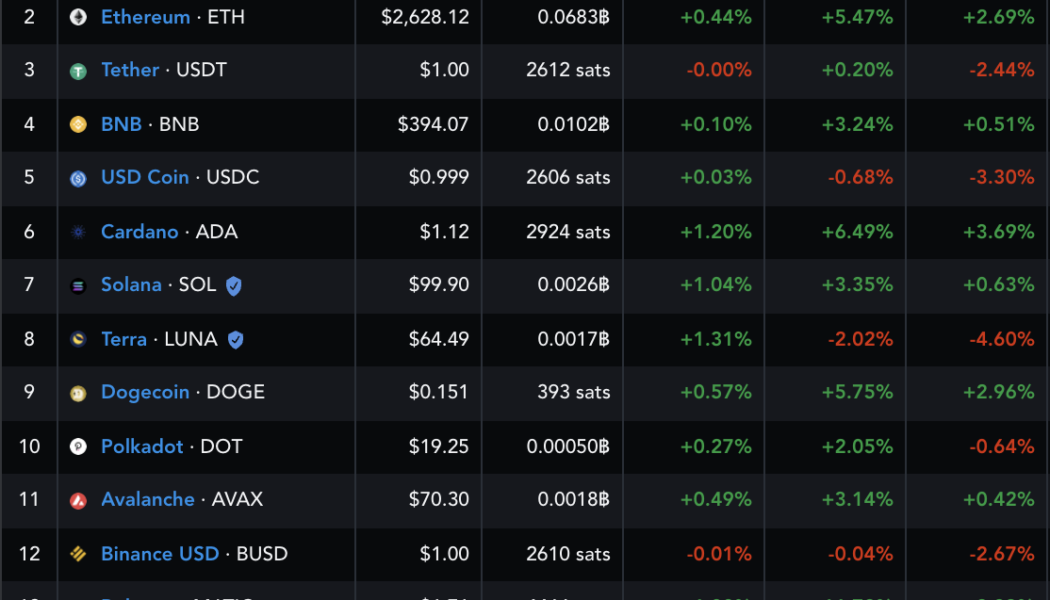

Polygon (MATIC) sees a strong oversold bounce after $250B crypto market rebound

Polygon (MATIC) emerged as one of the best performers among high-ranking cryptocurrencies on Jan. 26 as the price rose nearly 17% to reach an intraday high at $1.825. The gains surfaced amid a synchronous rebound across the crypto market that started on Jan. 24. In detail, investors and traders poured in over $250 billion across digital assets, benefiting Bitcoin (BTC), Ether (ETH) and many others in the process. Performance of the top-fifteen cryptocurrencies in the last 15 days. Source: TradingView Polygon, a secondary scaling solution for the Ethereum blockchain, also cashed in on the crypto market rebound. The valuation of its native token, MATIC, rose from as low as $9.77 billion on Jan.24 to as high as $13.58 billion two days later. Meanwhile, its price jumped from $1....

These 3 cryptocurrencies are taking an even bigger hit during Bitcoin’s price slump

The cost to purchase one Bitcoin (BTC) has dropped almost 10% in the last seven days and has been eyeing extended declines as it drops below $40,000, its interim psychological support, on Jan. 10. BTC/USD weekly price chart. Source: TradingView Nonetheless, the losses suffered by Bitcoin still appear less than that of some of its top crypto rivals’ performances. For instance, Cardano (ADA), the seventh-largest cryptocurrency by market valuation, has dropped by nearly 11% to around $1.15 in the last seven days. Similarly, Ripple (XRP), the eighth-largest by market capitalization, has dipped by around 10% to nearly $0.75 in the same period. Meanwhile, some cryptocurrencies listed among the top 50 digital assets have experienced bigger losses between 15% and 30% in the last week. They i...

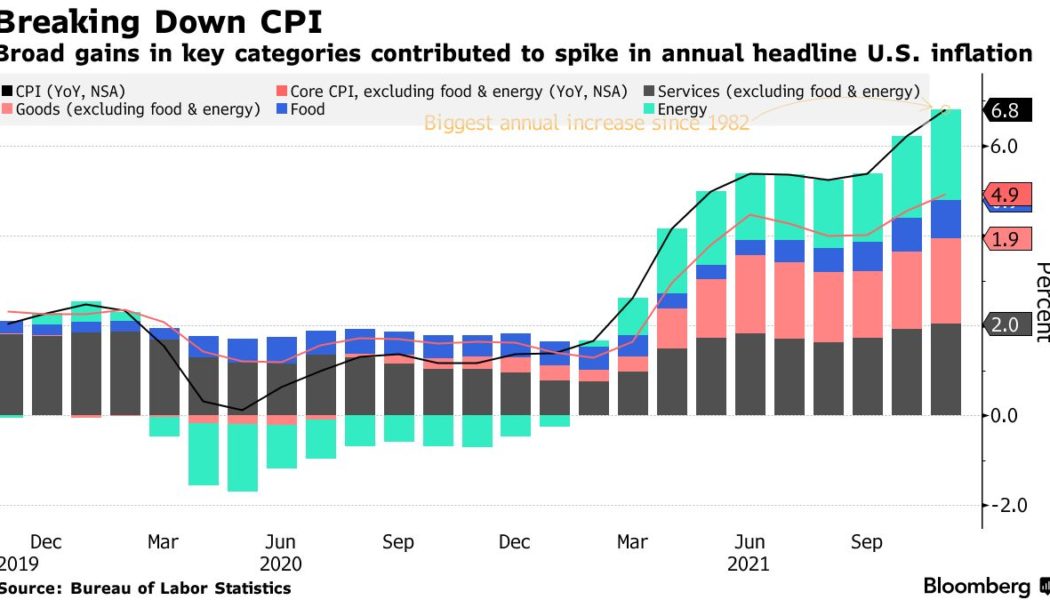

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...

Will this time be different? Bitcoin eyes drop to $35K as BTC price paints ‘death cross’

Bitcoin (BTC) formed a trading pattern on Jan. 8 that is widely watched by traditional chartists for its ability to anticipate further losses. In detail, the cryptocurrency’s 50-day exponential moving average (50-day EMA) fell below its 200-day exponential moving average (200-day EMA), forming a so-called “death cross.” The pattern appeared as Bitcoin underwent a rough ride in the previous two months, falling over 40% from its record high of $69,000. BTC/USD daily price chart. Source: TradingView Death cross history Previous death crosses were insignificant to Bitcoin over the past two years. For instance, a 50-200-day EMA bearish crossover in March 2020 appeared after the BTC price had fallen from nearly $9,000 to below $4,000, turning out to be lagging than predictive. ...

BTCS stock jumps 44% after announcing first-ever dividend payable in Bitcoin

On Wednesday, Nasdaq Composite logged its biggest daily loss since February last year. But for one of its listed companies, the day turned out to be extremely bullish. Blockchain stock soars The share value of BTCS Inc. (BTCS), a blockchain technology company, surged nearly 44% to $4.36 at the New York closing bell, thus becoming the third-best performer on Nasdaq after Lixte Biotechnology (LIXT) and Mainz Biomed BV (MYNZ). Top Nasdaq performers as of Jan. 5, 2022’s close. Source: TheStockMarketWatch.com In contrast, Nasdaq plunged 3.3% Wednesday, its losses driven primarily by the release of the minutes of the Federal Open Market Committee (FOMC) meeting in mid-December last year. In detail, the minutes revealed the Federal Reserve officials’ intention to rais...

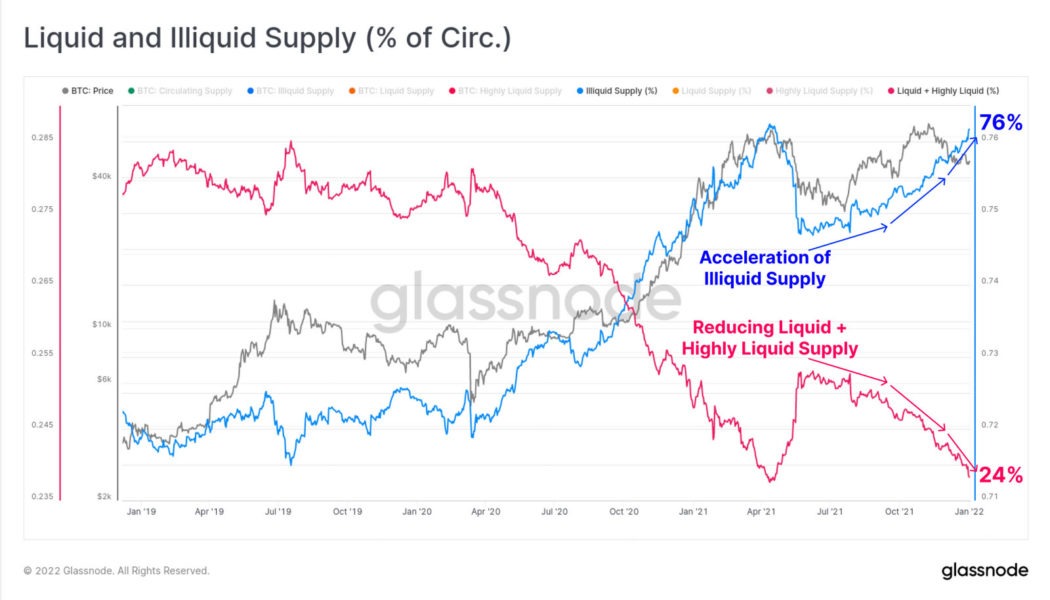

Wait and see approach: 3/4 of Bitcoin supply now illiquid

Bitcoin markets have been consolidating since the beginning of the year, but on-chain metrics are painting a more positive picture as more of the asset is becoming illiquid. On-chain analytics provider Glassnode has been delving into Bitcoin supply metrics to get a better view of the longer-term macro trends in its weekly report on Jan. 3. The findings revealed that although the asset has been trading sideways so far this year, more BTC has become illiquid. There has been an acceleration in illiquid supply growth which now comprises more than three quarters, or 76%, of the total circulating supply. Glassnode defines illiquidity as when BTC is moved to a wallet with no history of spending. Liquid supply BTC, which makes up 24% of the total, is in wallets that spend or trade regularly such a...

Bitcoin holdings of public companies have surged in 2021

The quantity of Bitcoin held by private corporations has increased significantly during 2021, building on increases from the previous year. In a Jan. 3 tweet, on-chain analyst Willy Woo claimed that public companies holding “significant BTC have gained market share from spot ETFs as a way to access BTC exposure on public equity markets”. This has been more noticeable since MicroStrategy’s “Bitcoin for Corporations” conference on Feb. 3 and 4, 2021. The online seminar aimed to explain the legal considerations for firms seeking to integrate Bitcoin into their businesses and reserves. Michael Saylor’s MicroStrategy is a leading business intelligence firm and is known for being particularly bullish on BTC, owning almost $6 billion in crypto assets. On Dec 30, Saylor’s firm pu...